I’ve seen it happen too many times – companies bleeding money on contracts they thought were airtight. Last month, I watched a mid-sized tech company realize they were losing nearly $200K annually because nobody caught a sneaky auto-renewal clause buried in their software agreements. The numbers back this up: businesses lose an average of 8.6% of their contract value due to poor management practices, with some organizations experiencing erosion exceeding 20%.

Here’s the thing that drives me crazy – everyone knows contracts are important, but most companies are still reviewing them like it’s 1995. Meanwhile, their smarter competitors are using technology and systematic approaches to review contracts faster and more thoroughly, closing deals while others are still squinting at fine print.

Look, I get it. Contract review isn’t exactly thrilling. But stick with me here, because this stuff can literally save your business.

Table of Contents

-

Traditional Contract Review Fundamentals

-

Technology-Enhanced Review Systems

-

Strategic Contract Review Checklists

-

Professional Legal Consultation

TL;DR

-

Traditional contract review methods still matter for legal compliance, but they’re painfully slow for today’s business pace

-

AI and machine learning tools can speed up initial contract analysis by 50% while catching issues you might miss after your 20th contract of the day

-

Smart checklists prevent expensive oversights and keep your review process consistent (hint: if yours has more than 20 items, nobody’s using it)

-

Knowing when to call in the lawyers (and how to work with them without going broke) can save thousands in both legal fees and potential disasters

-

The winning approach? Combine human smarts with technology rather than trying to do everything manually or trusting AI completely

Traditional Contract Review Fundamentals

Most businesses are still using contract review methods that haven’t changed much since your dad was negotiating deals with handshakes and fax machines. Don’t get me wrong – these foundational approaches are still legally necessary. The problem is they’re incomplete for today’s business world where you’re dealing with dozens of contracts monthly instead of a few per year.

I’ve watched too many companies get burned because they assumed their standard review process would catch everything. Spoiler alert: it won’t. When you’re manually reviewing contract after contract, things slip through the cracks. It’s not about being careless – it’s about being human.

Legal Contract Review Standards That Actually Matter

Legal standards for contract review aren’t just bureaucratic requirements – they’re your protection against lawsuits, regulatory fines, and business disasters. The challenge is figuring out which standards apply to your specific situation and how to implement them without drowning in paperwork.

You can’t just wing it when it comes to legal compliance. Every contract review needs to meet specific professional standards, but here’s what most people don’t realize: these standards vary dramatically based on your industry, contract value, and risk exposure.

Here’s a reality check: research shows that human-led contract review processes take 92 minutes on average – and that adds up fast when you’re dealing with heavy contract volumes. No wonder it feels like contracts are slowing down every deal.

Regulatory Compliance Framework

Building a compliance framework sounds intimidating, but it’s really just creating a systematic approach so you don’t miss critical regulatory requirements. The key is understanding which regulations actually apply to your contracts and building processes that address them efficiently.

Federal regulations hit every business differently. Healthcare companies deal with HIPAA requirements in their vendor contracts. Financial services firms navigate SOX compliance. Tech companies wrestle with data privacy laws across multiple jurisdictions. It’s enough to make your head spin.

I’ve watched businesses spend months negotiating contracts only to discover they violated industry-specific regulations that could’ve been addressed upfront. The documentation requirements alone can make or break an audit.

Your compliance framework needs to account for:

-

Industry-specific regulatory requirements that actually apply to you

-

Documentation and audit trail standards (because auditors love their paper trails)

-

Cross-jurisdictional compliance issues (especially if you work internationally)

-

Regular updates as regulations change (and they always do)

Here’s a story that’ll make you cringe: A healthcare technology company discovered during an audit that their vendor agreements lacked proper HIPAA business associate clauses, exposing them to potential $1.5 million in fines. They had to retroactively amend 47 contracts and implement new review protocols – a process that took six months and cost $200,000 in legal fees. All because nobody thought to check the HIPAA box during contract review.

Professional Liability Considerations

Contract reviewers face real professional liability risks that most people don’t consider. Understanding these risks helps you balance thoroughness with efficiency while protecting yourself and your organization from potential malpractice claims.

Professional liability in contract review isn’t just a lawyer’s problem. If you’re reviewing contracts as part of your job, you’re potentially on the hook for mistakes that cost your company money. Mess up a contract review, and you could be personally liable.

The standard of care expected from contract reviewers has evolved. Courts now expect reviewers to catch issues that technology could reasonably identify. Missing obvious red flags isn’t just embarrassing – it’s potentially actionable. The days of “I’m not a lawyer” as a defense are fading fast.

Risk mitigation strategies include:

-

Documenting your review process and decisions (cover your tracks)

-

Using appropriate tools for the contract’s complexity level

-

Knowing when to escalate to legal counsel (and actually doing it)

-

Maintaining professional development in contract law

Jurisdictional Requirements

Different legal jurisdictions create different rules for contract enforcement, dispute resolution, and review requirements. Understanding these differences prevents costly mistakes when dealing with multi-state or international agreements.

Jurisdiction shopping isn’t just for big corporations. The state or country whose laws govern your contract can dramatically impact your rights and obligations. Delaware corporate law differs significantly from California employment law. International contracts bring additional complexity with varying enforcement mechanisms and dispute resolution requirements.

Key jurisdictional considerations:

-

Governing law clauses and their implications (this matters more than you think)

-

Dispute resolution venue requirements

-

Enforcement mechanisms in different jurisdictions

-

Local counsel requirements for complex matters

Contract Review Process Methodology

A systematic approach to contract review ensures consistency and thoroughness while managing time and resources effectively. The methodology you choose should match your organization’s risk tolerance, resources, and business objectives.

Most contract review processes fail because they’re either too rigid or too loose. You need structure that adapts to different contract types and risk levels without becoming bureaucratic nonsense that nobody follows.

Similar to how businesses need advanced analytics for strategic growth, contract review requires systematic analysis and data-driven decision making to identify risks and opportunities effectively.

|

What You’re Dealing With |

How Long This Will Take |

Who Should Handle It |

Red Flags to Watch For |

|---|---|---|---|

|

Simple stuff (NDAs, basic service agreements) |

30-60 minutes |

Business professional |

Confidentiality scope, term duration |

|

Moderate complexity (Software licenses, consulting agreements) |

2-4 hours |

Legal or senior business professional |

Liability caps, IP rights, termination clauses |

|

Complex deals (Joint ventures, major acquisitions) |

8-40 hours |

Legal counsel required |

Regulatory compliance, financial exposure, operational integration |

|

Highly Complex nightmares (International partnerships, regulated industry deals) |

40+ hours |

Specialized legal team |

Multi-jurisdictional compliance, regulatory approvals, cross-border enforcement |

Initial Document Assessment

The first few minutes of contract review set the tone for everything that follows. A proper initial assessment helps you allocate appropriate time and resources while identifying potential deal-breakers early in the process.

Your initial assessment determines everything else. Spend five minutes upfront to save hours later. Trust me on this one.

Contract complexity isn’t always obvious from page count. A two-page licensing agreement might contain more legal landmines than a twenty-page service contract. Risk level depends on factors like financial exposure, operational impact, and regulatory implications.

Assessment criteria should include:

-

Contract type and whether it uses standard terms

-

Financial exposure and liability caps (the scary numbers)

-

Operational complexity and resource requirements

-

Regulatory compliance requirements

-

Timeline constraints and approval needs

Clause-by-Clause Analysis

Detailed clause analysis is where most contract issues are discovered and resolved. This systematic examination requires understanding both legal implications and business impact of each provision, but it doesn’t have to be overwhelming if you know what to prioritize.

Clause-by-clause review isn’t about reading every word with equal attention. You need to know which clauses typically cause problems and which ones are usually boilerplate. Payment terms, liability limitations, and termination clauses deserve extra scrutiny. Boilerplate provisions still need review, but they rarely contain surprises.

The devil’s in the details of custom provisions and modifications to standard language. That’s where people try to sneak things past you.

Focus areas for detailed analysis:

-

Financial terms and payment obligations (follow the money)

-

Liability, indemnification, and insurance requirements (who pays when things go wrong)

-

Intellectual property rights and restrictions

-

Termination and renewal provisions (how do you get out of this thing)

-

Dispute resolution and governing law

Risk Identification and Mitigation

Effective risk management in contract review goes beyond identifying problems – it’s about understanding the likelihood and impact of various risks and developing practical strategies to address them. The goal isn’t to eliminate all risk but to manage it intelligently.

Risk identification without mitigation strategies is just expensive worry. You need practical approaches to address the risks you’ve identified, not just a list of things that could go wrong.

Financial Exposure Analysis

Understanding your financial exposure from contracts requires looking beyond the obvious payment terms to identify hidden costs, liability risks, and potential penalties. This analysis helps you make informed decisions about acceptable risk levels.

Financial exposure often hides in unexpected places. Sure, you’ll notice the contract price, but what about the indemnification clause that could cost millions? Or the penalty structure that kicks in if you’re late on deliverables? I’ve seen companies focus so hard on the purchase price that they missed liability clauses that could bankrupt them.

Here’s something that should scare you: businesses lose $122 for every hour an in-house lawyer spends working on a contract. That makes efficient review processes a matter of direct cost control, not just speed.

Liability caps don’t always protect you the way you think they do. Exclusions for gross negligence, willful misconduct, or certain types of damages can blow right through your caps like they don’t exist.

Key financial risk areas:

-

Direct payment obligations and penalty structures

-

Indemnification and liability exposure (the big scary stuff)

-

Insurance requirements and coverage gaps

-

Hidden costs in operational requirements

Operational Risk Assessment

Contracts don’t exist in a vacuum – they impact your day-to-day operations, resource allocation, and strategic flexibility. Understanding these operational implications helps prevent agreements that look good on paper but create practical problems.

Operational risks are often harder to quantify than financial ones, but they can be just as costly. A contract that requires dedicated resources you don’t have or restricts your ability to work with other clients can damage your business even if the financial terms look attractive.

Resource allocation requirements need realistic assessment. Can you actually deliver what you’re promising? Do you have backup plans if key personnel leave? I’ve seen too many companies promise the moon and then scramble to deliver.

Operational considerations include:

-

Resource requirements and availability (do you actually have the people to do this)

-

Timeline feasibility and dependencies

-

Strategic flexibility and growth constraints

-

Integration with existing systems and processes

Legal Vulnerability Mapping

Legal vulnerabilities in contracts often stem from ambiguous language, conflicting provisions, or gaps in coverage rather than obviously problematic terms. Mapping these vulnerabilities helps you address them proactively rather than discovering them during disputes.

Legal vulnerabilities aren’t always obvious. Sometimes the biggest risk is what’s not in the contract rather than what is. Ambiguous language creates interpretation disputes. Conflicting provisions between different sections can void important protections. Missing force majeure clauses leave you exposed to circumstances beyond your control.

Vulnerability mapping focuses on:

-

Ambiguous or conflicting language (lawyers love to argue about this stuff)

-

Gaps in coverage or protection

-

Dispute resolution effectiveness

-

Enforcement challenges and remedies

Compliance Gap Analysis

Ensuring contract terms align with your existing policies, procedures, and regulatory requirements prevents conflicts that can create legal exposure or operational problems. This analysis identifies areas where you need to update either your contracts or your internal processes.

Compliance gaps create ongoing headaches. Your contract might require monthly reporting, but your systems only generate quarterly reports. Or the contract’s data handling requirements conflict with your privacy policies. These misalignments cause problems down the road.

Internal policy alignment matters as much as regulatory compliance. Contracts that require you to violate your own procedures create liability and operational confusion.

Gap analysis should cover:

-

Internal policy and procedure alignment

-

Regulatory requirement compliance

-

Industry standard adherence

-

Existing contract consistency

Technology-Enhanced Review Systems

Technology is transforming contract review from a purely manual process to a hybrid approach that combines human expertise with machine intelligence. These systems don’t replace human judgment but amplify it, catching issues that might be missed and speeding up routine analysis significantly.

Technology in contract review isn’t about replacing lawyers – it’s about making everyone more effective. The tools available today can handle routine analysis while flagging complex issues for human attention. Think of it as having a really thorough assistant who never gets tire

Technology in contract review isn’t about replacing lawyers – it’s about making everyone more effective. The tools available today can handle routine analysis while flagging complex issues for human attention. Think of it as having a really thorough assistant who never gets tired and catches things you might miss when you’re reviewing your 47th contract of the week.

The landscape is rapidly evolving. OpenAI recently unveiled a contract review agent that can “cut contract review times by 50%” and process hundreds of contracts at once. We’re not in sci-fi territory anymore – this stuff is happening now.

AI-Powered Contract Analysis

Artificial intelligence tools can rapidly scan contracts, identify potential issues, and suggest improvements with accuracy that often exceeds human reviewers for routine matters. However, understanding their limitations is crucial for effective implementation.

AI contract analysis has moved beyond simple keyword searches. Modern systems understand context, identify unusual provisions, and can even suggest alternative language based on best practices. It’s like having a contract expert who’s read thousands of agreements and remembers every problematic clause they’ve ever seen.

The technology works best on routine contracts with standard provisions. Complex, highly negotiated agreements still need significant human oversight, but AI can handle the initial heavy lifting and flag things that deserve your attention.

Just as creating continuously learning AI systems requires ongoing refinement and training, AI-powered contract review tools improve their accuracy through exposure to more contract data and feedback loops.

Natural Language Processing Applications

NLP technology interprets contract language in ways that go beyond simple text analysis, identifying ambiguous terms, inconsistent usage, and potential clarity improvements. This technology is particularly valuable for large contract portfolios where consistency matters.

Think of NLP as a really smart assistant that actually understands what contracts are saying – not just finding keywords. These systems understand legal concepts and can identify when terms are used inconsistently or ambiguously throughout a document.

I’ve seen NLP tools catch issues like using “shall” and “will” interchangeably in the same contract, or identifying when defined terms aren’t used consistently. These might seem minor, but they can create interpretation problems later when someone’s looking for wiggle room.

NLP applications include:

-

Ambiguous language identification

-

Consistent terminology enforcement

-

Readability and clarity analysis

-

Translation and multi-language consistency

Here’s a real example: A multinational corporation used NLP tools to review 3,000 supplier contracts across 15 countries. The system identified 847 instances where critical terms like “force majeure” were defined differently across similar agreements, potentially creating enforcement inconsistencies. The company standardized these definitions, reducing legal risk and improving contract enforceability.

Pattern Recognition and Anomaly Detection

AI systems learn from historical contract data to identify unusual clauses, inconsistent terms, or deviations from standard industry practices. This capability is particularly valuable for organizations that review many similar contracts.

Pattern recognition helps identify outliers that deserve extra attention. When a vendor contract includes unusual liability limitations or a customer agreement has non-standard payment terms, the system flags these for review. It’s like having someone who’s seen every trick in the book watching your back.

Anomaly detection works best when you have a large database of similar contracts. The system learns what’s normal for your industry and contract types, then highlights deviations that might be problems.

Key capabilities include:

-

Unusual clause identification

-

Industry standard comparisons

-

Historical trend analysis

-

Risk pattern recognition

Digital Workflow Integration

Modern contract review requires seamless integration with broader business systems to enable real-time collaboration, maintain version control, and automate routine approval processes. The goal is creating workflows that enhance rather than complicate existing business processes.

Digital workflows eliminate the email chains and version control nightmares that plague traditional contract review. Everyone works from the same document with clear audit trails and approval status. No more “which version are we looking at” conversations.

Industry consolidation is accelerating these capabilities, as demonstrated by LegalOn’s acquisition of German AI company Fides, which aims to expand corporate governance capabilities and better serve international customers through integrated workflow solutions.

Cloud-Based Collaboration Platforms

Cloud platforms enable multiple stakeholders to review, comment, and approve contracts simultaneously while maintaining security and comprehensive audit trails. These systems are essential for organizations with distributed teams or complex approval processes.

Cloud collaboration transforms contract review from a sequential process to a parallel one. Legal, procurement, and business teams can review simultaneously instead of waiting for each other to finish. It’s the difference between passing a document around a conference table and having everyone work on it at once.

Security remains paramount. The platform needs enterprise-grade security with role-based access controls and comprehensive audit logging. You can’t sacrifice security for convenience – one data breach will cost more than years of inefficient processes.

Platform features should include:

-

Real-time collaborative editing

-

Role-based access and permissions

-

Comprehensive audit trails

-

Integration with existing security systems

Automated Approval Routing

Intelligent routing systems direct contracts to appropriate reviewers based on predefined criteria such as value thresholds, risk levels, and organizational hierarchy. This automation reduces delays while ensuring proper oversight.

Automated routing eliminates bottlenecks and ensures contracts reach the right people quickly. The system knows that contracts over $100K need CFO approval, or that technology agreements require IT security review. No more contracts sitting in someone’s inbox for weeks.

Routing rules need regular updates as your organization changes. What worked when you had 50 employees might not scale to 500.

Routing considerations:

-

Value-based approval thresholds

-

Risk level escalation rules

-

Department-specific requirements

-

Backup reviewer assignments

Integration with CRM and ERP Systems

Connecting contract review platforms with existing business systems provides context and ensures alignment with broader business objectives. This integration eliminates data silos and improves decision-making.

System integration provides context that improves review quality. Knowing a customer’s payment history or a vendor’s performance record helps inform contract decisions. It’s the difference between reviewing a contract in isolation versus understanding the full business relationship.

Data flows both ways. Contract terms and obligations need to flow back into operational systems for tracking and compliance monitoring.

Integration benefits include:

-

Customer and vendor history context

-

Automated data population

-

Compliance monitoring and alerts

-

Performance tracking and reporting

Strategic Contract Review Checklists

Comprehensive checklists ensure consistency and thoroughness in contract review while adapting to different contract types and business contexts. The key is developing frameworks that are detailed enough to catch important issues but flexible enough to handle various situations efficiently.

Honestly? Most contract review checklists are garbage. They’re either so generic they miss everything important, or so detailed that nobody actually uses them. Here’s what nobody tells you about contract checklists – if yours has more than 20 items, nobody’s going to use it. I’ve seen 47-point checklists gathering dust while people wing it because the “proper” process takes too long.

Contract Review Checklist Development

Creating effective review checklists requires understanding your specific industry requirements, organizational needs, and risk tolerance levels. Generic checklists miss important details while overly specific ones become unwieldy.

Checklist development is more art than science. You need enough detail to ensure consistency but enough flexibility to handle unique situations. The best checklists guide thinking without constraining it.

With 9 in 10 contract professionals feeling like finding specific contracts is a challenge, and many spending up to two hours looking for specific terms and language within agreements, well-structured checklists become essential for maintaining efficiency and thoroughness.

Industry-Specific Considerations

Different industries have unique requirements that generic checklists can’t address. Healthcare contracts need HIPAA compliance checks, while technology agreements require intellectual property and data security provisions.

Industry-specific checklists reflect the unique risks and requirements of your sector. Healthcare organizations need HIPAA compliance verification. Financial services firms require regulatory approval processes. Manufacturing companies focus on supply chain and quality standards.

Generic checklists miss critical industry requirements. A standard service agreement checklist won’t remind you to verify SOC 2 compliance for a cloud services provider.

Industry considerations include:

-

Regulatory compliance requirements that actually matter in your field

-

Industry standard terms and practices

-

Common risk areas and mitigation strategies

-

Professional licensing and certification needs

Much like how market sizing requires industry-specific analysis to identify business opportunities accurately, contract review checklists must be tailored to address sector-specific risks and regulatory requirements.

Contract Type Categorization

Different types of contracts require different review approaches and checklists. Service agreements, licensing deals, employment contracts, and partnership agreements each have unique provisions and risk areas that need specialized attention.

Contract type determines review focus. Employment agreements need different scrutiny than software licensing deals. Partnership agreements require different analysis than vendor service contracts. It’s like using different tools for different jobs.

Categorization helps allocate appropriate time and expertise. A simple NDA might need 15 minutes of review, while a complex joint venture agreement could require days.

Common contract categories:

-

Service and consulting agreements

-

Software and technology licensing

-

Employment and contractor agreements

-

Partnership and joint venture deals

-

Real estate and facility agreements

|

Contract Review Categories |

Key Focus Areas |

Red Flags to Watch For |

How Much Attention This Needs |

|---|---|---|---|

|

Service Agreements |

Deliverables, payment terms, liability caps |

Unlimited liability, vague deliverables, auto-renewal |

Medium |

|

Technology/Software |

IP rights, data security, compliance |

Broad indemnification, data ownership gaps |

High |

|

Employment Contracts |

Non-compete, confidentiality, termination |

Overly broad restrictions, unclear compensation |

Medium |

|

Partnership/JV |

Governance, profit sharing, exit provisions |

Unequal control structures, unclear exit terms |

High |

|

Real Estate/Facilities |

Use restrictions, maintenance, insurance |

Personal guarantees, inadequate insurance |

Medium-High |

Quality Assurance Protocols

Systematic quality assurance ensures consistency and thoroughness across different reviewers and time periods. These protocols help maintain standards while identifying areas for process improvement.

Quality assurance in contract review isn’t just about catching mistakes – it’s about continuous improvement and knowledge sharing across your team. The goal is making everyone better at spotting problems before they become expensive disasters.

Peer Review Systems

Structured peer review processes help identify potential oversights and ensure comprehensive analysis by having multiple professionals examine the same contract. This approach is particularly valuable for high-risk or complex agreements.

Peer review catches issues that individual reviewers miss. Fresh eyes often spot problems that the original reviewer overlooked, especially after hours of detailed analysis. You know that feeling when you’ve been staring at the same paragraph for 20 minutes and still don’t know what it means? That’s when you need someone else to take a look.

The process needs structure to be effective. Random second opinions aren’t as valuable as systematic review by someone with complementary expertise.

Peer review elements:

-

Risk-based review triggers

-

Complementary expertise pairing

-

Structured feedback processes

-

Knowledge sharing and training opportunities

Here’s a success story: A technology company implemented a peer review system where contracts over $500K required review by both a legal professional and a technical expert. This dual-review approach caught a critical data security gap in a cloud services agreement that could have exposed customer data to regulatory violations, potentially saving the company millions in fines and reputation damage.

Documentation Standards

Consistent documentation methods for recording review findings, recommendations, and decision rationales create valuable institutional knowledge and support future audits or disputes.

Documentation serves multiple purposes: audit trails, knowledge transfer, and decision support for future similar contracts. The challenge is capturing enough detail without creating excessive administrative burden.

Documentation should explain what was decided and why. Future reviewers need to understand the reasoning behind decisions, especially when circumstances change or similar issues arise.

Documentation should include:

-

Review findings and risk assessments

-

Decision rationales and alternatives considered

-

Recommendations and implementation notes

-

Follow-up requirements and monitoring needs

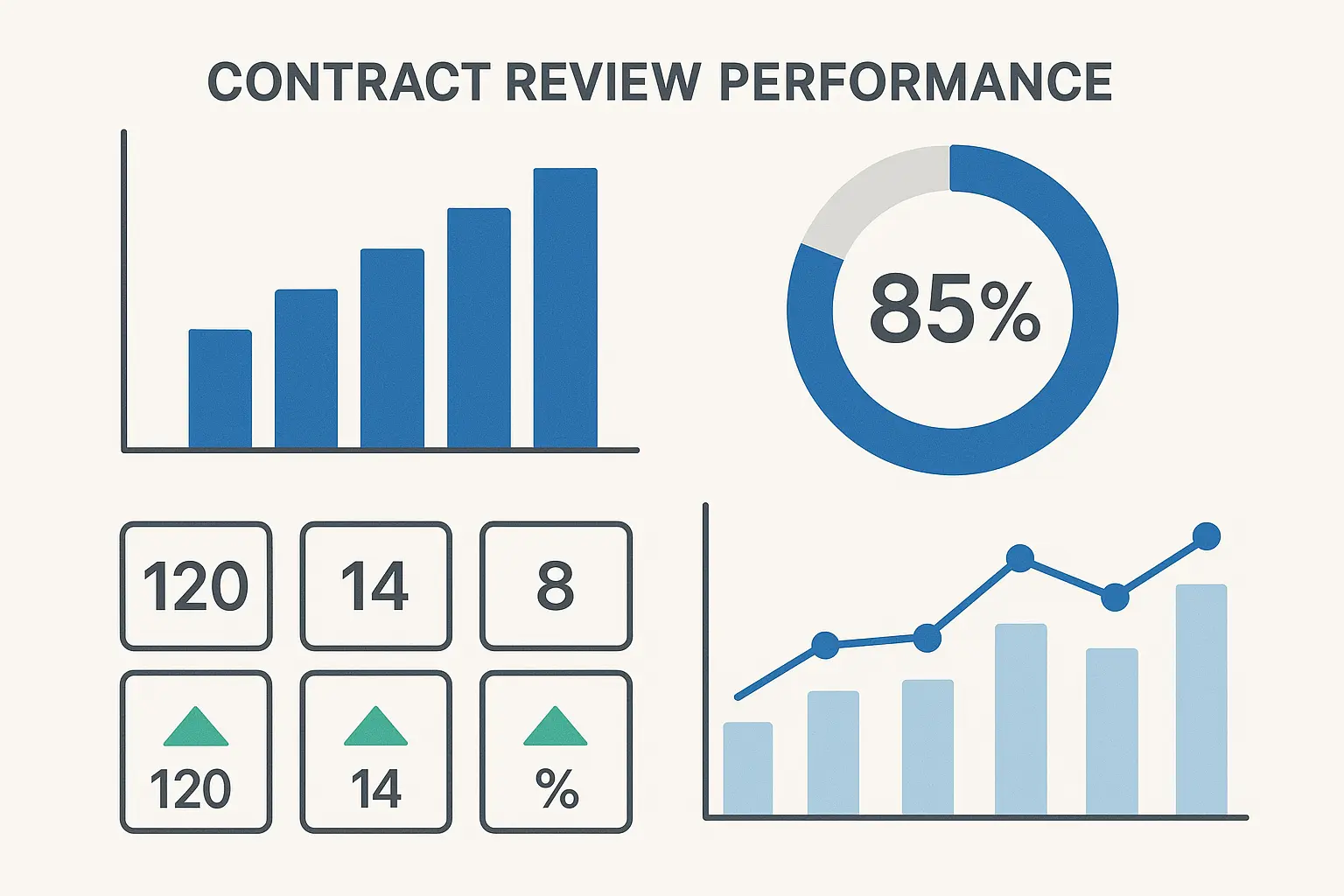

Performance Metrics and KPIs

Measuring contract review effectiveness through metrics such as review time, error rates, and post-signature issues helps identify improvement opportunities and demonstrate value to organizational leadership.

Metrics help optimize the review process and demonstrate value. But measuring the wrong things can create perverse incentives that prioritize speed over quality. Fast reviews don’t matter if they miss critical issues that cost you money later.

Effective metrics balance efficiency with effectiveness:

-

Review cycle time by contract type and complexity

-

Issue identification rates and severity levels

-

Post-signature problems and their root causes

-

Reviewer consistency and calibration metrics

-

Cost per contract review and ROI analysis

Similar to how ROI calculators help measure marketing effectiveness, contract review metrics need to balance cost efficiency with risk mitigation to demonstrate true business value.

Professional Legal

Professional Legal Consultation

Knowing when and how to engage legal professionals effectively can save significant costs while ensuring complex issues receive appropriate expert attention. The key is developing clear criteria for when legal consultation is necessary and structuring engagements for maximum efficiency.

Legal consultation isn’t an all-or-nothing decision. Smart engagement strategies help you get expert input where it matters most without breaking the budget. I’ve seen companies spend $50K on legal fees for routine contracts, and others try to handle complex deals without any legal input and get burned badly.

Lawyer Engagement Strategy

Strategic approaches to legal counsel engagement focus on maximizing value while controlling costs. This requires clear criteria for when legal review is necessary and structured processes for working with attorneys efficiently.

Effective lawyer engagement starts with understanding what you need and communicating it clearly. Vague requests for “legal review” waste time and money. Be specific about what you’re worried about and what decisions you need to make.

Just as businesses need strategic competitive response planning, engaging legal counsel requires careful planning and clear objectives to maximize value and minimize costs.

Cost-Benefit Analysis Framework

Systematic evaluation of when legal review costs are justified helps organizations make informed decisions about professional consultation based on contract value, complexity, and potential risk exposure.

Cost-benefit analysis for legal review isn’t just about hourly rates versus contract value. You need to consider the potential cost of getting it wrong. A $10,000 contract might justify $2,000 in legal fees if it contains unusual liability provisions or creates ongoing obligations. A $100,000 routine service agreement might not need any legal review if it uses standard terms you’ve vetted before.

Framework considerations:

-

Contract value and financial exposure

-

Complexity and unusual provisions

-

Regulatory compliance requirements

-

Precedent value for future agreements

-

Internal expertise and confidence levels

Scope Definition and Communication

Clear protocols for briefing legal counsel ensure focused and efficient analysis by communicating review objectives, timelines, and specific areas of concern upfront rather than leaving attorneys to figure out what you need.

Scope definition prevents scope creep and ensures you get the analysis you actually need. Lawyers will review everything if you don’t give them boundaries, and that gets expensive fast.

Effective briefings include background context, specific concerns, decision timeline, and budget constraints. The more context you provide, the more targeted and useful the advice.

Communication protocols should cover:

-

Background and business context

-

Specific legal questions and concerns

-

Timeline and decision requirements

-

Budget parameters and fee arrangements

-

Deliverable format and detail level

Final Thoughts

Modern contract review requires balancing traditional legal rigor with technological efficiency and strategic business thinking. The most successful approaches combine human expertise with smart tools while maintaining focus on practical business outcomes rather than perfect legal analysis.

Contract review doesn’t have to be the bottleneck that slows down your business deals. The combination of solid fundamentals, smart technology, systematic checklists, and strategic legal consultation creates a framework that’s both thorough and efficient.

The key insight I’ve gained from working with hundreds of contracts is that perfection isn’t the goal – informed risk management is. You can’t eliminate all risk from contracts, but you can understand and manage it intelligently. Bottom line: Your contract review process should make deals happen faster, not slower. If it’s taking weeks to get through routine agreements, something’s broken.

Technology will continue evolving, but the fundamentals remain constant: understand what you’re agreeing to, identify the risks, and make informed decisions about what’s acceptable for your business.

If you’re tired of contracts being the thing that slows down every deal, let’s talk. The Marketing Agency’s systematic approach to process optimization and technology integration can help streamline your contract processes while maintaining quality standards. We’ve helped dozens of businesses fix complex workflows – the same principles that make contract review more effective can work for your organization too. Ready to transform your contract processes? Our proven methodology is waiting for you.