Here’s something that bugs me: I see businesses all the time making investment decisions based on ROI calculations that are completely wrong. They’re using methods from the 90s to measure today’s complex marketing campaigns and wondering why their numbers don’t add up. The Standard & Poor’s 500® for the 10 years ending December 31st 2016 had an annual compounded rate of return of 6.6%, including reinvestment of dividends, yet most businesses still rely on outdated calculation methods that fail to capture true investment performance. Bankrate This disconnect reveals a fundamental problem in how organizations approach ROI analysis.

Table of Contents

-

Understanding ROI Calculator Fundamentals

-

Specialized ROI Calculator Applications

-

Implementation and Best Practices

-

Strategic ROI Calculator Evolution

-

Advanced ROI Calculator Features and Integrations

-

Final Thoughts

TL;DR

-

Most businesses are flying blind with outdated ROI calculations that miss the big picture

-

Modern ROI calculators actually connect to your business systems and give you real answers in real-time

-

Different industries need different approaches – your SaaS metrics won’t work for e-commerce

-

Smart ROI tools track the whole customer journey, not just the last click before purchase

-

AI-powered calculators can predict what’s going to work before you spend the money

-

Getting this right isn’t optional anymore – it’s the difference between growing and guessing

Understanding ROI Calculator Fundamentals

Look, ROI calculators aren’t just fancy math anymore. They’ve turned into business intelligence systems that actually tell you what’s working and what’s not. But here’s the thing – most people are still using them wrong.

I’ve been working with these tools for years, and I can tell you that understanding how they really work is the difference between making smart decisions and throwing money at problems.

Core ROI Calculation Mechanics

Here’s where most people mess up right from the start. They think ROI is just about dividing profit by cost, but there’s so much more hiding under the surface.

I’ve seen businesses celebrate “amazing” ROI numbers that were completely meaningless because they forgot to include half their actual costs. Don’t be that business.

Basic ROI Formula Structure

The formula looks simple enough: (Net Profit / Cost of Investment) × 100. But here’s what trips everyone up – net profit isn’t just revenue minus your obvious costs.

When I calculate ROI, I track every single dollar that went into the investment. That means the advertising spend, sure, but also the time your team spent managing it, the design work, the meetings about the meetings. Understanding comprehensive GA4 audit processes that examine every data touchpoint helps us see why a proper roi calculator must capture all investment variables to provide meaningful insights.

Let me give you a real example. You spend $10,000 on a marketing campaign, but you also have $3,000 in staff time managing it and $2,000 in design costs. Your real investment is $15,000, not $10,000. If that campaign brings in $25,000 in revenue, your actual ROI is 67%, not the 150% you’d calculate if you only counted ad spend.

That difference? That’s the difference between thinking you found a goldmine and realizing you need to optimize.

Advanced Calculation Variables

This is where it gets interesting. Modern ROI calculations go way beyond basic math. We’re talking about time value of money, risk assessments, and opportunity costs.

A 20% ROI over six months hits different than 20% over two years. Smart calculators factor in discount rates and inflation to show you what that return is actually worth. Risk adjustments matter too – sometimes a guaranteed 15% beats a risky 25%.

I’ve learned this the hard way: if you’re not accounting for these variables, you’re not calculating ROI. You’re just doing math.

Data Input Requirements

Want to know the biggest mistake I see? Businesses grabbing a few numbers from different systems and calling it ROI analysis. That’s not analysis – that’s guessing with extra steps.

Your data collection needs to be comprehensive:

-

Every penny of initial investment (and I mean every penny)

-

All ongoing operational costs

-

Direct revenue that you can actually trace back

-

Time-based performance metrics

-

Indirect costs that everyone forgets about

I can’t tell you how many times I’ve seen “profitable” campaigns become break-even when we added in the real costs.

|

Data Category |

What You Actually Need |

What Everyone Forgets |

|---|---|---|

|

Initial Investment |

Purchase price, setup fees, licensing |

Staff training time, opportunity costs |

|

Ongoing Costs |

Maintenance, subscriptions, utilities |

Management overhead, system downtime |

|

Revenue Attribution |

Direct sales, cost savings |

Indirect benefits, long-term value |

|

Time Factors |

Investment period, cash flow timing |

Seasonal variations, market cycles |

Return on Investment Calculator Technologies

The technology behind ROI calculators has completely changed the game. We’re not talking about Excel spreadsheets updated once a month anymore.

Cloud infrastructure gives you real-time data across all your systems. Your marketing team, sales department, and finance folks can all see the same numbers at the same time. No more “which version of the spreadsheet are we using?” conversations.

Cloud-Based Calculator Platforms

I remember the old days of emailing spreadsheets back and forth. Never again.

Cloud platforms give you real-time synchronization across all your business systems. Everyone works from the same source of truth, and you can access your data from anywhere. The collaborative aspect alone has saved me countless hours of version control nightmares.

Mobile-Responsive Calculation Tools

I can’t count how many times I’ve needed ROI data while sitting in a client meeting or traveling. Mobile-optimized calculators aren’t just shrunk-down desktop versions – they’re built specifically for on-the-go decision making.

You can pull up performance metrics, run quick calculations, and even generate reports right from your phone. It’s not fancy – it’s practical.

Integration Capabilities

This is where modern ROI calculators really shine. They connect directly with your CRM, marketing platforms, and financial software. No more manual data entry or CSV imports that break every other week.

Advanced AI search engine optimization tools integrate seamlessly with existing marketing stacks, and modern roi calculator platforms provide comprehensive connectivity across all business systems.

The integration pulls data automatically, which means no human error and you’re always working with current information. Your calculator knows exactly what you spent on that Facebook campaign and can track the revenue all the way through your sales funnel.

Automated Reporting Features

Automated reporting has been a game-changer for me. Instead of spending hours compiling data into presentations, the system generates dashboards with trend analysis and actionable insights.

These aren’t just pretty charts – they’re designed to highlight what you need to do next. The system spots patterns, flags weird trends, and suggests optimization opportunities. You get business intelligence, not data dumps.

ROI is lauded and still widely used due to its simplicity and broad usage as a quick-and-dirty method for evaluating investment profitability across different sectors, from stocks and real estate to employees and business operations. Calculator.net

ROI Calculation Methodologies

Not every business situation needs the same calculation approach. Sometimes you need quick answers, sometimes you need deep analysis. Knowing which method to use when is crucial.

Simple ROI Calculations

Sometimes you just need a straight answer. Simple ROI calculations work great for discrete projects with clear start and end points – product launches, specific ad campaigns, equipment purchases.

The math is straightforward, the results are immediately actionable, and you can communicate them to anyone. But don’t use simple calculations for complex, multi-touchpoint investments. You’ll miss crucial factors and make bad decisions.

Multi-Touch Attribution Models

Here’s the reality: customers don’t see your ad once and immediately buy. They might see your Facebook ad, visit your website, read some reviews, get your email, then finally purchase weeks later.

I worked with a company that was ready to kill their content marketing budget because it didn’t show direct conversions. When we implemented multi-touch attribution, we discovered that blog content was influencing 40% of their sales through nurturing and education.

These models require more sophisticated tracking, but they show you how your channels actually work together.

Lifetime Value Integration

This is where ROI calculation gets really powerful. Instead of looking at immediate transaction values, you factor in the long-term value of acquired customers.

A customer acquisition campaign might look expensive based on first-purchase ROI, but when you factor in two years of recurring revenue, the numbers tell a completely different story. I’ve seen “unprofitable” campaigns become the best performers when you account for customer lifetime value.

The key is having reliable historical data about customer behavior, retention rates, and expansion revenue.

Specialized ROI Calculator Applications

Different industries need different measurement approaches. What works for e-commerce won’t work for SaaS, and B2B services need their own framework entirely.

Sales ROI Calculator Systems

Sales ROI gets tricky because you’re dealing with longer cycles, relationship building, and complex attribution. You can’t just look at last-touch conversions and call it good.

Sales Campaign Performance Metrics

Sales campaigns need metrics that go way beyond basic conversion tracking. You need to measure lead quality, not just quantity.

I track cost per qualified lead, lead-to-opportunity conversion rates, and average deal size by campaign. A campaign that generates cheaper leads isn’t better if those leads don’t convert to actual sales.

Here’s a real example: Company A runs two lead gen campaigns. Campaign A generates 100 leads at $50 each ($5,000 total) with a 5% conversion rate (5 sales). Campaign B generates 50 leads at $100 each ($5,000 total) with a 20% conversion rate (10 sales).

Campaign A looks more cost-effective per lead, but Campaign B delivers double the sales. That’s why lead quality matters more than lead cost.

Sales Team Productivity Analysis

Measuring sales team ROI means looking at both individual and team performance. This includes training investments, productivity improvements, and the impact of sales tools.

When I analyze sales productivity, I look at revenue per rep, deal velocity, and win rates. But I also factor in the costs of training, tools, and management time. Sometimes a “less productive” rep who needs more support actually delivers better ROI when you account for their lower total cost.

The goal is optimizing your human capital investment. Which training programs actually improve performance? Which tools provide the best productivity boost for their cost?

Marketing ROI Calculator Frameworks

Marketing ROI is complicated because you’re dealing with multiple channels, brand building, and long-term customer relationships. Standard calculators often miss these nuances.

Adam Expo Stand recently launched Europe’s first AI-powered Exhibition ROI Calculator that analyzes over 50 variables to deliver ROI predictions with up to 89% accuracy, demonstrating how specialized industries are developing sophisticated ROI measurement tools. “Adam Expo Stand Unveils Europe’s First AI-Powered Exhibition ROI Calculator” Digital Journal

Digital Marketing Channel Analysis

Each digital channel has unique characteristics. Social media ROI looks different from search marketing ROI, which looks different from email marketing ROI.

For social media, I track engagement rates, share of voice, and social-driven conversions. But I also measure indirect impacts like brand awareness lift and customer service cost reduction. Understanding these nuances mirrors how we approach market sizing for business opportunities – each channel requires specific analytical frameworks to measure true impact.

Search marketing is more straightforward – click costs, conversion rates, and revenue attribution are pretty clear. Email marketing often gets underestimated because people focus only on direct conversions, but email nurtures prospects and reduces sales cycle length.

Brand Investment Measurement

Brand building investments are tough to measure, but they’re crucial for long-term success. You can’t look at immediate conversions – you need to track awareness metrics, sentiment, and long-term customer value creation.

I use brand tracking surveys, social listening data, and customer acquisition cost trends to measure brand ROI. When brand awareness increases, customer acquisition costs typically decrease over time. This relationship is key to understanding brand investment returns.

The challenge is establishing clear cause-and-effect relationships. It requires longer measurement periods and more sophisticated analysis, but the insights are invaluable.

Cross-Channel Attribution

Modern marketing involves multiple touchpoints across various channels. You need to understand how different activities work together to drive conversions.

I’ve seen businesses dramatically under-invest in top-of-funnel activities because they couldn’t see the connection to bottom-line results. Cross-channel attribution reveals these connections – how awareness campaigns influence search behavior, how content marketing supports sales conversations, how retargeting improves conversion rates.

It’s complex, but it provides much more accurate ROI assessments than single-touch attribution.

The ROI formula is based on two pieces of information – the gain from investment and the cost of investment, with the equation: ROI = (Net Profit / Cost of Investment) × 100, making it universally applicable across different investment types. Omni Calculator

Implementation and Best Practices

Getting ROI calculators right isn ‘t just about picking the right tool. It’s about strategic planning, proper integration, and ongoing optimization.

I’ve seen too many implementations fail because businesses rushed the setup process or skipped crucial planning steps.

Tool Selection and Setup Process

Before you pick any ROI calculator, you need to know exactly what you’re trying to measure and why. I start every implementation with a thorough requirements assessment.

Requirements Assessment Steps

Ask yourself these questions: What decisions will these ROI calculations inform? Who needs access to the data? How often do you need updates? What level of detail is required?

Don’t forget about reporting preferences. Some stakeholders want detailed dashboards, others prefer simple summary reports. Your calculator needs to accommodate different user types and use cases.

Here’s my ROI Calculator Selection Checklist:

-

Define exactly what you want to measure (be specific)

-

Map out all your data sources and required integrations

-

Figure out who needs access and what permissions they need

-

Determine how often you need reports and in what format

-

Set a realistic budget and timeline

-

Check that your current tech stack can handle the integration

-

Plan for growth – will this work in two years?

-

Make sure you meet security and compliance requirements

Integration Planning Process

This is where many implementations crash and burn. You need comprehensive plans that map exactly how data flows between your existing systems and the new ROI calculator.

I create detailed integration maps showing how data moves from source systems (CRM, marketing automation, financial software) into the calculator. This includes data transformation requirements, update frequencies, and error handling procedures. This systematic approach mirrors how we handle retail math calculations – every data point must be accurately captured and processed to ensure meaningful results.

Testing is absolutely crucial. Run parallel calculations during the transition period to ensure accuracy and catch integration issues before going live.

|

Integration Phase |

What You’re Actually Doing |

How You Know It’s Working |

What Usually Goes Wrong |

|---|---|---|---|

|

Assessment |

Map every data source |

100% of sources identified |

Missing systems in inventory |

|

Design |

Build integration architecture |

Zero data transformation errors |

Poor data quality planning |

|

Testing |

Run parallel validations |

99%+ calculation accuracy |

Not enough test scenarios |

|

Deployment |

Go live with new system |

Zero downtime implementation |

No rollback plan |

|

Optimization |

Monitor and improve |

<2 second response times |

Ignoring user feedback |

User Training and Adoption

The best ROI calculator is useless if people don’t use it correctly. I implement structured training programs that cover not just how to use the tool, but how to interpret results and apply insights.

Training should be role-specific. Marketing managers need different skills than financial analysts. Sales reps need different training than executives. Tailor the content to each group’s needs and responsibilities.

Ongoing support is essential. People will have questions, and they’ll discover new use cases over time. Plan for continued education and support to maximize tool effectiveness.

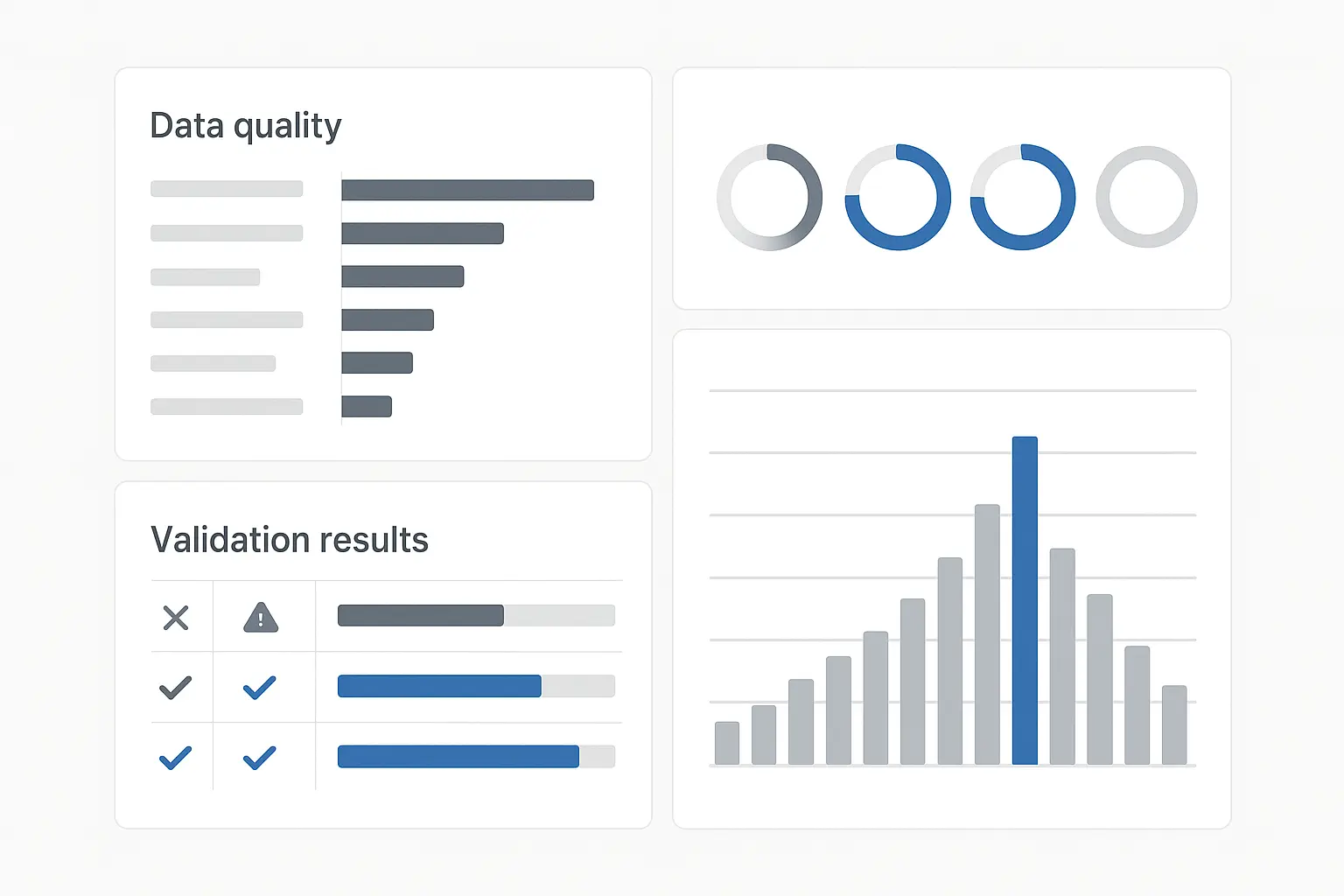

Optimization and Accuracy Enhancement

Getting your ROI calculator set up is just the beginning. Maintaining accuracy requires ongoing calibration, data validation, and methodology refinement to ensure reliable insights that support smart business decisions.

Volac Wilmar Feed Ingredients recently launched ROI Calculator 2.0 that allows dairy farmers to input their own herd data for instant projections on profitability and nutrient digestibility, showing how industry-specific ROI tools are becoming more sophisticated. “New ROI Tool Helps Dairy Farmers Optimize Fat Supplement Use” Feedstuffs

Data Quality Management

Garbage in, garbage out. I can’t stress this enough – data quality directly impacts ROI calculation accuracy, so you need solid quality management protocols.

I establish regular audit schedules to check data accuracy, completeness, and consistency. This includes validation checks that flag unusual values, missing data, and potential errors. Automated alerts notify me when data quality issues pop up.

Data cleansing procedures are equally important. You need standardized processes for handling duplicates, correcting errors, and filling data gaps. Document these procedures so they’re consistently applied across your organization.

Calculation Methodology Refinement

Business environments change, and your ROI calculation methodologies need to evolve too. What worked last year might not be accurate today.

I regularly review calculation methodologies based on business changes, market conditions, and new best practices. This might involve adjusting attribution models, updating lifetime value calculations, or incorporating new cost factors.

The key is balancing accuracy with consistency. You want to improve your calculations, but you also need to maintain comparability over time. Document all methodology changes and explain why you made them.

Strategic ROI Calculator Evolution

The future of ROI calculators is getting exciting. We’re talking AI integration, predictive analytics, and automation that will completely change how businesses measure and optimize investment performance.

AI-Enhanced ROI Prediction

AI isn’t just a buzzword here – it’s actually useful. Machine learning algorithms can analyze your historical data to spot patterns that humans would never catch.

Machine Learning Integration

I’ve worked with ML-enhanced calculators that identified seasonal patterns, channel interaction effects, and customer behavior trends that weren’t obvious from traditional analysis. The system flagged optimization opportunities that we would have missed otherwise.

This approach parallels how continuously learning AI systems adapt and improve over time, providing increasingly accurate insights as they process more data.

The key is having enough historical data for training. Machine learning needs large datasets to identify meaningful patterns and make accurate predictions.

Here’s a real example: A retail company’s AI-enhanced ROI calculator analyzed three years of marketing data and discovered that email campaigns sent on Tuesday mornings had 23% higher conversion rates than the same campaigns sent on other days. The system automatically recommended shifting email schedules, resulting in a 15% improvement in overall email marketing ROI without changing content or targeting.

Would they have figured that out manually? Maybe in five years. The AI found it in five minutes.

Predictive Analytics Capabilities

Predictive analytics takes ROI calculation from reactive to proactive. Instead of just measuring past performance, you can forecast future returns and model different scenarios.

These capabilities are incredibly valuable for budget planning and strategic decision-making. You can model the ROI impact of different investment levels, channel mix changes, or market condition scenarios before committing resources.

You get point estimates, confidence intervals, and risk assessments for different investment options. It’s like having a crystal ball that actually works.

Automated Optimization Recommendations

AI-powered systems can generate automated recommendations for investment reallocation and strategy adjustments based on real-time data analysis and predictive modeling.

I’ve seen systems that automatically recommend budget shifts between channels based on performance trends, suggest optimal timing for campaign launches, and identify underperforming investments that should be discontinued.

The recommendations come with supporting data and rationale, so you understand why the system is making specific suggestions. This transparency is crucial for building trust in automated recommendations.

Advanced ROI Calculator Features and Integrations

Modern ROI calculators offer features that would have seemed impossible just a few years ago. We’re talking real-time data processing, automated alerts, and industry-specific customization.

Real-Time Data Processing

Real-time capabilities have changed everything. You can see campaign performance update live and make adjustments immediately rather than waiting for weekly reports.

Live Dashboard Analytics

Real-time dashboards display continuously updated ROI metrics with interactive visualizations that let you drill down into specific performance segments. You can spot trends as they develop and identify optimization opportunities immediately.

I love being able to see campaign performance update in real-time during launches. When I see conversion rates dropping or costs spiking, I can make adjustments immediately rather than discovering problems days later.

The interactive elements are crucial. You can filter by date ranges, segment by audience, or compare different campaigns side-by-side. This flexibility helps you understand performance drivers and make data-driven optimization decisions quickly.

Automated Alert Systems

Smart notification systems monitor ROI thresholds and automatically alert stakeholders when performance deviates from expected ranges. You set the parameters, and the system watches everything for you.

I configure alerts for different scenarios – when ROI drops below acceptable levels, when costs exceed budgets, or when performance suddenly improves (so I can capitalize on what’s working). The alerts include context and suggested actions, not just raw numbers.

These systems prevent small problems from becoming big ones. Instead of discovering issues during monthly reviews, you get notified within hours and can take corrective action immediately.

Industry-Specific ROI Customization

Different industries need completely different approaches. Your SaaS metrics won’t work for e-commerce, and B2B services need their own framework entirely.

E-commerce ROI Calculations

E-commerce businesses have unique considerations that standard ROI calculators often miss. You need to factor in customer acquisition costs, average order values, return rates, and seasonal fluctuations.

I track metrics including customer lifetime value, repeat purchase rates, and cart abandonment recovery. Return rates significantly impact ROI calculations – a campaign that drives high-value orders isn’t successful if 30% of products get returned.

Seasonal adjustments are crucial too. Holiday performance looks different from regular periods, and you need to account for these variations when calculating annual ROI projections.

SaaS and Subscription Model Analytics

Software-as-a-Service businesses require completely different ROI calculation approaches. Monthly recurring revenue, churn rates, expansion revenue, and customer lifetime value are all critical factors.

I focus heavily on cohort analysis for SaaS ROI calculations. How much did it cost to acquire customers in January, and what’s their cumulative value over time? This approach reveals the true ROI of acquisition investments.

Expansion revenue often gets overlooked in SaaS ROI calculations, but it’s huge. Customers who upgrade or add features can dramatically improve the ROI of initial acquisition campaigns.

B2B Service ROI Frameworks

Business-to-business service companies deal with longer sales cycles, relationship-based revenue, and complex contract structures. Standard ROI calculators don’t handle these nuances well.

I track metrics including pipeline velocity, deal size progression, and relationship depth indicators. A marketing campaign might not generate immediate conversions, but if it accelerates existing deals or increases average contract values, the ROI impact is significant. This comprehensive approach to B2B measurement aligns with how we analyze high-impact content strategies – looking beyond immediate metrics to understand long-term value creation.

Contract renewals and expansions are crucial for B2B service ROI calculations. The initial sale is just the beginning – the real value comes from long-term client relationships and account growth over time.

From January 1, 1970 to December 31st 2016, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 10.3%, demonstrating the importance of long-term perspective in ROI calculations. Bankrate

How The Marketing Agency Can Transform Your ROI Measurement

Look, I get it. You’re probably tired of marketing agencies promising the moon and delivering a handful of dirt. But here’s the thing – most businesses are completely flying blind when it comes to ROI measurement.

I’ve seen companies spend six figures on marketing campaigns that looked profitable but were actually losing money. I’ve watched businesses kill their best-performing channels because they couldn’t measure them properly. It’s painful to watch.

The Marketing Agency specializes in implementing ROI tracking systems that actually work. We integrate advanced calculators with your existing business systems, so you finally get accurate, real-time data for every marketing dollar you spend.

Our approach means you’ll understand which channels, campaigns, and strategies deliver real returns. No more guessing about budget allocation or wondering if your marketing spend is working.

Here’s the deal – I could write another 5,000 words about ROI calculators, but you probably have actual work to do. If you’re tired of making marketing decisions based on gut feelings and partial data, and you want someone who’s been through this mess before to help you figure it out, let’s have a conversation. No sales pitch, just straight talk about what’s actually going to work for your business.

Final Thoughts

ROI calculators have evolved from simple math tools into sophisticated business intelligence systems that can transform how you measure and optimize investment performance. The key to success is selecting the right tools for your specific industry and business model, implementing them properly with comprehensive data integration, and continuously refining your measurement approaches as your business evolves.

Whether you’re tracking simple campaign performance or complex multi-touch customer journeys, modern ROI calculators provide the insights needed to make data-driven decisions that drive profitable growth.

The businesses that thrive in competitive markets are those that can accurately measure and optimize their investment returns. ROI calculators aren’t nice-to-have tools anymore – they’re essential for making informed decisions about where to allocate resources for maximum impact.

Don’t settle for basic spreadsheet calculations or gut-feeling decisions about your investments. The technology exists today to provide precise, real-time insights into what’s working and what isn’t. The question isn’t whether you can afford to implement sophisticated ROI tracking – it’s whether you can afford not to.

Start with your biggest investment areas and implement proper ROI measurement there first. Build your capabilities gradually, but start now. Every day you operate without accurate ROI data is another day of potentially suboptimal investment decisions that are costing you money.