Table of Contents

- Understanding CIMA Case Study Fundamentals

- CIMA Strategic Case Study Exam Preparation

- CIMA Management Case Study Applications

- Advanced Case Study Success Strategies

TL;DR

- CIMA case studies test whether you can think like a business advisor, not just memorize formulas

- Strategic analysis needs systematic stakeholder assessment and realistic risk evaluation

- Pre-seen material analysis is your foundation – spend serious time here before exam day

- Financial analysis must support strategic recommendations with solid quantitative backing

- Communication skills matter as much as technical knowledge – executives need clear, actionable insights

- Time management during exams can make or break your performance regardless of preparation

- Modern case studies increasingly include digital transformation and ESG considerations

Understanding CIMA Case Study Fundamentals

I’ll be honest – my first CIMA case study exam was a disaster. I walked out thinking I’d nailed it, only to get my results and realize I’d completely missed what the examiners were actually looking for. That failure taught me more about these exams than any textbook ever could.

Look, CIMA case studies are tough. They’re designed to see if you can actually think like a business advisor, not just regurgitate formulas you memorized. You’re stepping into the role of someone who must analyze messy, complex scenarios and deliver recommendations that executives can actually use.

With Case Study exams showing pass rates between 53-71% according to VIVA Tuition’s latest analysis, success requires more than technical knowledge – it demands strategic thinking and practical application skills. These numbers should actually give you confidence that these exams are absolutely passable with the right approach.

Strategic Business Analysis Framework

Here’s what I learned the hard way: you need a system, but it can’t feel robotic. I’ve seen too many students memorize some framework and then force every case study into the same template. That’s not how real business works.

My approach now? I start by asking myself the same questions I’d ask if I was consulting for a friend’s business. What industry are we talking about? Who are the competitors? What’s keeping the CEO up at night? These aren’t throwaway questions – they’re the foundation of everything you’ll recommend.

I remember one case about a manufacturing company where everyone focused on the obvious cost issues. But when I dug into the industry context, I realized they were in a sector that was about to be hit by new regulations. That insight completely changed my recommendations and probably saved my grade.

The systematic approach to business analysis mirrors the methodologies used in our market sizing guide for business opportunities, where breaking down complex business scenarios into manageable components is essential for accurate assessment.

The trick is creating a logical story that the examiner can follow without getting lost. Start with the big picture problem, then show how smaller issues either cause it or make it worse. Consider a manufacturing company facing declining margins. Your primary analysis might reveal that raw material costs increased 15% while selling prices stayed flat. Secondary issues could include outdated production equipment reducing efficiency by 8%, competitor pricing pressure from new market entrants, and inventory management problems tying up £2.3 million in working capital. This interconnected analysis shows how multiple factors compound to create the margin pressure.

Stakeholder Impact Assessment

This is where a lot of people get bogged down in theory. Yes, you need to consider different stakeholders, but don’t just list them like you’re reading from a textbook. Think about who actually has power to mess up your recommendations.

I learned this lesson when I recommended a cost-cutting program without thinking about the union implications. In the real world, that recommendation would have been dead on arrival. The examiner probably thought I had no clue how businesses actually operate.

The key insight I wish I’d grasped earlier: stakeholders aren’t equally important. A customer who represents 30% of your revenue gets different treatment than one who represents 0.1%. But here’s the catch – sometimes those small stakeholders can cause disproportionate problems if you ignore them.

| Stakeholder Group | Influence Level | Interest Level | Key Concerns | Potential Impact on Strategy |

|---|---|---|---|---|

| Major Customers (>10% revenue) | High | High | Service continuity, pricing stability | Can veto cost-cutting affecting service |

| Employees | Medium | High | Job security, working conditions | Union resistance, productivity changes |

| Key Suppliers | Medium | Medium | Payment terms, contract stability | Supply chain disruption risk |

| Regulators | High | Low | Compliance, safety standards | Can halt operations if non-compliant |

| Local Community | Low | Medium | Environmental impact, employment | Public relations, licensing issues |

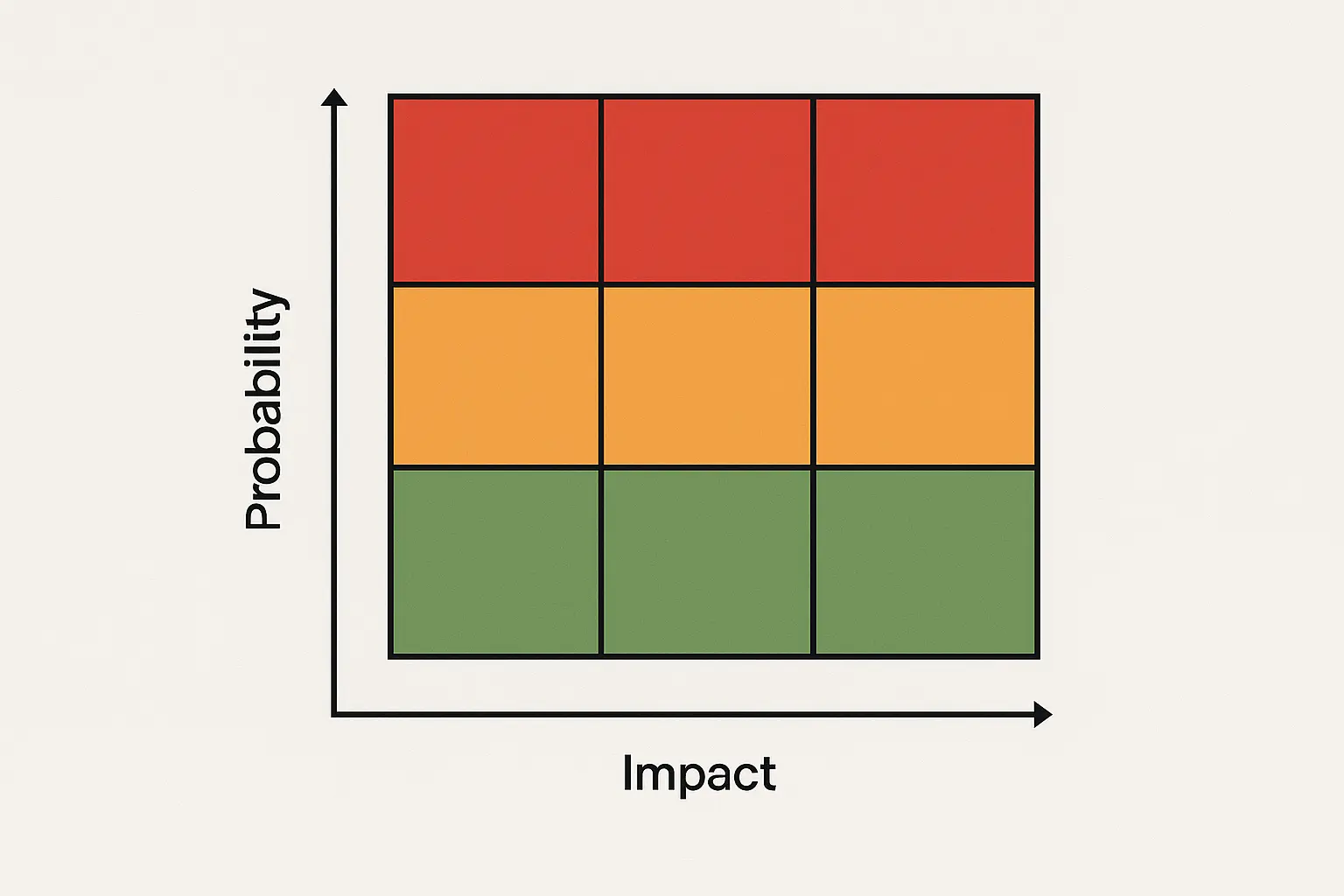

Risk Evaluation Methodology

Risk analysis used to terrify me because I thought I had to identify every possible thing that could go wrong. Spoiler alert: you don’t. The examiner wants to see that you understand the big risks and have thought about realistic ways to handle them.

I now bucket risks into four categories: operational, financial, strategic, and compliance. This keeps me organized and helps ensure I’m not missing obvious stuff. But the real skill is in the mitigation strategies – they need to make business sense, not just sound impressive.

Here’s a reality check that saved me: don’t recommend a £500k risk management system to address a £100k risk. I actually did this once and the examiner’s feedback basically said “this candidate doesn’t understand proportionality.” Ouch, but fair.

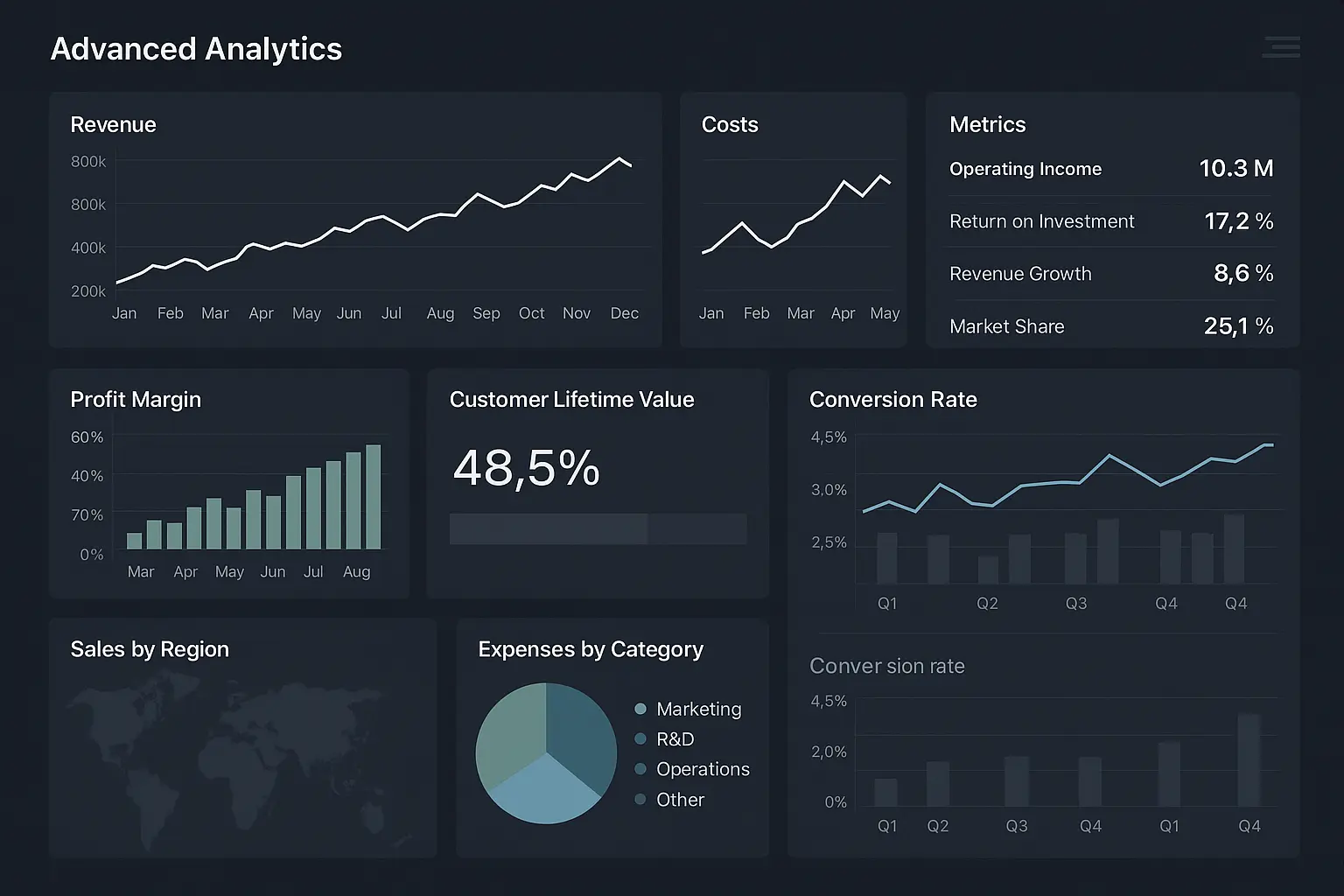

Performance Measurement Integration

The balanced scorecard is fine in theory, but in case studies, you need to think about what metrics actually matter for the specific business problem you’re solving. I used to include customer satisfaction scores for every recommendation until I realized that for some businesses, it’s just not that relevant.

Modern performance measurement requires balancing financial metrics with non-financial KPIs to create a complete view of business performance. You can’t rely solely on profit margins and ROI – customer satisfaction, employee engagement, and operational efficiency metrics provide crucial context for strategic decision-making.

The trick I learned: always connect your proposed metrics to the strategic objectives you’re recommending. If you’re suggesting a digital transformation initiative, you better have metrics that track both the implementation progress and the business impact. Website conversion rates, customer acquisition costs, and employee productivity measures might all be relevant.

Effective performance measurement shares principles with comprehensive analytics strategies outlined in our advanced analytics for strategic growth guide, where data-driven insights drive meaningful business outcomes.

My personal rule now: if I can’t explain why a metric matters in one sentence, I probably shouldn’t include it.

Financial Analysis and Decision Making

This is where the rubber meets the road. Your financial analysis needs to support real business decisions, not just demonstrate that you can use a calculator. I’ve seen brilliant calculations that led to terrible recommendations because the person doing the analysis forgot they were solving a business problem.

Investment Appraisal Techniques

NPV and IRR calculations seem straightforward until you’re dealing with a case study that doesn’t give you nice, clean numbers. Real businesses don’t hand you the discount rate on a silver platter – you have to make reasonable assumptions and be upfront about them.

I used to get paralyzed trying to find the “perfect” discount rate. Now I use the company’s cost of capital if it’s available, or industry benchmarks if it’s not, and I state my assumption clearly. The examiner wants to see your judgment, not your ability to guess what number they had in mind.

Sensitivity analysis became my secret weapon after I realized how much uncertainty exists in any business projection. What happens if sales are 5% lower than projected? What if costs increase by 10%? These scenarios show you understand that business isn’t an exact science.

Here’s something that took me too long to learn: sometimes IRR and NPV give you different rankings for projects. When that happens, explain why one metric is more relevant for this specific decision. Don’t just calculate both and hope the examiner figures it out.

The principles of financial modeling and calculation accuracy mirror those used in our ROI calculator methodology, where precision in financial analysis drives strategic decision-making.

Working Capital Optimization

Working capital analysis is where you can really show business insight. Everyone can calculate ratios, but can you explain what they mean for day-to-day operations?

I remember analyzing a retail company where inventory turnover looked terrible compared to industry averages. My first instinct was to recommend cutting inventory levels. But when I thought about it more, I realized they were in a seasonal business that needed to stock up before peak periods. The real issue wasn’t inventory levels – it was demand forecasting accuracy.

Working capital analysis requires understanding cash flow patterns, inventory management efficiency, and credit policies to identify opportunities for improving cash generation without compromising business performance. Credit policies need balancing between sales growth and cash flow management. Extending payment terms might win new customers, but it also ties up cash and increases bad debt risk.

Cash conversion cycles tell the complete story, but you need to understand the business context. A 60-day cycle might be excellent for one type of business and terrible for another. Don’t just compare numbers – understand what drives them.

Communication and Presentation Skills

This might be the most underrated skill in case study exams. I’ve seen technically brilliant analyses get poor grades because they were impossible to follow. Remember, you’re writing for busy executives who need to make decisions quickly.

Your technical analysis means nothing if you can’t communicate it effectively to different audiences. The communication challenge is real: you’re often addressing multiple audiences at once. The CEO wants strategic insights, the CFO wants financial details, and operational managers need implementation guidance. Your structure needs to work for all of them without becoming a mess.

My breakthrough came when I started leading with conclusions instead of building up to them. Executives don’t have time for mystery novels – they want to know your recommendation first, then they’ll dig into the supporting analysis if they need to.

Executive Summary Construction

Executive summaries aren’t just shortened versions of your full response – they’re standalone documents that could drive decisions on their own. I limit mine to one page and include the problem, key findings, main recommendation, timeline, and expected outcomes.

Executive summaries in CIMA case studies must capture key insights, recommendations, and expected outcomes in a format that enables quick decision-making while providing enough detail to demonstrate the depth of your analysis.

Numbers need context in executive summaries. Instead of “NPV is £2.3 million,” I write “The investment generates £2.3 million in net present value, representing a 23% return that beats our cost of capital by 8 percentage points.” See the difference?

The tone needs to be confident but not arrogant. You’re giving professional advice based on thorough analysis, but you’re also acknowledging that business involves judgment calls beyond pure math.

My Executive Summary Checklist:

- Problem stated in one clear sentence

- Key numbers with context (not just raw figures)

- Main recommendation with timeline

- Expected outcomes and success measures

- Major risks and how to handle them

- What resources you’ll need

- What needs to happen next

CIMA Strategic Case Study Exam Preparation

Strategic case study prep is completely different from other CIMA exams. You’re not memorizing formulas or procedures – you’re developing the thinking skills that senior managers use every day. The preparation process itself teaches you how to approach complex business problems systematically.

Pre-Seen Material Analysis

This is where most people go wrong. They read through the pre-seen material once or twice and think they’re ready. I spend at least 20 hours with this stuff before exam day, and I’m not a slow reader. This isn’t casual reading – it’s detective work.

Pre-seen material analysis forms the foundation of your exam performance, requiring systematic evaluation of the case company’s strategic position, financial performance, and competitive environment. You need to know the company inside and out. What’s their history? Where are they struggling? What opportunities might they be missing? I actually create a one-page company summary that I could use to brief someone who’s never heard of the business.

Financial statement analysis goes way beyond calculating ratios. What story do the numbers tell? Are margins improving or declining? How does working capital management compare to competitors? These insights become the foundation for your exam day recommendations.

Industry research is crucial because the pre-seen material won’t tell you everything. What are the key success factors in this industry? Who are the major players? What external factors might shake things up? This context often determines whether your recommendations make sense.

Industry and Competitive Analysis

Porter’s Five Forces is useful, but don’t just mechanically apply it. Think about how each force specifically affects your case company. Supplier power might be high generally, but maybe your company has long-term contracts that protect them.

Industry and competitive analysis requires thorough research beyond the pre-seen materials to understand market dynamics, competitive positioning, and external factors that could impact your case study organization’s strategic options and performance potential.

I learned to go beyond market share when analyzing competitors. How do their business models differ? What are they really good at, and where are they vulnerable? Sometimes your case company’s biggest opportunity comes from a competitor’s weakness.

Technology disruption deserves special attention these days. Even traditional industries face digital transformation pressure. How might new technologies change customer expectations or competitive dynamics? This often becomes a key exam theme.

The importance of staying current with technological trends is highlighted by “CIMA’s new syllabus updates for 2026” Financial Express, which emphasize cutting-edge financial technologies including GenA

The importance of staying current with technological trends is highlighted by “CIMA’s new syllabus updates for 2026” Financial Express, which emphasize cutting-edge financial technologies including GenAI content and sustainability considerations, reflecting how modern case studies increasingly incorporate these contemporary business realities.

Financial Statement Deep Dive

Trend analysis over multiple years reveals way more than single-year snapshots. Is revenue growth accelerating or slowing? Are margins expanding or shrinking? How has the balance sheet evolved, and what does that tell you about management’s priorities?

Financial statement analysis in strategic case studies requires extracting meaningful insights that support strategic decision-making rather than simply calculating standard ratios. Cash flow analysis often reveals insights that P&L statements miss. A company might show strong profits while struggling with cash generation due to working capital issues or heavy investment requirements.

Ratio analysis needs industry context to mean anything. A 15% return on assets might be fantastic in manufacturing but mediocre in consulting. I always try to benchmark against industry averages and direct competitors when possible.

The systematic approach to financial analysis shares methodologies with our retail math secrets guide, where understanding financial relationships drives strategic business decisions.

When I analyzed a retail chain, I found that revenue grew 12% annually but the cash conversion cycle deteriorated from 45 to 67 days over three years. Inventory turnover dropped from 8.2x to 6.1x, suggesting demand forecasting problems. This insight led to recommendations for better planning systems and inventory management – a £1.8 million investment that could free up £4.2 million in working capital.

Strategic Options Evaluation

Don’t fall in love with your first idea. Generate multiple viable options before evaluating them. Could the company achieve its goals through organic growth, acquisition, partnership, or maybe even selling off parts of the business?

Strategic options evaluation requires developing frameworks for generating and assessing alternative courses of action, considering factors such as feasibility, risk, resource requirements, and alignment with organizational capabilities and objectives.

Feasibility analysis goes beyond financial calculations. Does the company have the management skills to execute this strategy? Are the required resources actually available? What organizational changes would be necessary, and how realistic are they given the company’s culture?

Risk assessment needs to be specific and actionable for each option. Generic risks don’t help anyone. What specific risks does each option create, how likely are they, and what can you actually do about them?

| Strategic Option | Investment Required | Expected NPV | Implementation Risk | Key Success Factors |

|---|---|---|---|---|

| Organic Growth | £2.5M | £8.2M | Medium | Market acceptance, execution capability |

| Acquisition | £15.0M | £12.8M | High | Integration success, cultural fit |

| Strategic Partnership | £0.5M | £4.1M | Low | Partner reliability, shared objectives |

| Market Exit | (£3.2M) | £1.9M | Low | Asset disposal values, employee costs |

Exam Day Execution Strategy

All your preparation means nothing if you can’t execute under pressure. I learned this the hard way when I knew the material cold but still struggled with time management and organization during the actual exam.

Time Management Framework

I spend the first 15 minutes reading all requirements and planning my approach. This feels like wasted time when you’re panicking, but it prevents you from diving into detailed analysis that might not be relevant to what they’re actually asking.

Effective time management during CIMA case study exams requires a structured approach to allocating time across different exam requirements while maintaining flexibility to adapt when certain sections prove more complex than anticipated.

Time allocation should roughly match mark allocation, but build in some buffer for complex calculations or unexpected complications. A 25-mark question gets about 45 minutes, but I might allocate 50 to ensure I can provide thorough analysis.

The biggest time trap is perfectionism. You don’t need NPV calculated to four decimal places or every possible risk factor considered. Focus on analysis that directly supports your recommendations and moves the business decision forward.

Those pass rates of 53-71% according to VIVA Tuition’s analysis should give you confidence – these exams are definitely passable with proper time management and structured approaches, unlike some Objective Test exams that show pass rates as low as 44%.

Response Structure Optimization

Professional formatting matters more than you might think. Clear headings, bullet points for key recommendations, and logical paragraph structure make your response easier to follow and more likely to get full credit.

Response structure in CIMA case studies should enhance readability and demonstrate business acumen through clear headings, logical flow, and professional formatting that makes it easy for examiners to identify and credit your key insights and recommendations.

Each major section should have a clear purpose and conclusion. Don’t just present analysis without explaining what it means for the business decision. How does your financial analysis support your strategic recommendation? What are the implementation implications?

Conclusions need to be specific and actionable. Instead of recommending that the company “improve efficiency,” specify which processes should be targeted, what improvements are realistic, and how success should be measured.

My Response Structure Checklist:

- Clear executive summary up front

- Logical section headings that match requirements

- Bullet points for key recommendations

- Supporting calculations clearly presented

- Risk analysis woven throughout

- Implementation timeline specified

- Success metrics defined

CIMA Management Case Study Applications

Management case studies are more about day-to-day operational stuff than big strategic decisions. You’re showing how management accounting tools solve practical problems and support the decisions managers make every day.

Cost Management and Control Systems

Cost management in these case studies isn’t just about cutting costs – it’s about designing systems that help managers make better decisions. The most technically perfect costing system is useless if managers don’t understand it or won’t use it.

Activity-Based Costing Implementation

ABC implementation isn’t just a technical exercise – it’s about business impact. What decisions will this costing information support? How will it change management behavior? The most technically perfect ABC system is worthless if managers don’t use the information it provides.

Activity-based costing implementation in case studies requires understanding how to design ABC systems that provide meaningful insights for strategic and operational decisions while considering the practical challenges and costs of implementation.

Cost driver selection is all about balancing accuracy with practicality. The theoretically best cost driver might be impossible to measure reliably or too expensive to track. You need cost drivers that are accurate enough to improve decision-making while being practical to implement and maintain.

The implementation process needs serious change management. Managers who are comfortable with traditional costing methods will resist ABC if they don’t understand its benefits or if it threatens their departmental budgets. Your implementation plan needs to address these human factors, not just the technical ones.

I saw a manufacturing company implement ABC and discover that their “low-cost” Product A actually consumed 40% more overhead resources than traditional costing suggested, while Product B was way more profitable than they thought. The ABC analysis revealed that Product A required 12 quality inspections per batch versus 3 for Product B, and generated 8 customer service calls per 100 units versus 1.2 for Product B. This led to an 18% price increase for Product A and a £650,000 investment in quality improvements, ultimately boosting overall profitability by 12%.

Variance Analysis and Corrective Actions

Here’s what they don’t teach you in textbooks: variance analysis is only valuable if it leads to action. A £50,000 adverse material price variance might look scary, but if it resulted from a strategic decision to source higher-quality materials that reduce defect rates, it might actually represent good management.

Variance analysis in case studies goes beyond calculating differences between actual and budgeted performance to interpreting results and developing practical recommendations for addressing performance gaps and operational inefficiencies.

Understanding the story behind the numbers is everything. Why did the variance occur? Was it due to factors within management control or external circumstances? What should management actually do in response, and how can similar variances be prevented?

Corrective actions need to be specific and realistic. Recommending that management “control costs better” is useless. Specific actions might include renegotiating supplier contracts, implementing new quality control procedures, or revising production schedules to improve efficiency.

With Objective Test exams showing pass rates ranging from 44% up to 83% depending on the subject according to VIVA Tuition’s latest data, mastering variance analysis becomes crucial for success across both OT and Case Study formats, since these skills translate directly between exam types.

Budgeting and Forecasting Excellence

Budgeting in case studies isn’t about creating perfect spreadsheets – it’s about creating planning processes that actually help the business adapt and make better decisions.

Rolling Forecast Implementation

Rolling forecasts work when they’re integrated with how the company actually makes decisions. A quarterly rolling forecast might be perfect for a stable business, while a monthly or even weekly forecast might be necessary for companies in volatile industries.

Rolling forecast systems provide flexibility and relevance that traditional annual budgets often lack, requiring careful design to balance accuracy with practicality while supporting both strategic planning and operational decision-making.

The forecasting process needs to balance detail with efficiency. Too much detail makes it cumbersome and time-consuming, while too little detail makes it useless for decision-making. The right level depends on how the forecast will actually be used.

Accuracy measurement and continuous improvement are crucial. How accurate have previous forecasts been, and what caused the forecast errors? This analysis helps refine the process and improve future accuracy.

Zero-Based Budgeting Applications

ZBB works best during periods of significant change or when traditional budgeting has allowed inefficiencies to pile up. It’s resource-intensive, so you need to focus on areas where the potential benefits justify the extra effort required.

Zero-based budgeting requires justifying every expense from scratch rather than simply adjusting previous year’s budgets, making it particularly valuable for identifying cost reduction opportunities and ensuring resources align with current strategic priorities.

The process forces managers to think critically about what activities truly add value. Instead of asking “How much should we spend on marketing?” ZBB asks “What marketing activities are essential to achieve our objectives, and what’s the minimum cost to execute them effectively?”

Implementation challenges include manager resistance (especially from departments facing potential budget cuts) and the time required for thorough analysis. Your implementation plan needs realistic timelines and clear criteria for evaluating budget requests.

Capital Budgeting Integration

The connection between operational and capital budgets often gets overlooked, but it’s crucial for realistic planning. A new production facility requires the initial capital investment plus ongoing operational costs for staffing, maintenance, and utilities.

Capital budgeting integration ensures alignment between operational budgets and long-term investment decisions, requiring coordination between short-term operational planning and strategic capital allocation to optimize overall business performance.

Timing coordination becomes critical when capital projects affect operational capacity. If you’re budgeting for 20% sales growth but the new warehouse won’t be ready until Q3, your operational budget needs to reflect the capacity constraints in the first half.

Resource allocation decisions need to consider both operational and capital requirements. Limited management attention and cash flow might force choices between operational improvements and capital investments, requiring clear prioritization criteria.

Advanced Case Study Success Strategies

Advanced strategies are what separate decent responses from exceptional ones. You’re showing sophisticated thinking that reflects current business realities and emerging trends, not just textbook knowledge.

Professional Skepticism and Critical Analysis

Professional skepticism means questioning assumptions and challenging conventional thinking. You’re demonstrating the mature judgment expected of senior management accountants, not just following formulas.

Assumption Testing Framework

Every business case rests on assumptions, and your job is to identify the critical ones and test their validity. Market growth projections, competitor responses, cost estimates, and implementation timelines all involve assumptions that might prove wrong.

Assumption testing involves identifying and evaluating the validity of underlying assumptions in business scenarios, developing alternative scenarios and assessing their implications for your recommendations and the organization’s strategic direction.

Scenario analysis helps quantify the impact of different assumptions. What happens if market growth is half the projected rate? How do your recommendations change if a key competitor launches a similar product? These scenarios show sophisticated thinking.

The most dangerous assumptions are often the ones that seem obviously true. “Customers will continue to value low prices above all else” might seem reasonable until a competitor successfully differentiates on quality or service.

Evidence-Based Reasoning

Strong evidence comes from multiple sources and different types of analysis. Financial data provides one perspective, but customer feedback, industry benchmarks, and operational metrics add important context that strengthens your conclusions.

Evidence-based reasoning requires supporting recommendations with relevant data, logical analysis, and sound business judgment that can withstand professional scrutiny and provide confidence for executive decision-making.

Quality of evidence matters more than quantity. One highly relevant benchmark might be more valuable than dozens of generic statistics that don’t relate to your specific situation.

Logical reasoning needs to be explicit and easy to follow. Don’t assume examiners will make the same connections you do – spell out your reasoning process so they can evaluate and credit your thinking.

Innovation and Value Creation Focus

Innovation isn’t about implementing the latest technology for its own sake – it’s about identifying opportunities for genuine improvement that align with current business practices and emerging trends.

Innovation and value creation require identifying opportunities for process improvement, technological advancement, and business model evolution that align with contemporary business practices and emerging trends in digital transformation and sustainability.

The evolving landscape of management accounting is reflected in “CIMA’s sylla

The evolving landscape of management accounting is reflected in

“CIMA’s syllabus updates” The Accountant Online, which emphasize the importance of synergizing technology with human insight for career advancement, highlighting how modern case studies increasingly require understanding of financial technologies and sustainability considerations.

Digital Transformation Integration

Digital transformation isn’t about implementing new software – it’s about reimagining business processes to take advantage of digital capabilities. How might AI improve forecasting accuracy? Could blockchain technology enhance supply chain transparency?

Digital transformation considerations must reflect current business realities where technology solutions and digital initiatives are fundamental to competitive advantage rather than optional enhancements to traditional business processes.

The business case for digital initiatives needs to consider both direct financial benefits and strategic advantages that might be harder to quantify. Improved customer experience might not show immediate ROI but could provide long-term competitive advantages.

Implementation challenges include change management, skills development, and integration with existing systems. Your recommendations need realistic timelines and adequate resources for training and system integration.

Understanding digital transformation principles aligns with our expertise in creating continuously learning systems with AI, where technology integration drives sustainable competitive advantages.

Sustainability and ESG Considerations

ESG considerations affect both costs and revenues in ways that traditional financial analysis might miss. Carbon pricing, regulatory compliance costs, and consumer preferences for sustainable products all have financial implications that need consideration.

Environmental, social, and governance factors increasingly influence business decisions and stakeholder expectations, requiring integration of sustainability considerations into financial analysis and strategic recommendations rather than treating them as separate concerns.

Stakeholder expectations around sustainability continue to evolve, affecting everything from employee recruitment to customer loyalty to investor relations. Your recommendations need to consider these broader impacts beyond immediate financial returns.

Measurement and reporting of ESG performance requires new metrics and systems that complement traditional financial measures. How will you track progress on sustainability goals, and how do these metrics integrate with existing performance management systems?

My ESG Integration Framework:

Environmental Analysis:

- Carbon footprint assessment and reduction targets

- Resource efficiency opportunities and cost savings

- Regulatory compliance requirements and timelines

- Green technology investment options and ROI

Social Impact Evaluation:

- Employee engagement and retention strategies

- Community impact assessment and stakeholder relations

- Customer perception and brand value implications

- Supply chain social responsibility considerations

Governance Enhancement:

- Board oversight and reporting structures

- Risk management framework integration

- Transparency and disclosure improvements

- Stakeholder communication strategies

Final Thoughts

CIMA case study success comes down to combining technical skills with strategic thinking, communication abilities, and business judgment. The journey from understanding basic management accounting concepts to applying them in complex scenarios represents significant professional development that prepares you for senior roles.

The skills you develop through case study preparation extend way beyond exam success. You’re learning to think like a business advisor, analyze complex situations systematically, and communicate insights effectively to different audiences. These capabilities serve you throughout your career, whether you’re in industry, practice, or consulting.

Remember that case studies test your professional judgment as much as your technical knowledge. There’s rarely one “correct” answer – examiners want to see well-reasoned analysis that demonstrates understanding of business complexities and trade-offs. Trust your analytical process and support your recommendations with solid evidence.

The investment in case study preparation pays dividends long after you’ve passed your exams. The analytical frameworks, communication skills, and strategic thinking capabilities you develop become part of your professional toolkit, helping you add value in whatever role you pursue next.

Bottom line: these exams are passable. I’m not naturally brilliant at this stuff – I just learned from my mistakes and figured out what actually works. If I can do it, you definitely can.