So I’m procrastinating on LinkedIn Tuesday morning (don’t judge me), and this post from some McKinsey newbie pops up about nailing their case interview. They mentioned that market sizing questions are commonly asked in consulting interviews because they assess a variety of skills, including analytical thinking, problem solving, and communication. Hit me like a brick wall – I’d been doing market analysis completely wrong for years.

That moment took me straight back to my first attempt at estimating market size for a client project. Picture this: me, diving headfirst into complex calculations with zero structure, getting completely lost in the weeds, and ending up with numbers that made absolutely no sense. My boss took one look at my work and said, “This is why we need frameworks.” Ouch. But he was right.

Market sizing isn’t some academic torture device they use in interviews. It’s literally the foundation of every major business decision – from product launches to investment strategies. Whether you’re trying to convince investors, allocate resources, or figure out if your brilliant idea has actual legs, you need to know how big the opportunity really is. No guessing allowed.

I’ve spent the last few years obsessively collecting and analyzing market sizing case studies across different industries. What surprised me? The best practitioners don’t just crunch numbers – they follow proven frameworks that turn wild guesswork into strategic intelligence.

Understanding what is market sizing becomes crucial when you need to evaluate business opportunities with data-driven precision, especially when traditional market research gives you nothing but fluff and outdated reports.

Table of Contents

-

What Makes a Market Sizing Case Study Worth Your Time

-

The Framework That Actually Works (Before You Touch Any Numbers)

-

Technology & Digital Services Cases

-

Healthcare & Wellness Market Opportunities

-

Sustainability & Clean Energy Scenarios

-

Financial Technology Challenges

-

Food & Consumer Goods Markets

-

Education & Professional Services Sectors

-

How to Evaluate These Cases Against Real-World Needs

-

Why The Marketing Agency Gets Market Sizing Right

TL;DR

-

Market sizing success depends on choosing cases that match your data availability, complexity level, and time constraints (don’t bite off more than you can chew)

-

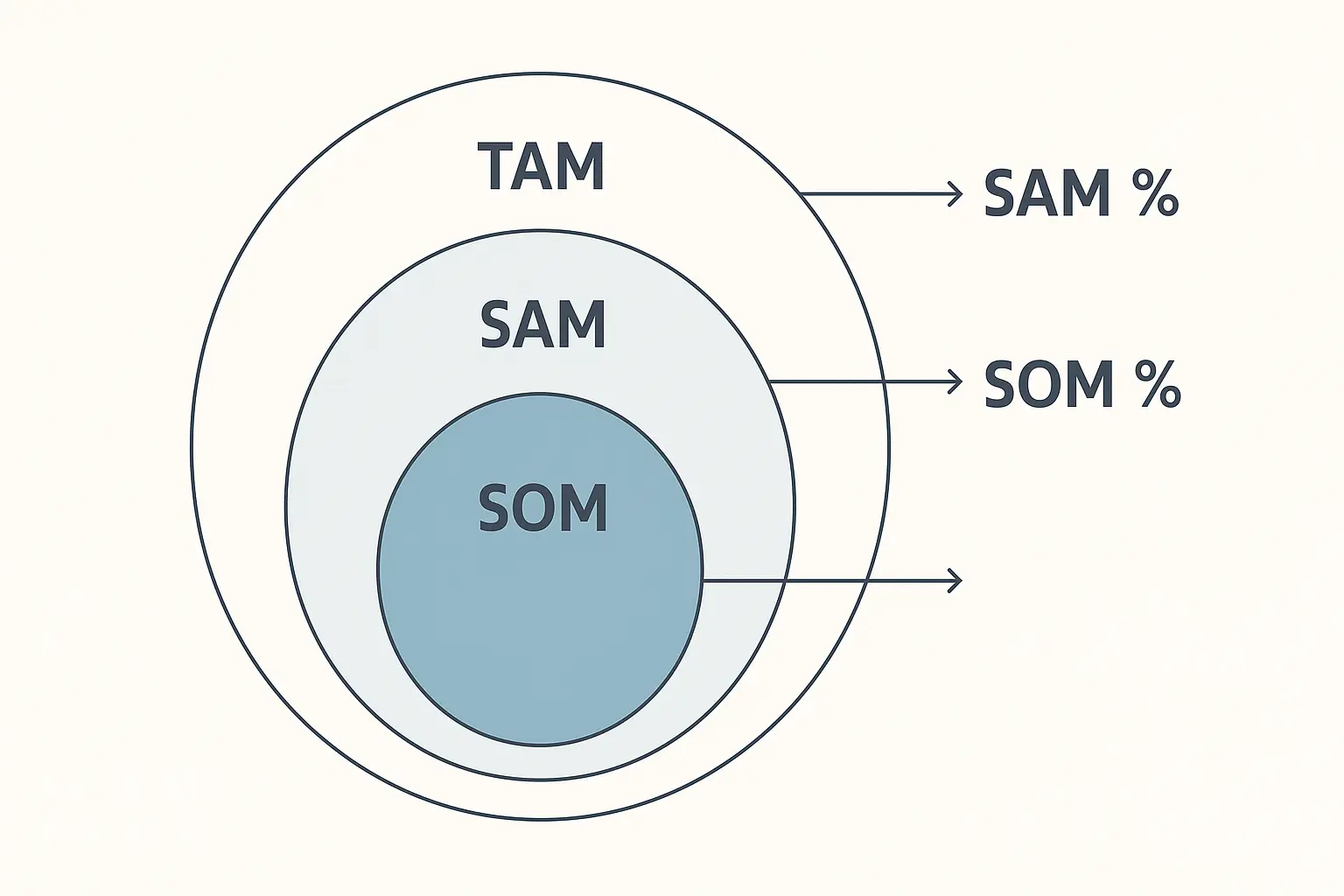

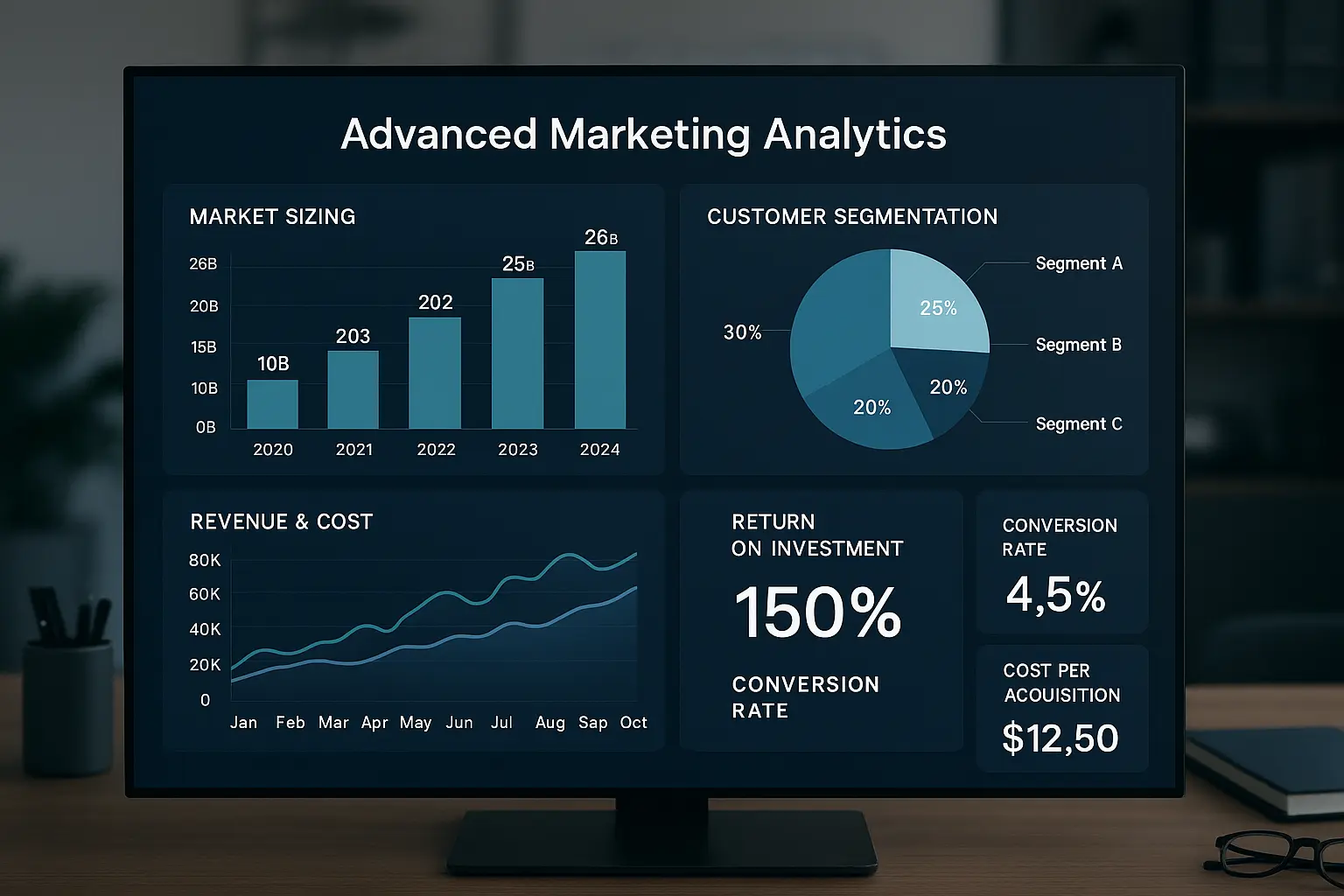

The core framework involves TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market) calculations

-

Top-down approaches start broad and narrow down, while bottom-up builds from specific data points (both have their place)

-

Technology cases require understanding adoption curves and pricing premiums (spoiler: most people get this wrong)

-

Healthcare market sizing must account for regulatory factors and demographic segmentation

-

Sustainability markets involve complex variables including government incentives and technology cost reductions

-

FinTech cases need deep understanding of institutional landscapes and transaction volumes

-

Consumer goods sizing requires replacement cycles and premium pricing analysis

-

Professional services markets depend on corporate training budgets and employee segmentation

-

Always triangulate your estimates using multiple methods and perform sensitivity analysis (seriously, always)

What Makes a Market Sizing Case Study Worth Your Time

Not all market sizing cases are created equal. I learned this the hard way when I spent three entire days analyzing a market that had virtually no reliable data sources. The exercise taught me nothing except how to waste time and get frustrated. Understanding what is market sizing really means in practical terms starts with choosing the right analytical scenarios.

Here’s what separates valuable case studies from complete time-wasters:

Data Quality Makes or Breaks Your Analysis

You need access to reliable primary and secondary sources. Industry reports, government statistics, and market research should be current and relevant to 2025 conditions. If you’re spending more time hunting for basic data than actually analyzing it, you’ve picked the wrong case. (Trust me on this one.)

Match Complexity to Your Goals

Simple cases work great for interview prep – you can knock them out in 20-30 minutes and feel accomplished. Complex multi-variable analyses might take several days but provide the deep strategic insights that actually matter. Know what you’re signing up for before you start, or you’ll hate your life halfway through.

|

Case Complexity |

Time Required |

Best Use Case |

Data Requirements |

Skills Developed |

|---|---|---|---|---|

|

Simple |

20-30 minutes |

Interview prep, quick estimates |

Basic industry data |

Fundamental framework application |

|

Moderate |

1-2 hours |

Strategic planning, market entry |

Multiple data sources |

Multi-variable analysis, segmentation |

|

Complex |

2-4+ hours |

Investment decisions, comprehensive analysis |

Extensive research required |

Advanced modeling, sensitivity analysis |

Real-World Applicability Matters Most

The best cases translate directly to actual business decisions. Can you replicate the methodology across similar industries? Will the insights actually inform strategic planning? If you’re sitting there thinking “maybe,” just move on. Life’s too short for theoretical exercises that don’t help you make better decisions.

Time Constraints Drive Everything

Interview practice requires 45-minute solutions. Comprehensive business analysis might need several days. Strategic planning could take weeks. Be brutally honest about your timeline before choosing your approach, or you’ll end up with half-finished analysis that helps nobody.

Stakeholder Relevance Determines Success

Who’s going to use these insights? What decisions depend on your accuracy? How will success be measured? Understanding your audience shapes every assumption you make. Because honestly, if you don’t know who you’re doing this for, why are you doing it?

The Framework That Actually Works (Before You Touch Any Numbers)

Most people mess up market sizing because they start calculating before they understand what they’re calculating. The market sizing framework comes first, always. No exceptions.

The Three-Layer Market Structure

Every market sizing exercise revolves around three key metrics (and if you forget these, you’re already screwed):

-

Total Addressable Market (TAM): The entire revenue opportunity if you captured 100% market share (spoiler: you won’t)

-

Serviceable Addressable Market (SAM): The portion you can realistically target with your product/service

-

Serviceable Obtainable Market (SOM): What you can actually capture given competition and real-world constraints

Top-Down vs. Bottom-Up Approaches

Top-down starts with broad market data and narrows down. You might begin with “all small businesses in North America” and filter to “SMBs using digital marketing tools.” It’s faster but relies heavily on market research accuracy – which, let’s be honest, is often questionable.

Bottom-up builds from specific data points upward. Start with individual customer behavior, multiply by customer segments, then scale to total market. Takes longer but often provides way more accurate results. (This is my preferred method when I have time.)

When developing your market sizing approach, consider how advanced analytics can enhance strategic growth planning by providing more sophisticated data modeling capabilities for complex market scenarios.

Let’s say you’re estimating the market for coffee shops in Manhattan. I picked this because, honestly, we’ve all wondered about this walking down the street. Top-down approach: Start with Manhattan’s population (1.6M), estimate coffee consumption per person ($400/year), calculate total coffee market ($640M), then determine coffee shop share (40% = $256M). Bottom-up approach: Count coffee shops per block (2), multiply by Manhattan blocks (200 x 11 = 2,200), calculate average revenue per shop ($300K), total market = 4,400 shops x $300K = $1.32B. The massive difference? That’s your signal that assumptions need serious work.

Triangulation Validates Your Estimates

Never rely on a single methodology. Use both top-down and bottom-up approaches, then compare results. Significant differences signal flawed assumptions that need investigation. This step separates amateurs from professionals.

Sensitivity Analysis Tests Your Assumptions

Change your key assumptions by 20-30% and see how it affects outcomes. If small assumption changes create massive result swings, you need more reliable data or completely different assumptions. (I’ve seen entire business plans fall apart because of this step.)

Technology & Digital Services Cases

Tech markets move ridiculously fast, which makes them both exciting and terrifying to analyze. The market sizing examples I’ve selected here represent the full spectrum of complexity you’ll encounter, perfect for those looking to practice market sizing questions in real-world scenarios.

1. AI-Powered Marketing Automation Platform

This one’s a real pain to calculate, but worth it. Complex case that teaches you how to handle emerging technology adoption rates and pricing premiums.

Market Definition: SaaS platform using AI for automated marketing campaigns targeting SMBs in North America.

The Analysis Framework:

-

Start with 30 million SMBs in North America

-

Filter to 18 million using digital marketing (60% adoption – probably generous, but whatever)

-

Calculate average annual marketing software spend at $2,400

-

TAM = 18M × $2,400 = $43.2B

SAM Refinement Gets Tricky:

-

Only 4.5M SMBs ready for AI automation (25% of digital marketers – this is where most people screw up)

-

Premium pricing for AI features: $3,600 annually

-

SAM = 4.5M × $3,600 = $16.2B

SOM Reality Check:

-

Realistic 5-year market capture: 2% (being optimistic here)

-

SOM = $16.2B × 0.02 = $324M

The key insight? AI adoption rates and pricing premium acceptance drive everything. Get these assumptions wrong, and your entire analysis becomes expensive fiction.

2. Cybersecurity for Remote Work

Moderate complexity case perfect for understanding distributed workforce dynamics. (This one’s actually pretty straightforward.)

Market Scope: Enterprise cybersecurity solutions for distributed workforces

-

1.2B remote workers globally

-

2M companies with 100+ remote employees

-

Average security spend per remote worker: $480

-

Market size: $576B globally

3. E-learning Platform for Professional Development

Simple case that demonstrates basic consumer market analysis. Good starter case if you’re new to this.

Target Market: Online certification courses for working professionals

-

3.5B working professionals globally

-

15% seeking additional training annually

-

Average course spend: $300

-

Market size: $157.5B

4. IoT Solutions for Smart Cities

Complex infrastructure case requiring government procurement understanding. Honestly, I hate these types of cases because government data is usually garbage, but they’re important.

Market Definition: Internet of Things infrastructure for municipal governments

City Segmentation Approach:

-

Tier 1 cities (1M+ population): 500 globally

-

Tier 2 cities (100K-1M population): 4,000 globally

-

Smart city budget allocation: 3-8% of municipal budget (huge range, I know)

Bottom-Up Calculation:

-

Tier 1 average IoT investment: $50M over 5 years

-

Tier 2 average IoT investment: $5M over 5 years

-

TAM = (500 × $50M) + (4,000 × $5M) = $45B

Penetration Timeline Reality:

-

Current adoption: 12% of eligible cities

-

5-year projection: 35% adoption (probably optimistic)

-

Addressable market 2025-2030: $15.75B

5. Virtual Reality Training Solutions

Moderate case focusing on enterprise training budget allocation. This one’s actually pretty interesting once you dig into it.

Market Focus: VR-based employee training across industries

-

200,000 large enterprises globally

-

Training budget per enterprise: $2.5M annually

-

VR allocation: 8% (growing fast)

-

Market size: $40B

Healthcare & Wellness Market Opportunities

Healthcare markets present unique challenges because they involve life-and-death decisions, heavy regulation, and complex reimbursement models. These cases will test your ability to handle sensitive variables while understanding what is market sizing means in highly regulated industries. (Pro tip: regulatory factors can kill your beautiful market analysis overnight.)

6. Telemedicine Platform for Rural Areas

Complex case requiring geographic and demographic segmentation. This one taught me how infrastructure constraints can completely reshape market opportunities.

Market Definition: Healthcare delivery via digital platforms in underserved rural communities

Geographic Segmentation Strategy:

-

Rural population in developed countries: 250M

-

Healthcare access challenges: 70% (175M people)

-

Annual healthcare spend per person: $4,200

-

Telehealth addressable portion:

-

Telehealth addressable portion: 25%

Market Calculation Process:

-

Addressable population: 175M

-

Per-person telehealth opportunity: $1,050

-

TAM = 175M × $1,050 = $183.75B

Penetration Analysis Reality:

-

Current telehealth adoption in rural areas: 15%

-

Technology infrastructure readiness: 60% (this is the killer)

-

Realistic 5-year penetration: 35%

-

SOM = $183.75B × 0.35 = $64.3B

7. Mental Health Apps for Workplace Wellness

Moderate case examining corporate wellness program allocation. Corporate mental health spending is exploding right now.

Market Scope: Employee mental health support through mobile applications

-

Global workforce: 3.5B

-

Employer-sponsored wellness programs: 40%

-

Mental health app allocation: $50 per employee

-

Market size: $70B

8. Wearable Health Monitoring Devices

Simple consumer electronics market analysis. Good practice case because the data’s readily available.

Target Market: Consumer wearables for health tracking

-

Health-conscious consumers globally: 800M

-

Wearable device adoption rate: 45%

-

Average device cost: $250

-

Replacement cycle: 3 years

-

Annual market size: $30B

When Apple launched the Apple Watch, they didn’t just estimate the smartwatch market – they analyzed the broader health monitoring opportunity. Their approach combined fitness tracker users (50M), health-conscious smartphone owners (200M), and premium consumer electronics buyers (100M with overlap). By identifying the intersection of these segments and applying a premium pricing strategy, they discovered a $15B addressable market that traditional fitness tracker companies had completely missed. Smart.

9. Personalized Nutrition Services

Complex case involving DNA testing and ongoing service models. This market’s getting crazy competitive.

Market Definition: DNA-based dietary recommendations and meal planning services

Consumer Segmentation Framework:

-

Health-conscious adults in developed markets: 400M

-

Willing to pay for personalized nutrition: 25% (100M)

-

Average annual service cost: $600

Market Layer Analysis:

-

DNA testing component: $150 per customer

-

Ongoing nutrition guidance: $450 annually

-

TAM = 100M × $600 = $60B

Competitive Landscape Factors:

-

Direct-to-consumer services: 60% of market

-

Healthcare provider partnerships: 40%

-

Market fragmentation level: High (top 5 players = 30% share)

Sustainability & Clean Energy Scenarios

Sustainability markets are exploding, but they’re also incredibly complex due to government incentives, changing regulations, and rapidly evolving technology costs. These cases will challenge your ability to model dynamic market conditions, with each market sizing example requiring careful analysis of policy impacts and technological adoption curves. (Side note: government policy changes can completely destroy your projections overnight.)

10. Residential Solar Panel Installation

Complex case requiring housing stock analysis and regulatory understanding. This one’s fascinating because policy changes create massive market swings.

Market Definition: Home solar energy systems including installation and maintenance

Housing Stock Analysis Process:

-

Single-family homes in solar-viable regions: 80M (US)

-

Suitable roof conditions: 70% (56M homes – a lot of homes have terrible roof angles)

-

Economic viability (income >$75K): 60% (33.6M homes)

Market Penetration Dynamics:

-

Current solar adoption: 4% (1.34M homes)

-

Remaining addressable market: 32.26M homes

-

Average system cost: $20,000

-

TAM = 32.26M × $20,000 = $645.2B

Growth Factor Analysis:

-

Government incentives impact: +15% adoption

-

Technology cost reduction: -20% system cost over 5 years

-

Net market expansion: $580B by 2030

11. Electric Vehicle Charging Infrastructure

Moderate case focusing on infrastructure scaling requirements. The math here gets interesting when you consider charging patterns.

Market Scope: Public and private EV charging stations

-

Projected EVs on road by 2030: 145M globally

-

Charging stations needed per EV: 0.1

-

Average station cost: $50,000

-

Market size: $725B

12. Sustainable Packaging Solutions

Simple case demonstrating market segment growth analysis. E-commerce growth is driving this market like crazy.

Target Market: Biodegradable packaging for e-commerce and retail

-

Global packaging market: $1.2T

-

Sustainable packaging segment: 15%

-

Growth rate: 12% annually

-

Market size: $180B

13. Carbon Credit Marketplace

Complex case requiring regulatory environment understanding. Here’s where most people completely screw this up – they ignore the regulatory complexity.

Market Definition: Platform for buying, selling, and trading verified carbon offset credits

Regulatory Environment Mapping:

-

Countries with carbon pricing: 40

-

Companies subject to carbon regulations: 15,000 globally

-

Voluntary carbon market participants: 5,000 additional

Market Dynamics Analysis:

-

Average carbon credit price: $50 per ton CO2

-

Global CO2 offset demand: 2B tons annually

-

Platform transaction fee: 5-15%

-

TAM = 2B tons × $50 × 10% = $10B

Market Segment Breakdown:

-

Compliance market: 70% of volume

-

Voluntary market: 30% of volume

-

Premium for verified credits: 25%

Financial Technology Challenges

FinTech markets combine traditional financial complexity with technology disruption. These cases require understanding both financial market dynamics and technology adoption patterns, with each market sizing example demonstrating different approaches to analyzing financial service opportunities. (Fun fact: Most FinTech projections are wildly optimistic because they ignore regulatory friction.)

14. Cryptocurrency Exchange for Institutional Investors

Complex case requiring institutional landscape analysis. The regulatory environment here changes weekly, which makes this challenging.

Market Definition: Digital asset trading platform serving hedge funds, banks, and institutional investors

Institutional Landscape Mapping:

-

Hedge funds globally: 15,000

-

Asset management firms: 25,000

-

Banks with trading operations: 5,000

-

Total institutional investors: 45,000

Market Sizing Calculation:

-

Institutions trading crypto: 35% (15,750)

-

Average annual trading volume per institution: $100M

-

Platform fee rate: 0.25%

-

TAM = 15,750 × $100M × 0.0025 = $3.94B

Growth Projection Factors:

-

Institutional adoption growth: 25% annually

-

Trading volume growth: 40% annually

-

5-year market projection: $15.2B

15. Buy Now, Pay Later for B2B Transactions

Moderate case examining business financing needs. B2B BNPL is exploding right now – way more interesting than consumer BNPL.

Market Scope: Short-term financing for business purchases

-

B2B transactions globally: $125T annually

-

BNPL addressable portion: 2%

-

Average transaction fee: 3%

-

Market size: $75B

16. Robo-Advisory for Retirement Planning

Simple case focusing on automated investment management. This market’s getting commoditized fast.

Target Market: Automated investment management for retirement savings

-

Working adults in developed markets: 800M

-

Retirement savings participants: 60%

-

Average account management fee: $200 annually

-

Market size: $96B

17. Blockchain-Based Supply Chain Finance

Complex case requiring supply chain finance understanding. This one’s a beast because supply chain finance is already complex without adding blockchain.

Market Definition: Working capital financing secured by supply chain data and smart contracts

Supply Chain Finance Market Analysis:

-

Global trade finance gap: $1.5T

-

Blockchain-addressable portion: 20% ($300B)

-

Platform revenue model: 2-4% of financed amount

Customer Segmentation Strategy:

-

Large enterprises (suppliers): 50,000 globally

-

SMB suppliers in global supply chains: 2M

-

Average financing need per SMB: $500K

-

Average financing need per enterprise: $10M

Market Calculation Breakdown:

-

SMB segment: 2M × $500K × 3% = $30B

-

Enterprise segment: 50K × $10M × 3% = $15B

-

Total addressable revenue: $45B

|

FinTech Sector |

Market Complexity |

Key Variables |

Revenue Model |

Growth Drivers |

|---|---|---|---|---|

|

Crypto Exchange |

High |

Institutional adoption, trading volume |

Transaction fees (0.1-0.5%) |

Regulatory clarity, institutional FOMO |

|

B2B BNPL |

Medium |

Transaction volume, default rates |

Transaction fees (2-4%) |

Cash flow optimization needs |

|

Robo-Advisory |

Low |

AUM growth, fee compression |

Management fees (0.25-0.75%) |

Retirement savings gap |

|

Supply Chain Finance |

High |

Trade finance gap, blockchain adoption |

Platform fees (2-4%) |

Working capital optimization |

Food & Consumer Goods Markets

Consumer goods markets seem straightforward until you dig into the details. These cases will teach you how consumer behavior, demographics, and pricing psychology interact in complex ways, fundamentally changing what is market sizing when applied to consumer-driven industries. (Spoiler: Consumer behavior is way more irrational than your spreadsheets assume.)

18. Plant-Based Meat Alternatives

Complex case requiring protein market analysis and consumer segmentation. This market’s fascinating because it’s all about changing deeply ingrained habits.

Market Definition: Protein products that replicate meat taste and texture using plant ingredients

Protein Market Analysis Framework:

-

Global meat market: $1.4T

-

Flexitarian/vegetarian consumers: 25% of population

-

Plant-based substitution rate: 15% of meat consumption

Consumer Segmentation Insights:

-

Health-conscious consumers: 40% of addressable market

-

Environmental concerns: 35% of addressable market

-

Taste preference: 25% of addressable market (this group’s the hardest to convert)

Market Calculation Process:

-

Addressable meat market: $350B (25% of $1.4T)

-

Plant-based penetration: 12%

-

TAM = $350B × 0.12 = $42B

Premium Pricing Analysis:

-

Plant-based price premium: 50-100%

-

Premium acceptance rate: 60%

-

Market value adjustment: +30%

-

Adjusted TAM: $54.6B

19. Meal Kit Delivery Services

Moderate case examining subscription-based food delivery. Customer acquisition costs are brutal in this market.

Market Scope: Pre-portioned ingredients and recipes delivered to homes

-

Households in target demographics: 150M

-

Households in target demographics: 150M globally

-

Meal kit trial rate: 25%

-

Average annual spend: $600

-

Market size: $22.5B

20. Premium Pet Food and Supplements

Simple case demonstrating pet industry market dynamics. Pet owners will spend ridiculous amounts on their animals – it’s actually amazing.

Target Market: High-end nutrition products for cats and dogs

-

Pet-owning households globally: 800M

-

Premium product adoption: 30%

-

Average annual premium spend: $400

-

Market size: $96B

21. Functional Beverages

Complex case requiring beverage market segmentation and health trend analysis. This market’s getting crowded fast.

Market Definition: Drinks with added health benefits beyond basic nutrition (probiotics, adaptogens, nootropics)

Beverage Market Segmentation:

-

Global beverage market: $1.8T

-

Non-alcoholic segment: 65% ($1.17T)

-

Functional beverage category: 8% ($93.6B)

Consumer Demographics Analysis:

-

Health-conscious consumers: 35% of population

-

Willing to pay premium for function: 60%

-

Target demographic overlap: 21% of population

Market Opportunity Assessment:

-

Current functional beverage penetration: 12%

-

Growth potential to 25% penetration

-

Price premium over regular beverages: 40%

-

5-year market projection: $175B

Education & Professional Services Sectors

Professional services markets depend heavily on corporate budgets and individual career investment decisions. These cases will help you understand how professional development spending works across different market segments, with each market sizing example revealing unique patterns in B2B service consumption. (Corporate training budgets are usually the first thing cut during economic downturns, just saying.)

22. Corporate Training and Development Platforms

Complex case requiring corporate learning landscape analysis. This market’s huge but fragmented as hell.

Market Definition: Digital learning management systems and content for employee skill development

Corporate Learning Landscape Mapping:

-

Companies with >100 employees: 2M globally

-

Average annual training budget: $1,200 per employee

-

Digital platform allocation: 40%

Market Segmentation by Company Size:

-

Large enterprises (1000+ employees): 200K companies

-

Mid-market (100-999 employees): 1.8M companies

-

Average employees per large enterprise: 5,000

-

Average employees per mid-market: 300

Market Calculation Framework:

-

Large enterprise segment: 200K × 5,000 × $480 = $480B

-

Mid-market segment: 1.8M × 300 × $480 = $259.2B

-

Total TAM: $739.2B

Platform Revenue Model Breakdown:

-

Subscription fees: 60% of revenue

-

Content licensing: 25% of revenue

-

Implementation services: 15% of revenue

23. Online Language Learning for Business

Moderate case examining corporate language training needs. Globalization is driving serious demand here.

Market Scope: Corporate language training for global workforce

-

Multinational companies: 100,000

-

Average employees needing language training: 500

-

Annual training cost per employee: $800

-

Market size: $40B

24. Professional Certification and Licensing

Simple case analyzing industry certification markets. Professional certifications are recession-proof – people always want to skill up.

Target Market: Online courses and exams for industry certifications

-

Professionals seeking certification annually: 50M

-

Average certification cost: $500

-

Renewal and continuing education: $200 annually

-

Market size: $35B

25. Executive Coaching and Leadership Development

Complex case requiring executive population analysis and service utilization modeling. Executive coaching is expensive but companies keep paying for it.

Market Definition: One-on-one and group coaching services for senior executives and high-potential employees

Executive Population Segmentation:

-

C-level executives globally: 500K

-

VP-level and senior directors: 2.5M

-

High-potential managers: 5M

-

Total addressable executives: 8M

Service Utilization Rate Analysis:

-

C-level coaching participation: 40%

-

VP-level coaching participation: 25%

-

Manager-level coaching participation: 15%

When analyzing professional services markets, understanding retail math principles can enhance your revenue modeling accuracy by providing better frameworks for calculating customer lifetime value and service pricing optimization.

LinkedIn Learning’s market entry strategy shows how smart professional services sizing works. Instead of targeting all 3.5B working professionals, they focused on the 750M professionals actively seeking career advancement, then narrowed to the 225M willing to pay for premium content. By analyzing corporate learning budgets ($366B globally) and individual professional development spending ($50B), they identified a $25B addressable market for their freemium-to-premium model, leading to their $26.2B acquisition by Microsoft. That’s how you do market sizing right.

How to Evaluate These Cases Against Real-World Needs

Now that you’ve seen all 25 cases, how do you pick the right ones for your situation? I’ve learned that wrong case selection wastes more time than poor analysis technique. Whether you’re preparing for a market sizing case interview or conducting strategic analysis, matching the right case to your objectives saves you from hours of frustration.

Data Availability Determines Feasibility

High availability cases (like e-learning platforms or wearable devices) let you focus on methodology rather than data hunting. Moderate availability cases (cybersecurity or VR training) require more creative assumption-making – which is honestly more realistic. Low availability cases (IoT smart cities) demand extensive triangulation and sensitivity analysis. Pick based on how much time you want to spend researching versus analyzing.

Complexity Matching Prevents Frustration

Simple cases work perfectly for interview prep or quick strategic estimates. You can complete them in 20-45 minutes with basic multiplication and feel accomplished. Moderate cases require 1-2 hours and involve multiple variables or market segments – good for building confidence. Complex cases need 2-4 hours and demand deep industry knowledge plus sophisticated modeling. Don’t jump into complex cases if you haven’t mastered the simple ones.

Time Requirements Drive Selection

Interview practice? Stick to simple and moderate cases. Strategic planning? Complex cases provide the depth you actually need. Investor presentations? You’ll want comprehensive analysis with multiple scenarios and sensitivity testing. Be honest about your timeline or you’ll end up with half-finished analysis that helps nobody.

Stakeholder Relevance Shapes Approach

Investors care about market size and growth potential – show them the big numbers. Product teams need customer segmentation and pricing insights – get granular. Sales teams want competitive landscape and penetration analysis – focus on market share dynamics. Marketing teams require demographic breakdowns and channel opportunities – segment everything. Know your audience or waste everyone’s time.

|

Use Case |

Recommended Cases |

Time Investment |

Key Outputs |

Success Metrics |

|---|---|---|---|---|

|

Interview Prep |

E-learning, Wearables, Pet Food |

20-45 minutes each |

Quick TAM calculations |

Framework mastery, speed |

|

Strategic Planning |

AI Marketing, Telemedicine, Plant-based Meat |

2-4 hours each |

Detailed segmentation |

Decision confidence |

|

Investment Analysis |

Solar, Crypto Exchange, Supply Chain Finance |

4+ hours each |

Risk-adjusted projections |

ROI accuracy |

|

Product Launch |

Cybersecurity, BNPL, Functional Beverages |

1-3 hours each |

Go-to-market sizing |

Revenue forecasting |

Real-World Application Validates Effort

Look, the best cases translate directly to business decisions. Can you actually use this methodology for similar industries? Will these insights inform real strategic planning? Does the framework work when you need it six months from now? If you’re sitting there thinking “maybe” to any of these, just pick a different case. Life’s too short.

Why The Marketing Agency Gets Market Sizing Right

Here’s what hit me after going through all these cases: most businesses are basically throwing darts blindfolded when it comes to understanding their market opportunity. They’re dropping serious cash on marketing campaigns based on “it feels right” and whatever competitor analysis they Googled last Tuesday. (Been there, done that, bought the expensive t-shirt.)

The Marketing Agency actually gets it though. Their whole “highly tuned scientific approach” thing isn’t just marketing fluff – they’re literally doing rapid market sizing during their discovery calls. When they’re asking about your competitive landscape and target segments, they’re running these same calculations in real-time.

Strategic Alignment with Market Sizing

Their SEO work? That’s keyword opportunity sizing – figuring out total search volume and competition levels to decide where to spend your time and money. PPC campaigns need accurate market sizing or you’ll set conversion targets that make your CFO cry. And don’t get me started on email segmentation without understanding segment sizes first.

Their approach to market analysis integrates seamlessly with ROI calculation methodologies that help businesses understand the true value of their marketing investments across different market segments.

AI-Driven Market Intelligence

What’s cool is how they integrate AI-driven analytics with these market sizing principles. So instead of you sitting there with a calculator for three hours, their systems automate the data collection, adjust based on real performance, and use predictive analytics to forecast where markets are heading.

By leveraging strategic budget allocation tools, they ensure that market sizing insights translate directly into optimized marketing spend across channels and customer segments.

This scientific approach means your marketing investments are based on solid market intelligence instead of “well, Facebook worked for that other company we heard about.” Because as they put it, “your business shouldn’t gamble on marketing.” (Finally, someone who gets it.)

Ready to stop guessing and start using real market sizing for your business strategy? The Marketing Agency can help you turn all this analysis into marketing results that actually matter.

Final Thoughts

Market sizing isn’t some academic exercise they torture you with in interviews – it’s literally the foundation of every smart business decision you’ll make. These 25 cases? They represent years of real-world application across industries that are completely reshaping how we do business.

What gets me about working through these scenarios is how they expose the massive gap between what we assume and what’s actually happening. That AI marketing platform case? Taught me that adoption rates crush total market size every single time. The rural telemedicine analysis showed me how infrastructure constraints can kill even the most promising market opportunities. And the plant-based meat case… man, that one proved that consumer segmentation drives absolutely everything in emerging markets.

Here’s the thing though – the framework matters way more than getting the perfect numbers. Top-down versus bottom-up, triangulation, sensitivity analysis… these aren’t just consulting buzzwords that sound impressive in meetings. They’re literally the difference between strategic insights that drive growth and really expensive mistakes that get you fired.

Start simple if you’re new to this stuff. Build confidence with e-learning platforms and wearable devices before you jump into blockchain supply chain finance or carbon credit marketplaces. (Trust me on this one – I’ve watched people get completely lost in the weeds on complex cases.) But don’t stay comfortable forever. The complex cases are where you develop the analytical thinking that separates strategic leaders from Excel jockeys.

Your next market sizing exercise might inform a product launch, guide a major investment decision, or shape your company’s entire five-year strategy. The methodology you choose today determines whether that decision succeeds spectacularly or fails expensively.

Choose wisely, calculate carefully, and remember – the goal was never precision. It’s insight that actually drives action.