Table of Contents

-

Understanding VAT Calculator Fundamentals

-

Mastering Core Calculation Methods

-

Navigating Regional Rate Variations

-

Implementing Business-Ready Solutions

-

Choosing the Right Online VAT Calculator Tools

-

VAT Calculator Applications for US Businesses

-

Handling Advanced Calculation Scenarios

-

Building Implementation and Maintenance Systems

-

How The Marketing Agency Can Transform Your VAT Calculator Strategy

TL;DR

-

VAT calculations require mastering both standard addition formulas and reverse calculations for inclusive pricing

-

Regional variations in VAT rates demand flexible systems that handle standard, reduced, zero-rated, and exempt classifications

-

Online VAT calculator tools must prioritize accuracy, compliance features, and seamless integration capabilities

-

US businesses need VAT calculation capabilities for international operations and cross-border e-commerce

-

Advanced scenarios involving multi-rate transactions and partial exemptions require sophisticated calculation approaches

-

Successful implementation depends on robust system integration, performance optimization, and comprehensive testing protocols

Understanding VAT Calculator Fundamentals

Look, I’ll be honest – VAT calculations used to give me serious headaches. It’s not just about punching numbers into a calculator and calling it a day. Last year, I watched a client get slammed with a massive penalty because their “simple” VAT setup had been calculating everything wrong for months. That’s when it hit me – most of us are basically flying blind with this stuff.

Here’s the thing nobody tells you: a decent vat calculator isn’t just nice to have when you’re processing tons of transactions daily – it’s absolutely critical. I learned this the hard way after spending way too many late nights trying to figure out why the numbers weren’t adding up. The folks at Omnicalculator put it perfectly when they explain that “VAT/GST applies to every stage of production of goods and services (therefore called a multi-stage tax) and is calculated based on the ‘added value’ only”. Sounds simple enough, right? Wrong.

The scary part is how quickly small mistakes snowball. I’ve seen businesses discover they’ve been off by thousands because they didn’t nail down the basics first. It’s like building a house on a shaky foundation – everything else crumbles. Just like when I was learning about retail math calculations, getting your vat calculator fundamentals rock-solid is what keeps you from losing sleep over compliance issues.

Mastering Core Calculation Methods

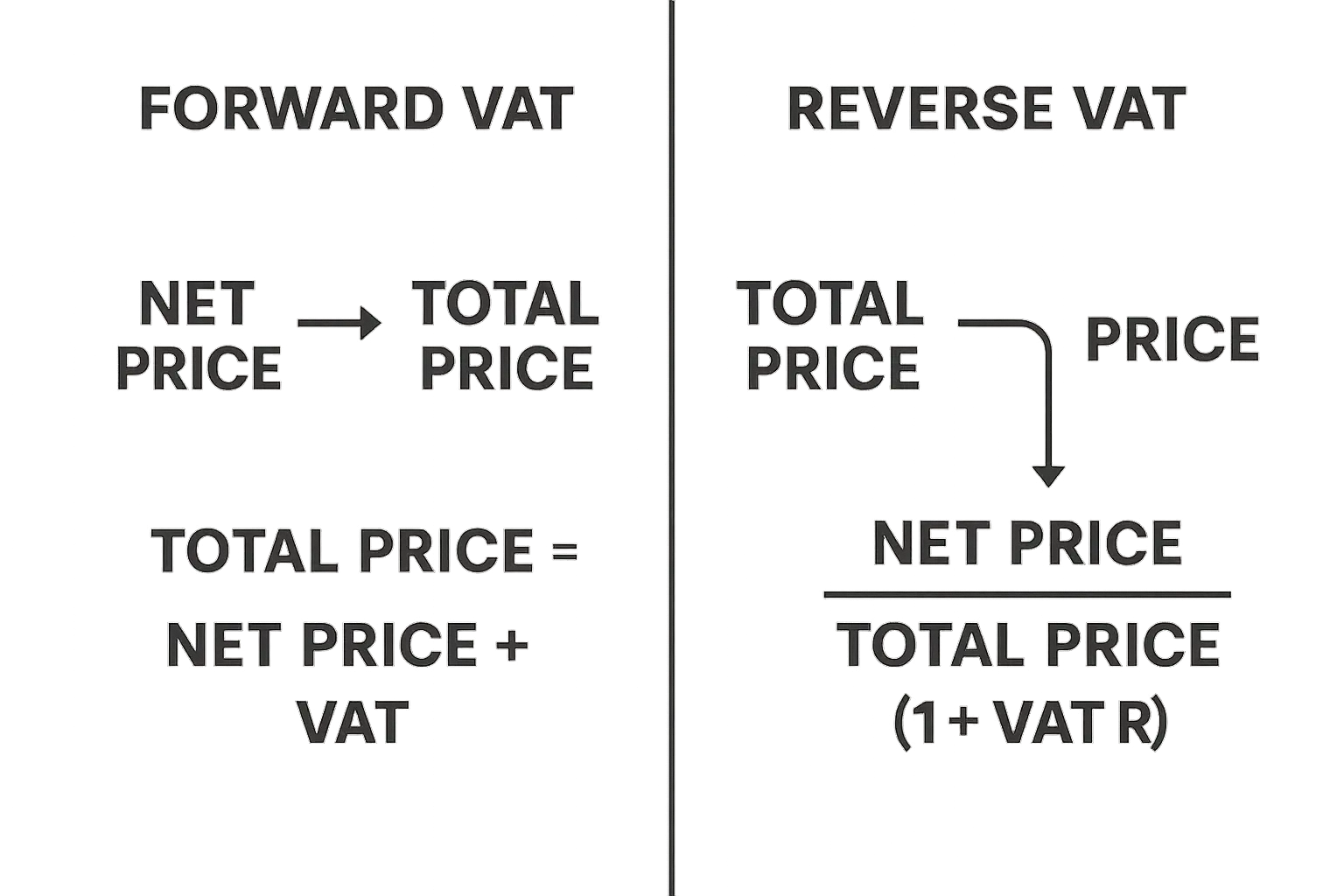

Okay, math time. Don’t panic – this isn’t as scary as it looks, and you won’t need to dust off your high school algebra textbook. There are really just two ways to handle VAT calculations: adding tax to a net price, or working backwards from a price that already includes VAT. Master these two, and you’re 90% of the way there.

Standard VAT Addition Formula

This one’s pretty straightforward – you take your base price and add the tax on top. Say you’ve got a 10% VAT rate. You multiply your price by 0.10 to get the VAT amount, then add it to your original price. Done.

I use this method mostly for business-to-business stuff where companies expect to see the breakdown. They want transparency, and honestly, it makes everyone’s life easier when the invoice clearly shows what’s what. Any vat calculator worth its salt should handle this without breaking a sweat.

Here’s a real example that makes sense: You’re charging $1,000 for consulting work, and you need to add 20% VAT. VAT comes to $200, so your client pays $1,200 total. Simple, clean, no confusion.

Reverse VAT Calculation

Now this is where things get interesting – and where I used to mess up constantly. When you’ve got a price that already includes VAT, you need to work backwards to figure out how much of that is actually tax.

The trick is dividing your total price by (1 + VAT rate), then subtracting that result from your original price to get the VAT portion. I know it sounds backwards, but once you get the hang of it, it becomes second nature.

This comes up all the time with consumer pricing or when you need to figure out how much VAT you’ve actually collected. Trust me, any decent vat calculator better be able to handle both directions flawlessly, or you’re going to have problems.

Navigating Regional Rate Variations

Different countries and their VAT rates – this is where things get messy fast. It’s like trying to remember everyone’s birthday, except the consequences of forgetting are a lot more expensive. Most places have standard rates somewhere between 15-25%, but then they throw in reduced rates, zero rates, and exemptions just to keep us on our toes.

Standard Rate Applications

Most countries stick their standard VAT rates somewhere in that 15-25% range for regular stuff. Seems simple enough, right? Here’s where I used to screw up – I assumed everything fell under the standard rate. Big mistake. Huge.

Taking the time upfront to properly categorize what you’re selling saves you from nasty surprises later. Trust me on this one.

|

Country |

Standard VAT Rate |

Reduced Rate |

Zero Rate Items |

|---|---|---|---|

|

United Kingdom |

20% |

5% |

Food, children’s clothing, books |

|

Germany |

19% |

7% |

Food, medical supplies, books |

|

France |

20% |

5.5% / 10% |

Food, pharmaceuticals, hotels |

|

Spain |

21% |

10% |

Food, medical products, books |

|

Italy |

22% |

4% / 10% |

Food, medical supplies, books |

Reduced Rate Categories

Essential stuff like food, medical supplies, and educational materials often get reduced VAT rates. Sounds reasonable, except figuring out what counts as “essential” in each country is like solving a puzzle where the pieces keep changing shape.

What drives me crazy is how different each country’s definition is. Something that’s considered essential in Germany might not qualify for reduced rates in France. If you’re dealing with multiple countries, a solid vat calculator needs to handle all these variations automatically, or you’ll go nuts trying to keep track.

The situation in Cyprus shows just how quickly things can change. “The legislation concerning the VAT reductions was amended by the Government in June 2023 introducing new provisions” according to Cyprus Property Buyers. Property VAT rates shifted from 19% down to 5% for first-time buyers, but only if you meet specific criteria. See what I mean about things changing?

Zero-Rated and Exempt Classifications

Here’s where it gets really fun – zero-rated transactions have 0% VAT but you’re still in the VAT system, while exempt transactions are completely outside the system. The difference matters more than you’d think, especially when it comes to reclaiming input VAT.

I’ve watched businesses miss out on legitimate VAT reclaims because they didn’t understand this distinction. It’s one of those things that seems minor until it costs you money.

Implementing Business-Ready Solutions

Getting VAT calculations working in your actual business is where theory meets reality – and reality can be pretty unforgiving. You can’t just slap VAT calculations onto your existing systems and hope for the best. Everything needs to work together smoothly, or you’ll create more problems than you solve.

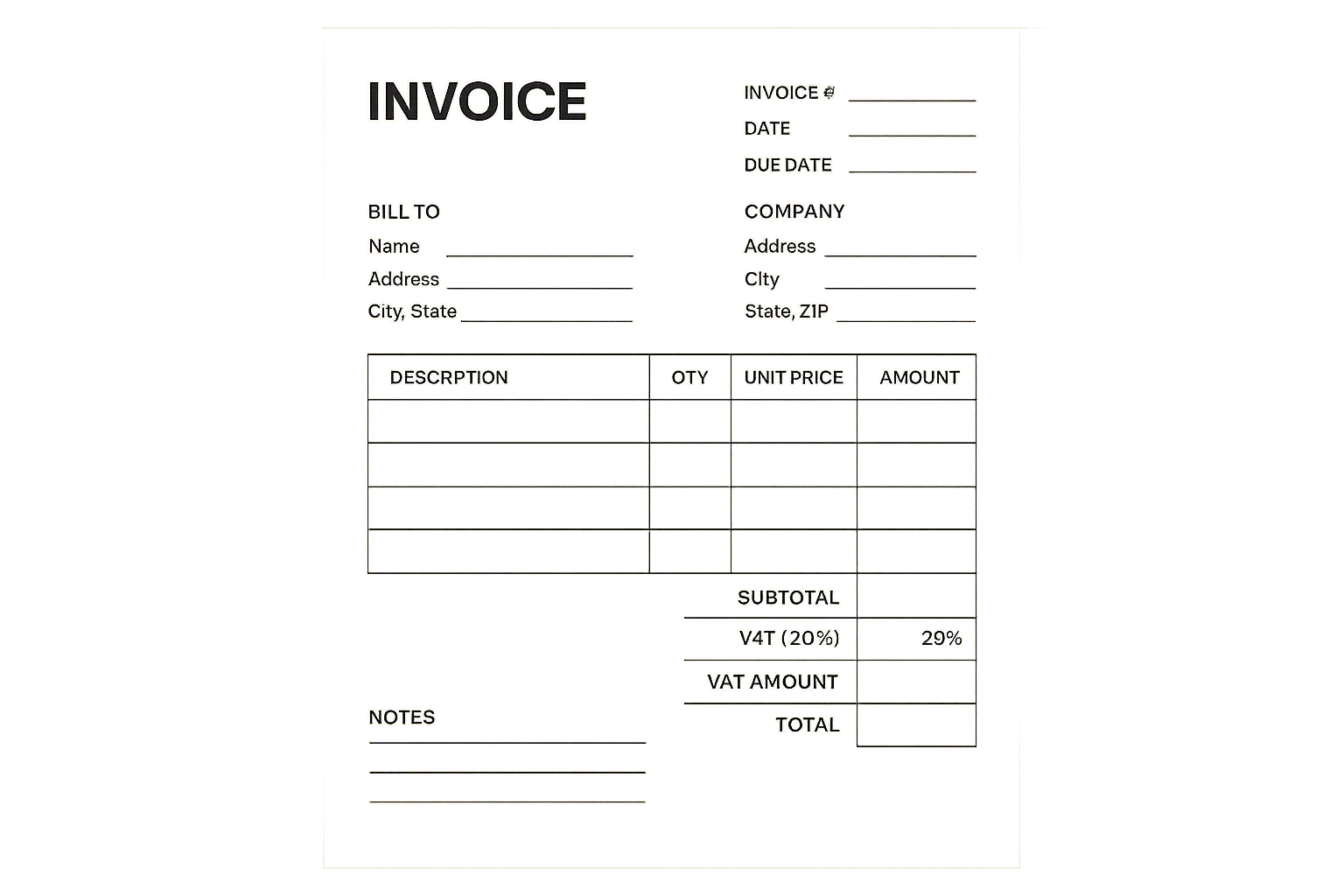

Invoice and Pricing Integration

Your VAT calculations need to play nice with how you already price things and create invoices. Customers shouldn’t be confused, and your accounting team shouldn’t want to strangle you every month when they’re trying to reconcile everything.

I always tell people to establish clear policies for how VAT shows up on invoices and quotes right from the start. Consistency saves everyone headaches later. It’s like setting up proper Google Analytics 4 tracking – do it right the first time, and you won’t hate yourself later. Your vat calculator integration needs the same systematic approach.

You can’t just bolt VAT calculations on as an afterthought. They need to be woven into your entire pricing and invoicing process from day one.

VAT Invoice Integration Checklist:

-

Make sure VAT registration numbers show up on all invoices

-

Display net amount, VAT rate, VAT amount, and gross total separately

-

Include proper product/service categories for different VAT rates

-

Set up automatic VAT rate updates based on where your customer is

-

Create validation rules so you can’t accidentally use wrong rates

-

Build audit trails for all VAT calculations and changes

-

Test that your invoice formats work with your accounting software

-

Have backup plans for when systems go down (because they will)

Choosing the Right Online VAT Calculator Tools

I’ve tested more online vat calculator tools than I care to admit, and honestly, most of them are garbage. The good ones nail accuracy, compliance, integration, and actually work on your phone without making you want to throw it across the room.

Platform Selection Criteria

Picking the right online VAT calculator feels a lot like shopping for a car – there are tons of options, but most of them won’t actually do what you need. You need something accurate, compliant, and that plays well with your existing systems.

The quality differences are shocking. Some tools give you basic calculations but completely ignore compliance features that actual businesses need. It’s like choosing between comprehensive SEO tools – you want something that delivers both functionality and reliability, not just pretty interfaces.

Accuracy and Compliance Features

Good VAT calculators stay up-to-date with tax rate changes automatically and support multiple countries without breaking. They include validation that catches errors before they become expensive problems.

These features aren’t optional if you’re selling internationally. Tax rates change all the time, and manual updates are just asking for trouble.

|

Feature Category |

Essential Requirements |

Advanced Features |

|---|---|---|

|

Calculation Accuracy |

Multi-decimal precision, Rounding rules |

Real-time rate validation, Error detection |

|

Rate Management |

Manual rate updates, Basic jurisdictions |

Automatic updates, Global coverage |

|

Integration Options |

Basic API, CSV export |

REST/SOAP APIs, Webhook support |

|

Compliance Tools |

Standard reporting, Audit logs |

Regulatory alerts, Compliance dashboards |

|

User Interface |

Desktop compatibility, Basic mobile |

Responsive design, Mobile apps |

Integration and Automation Capabilities

The best vat calculator tools connect with your accounting software, e-commerce platform, and other business systems through APIs. This automation eliminates the manual work and reduces the chance of human error screwing things up.

The time savings from proper integration are massive. Instead of manually calculating VAT for every transaction, your systems handle everything automatically while keeping everything accurate.

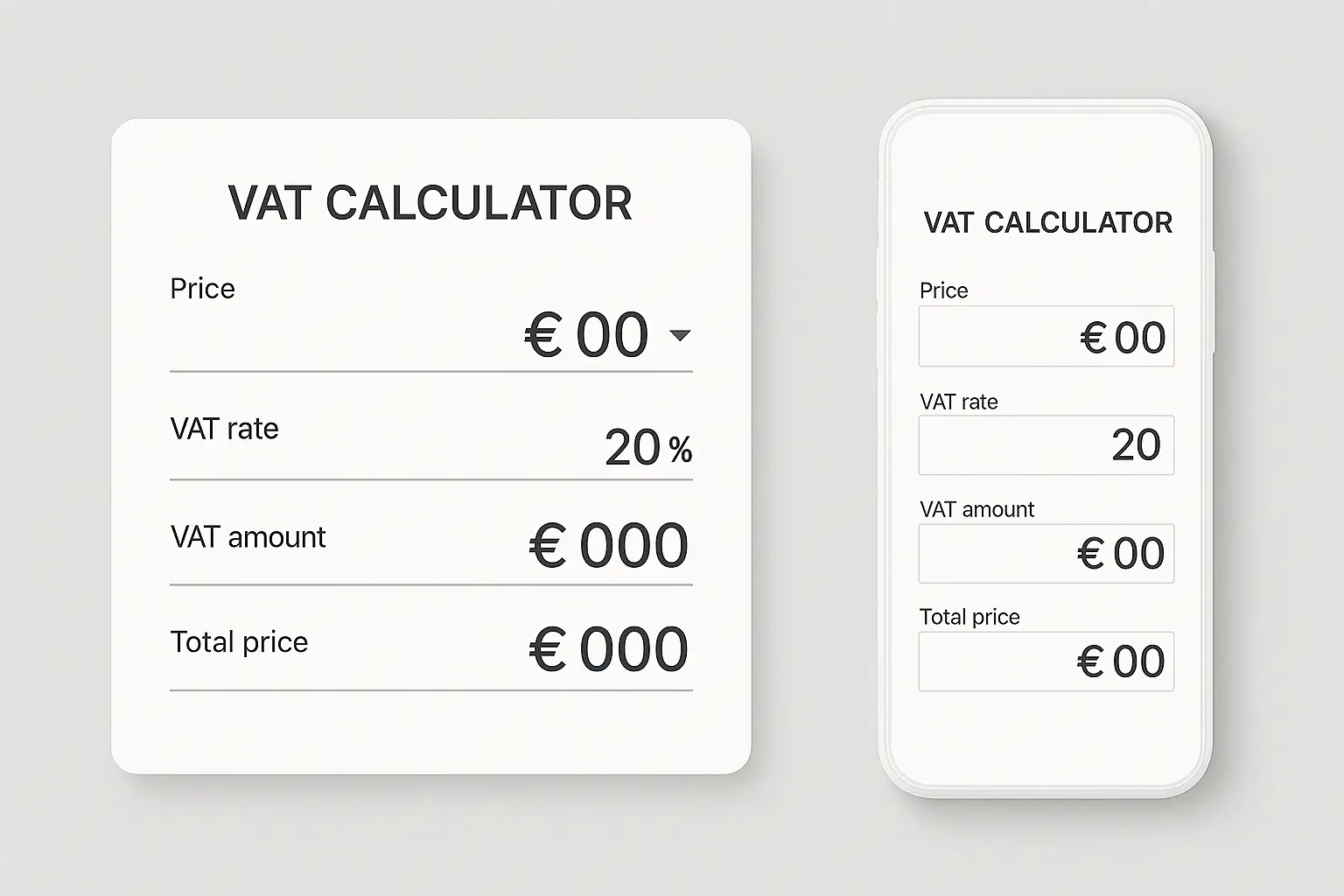

User Experience and Accessibility

Great VAT calculator tools don’t require a computer science degree to use. The best ones are intuitive enough that anyone on your team can figure them out without extensive training.

Mobile Optimization Standards

Your vat calculator needs to work just as well on phones and tablets as it does on desktop. Your team needs consistent accuracy and usability no matter what device they’re using.

I’ve found that mobile optimization often reveals design flaws. If a tool doesn’t work well on mobile, it probably has underlying usability issues that affect desktop users too.

VAT Calculator Applications for US Businesses

Here’s something most US businesses don’t realize until it’s too late – you might need VAT calculations even though we don’t use VAT domestically. If you’re selling internationally or have overseas operations, you’re going to need to understand this stuff whether you like it or not.

International Business Requirements

US companies doing business globally can’t ignore VAT anymore. This gets particularly messy when you’re selling to countries that use VAT or running subsidiaries abroad.

The complexity multiplies fast when you’re dealing with multiple countries, each with their own rates and rules. What works for US sales tax doesn’t translate to international VAT at all. A good vat calculator usa solution needs to handle these unique requirements without making your head spin.

Export and Import Considerations

American businesses exporting goods or services to VAT countries need to understand how VAT affects their transactions. This includes zero-rating for exports and potentially needing to register for VAT in destination countries.

Export transactions often qualify for zero-rating, but you need proper paperwork to back this up. Miss the documentation, and you could face unexpected VAT bills that kill your profit margins.

Here’s a real example: A US software company selling a $5,000 annual subscription to a UK business would typically zero-rate the transaction for VAT since it’s an export. But if that same company sets up a UK subsidiary and sells locally, they’d need to charge 20% UK VAT ($1,000) on the same service. Suddenly that transaction looks very different.

Cross-Border E-commerce Compliance

US online retailers selling to international customers need VAT calculations that comply with destination country rules. This includes digital services taxes and marketplace rules that change constantly.

This landscape shifts so fast it’ll make your head spin. New regulations keep affecting how VAT applies to digital services and cross-border sales. Staying compliant requires systems that can adapt to changing requirements. Understanding market sizing for business opportunities becomes crucial when weighing international VAT compliance costs against potential revenue.

Software and Service Provider Selection

US businesses need VAT solutions that handle both domestic sales tax and international VAT within the same system.

Dual Tax System Management

Good solutions for US businesses need to juggle state sales tax for domestic sales and VAT for international transactions. This requires sophisticated systems that can switch between calculation methods based on transaction details.

Managing two different tax systems at once creates complexity that most businesses underestimate. You need solutions that can seamlessly switch between calculation methods based on what kind of transaction you’re processing. Your vat calculator needs to handle these dual requirements without missing a beat.

Handling Advanced Calculation Scenarios

Once you get past the basics, VAT calculations can get really complicated really fast. We’re talking about transactions with multiple tax rates, bundled products, and partial exemptions that require sophisticated approaches to get right.

Multi-Rate Transaction Processing

Many transactions involve multiple products or services with different VAT rates. You need systematic approaches to get accurate total tax calculations when dealing with mixed-rate transactions.

I’ve dealt with invoices that include standard-rated services, reduced-rate products, and exempt items all on the same bill. Each piece needs separate calculation and proper documentation, or you’re asking for trouble.

Bundled Product Calculations

Selling bundles with items that have different VAT rates requires allocating the total price appropriately across components. You need to apply the correct VAT rate to each portion while keeping accurate records.

The allocation method you choose can significantly impact your VAT liability. Some approaches are more conservative, while others optimize for tax efficiency within compliance boundaries. A sophisticated vat calculator needs to handle these complex scenarios automatically.

Here’s a practical example: A restaurant meal bundle costs $50 and includes food (5% VAT), alcoholic beverages (20% VAT ), and a service charge (20% VAT). If the breakdown is $30 food, $15 drinks, and $5 service, the VAT calculation becomes: Food VAT = $30 × 0.05 = $1.50, Drinks VAT = $15 × 0.20 = $3.00, Service VAT = $5 × 0.20 = $1.00, for a total of $5.50 in VAT.

Partial Exemption Scenarios

Businesses with both taxable and exempt activities need to calculate VAT proportionally. This requires sophisticated allocation methods and careful documentation of your calculation methodology.

Partial exemption calculations get particularly complex when your business activities change over time. You need systems that can adapt to evolving business models while maintaining compliance.

Partial Exemption Calculation Template:

-

Figure out total input VAT incurred during the period

-

Calculate taxable supplies as percentage of total supplies

-

Apply partial exemption percentage to input VAT

-

Determine recoverable VAT amount

-

Account for any de minimis thresholds

-

Document calculation methodology for audit purposes

-

Review and adjust quarterly or annually as required

Building Implementation and Maintenance Systems

Here’s where the rubber meets the road – building VAT calculator systems that actually work in the real world and don’t fall apart when you need them most. You need solid architecture, performance that doesn’t suck, and quality assurance that catches problems before they become expensive disasters.

System Integration Architecture

Modern VAT calculators can’t exist in isolation – they need to play nice with your existing business systems while keeping data accurate across all touchpoints. The architecture decisions you make now will either save you headaches or create them for years to come.

API Development Standards

Solid VAT calculator APIs need standardized endpoints, proper error handling, and rate limiting. These ensure things keep working reliably when integrated with e-commerce platforms, accounting software, and custom business applications.

I’ve watched too many implementations crash and burn because they didn’t establish proper API standards from day one. Trying to fix this stuff later is expensive and disruptive. Just like implementing AI-powered optimization systems, your vat calculator needs systematic architecture planning from the start.

Database Management Protocols

VAT rate databases need regular updates to keep up with changing tax laws. You need automated sync processes and rollback capabilities to maintain system stability when rates change.

Tax rate changes happen more often than you’d think, and you can’t afford to miss updates. Automated systems reduce the risk of human error while ensuring you stay compliant on time.

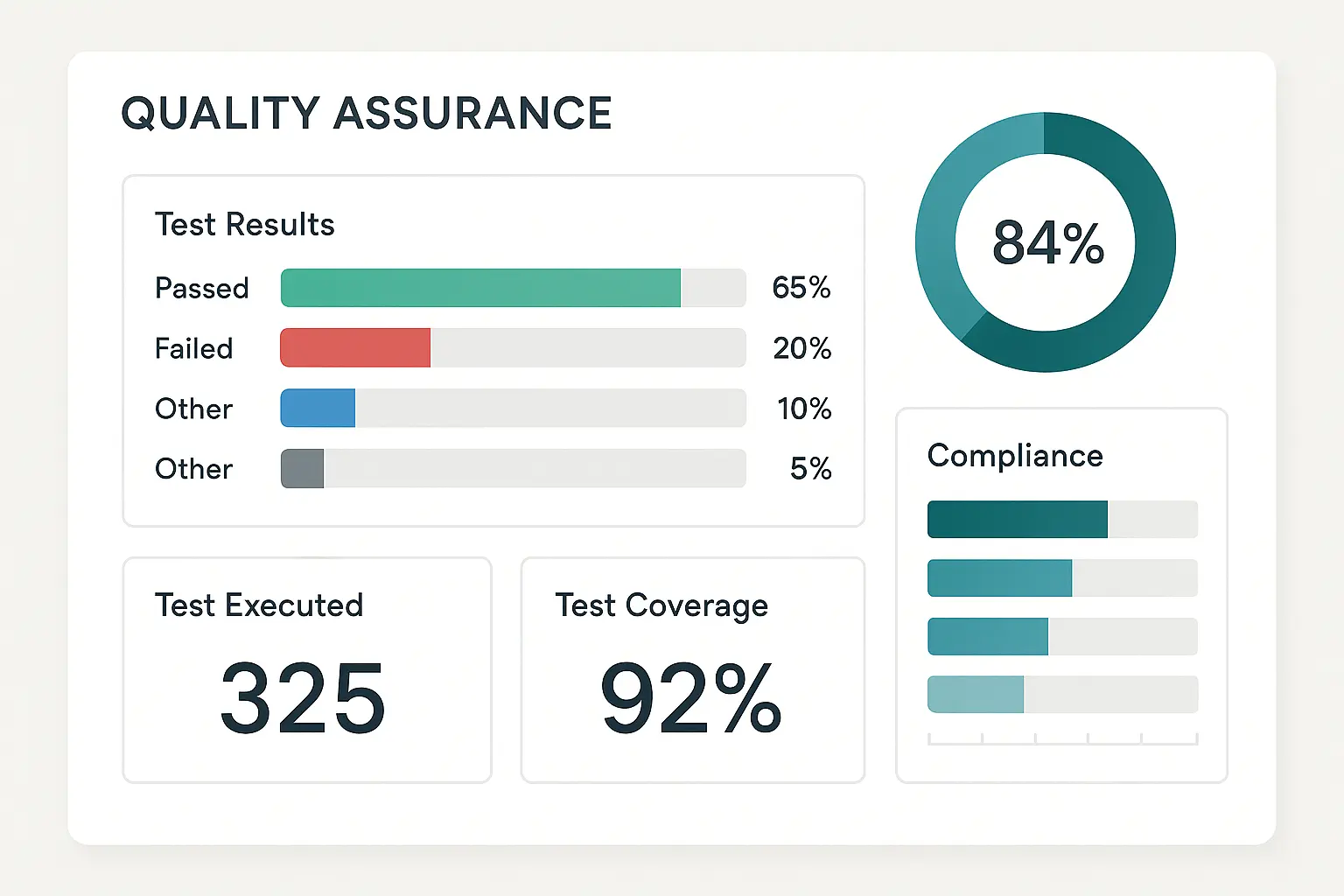

Quality Assurance and Testing

Comprehensive testing ensures VAT calculators maintain accuracy across all scenarios and edge cases. You absolutely cannot afford calculation errors in production systems – the cost is just too high.

Automated Testing Suites

Your continuous integration pipelines need comprehensive VAT calculation tests. These should cover standard rates, edge cases, rounding scenarios, and multi-currency calculations to prevent regression errors.

Manual testing alone isn’t enough for complex VAT calculations. Automated tests catch issues that human testers might miss while providing consistent validation across code changes. The testing approach is similar to comprehensive SEO tool evaluation – you need systematic validation to ensure reliable performance.

Compliance Validation Processes

Regular audits against official tax authority guidelines ensure your calculation methods stay compliant with evolving regulations. Tax interpretation can change without much notice, affecting your calculation requirements.

Compliance validation needs ongoing attention, not just one-time setup. Regulations evolve constantly, and your systems need to adapt accordingly.

The ongoing changes in property VAT regulations show why adaptability matters. “The first 130 sq. m. of a newly constructed property, provided that the total buildable area does not exceed 190 sq. m.” according to Cyprus Property Buyers demonstrates how specific thresholds and conditions can change, requiring systems that handle complex rule modifications without manual intervention.

How The Marketing Agency Can Transform Your VAT Calculator Strategy

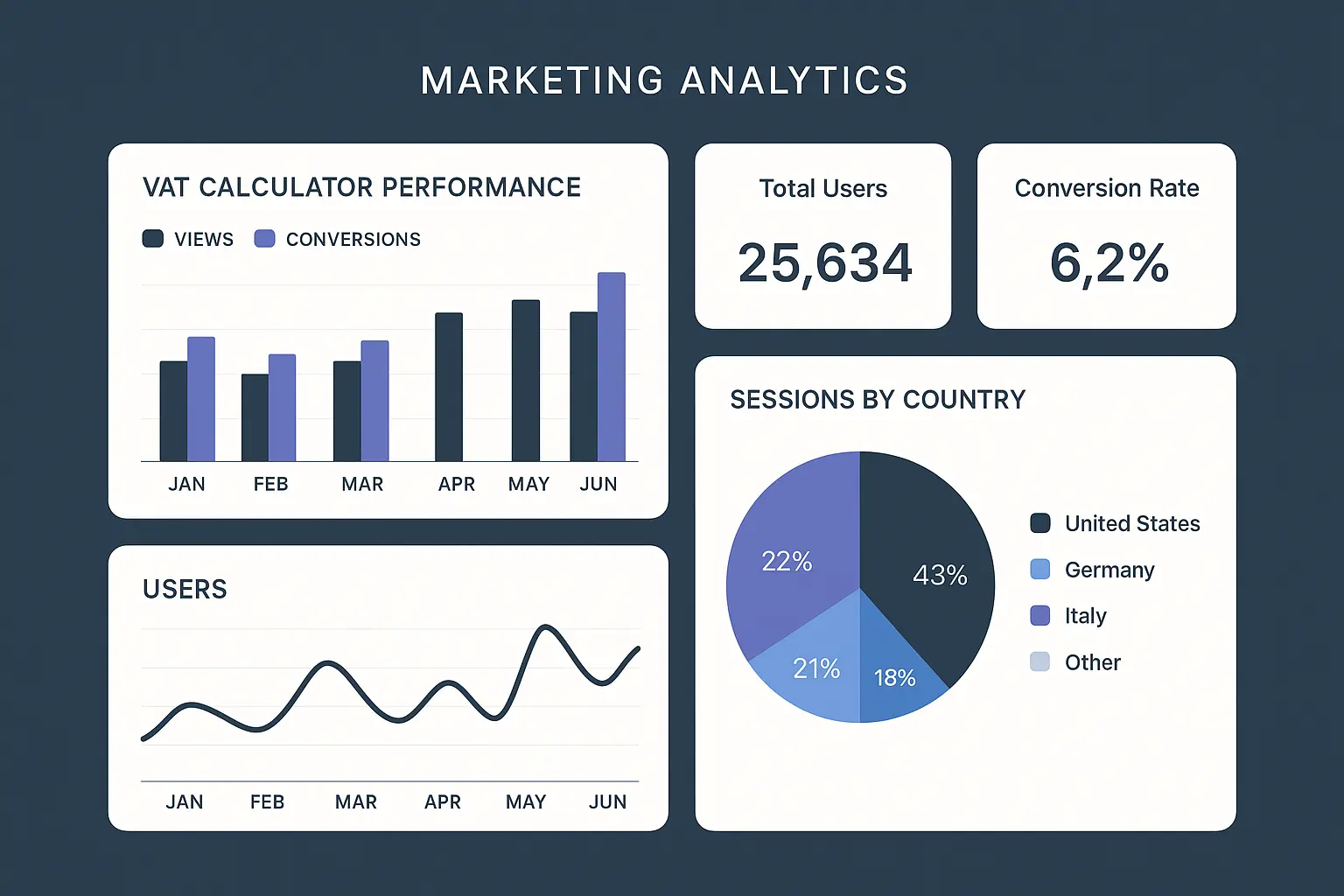

The Marketing Agency’s data-driven approach and AI-powered analytics put them in a unique position to help businesses optimize VAT calculator implementations and related digital infrastructure. Their performance-focused marketing expertise can drive targeted traffic to VAT calculator tools while their scientific methodology ensures maximum ROI through strategic resource allocation and user experience optimization.

The Marketing Agency’s scientific approach to market analysis positions them perfectly to spot opportunities in VAT calculator tool marketing that most agencies completely miss. Their proprietary systems analyze user behavior patterns around financial tools, optimizing conversion paths for businesses offering VAT calculation services.

Their AI-driven analytics segment audiences based on specific VAT calculation needs – from small businesses needing basic tools to enterprises requiring complex multi-jurisdictional solutions. This data-backed approach ensures marketing budgets focus on the highest-converting user segments while real-time campaign optimization maximizes ROI for VAT calculator tool providers.

The agency’s LLM optimization expertise becomes particularly valuable for VAT calculator tools, ensuring these financial resources appear prominently in AI-generated responses when users search for tax calculation assistance. This positions clients as authoritative sources in the financial tools space.

Ready to optimize your VAT calculator marketing strategy? The Marketing Agency’s performance-driven approach can help you reach the right audience with precision targeting and measurable results.

Final Thoughts

Building effective VAT calculator systems means balancing technical accuracy with practical usability. Modern tax regulations are complex enough to demand sophisticated solutions that can adapt to changing requirements while staying reliable under high-volume conditions.

Success in VAT calculator implementation comes from understanding both the math and the real-world business contexts where these calculations matter. Whether you’re handling simple domestic transactions or complex international scenarios, the core principles stay consistent even as applications get more sophisticated.

The investment in proper VAT calculator systems pays off through improved compliance, fewer manual errors, and streamlined business operations. As tax regulations keep evolving and businesses expand internationally, having robust calculation capabilities becomes increasingly essential for sustainable growth.