Here’s something that might shock you – 89% of developers have spent development time on low-code platforms in the past 12 months, with the Digital Process Automation market maintaining an impressive 21% annual growth rate since 2019. I’ve seen this happen over and over while working with companies that are drowning in manual processes that eat up resources and create bottlenecks everywhere.

Here’s what’s actually happening – businesses are scrambling to automate everything from customer service to financial reporting. But here’s the part nobody talks about: most automation projects fail spectacularly. The difference between companies that transform their operations and those that waste millions? Understanding what actually works in the real world.

That’s why I’ve put together these 25 detailed case studies from companies that figured out what actually works with process automation. You’ll see exactly how JPMorgan Chase saved $200 million every year and how Amazon achieved 99.9% inventory accuracy through smart automation choices.

Table of Contents

-

Key Considerations for Evaluating Process Automation Success

-

Financial Services and Banking Automation Wins

-

Healthcare and Life Sciences Process Transformations

-

Manufacturing and Supply Chain Automation Breakthroughs

-

Human Resources and Talent Management Innovations

-

Customer Service and Support Automation Excellence

-

Finance and Accounting Operations Optimization

-

Implementation Insights from Simple to Complex Projects

-

How The Marketing Agency Addresses Process Automation Challenges

TL;DR

-

Process automation ROI is all over the place – some companies see payback in 6 months (JPMorgan’s contract system), others wait 2 years (Maersk’s blockchain solution)

-

Fancy doesn’t always mean better – simple automation often crushes complex AI systems

-

Banks lead the pack with the biggest cost savings, while hospitals focus on getting things right and staying compliant

-

Manufacturers care about preventing breakdowns and catching defects – some cut downtime by 45%

-

Customer service automation is all about speed – companies are getting 65% faster at responding to customers

-

What makes it work: document everything, test like crazy, train your people, and keep making it better

-

Risk levels vary big time – banks and hospitals need way more safety checks than other industries

-

When picking vendors, look beyond the sticker price – support and total ownership costs matter more

Key Considerations for Evaluating Process Automation Success

Look, before we dive into specific examples, you need to understand what actually separates successful automation from expensive disasters. This section covers the five things that determine whether your automation project transforms your business or becomes a cautionary tale.

Smart automation decisions start with the right questions. You can’t just look at flashy marketing materials – you need to understand the complete picture.

ROI and Performance Metrics That Actually Matter

Real results come from concrete numbers, not vague promises about “efficiency improvements.” Look for hard data like cost savings, time reduction, error rates, and productivity gains. But here’s the catch – payback periods are all over the map depending on your industry and how complex things get.

The companies that win have real numbers to show for it. JPMorgan’s contract system cut processing time from 360,000 hours to seconds. Bank of America’s chatbot handles 1.5 billion customer conversations every year. These aren’t fuzzy “we got more efficient” claims – they’re measurable business impacts you can actually verify.

When you’re looking at automation ROI, consider using our ROI calculator to figure out your baseline before you start changing anything.

|

Industry |

Average ROI Timeline |

Primary Success Metrics |

Typical Cost Savings Range |

|---|---|---|---|

|

Financial Services |

6-18 months |

Transaction processing speed, error reduction |

$50M – $300M annually |

|

Healthcare |

10-24 months |

Accuracy rates, compliance scores |

$15M – $100M annually |

|

Manufacturing |

12-36 months |

Downtime reduction, quality improvements |

$25M – $500M annually |

|

Customer Service |

8-15 months |

Response time, satisfaction scores |

$10M – $40M annually |

Here’s what really matters: benefits should grow as you scale up. Amazon’s warehouse automation shows this perfectly – their $2.5 billion in annual savings keeps growing with every new fulfillment center they build.

Technical Complexity and Implementation Reality Checks

Integration can make or break your entire project. You need to figure out how well new solutions work with your existing systems without creating new problems or security holes.

Think about what you’re actually signing up for. Simple automation might need basic IT support, while AI-powered solutions require specialized experts and constant model training.

Here’s a real example: A mid-sized insurance company looking at claims processing automation. A basic system might automate form data entry and simple validation – that’s 3-6 months with your current IT team. But an AI system that analyzes claims and spots fraud? You’re looking at 12-18 months, specialized data scientists, and tons of training data prep. The AI system could potentially catch fraudulent claims and optimize settlements, but the complexity jump is massive.

Implementation timelines tell you more about project complexity than any marketing brochure. Realistic timeframes range from 8-month standard deployments to 36-month enterprise-wide systems like General Electric’s predictive maintenance setup.

Business Impact and Strategic Alignment Assessment

The process you pick matters more than the technology you use. The best candidates are rule-based, repetitive, high-volume processes with clear decision trees.

But strategic value goes way beyond just saving money. Does automation support bigger business goals like better customer experience, competitive advantage, or market expansion? Spotify’s recommendation engine generates over $500 million in annual revenue impact because it’s core to how they make money.

Here’s what most companies miss: change management requirements. You need to think about the human impact, training needs, and cultural shifts required for people to actually use the new system.

Financial Services and Banking Automation Wins

Banks lead the automation charge with the most sophisticated setups and biggest cost savings. These five examples show how financial companies achieve incredible ROI through smart automation of document processing, customer service, fraud detection, and day-to-day operations.

Financial institutions face unique pressures – regulatory compliance, security requirements, and massive transaction volumes. That’s why they’ve become automation pioneers, developing solutions that other industries now copy.

1. JPMorgan Chase – COiN (Contract Intelligence)

JPMorgan’s Contract Intelligence system is basically the gold standard for AI-powered document automation. They tackled a massive headache: processing 12,000 commercial credit agreements every year that used to require 360,000 hours of lawyer time.

Think about that for a second – that’s basically 180 lawyers working full-time just on reading contracts.

The implementation took 18 months of custom AI development using technology that can read and understand legal language. The technical complexity was enormous – they had to train AI models to understand legal nuances and contract variations across different jurisdictions.

The results speak for themselves: processing time dropped from 360,000 hours to seconds with 99.5% accuracy. The $200 million+ annual cost savings came with a 6-month payback period, making this one of the most successful automation projects ever documented.

The risk assessment was critical given the legal implications. JPMorgan implemented extensive testing and validation procedures, with human oversight for complex cases. Their internal development approach allowed complete control over security and compliance requirements.

2. Bank of America – Erica Virtual Assistant

Bank of America’s Erica shows how conversational AI can transform customer service at massive scale. With 37 million active users, Erica handles routine banking tasks that used to require human agents.

Remember waiting forever on hold to check your balance or transfer money? Erica eliminates that frustration entirely.

The technical implementation required sophisticated language understanding and integration with core banking systems. Training the AI to handle banking terminology, security protocols, and customer service nuances took significant investment in data preparation and model development.

Erica processes 1.5 billion customer interactions annually with an 85% satisfaction rate. The 40% reduction in call center volume translates to $300 million annual operational savings while improving customer experience through 24/7 availability.

Risk management focuses on security and accuracy monitoring. Bank of America continuously updates Erica’s capabilities while maintaining strict data protection and fraud prevention measures.

3. Deutsche Bank – Trade Finance Automation

Deutsche Bank automated trade finance document processing using technology that can read documents and intelligent processing systems. Trade finance involves complex international documentation with strict compliance requirements.

The 12-month phased implementation connected document reading technology with machine learning algorithms to extract data from letters of credit, bills of lading, and trade documents. Integration with multiple legacy systems required careful planning and testing.

Results include 90% reduction in manual processing time and 95% accuracy in data extraction. The $50 million annual cost savings came with a 14-month payback period, while customers benefit from 70% faster trade finance processing.

The moderate risk assessment reflects international compliance requirements and the need for continuous monitoring. Deutsche Bank uses a hybrid approach combining established vendors with custom development.

4. American Express – Fraud Detection Automation

American Express implemented real-time fraud detection using machine learning algorithms to automatically flag suspicious transactions across billions of annual transactions globally.

Here’s how it works: the moment you swipe your card, AI analyzes that purchase against your spending patterns, location data, merchant information, and thousands of other signals – all in the split second before approving or declining the transaction.

The technical complexity is staggering – processing transactions in real-time while maintaining 99.9% accuracy requires sophisticated algorithms and massive computing infrastructure. Integration with payment processing and customer systems happens in milliseconds.

The system prevents $2 billion+ in fraudulent transactions annually while reducing false positive alerts by 50%. The 60% improvement in genuine transaction approval rates enhances customer experience by reducing legitimate transaction declines.

Risk assessment is critical for fraud detection systems. American Express maintains extensive testing and fallback procedures to ensure system reliability and prevent legitimate transactions from being blocked.

5. Wells Fargo – Mortgage Processing Automation

Wells Fargo automated end-to-end mortgage processing using automation software and Document AI. Mortgage processing involves complex documentation, regulatory compliance, and multiple system integrations.

The 24-month implementation across multiple regions required careful coordination with regulatory requirements and existing workflows. Automation bots handle routine tasks while AI systems verify documents and support underwriting decisions.

Results include 65% reduction in processing time and 40% decrease in costs. The 98% accuracy in document verification improves compliance while the 30% improvement in customer satisfaction reflects faster processing times.

The moderate risk assessment reflects regulatory compliance requirements and the need for audit trails. Wells Fargo uses established automation platforms with specialized mortgage processing capabilities.

Healthcare and Life Sciences Process Transformations

Healthcare automation is different – it’s all about accuracy, compliance, and patient safety rather than pure cost savings. These four examples show how healthcare organizations achieve operational efficiency while maintaining strict regulatory compliance and improving patient outcomes.

Healthcare automation requires a completely different approach than other industries. Patient safety, HIPAA compliance, and regulatory requirements create unique constraints that shape every implementation decision.

6. Cleveland Clinic – Patient Registration and Scheduling

Cleveland Clinic automated patient registration, insurance verification, and appointment scheduling across all outpatient facilities. Healthcare registration involves complex insurance verification and coordination between multiple departments.

You know how frustrating it is to fill out the same forms every time you visit a doctor, then wait while they verify your insurance? Cleveland Clinic solved that problem.

The 8-month implementation used standard automation with API integrations to Electronic Medical Record systems. The technical complexity remained moderate by focusing on well-defined processes with clear business rules.

Results include 80% reduction in patient wait times and 95% accuracy in insurance verification. The $15 million annual administrative cost savings came with a 10-month payback period, while the 90% patient satisfaction improvement demonstrates the patient experience benefits.

HIPAA compliance requirements were managed through established healthcare automation vendors with proven security frameworks. The low-medium risk assessment reflects the routine nature of registration processes.

7. Pfizer – Clinical Trial Data Management

Pfizer automated clinical trial data collection, validation, and reporting for Phase II and III trials. Clinical data management requires extreme accuracy and regulatory compliance for FDA submissions.

The implementation combined automation with machine learning and data analytics, connecting multiple clinical databases and regulatory systems. The high technical complexity reflects the sophisticated data validation requirements and regulatory submission processes.

Here’s how it actually works: When a patient visits a trial site, sensors automatically capture vital signs and input them directly into the clinical database. The AI system immediately flags any readings outside normal parameters, alerts medical staff, and cross-references with the patient’s medical history – all while maintaining complete audit trails for FDA compliance. This process used to require manual data entry by multiple staff members and took hours to complete.

Results include 70% reduction in data processing time and 99.5% data accuracy. The $25 million annual cost savings came with a 15-month payback period, while 50% faster regulatory submission preparation accelerates drug development timelines.

The high risk assessment reflects the critical nature of clinical data for patient safety and regulatory approval. Pfizer uses specialized life sciences automation platforms with proven regulatory compliance capabilities.

8. Kaiser Permanente – Claims Processing Automation

Kaiser Permanente implemented intelligent automation for medical claims processing, handling 50+ million claims annually across their integrated healthcare system.

The 18-month phased rollout used automation, document reading, and machine learning to process claims, handle prior authorizations, and manage payment processing. Integration with multiple payer systems and regulatory compliance requirements created high technical complexity.

Results include 85% reduction in claims processing time and $100 million+ annual operational savings. The 98% accuracy in claims adjudication improves compliance while 75% reduction in prior authorization wait times enhances patient experience.

The medium risk assessment requires continuous monitoring and compliance validation. Kaiser Permanente uses enterprise-grade automation platforms with healthcare specialization and proven regulatory compliance.

9. Johnson & Johnson – Supply Chain Automation

Johnson & Johnson automated pharmaceutical supply chain management including inventory optimization, demand forecasting, and distribution planning across their global operations.

The implementation used AI/ML, automation, and advanced analytics connected to ERP, warehouse management, and supplier systems. The very high technical complexity reflects global system integration and sophisticated forecasting algorithms.

Results include 30% reduction in inventory carrying costs and 95% improvement in demand forecast accuracy. The $200 million annual supply chain cost savings came with a 12-month payback period, while 40% reduction in stockouts improves product availability.

The medium-high risk assessment reflects supply chain disruption risks and the critical nature of pharmaceutical availability. Johnson & Johnson uses best-of-breed solutions with proven pharmaceutical industry experience.

Manufacturing and Supply Chain Automation Breakthroughs

Manufacturing automation has evolved way beyond simple robotics to encompass predictive analytics, quality control, and supply chain optimization. The focus has shifted from replacing workers to achieving operational excellence and competitive advantage.

These four examples demonstrate how manufacturers achieve significant cost savings and operational improvements through IoT sensors, computer vision, robotics, and AI-driven optimization systems.

10. General Electric – Predictive Maintenance Automation

General Electric implemented IoT sensors and AI-driven predictive maintenance across 200+ manufacturing facilities globally. Traditional maintenance schedules often result in unnecessary downtime or unexpected failures that cost millions.

The 36-month enterprise-wide implementation required massive IoT infrastructure deployment and advanced analytics development. Machine learning algorithms analyze sensor data to predict equipment failures before they occur.

Results include 45% reduction in unplanned downtime and $500 million annual maintenance cost savings. The 25% increase in equipment lifespan extends asset value while 90% accuracy in failure prediction enables proactive maintenance scheduling.

The medium risk assessment requires robust data security and system reliability. GE developed custom solutions with industrial IoT specialists to ensure manufacturing environment compatibility.

Similar predictive analytics approaches are discussed in our AI in manufacturing case study, which explores how manufacturers leverage data-driven insights for operational excellence.

11. Toyota – Quality Control Automation

Toyota automated visual inspection and quality control using computer vision and AI across 14 production plants. Manual quality inspection is time-consuming and varies based on human factors like fatigue and attention.

You know how sometimes you get a car with a tiny paint defect or interior flaw? Toyota’s system catches these issues before the car ever leaves the factory.

The implementation integrated computer vision with machine learning and robotic systems connected to manufacturing execution systems. The high technical complexity required advanced computer vision algorithms trained on Toyota’s specific quality standards.

Results include 99.8% defect detection accuracy and 60% reduction in quality control labor costs. The 40% faster inspection processes improve production throughput while 90% reduction in customer quality complaints maintains Toyota’s reputation.

The medium risk assessment requires continuous calibration and monitoring to maintain accuracy. Toyota partnered with leading computer vision technology providers while maintaining internal expertise.

12. Amazon – Warehouse Automation (Fulfillment Centers)

Amazon deployed robotic systems and AI-driven inventory management across 185+ fulfillment centers globally. Warehouse automation enables Amazon’s rapid delivery promises while managing massive inventory volumes.

The ongoing multi-year implementation combines robotics, AI, computer vision, and warehouse management systems. The very high technical complexity includes custom robotics development and AI systems for inventory optimization.

Results include 50% improvement in order fulfillment speed and $2.5 billion annual operational cost savings. The 99.9% inventory accuracy enables precise stock management while 70% reduction in order processing errors improves customer satisfaction.

For businesses looking to implement similar warehouse automation solutions, our warehouse automation case study provides detailed insights into implementation strategies and ROI considerations.

|

Automation Technology |

Implementation Timeline |

Primary Benefits |

Complexity Level |

|---|---|---|---|

|

Basic RPA |

3-8 months |

Cost reduction, error elimination |

Low |

|

Computer Vision |

8-18 months |

Quality improvement, defect detection |

Medium-High |

|

Predictive Analytics |

12-36 months |

Downtime reduction, optimization |

High |

|

Full Robotics Integration |

18-48 months |

Throughput increase, scalability |

Very High |

The well-managed risk assessment includes extensive testing and redundancy systems. Amazon’s primarily internal development approach with strategic acquisitions provides complete control over their competitive advantage.

13. Siemens – Production Planning Automation

Siemens automated production scheduling, resource allocation, and supply chain coordination using AI and advanced analytics across 300+ facilities worldwide.

The implementation connected AI/ML with advanced planning systems and ERP integration. The high technical complexity includes sophisticated optimization algorithms that balance production capacity, demand forecasting, and supply chain constraints.

Results include 35% improvement in production efficiency and $300 million annual cost savings. The 25% reduction in inventory levels improves cash flow while 90% improvement in delivery performance enhances customer satisfaction.

The medium risk assessment requires continuous optimization and monitoring. Siemens combined internal development with specialized planning software to create competitive advantages in manufacturing efficiency.

Human Resources and Talent Management Innovations

HR automation requires balancing efficiency gains with human-centered approaches. The best implementations enhance rather than replace human interactions in talent management.

These four examples show how organizations automate recruitment, onboarding, performance management, and learning development while maintaining the human touch essential for talent management success.

14. Unilever – Recruitment Process Automation

Unilever automated candidate screening, interview scheduling, and initial assessment processes using AI-powered chatbots and video analysis across their global recruitment operations.

The 12-month implementation integrated AI chatbots with video analysis and applicant tracking systems. The medium-high technical complexity includes AI training for bias mitigation and integration with existing HR systems.

Results include 75% reduction in time-to-hire and 90% candidate satisfaction improvement. The $10 million annual recruitment cost savings came with a 15-month payback period, while 50% increase in recruitment team productivity allows focus on strategic hiring decisions.

Why does this matter to you? Because if Unilever can hire people 75% faster, they’re getting the best candidates before their competitors even know they’re looking.

The medium risk assessment requires bias monitoring and compliance management. Unilever uses specialized HR technology vendors with proven bias mitigation capabilities and regulatory compliance.

15. IBM – Employee Onboarding Automation

IBM automated new employee onboarding including documentation, system access provisioning, and training coordination across their global workforce.

The implementation used automation and workflow systems with HRIS integration connected to HR, IT, and facility management systems. The medium technical complexity focuses on standard automation with multiple system integrations.

Results include 80% reduction in onboarding processing time and 95% accuracy in system access provisioning. The $8 million annual administrative cost savings came with a 12-month payback period, while 85% improvement in new employee satisfaction enhances retention.

The low-medium risk assessment includes security and compliance controls. IBM uses established automation platforms with HR specialization and proven security frameworks.

16. Accenture – Performance Management Automation

Accenture automated performance review processes, goal tracking, and talent analytics for 500,000+ employees globally using AI analytics and workflow automation.

The 18-month implementation with continuous improvements required advanced analytics and change management across a massive global workforce. The high technical complexity includes sophisticated analytics and cultural change management.

Results include 70% reduction in performance review administrative time and 40% improvement in manager engagement with performance processes. The $15 million annual HR operational savings came with an 18-month payback period, while 60% increase in real-time feedback frequency improves employee development.

The medium risk assessment requires employee privacy and bias considerations. Accenture developed internal platforms with third-party integrations to maintain control over sensitive employee data.

17. Microsoft – Learning and Development Automation

Microsoft automated personalized learning recommendations, skill gap analysis, and training delivery using machine learning and learning analytics across their enterprise-wide programs.

The implementation connected machine learning with learning analytics and LMS integration to performance systems and career development platforms. The high technical complexity includes advanced ML algorithms and comprehensive learning analytics.

Results include 90% improvement in learning engagement and 50% reduction in training administration costs. The $25 million annual learning efficiency gains came with a 14-month payback period, while 80% improvement in skill development tracking enhances career progression.

The low-medium risk assessment focuses on privacy considerations for learning data. Microsoft’s internal development with learning technology partnerships maintains employee data security while enabling personalization.

Customer Service and Support Automation Excellence

Customer service automation walks a fine line between efficiency and personalization. The most successful implementations enhance human agents rather than replacing them entirely.

These four examples demonstrate how organizations achieve faster response times, improved accuracy, and enhanced customer experiences through intelligent automation of support processes.

18. Salesforce – Customer Support Ticket Automation

Salesforce automated customer support ticket routing, initial response generation, and resolution tracking using AI and natural language processing for 10+ million support tickets annually.

The 15-month implementation with continuous optimization used language processing and machine learning with CRM integration. The high technical complexity includes advanced language processing for understanding customer intent and sophisticated routing algorithms.

Results include 65% reduction in first response time and 85% accuracy in ticket categorization. The $40 million annual support cost savings came with a 12-month payback period, while 90% customer satisfaction improvement demonstrates enhanced service quality.

The medium risk assessment requires quality monitoring and escalation procedures. Salesforce’s internal platform with AI technology partnerships maintains control over customer data while leveraging specialized AI capabilities.

19. Zappos – Order Processing and Returns Automation

Zappos automated order processing, inventory management, and returns handling using automation and intelligent workflow systems across their end-to-end fulfillment operations.

The implementation connected automation with workflow systems and ERP integration to e-commerce, inventory, and shipping systems. The medium technical complexity focuses on standard automation with comprehensive e-commerce integration.

Results include 75% reduction in order processing time and 95% accuracy in inventory updates. The $12 million annual operational savings came with a 16-month payback period, while 80% improvement in returns processing speed enhances customer experience.

The low risk assessment reflects well-established processes with clear validation procedures. Zappos uses commercial automation platforms with e-commerce specialization and proven reliability.

20. American Airlines – Flight Operations Automation

American Airlines automated flight scheduling optimization, crew assignment, and maintenance coordination using AI and operational research algorithms across their global operations.

The 24-month phased implementation required AI/ML with optimization algorithms and operations management systems. The very high technical complexity includes sophisticated optimization for safety-critical operations and complex regulatory requirements.

Results include 25% improvement in on-time performance and $200 million annual operational cost savings. The 40% reduction in crew scheduling conflicts improves employee satisfaction while 90% improvement in maintenance scheduling efficiency enhances safety and reliability.

The high risk assessment reflects safety-critical operations requiring extensive validation. American Airlines uses specialized aviation software with custom development to meet stringent safety and regulatory requirements.

21. Spotify – Content Recommendation Automation

Spotify automated music recommendation, playlist generation, and user engagement optimization using machine learning and behavioral analytics for 400+ million users globally.

The implementation uses machine learning with collaborative filtering and real-time analytics connected to streaming platforms and user behavior systems. The very high technical complexity includes real-time ML at massive scale with sophisticated personalization algorithms.

Here’s how it actually works: When a Spotify user skips a song within the first 30 seconds, the recommendation engine immediately analyzes this behavior alongside 50+ other data points including time of day, device type, previous listening history, and similar user patterns. Within milliseconds, it adjusts future recommendations and updates the user’s personalized playlists. This real-time learning happens across 400+ million users simultaneously, processing billions of data points to continuously improve music discovery.

Results include 40% increase in user engagement and 30% improvement in user retention. The $500 million+ annual revenue impact from improved recommendations came with exceptional ROI, while 85% user satisfaction with personalized content drives competitive advantage.

The medium risk assessment requires continuous algorithm optimization. Spotify’s internal development with specialized ML infrastructure provides complete control over their core competitive differentiator.

Finance and Accounting Operations Optimization

Finance automation demands the highest accuracy standards and comprehensive audit trails. Regulatory compliance and financial controls shape every implementation decision.

These four examples show how organizations automate invoice processing, financial reporting, trade documentation, and tax preparation while maintaining strict financial controls and regulatory compliance.

22. PwC – Accounts Payable Automation

PwC automated invoice processing, approval workflows, and payment processing using automation and intelligent document processing for 2+ million invoices annually across global offices.

The 18-month global rollout used automation, document reading, and machine learning with ERP integration. The medium-high technical complexity includes multiple ERP integrations and sophisticated validation rules for financial accuracy.

Results include 90% reduction in invoice processing time and 99.5% accuracy in data extraction. The $30 million annual processing cost savings came with a 10-month payback period, while 85% reduction in payment delays improves vendor relationships and cash flow management.

The medium risk assessment requires strong financial controls and comprehensive audit trails. PwC uses enterprise automation platforms with financial services focus and proven compliance capabilities.

Organizations considering similar financial automation can reference our AP automation case study for detailed implementation guidance and best practices.

23. Coca-Cola – Financial Reporting Automation

Coca-Cola automated financial consolidation, regulatory reporting, and management dashboard generation using automation and business intelligence tools across 200+ global markets.

The implementation connected automation with business intelligence and financial planning systems to multiple ERP systems and regulatory platforms. The high technical complexity includes sophisticated financial rules and diverse regulatory requirements across global markets.

Results include 70% reduction in monthly close time and 95% accuracy in financial reporting. The $25 million annual finance operations savings came with a 14-month payback period, while 80% improvement in reporting timeliness enables faster business decisions.

The high risk assessment reflects financial accuracy and regulatory compliance requirements. Coca-Cola uses specialized financial automation platforms with proven regulatory compliance across multiple jurisdictions.

24. Maersk – Trade Finance and Documentation

Maersk automated trade finance processing, customs documentation, and shipping coordination using blockchain and automation technologies across their global shipping operations.

The 30-month implementation with pilot programs used blockchain with automation and document management systems. The very high technical complexity includes blockchain integration and complex international regulatory compliance requirements.

Results include 60% reduction in documentation processing time and $100 million+ annual operational savings. The 98% accuracy in customs documentation improves compliance while 50% improvement in shipment tracking accuracy enhances customer service.

The medium-high risk assessment includes international compliance and security requirements. Maersk developed custom blockchain solutions with established automation platforms to create competitive advantages in global shipping.

25. H&R Block – Tax Preparation Automation

H&R Block automated tax document processing, calculation verification, and filing preparation using AI and tax software integration for 20+ million tax returns annually.

The 24-month development and deployment used AI/ML with document reading and tax software integration. The high technical complexity includes sophisticated tax rules and comprehensive IRS compliance requirements.

Results include 80% reduction in tax preparation time and 99.8% accuracy in tax calculations. The $150 million annual operational cost savings came with an 8-month payback period, while 90% improvement in customer satisfaction reflects faster service and higher accuracy.

The high risk assessment focuses on tax accuracy and IRS compliance requirements. H&R Block’s internal development with specialized tax technology maintains complete control over compliance and customer data security.

|

Risk Level |

Validation Requirements |

Compliance Monitoring |

Recommended Approach |

|---|---|---|---|

|

Low |

Basic testing, user acceptance |

Standard audit trails |

Commercial automation platforms |

|

Medium |

Extended pilot programs, staged rollout |

Regular compliance reviews |

Hybrid vendor/custom solutions |

|

High |

Extensive validation, regulatory approval |

Continuous monitoring, audit readiness |

Specialized industry platforms |

|

Very High |

Multi-phase testing, regulatory certification |

Real-time compliance tracking |

Custom development with proven vendors |

Implementation Insights from Simple to Complex Projects

Implementation success depends more on preparation and change management than technology sophistication. Simple solutions often deliver better ROI than complex systems when properly executed.

Understanding the key success factors and technical requirements helps organizations choose appropriate automation approaches and avoid common implementation pitfalls.

Simple Implementation: Zappos Order Processing

Zappos’ order processing automation demonstrates how straightforward automation can deliver exceptional results. The step-by-step process includes order receipt monitoring, inventory verification, payment processing, shipping coordination, and customer communication.

Key success factors include clear process documentation with comprehensive exception handling, seamless integration with existing e-commerce and warehouse systems, thorough testing before full deployment, and comprehensive staff training for bot monitoring and maintenance.

The implementation timeline was relatively short because the processes were well-defined with clear business rules. Staff training focused on monitoring automated processes and handling exceptions rather than learning complex new systems.

Complex Implementation: JPMorgan COiN System

JPMorgan’s contract intelligence system required sophisticated technical architecture including secure document upload pipelines, advanced language processing engines, machine learning models for contract analysis, human-in-the-loop validation frameworks, and integration APIs for legal systems.

The implementation phases spanned document digitization and data preparation (6 months), AI model development and training (8 months), pilot testing with limited document types (4 months), and full production deployment with ongoing optimization.

Critical success elements included extensive legal expert involvement in AI training, robust security and compliance frameworks, comprehensive change management for legal staff, and continuous model improvement with accuracy monitoring.

The complexity required specialized expertise in AI development, legal document analysis, and financial services compliance. Internal development provided complete control over sensitive legal data and proprietary algorithms.

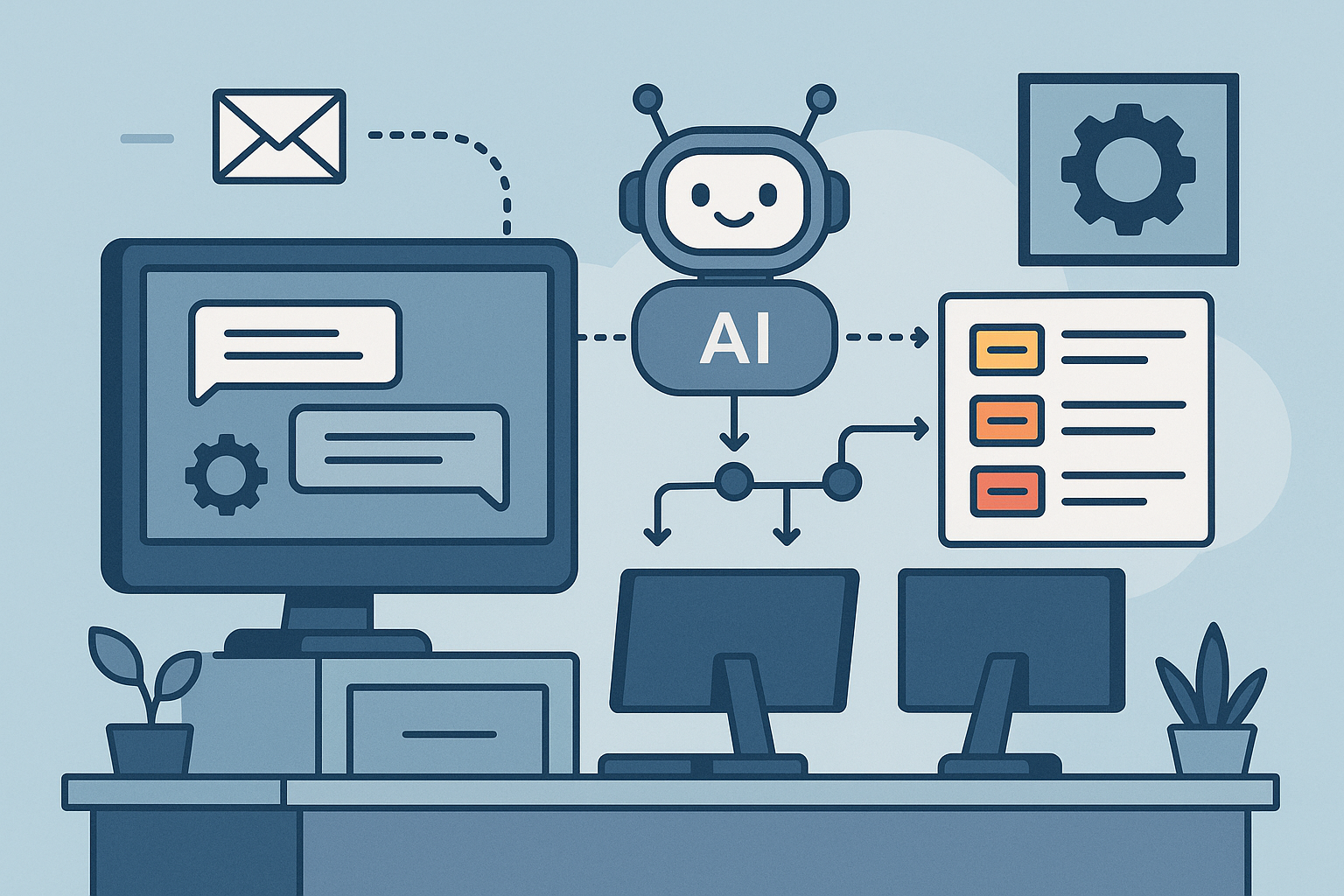

How The Marketing Agency Addresses Process Automation Challenges

Process automation success requires the same analytical rigor and systematic approach that drives successful marketing campaigns. That’s where our expertise becomes invaluable for businesses considering automation investments.

Look, here’s the thing about automation – most companies jump straight to the fancy stuff without understanding their basic processes. It’s like trying to automate a messy garage – you need to clean it up first.

Our data-driven approach and performance-focused methodology positions us uniquely to help businesses navigate process automation decisions and implementations. Our expertise in analytics, technology evaluation, and systematic optimization directly applies to automation project success.

Strategic Automation Assessment

We apply our scientific approach to market analysis for identifying automation opportunities through data-driven process analysis. Our expertise in behavioral insights and performance measurement helps identify which processes deliver the highest automation ROI.

Using our 80/20 rule methodology, we focus automation efforts on the highest-impact processes that drive measurable business results. Our experience with performance benchmarking establishes clear automation success metrics from day one.

We leverage our commitment to providing all the facts so you can make decisions based on real data. This transparency ensures stakeholders understand automation benefits, risks, and realistic timelines before making investment decisions.

Implementation Strategy and Change Management

We take the same approach we use for marketing campaigns: start with data, test everything, and optimize as you go. No guesswork, no ‘set it and forget it’ – just steady improvement based on what’s actually working.

Just as we optimize marketing campaigns in real-time, we apply continuous improvement methodologies to automated processes. This ensures automation solutions deliver sustained value and adapt to changing business requirements.

Our experience with technology integration helps businesses avoid common automation pitfalls. We evaluate vendor capabilities, integration requirements, and total cost of ownership to ensure successful implementations.

Our expertise in digital transformation helps organizations navigate the complex landscape of process automation with confidence and measurable results.

Marketing Automation Specialization

Given our core expertise in digital marketing, we’re particularly well-positioned to help businesses implement marketing-specific automation solutions. We combine inbound marketing expertise with process automation to create seamless customer experiences.

Our behavioral insights methodology enables sophisticated lead scoring, qualification, and nurturing automation. We implement automated systems that respond to customer behavior patterns and optimize engagement throughout the buyer’s journey.

We specialize in campaign optimization automation including bid management, creative testing, and performance tracking systems. Our real-time analytics approach ensures automated marketing systems deliver measurable results and continuous improvement.

For businesses looking to optimize their marketing operations, our marketing automation case study demonstrates how strategic automation drives revenue growth and operational efficiency.

Ready to explore how process automation can transform your business operations? We can discuss your specific automation opportunities and develop a data-driven implementation strategy that delivers measurable results.

Final Thoughts

Process automation represents one of the most significant opportunities for business transformation in the next decade. The 25 case studies we’ve examined demonstrate that success isn’t about implementing the most sophisticated technology – it’s about choosing the right automation approach for your specific business needs and executing with precision.

The most successful implementations share common characteristics: clear process documentation, comprehensive testing, strong change management, and continuous optimization. Whether you’re considering simple automation for routine tasks or complex AI systems for strategic advantage, the fundamentals remain the same.

Banks lead the way with the highest cost savings and most sophisticated implementations, but every industry can benefit from strategic automation. Healthcare focuses on accuracy and compliance, manufacturing emphasizes operational efficiency, and customer service prioritizes response time improvements.

Here’s the key insight from these case studies: automation success depends more on implementation quality than technology complexity. Simple solutions often deliver better ROI than sophisticated systems when properly executed with clear business objectives and comprehensive change management.

Bottom line? Automation isn’t going anywhere, and the companies that figure it out now will have a huge advantage later. But don’t get caught up in the hype – start with something simple, make sure it actually works, then build from there.

The best part about these 25 examples? None of them got it perfect on the first try. They just kept tweaking until it worked. That’s really all this is – smart companies making gradual improvements until they’re way ahead of everyone else.

As AI continues to evolve and low-code platforms become more accessible, process automation will become even more critical for competitive advantage. The organizations that start now with strategic, well-executed automation projects will be best positioned for future success.

Ready to stop talking about automation and actually do something about it? Let’s figure out what makes sense for your business – no sales pitch, just straight talk about what might work.