Here’s something that confused the hell out of me when I first started my LLC: the IRS basically pretends your business doesn’t exist. They call it a “pass-through entity,” which is just fancy talk for “we’re going to tax you personally for all your business income.”

Sounds simple enough, right? Wrong. I’ve watched so many business owners—smart people!—completely mess this up because nobody explains how it actually works in practice. Look, figuring out your LLC taxes right isn’t just about staying out of trouble with the IRS—it’s about not leaving money on the table and avoiding those gut-punch surprises come April.

According to Embroker’s LLC tax analysis, all businesses with employees need to pay a federal unemployment tax (FUTA) at 6% of the first $7,000 that each employee earns in a calendar year, meaning for any employee earning $7,000 or more, the FUTA contribution is $420. Yeah, it adds up fast.

Table of Contents

-

Understanding LLC Tax Structure Fundamentals

-

LLC Tax Rate Calculator Components and Variables

-

Digital Tax Calculator Tools and Selection Criteria

-

Implementation and Strategic Tax Planning

TL;DR

-

LLCs use pass-through taxation where profits flow directly to your personal tax return, but single and multi-member LLCs face different calculation requirements (and trust me, multi-member gets messy fast)

-

Self-employment taxes at 15.3% hit most LLC owners hard, though S-Corp elections can reduce this burden if you know what you’re doing

-

Free online calculators often miss state taxes and complex deductions, while professional tools integrate with accounting software for real-time projections (learned this the expensive way)

-

The Section 199A qualified business income deduction can save you 20% on LLC profits, but income limits and business type restrictions apply—it’s not as simple as it sounds

-

Quarterly estimated tax payments require careful calculation to avoid underpayment penalties and cash flow problems (ask me how I know)

Understanding LLC Tax Structure Fundamentals

Most people think LLC taxation is straightforward. After helping my brother set up his consulting LLC three years ago and watching him panic during his first tax season, I realized this stuff is way trickier than anyone tells you upfront.

Basically, the IRS pretends your LLC doesn’t exist for tax purposes. Weird, right? But that’s how it works. Everything flows through to your personal return, which means you avoid that double taxation nightmare that corporations deal with. But—and this is a big but—you’re also on the hook for self-employment taxes on your share of LLC profits. Getting this calculation right from the start saves you from those nasty surprises that make you want to throw your laptop out the window.

Pass-Through Taxation Mechanics

The mechanics work differently than you might expect. When your LLC makes $100,000 in profit, that money doesn’t get taxed at some corporate rate. Instead, it shows up on your Form 1040 as business income, subject to your personal tax brackets.

This creates an interesting dynamic—and by interesting, I mean it gave me a headache for weeks when I first tried to wrap my head around it. Your LLC’s performance directly impacts your personal tax situation. A profitable year means higher personal taxes, while business losses can actually offset other income on your return. Once you understand this flow, accurate tax calculations become possible.

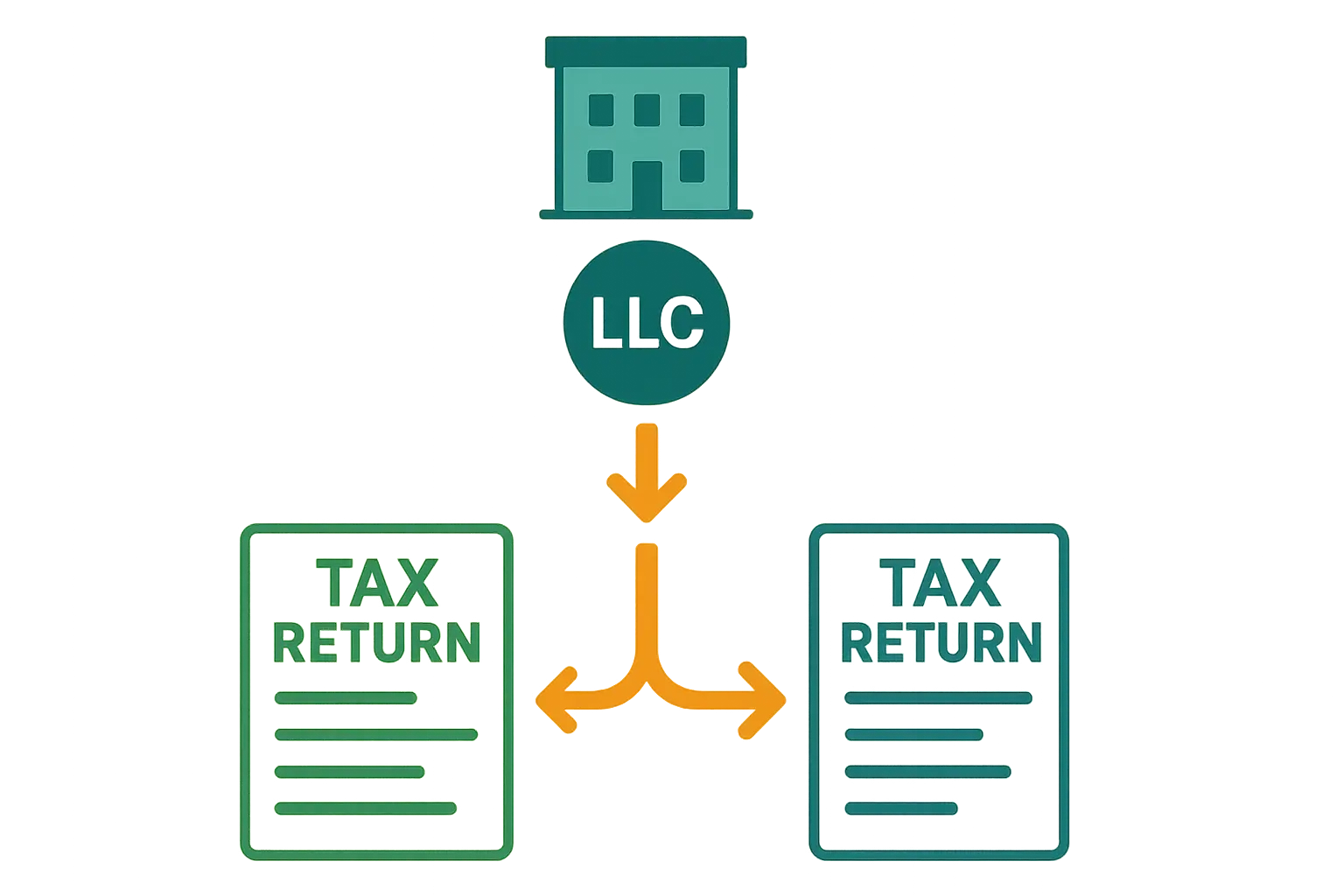

Single vs. Multi-Member Tax Treatment

Single-member LLCs get the simplest treatment. The IRS basically ignores your LLC structure and treats you as a sole proprietor. You’ll report income and expenses on Schedule C, and the profit flows to your Form 1040. Straightforward enough, but you’re getting hit with SE tax on the entire profit.

Multi-member LLCs? Welcome to partnership tax hell. The LLC files Form 1065 (an informational return), and each member gets a K-1 showing their share of income, deductions, and credits. This creates allocation headaches and requires way more sophisticated calculation methods than most people realize.

The difference matters big time for tax calculators. Single-member tools can be relatively simple, while multi-member calculators need to handle profit allocations, guaranteed payments, and varying ownership percentages. I’ve seen too many people try to use single-member calculators for multi-member situations. Don’t do it.

Here’s a real example: two founders with equal ownership in a multi-member LLC that earns $200,000 profit. Each founder reports 50% of the company’s income ($100,000) on their personal tax return. Seems simple, but what if one founder owns 60% and the other owns 40%? Now Founder A reports 60% of the income ($120,000), while Founder B reports the remaining 40% ($80,000). The calculator better get this right, or you’re screwed.

Self-Employment Tax Implications

SE tax hits most LLC owners like a brick wall. You’re paying both the employer and employee portions of Social Security and Medicare taxes, totaling 15.3% on your LLC profits. This applies to your entire share of LLC income, not just what you actually take out of the business.

The calculation gets tricky—and by tricky, I mean it made my accountant explain it to me three times before it clicked—because SE tax applies before you calculate your income tax deduction for half of the self-employment tax paid. Quality tax calculators need to handle this circular calculation correctly, or your projections will be completely off.

Some LLC members can dodge SE tax on certain types of income (rental income from real estate LLCs), but active business income almost always triggers it. This is where understanding your specific situation becomes critical for accurate calculations, not just plugging numbers into whatever calculator you found on Google.

Tax Election Options and Their Impact

When evaluating different tax election strategies for your LLC, it’s important to consider how these decisions impact your overall business performance metrics. Understanding the market sizing implications of tax elections can help you make more informed decisions about which structure optimizes both tax efficiency and growth potential.

Your LLC isn’t stuck with default tax treatment, which is good news. You can elect S-Corp or C-Corp taxation, and each election completely changes your tax calculation requirements. These elections can save you serious money, but they also complicate your tax planning considerably.

Now, I’ll be honest—I used to think S-Corp elections were always the way to go for profitable LLCs. Turns out I was wrong about half the time. The election decision impacts which tax calculator you need and how you input your data. Default LLC taxation, S-Corp election, and C-Corp election each require different calculation approaches and different forms.

|

Tax Election |

Federal Form |

Self-Employment Tax |

Key Benefits |

Best For |

|---|---|---|---|---|

|

Default LLC |

Schedule C (Single) / 1065 (Multi) |

15.3% on all profits |

Simplicity, business loss deductions |

LLCs with moderate profits |

|

S-Corp Election |

Form 1120S |

Only on salary portion |

Reduced SE tax, pass-through benefits |

Profitable LLCs ($60K+ profit) |

|

C-Corp Election |

Form 1120 |

None (payroll taxes only) |

Retained earnings, corporate deductions |

High-growth, reinvestment focus |

S-Corp Election Benefits and Calculations

S-Corp elections can save substantial money on self-employment taxes. Instead of paying 15.3% on all LLC profits, you pay yourself a reasonable salary (subject to payroll taxes) and take the remaining profits as distributions (not subject to SE tax).

The calculation becomes more complex because you need to determine what constitutes a “reasonable salary” for your role and industry. The “pay yourself a reasonable salary” advice for S-Corps? That’s like saying “drive carefully.” What does that even mean? The IRS scrutinizes this hard, so your calculator needs to help you find the sweet spot between tax savings and compliance risk.

This election works best when your LLC profits significantly exceed what you’d reasonably pay yourself as an employee. The break-even point varies, but many tax pros suggest it becomes worthwhile around $60,000-$80,000 in annual profits. But don’t just take their word for it—run the numbers yourself.

C-Corp Election Considerations

C-Corp elections are less common for LLCs, but they make sense in specific situations. You’ll face double taxation (corporate tax on profits, then personal tax on distributions), but you gain access to certain deductions and can retain earnings at potentially lower corporate rates.

The calculation complexity increases dramatically. You need to model corporate tax liability, personal tax on distributions, and the timing of when you take money out of the business. This requires sophisticated calculators that can handle multiple tax entities—good luck finding a free one that does this right.

Most LLC owners won’t benefit from C-Corp elections, but if you’re retaining significant earnings for future growth or need specific corporate deductions, the math might work in your favor. Might being the key word here.

State-Specific Election Variations

Okay, here’s where it gets weird. Some states don’t recognize your federal S-Corp election, meaning you could be an S-Corp for federal purposes but still a partnership or disregarded entity for state taxes. This creates a calculation nightmare that most basic calculators can’t handle.

California is notorious for this—and if you’re in California like my buddy Mike, you’re getting hit with that brutal $800 minimum tax even if you made zero dollars. Thanks, Sacramento. They’ll tax your LLC as a partnership even if you’ve elected S-Corp status federally. You need calculators that can handle these split treatments and calculate both federal and state obligations accurately.

Multi-state operations? Good luck with that. You might have different tax treatments in different states, requiring apportionment calculations and state-specific rules that basic calculators simply can’t handle. I tried three different “professional” calculators that couldn’t handle California’s weird franchise tax rules properly.

Recent tax law changes under the One Big Beautiful Bill Act (OBBBA) have made permanent the larger standard deduction created under the TCJA, with 2025 amounts set at $15,750 for single filers and $31,500 for married filing jointly, affecting how LLC income stacks with other personal income in tax bracket calculations.

LLC Tax Rate Calculator Components and Variables

Building or choosing an LLC tax calculator isn’t just about finding something that spits out a number. You’re dealing with multiple rate structures, various deductions, and state-specific rules that all interact in ways that’ll make your head spin.

The best calculators handle this complexity without making you feel like you need a PhD in tax law, but you still need to understand what’s happening behind the scenes to input accurate data and not get completely lost. Missing even one component can throw off your entire tax projection by thousands of dollars.

Federal Tax Rate Structures

Federal LLC taxation isn’t a single rate—that would be too easy. You’re dealing with progressive income tax brackets, self-employment taxes, and potentially additional Medicare taxes. Each has different rates and applies to different portions of your income, because why would the government make anything simple?

Your LLC profits flow to your personal return where they get hit with tax brackets ranging from 10% to 37%. But that’s just income tax. You’re also paying 15.3% SE tax on most LLC income, plus an additional 0.9% Medicare tax if you’re a high earner. It adds up fast.

Progressive Income Tax Brackets

Here’s the thing that trips people up: LLC income doesn’t get taxed in isolation. It stacks on top of your other income (spouse’s wages, investment income, etc.) and fills up the tax brackets from bottom to top.

This means the same LLC profit could face vastly different tax rates depending on your other income. If you’re already in the 32% bracket from other sources, your LLC profits get taxed at 32% or higher. But if you have little other income, those same profits might face much lower rates. The difference can be huge.

Quality calculators need to account for this stacking effect and help you understand how LLC income interacts with your overall tax picture. This is especially important for tax planning and quarterly payment calculations—trust me on this one.

The OBBBA has made permanent the seven tax rates created by the TCJA: 10%, 12%, 22%, 24%, 32%, 35% and 37%, with an initial inflation adjustment in 2026 for the first two brackets, providing some stability for LLC tax planning calculations. Finally, some predictability.

State and Local Tax Variables

State taxes add another layer of complexity that many basic calculators completely ignore. You might face state income taxes, franchise taxes, annual LLC fees, and even local business taxes depending on where you’re located and what your business does.

The variation is enormous. Texas folks have it easy with no state income tax, but don’t get cocky—you still have federal headaches. Meanwhile, California and New York can hit you with rates over 13%. Some states have flat rates, others use progressive brackets, and a few have different rates for different types of income because apparently they enjoy making things complicated.

Franchise Tax and Annual Fees

Don’t forget about franchise taxes and annual fees—these will sneak up on you. Many states charge LLCs annual fees regardless of whether you made any money. California hits LLCs with an $800 minimum franchise tax every year, even if you had zero income. It’s basically a “congratulations on existing” fee.

These fixed costs might seem small compared to income taxes, but they add up and mess with your cash flow planning. A decent tax calculator should include these fees in your total tax liability projection, not just the income-based taxes.

Some states base franchise taxes on LLC income or assets, creating another variable that needs calculation. Delaware, for example, has this complex franchise tax calculation based on assumed par value or gross assets and income. It’s like they designed it to be confusing on purpose.

Multi-State Tax Apportionment

Multi-state operations create apportionment nightmares that’ll make you want to stick to one state forever. You need to determine which states you have nexus in, how to allocate income between states, and what each state’s specific rules require. This is where basic calculators completely fail and leave you hanging.

Each state has different rules for determining nexus (the connection that creates tax obligations) and different formulas for apportioning income. Some use three-factor formulas (property, payroll, sales), others use single sales factor, and the weightings vary by state because consistency would be too logical.

Professional-grade calculators can handle these complexities, but you need to input accurate data about where your property, employees, and sales are located. Get this wrong and you could end up significantly under or overpaying state taxes in multiple states.

Deduction and Credit Integration

When evaluating business expenses and deductions, it’s crucial to understand which costs provide the best return on investment. Our retail math analysis shows how proper expense categorization and deduction optimization can significantly impact your bottom line and tax liability calculations.

Deductions and credits can dramatically reduce your LLC tax liability, but they need to be calculated correctly and in the right order. The Section 199A qualified business income deduction alone can save you 20% on LLC profits, but it has complex limitations that calculators must navigate properly.

Business expense deductions reduce your LLC’s taxable income, while tax credits directly reduce your tax liability dollar-for-dollar. Understanding how these interact and which calculators properly handle them is crucial for accurate projections—and for not leaving money on the table.

Section 199A QBI Deduction Calculations

The QBI deduction can be a game-changer, potentially reducing your tax on LLC profits by 20%. But here’s what blew my mind when I first discovered this: the calculation is incredibly complex, with income thresholds, business type restrictions, and limitations based on W-2 wages and depreciable property.

For 2023, the deduction starts phasing out at $182,050 for single filers and $364,100 for married filing jointly. Above these thresholds, you face additional limitations that can reduce or eliminate the deduction entirely. So much for simple tax relief, right?

Certain businesses—specified service trades or businesses including law, accounting, consulting—face additional restrictions. If your income exceeds the threshold limits, you might lose the deduction completely, regardless of your business type. It’s like a cruel joke for successful service businesses.

Quality calculators need to handle all these variables and help you understand how different income levels and business structures affect your available deduction. This is where the difference between basic and professional calculators becomes painfully obvious.

Here’s a real scenario: a consulting LLC with $250,000 in profits and a single owner would face QBI deduction limitations due to being a specified service business above the income threshold. The calculator must determine if the business qualifies for any deduction based on W-2 wages paid and depreciable property owned, potentially reducing the available deduction from the full 20% to a much smaller amount or zero.

Digital Tax Calculator Tools and Selection Criteria

Choosing the right LLC tax calculator can make or break your tax planning efforts. I’ve seen business owners rely on basic online calculators that missed major deductions or state tax obligations, leading to significant underpayment penalties and serious cash flow problems.

The range of available tools is vast, from free online calculators that provide rough estimates to professional software platforms that integrate with your accounting system and provide real-time projections. Understanding what you need and what each type of tool actually delivers is crucial for making the right choice—and not getting burned.

Professional vs. Basic Calculator Options

Just as selecting the right marketing tools for your business requires careful evaluation of features and capabilities, choosing tax calculators demands thorough analysis. Our comprehensive SEO content tools review demonstrates how detailed tool analysis helps businesses make informed decisions that impact their bottom line.

The divide between basic and professional calculators is huge. Basic tools might work for simple, single-member LLCs with straightforward income and expenses. But if you have multiple members, operate in multiple states, or need accurate quarterly projections, you’ll need professional-grade tools—and you’ll pay for them.

Professional calculators cost more upfront but can save you thousands in avoided penalties, missed deductions, and better tax planning decisions. The question isn’t whether you can afford professional tools—it’s whether you can afford not to use them. I learned this the expensive way.

Free Online Calculator Limitations

Free online calculators have serious limitations that can cost you real money. Most don’t handle state taxes properly, if at all. They often miss complex deductions like Section 199A, and many aren’t updated regularly for tax law changes—some are using tax brackets from three years ago.

I’ve seen free calculators that still use old tax brackets or don’t account for recent law changes. Using outdated information for tax planning can lead to significant underpayment penalties and cash flow problems that’ll ruin your whole quarter.

The biggest issue with free calculators is they give you a false sense of security. You get a number that looks official, but it might be missing thousands of dollars in taxes or deductions. For rough estimates when you’re just starting out, they’re fine. For actual tax planning? They’re dangerous.

Professional Software Integration

Professional tax calculators that integrate with your accounting software are absolute game-changers. Instead of manually entering data every quarter—which is about as fun as it sounds—the calculator pulls information directly from QuickBooks, Xero, or other platforms and gives you real-time tax projections.

This integration enables proactive tax planning throughout the year. You can see how different business decisions affect your tax liability before you make them. Considering a large equipment purchase? The calculator shows you the immediate tax impact without you having to do mental math.

The time savings alone often justify the cost. Instead of spending hours gathering data and inputting numbers, you get instant updates whenever your financial data changes. This is especially valuable for businesses with fluctuating income or those making frequent business decisions that affect tax liability.

But here’s the reality check: QuickBooks integration sounds great until you realize it takes 20 minutes to sync and crashes half the time. Browser compatibility issues are real—Chrome works best, but Safari users are often screwed.

|

Calculator Type |

Cost Range |

State Tax Support |

Integration |

Best For |

|---|---|---|---|---|

|

Free Online |

$0 |

Limited/None |

None |

Simple single-member LLCs |

|

Basic Paid |

$50-200 |

Basic |

Limited |

Small LLCs with straightforward taxes |

|

Professional |

$500-2000+ |

Comprehensive |

Full accounting integration |

Multi-member, multi-state LLCs |

|

Enterprise |

$2000+ |

Advanced multi-state |

Custom integrations |

Large LLCs with complex structures |

Accuracy Validation and Testing Methods

How do you know if your tax calculator is actually accurate? I’ve learned to test calculators against known scenarios before relying on them for important decisions. Run a calculation with data from a previous year where you know the actual tax outcome, and see how close the calculator comes.

I tested seven different calculators last year. Three were completely wrong, two were close enough, and two actually got it right. Professional calculators often provide detailed calculation breakdowns, showing exactly how they arrived at each number. This transparency lets you verify the logic and catch potential errors. If a calculator just gives you a final number without showing the work, be skeptical.

Regular updates are another crucial indicator of quality. Tax laws change frequently, and calculators that aren’t updated quickly become unreliable and potentially expensive mistakes waiting to happen.

Tax Law Update Mechanisms

Tax law changes constantly—it’s like they enjoy moving the goalposts—and your calculator needs to keep up. The best tools have automatic update mechanisms that push new tax rates, bracket changes, and law modifications without requiring manual intervention from you.

Some calculators require manual updates or subscription renewals to get current tax information. This creates gaps where you might be using outdated calculations without realizing it. I made this exact mistake with my own LLC in 2019 and ended up with a $3,200 penalty. Not fun.

The timing of updates matters too. Quality calculators update immediately when new tax guidance is released, not months later. During tax law transition periods, this can make the difference between accurate and dangerously wrong calculations.

Implementation and Strategic Tax Planning

Getting accurate results from your LLC tax calculator depends heavily on how you actually use it—and most people mess this up. I’ve seen business owners input incorrect data and make major financial decisions based on completely flawed projections.

The goal isn’t just to calculate your tax liability—it’s to use that information for better business decisions, cash flow management, and long-term tax planning. This requires understanding how to interpret calculator results and integrate them into your broader financial strategy without losing your mind.

Data Input Best Practices

Proper data organization and analysis are fundamental to accurate tax calculations. Understanding how to systematically approach data collection and categorization, similar to the methodical approach outlined in our GA4 audit guide, ensures your tax calculator inputs are comprehensive and accurate.

Garbage in, garbage out applies perfectly to tax calculators. The accuracy of your results depends entirely on the quality of data you input. This means properly classifying different types of income, documenting all deductible expenses, and understanding how your specific LLC structure affects the calculations.

Income classification is particularly important because different types of income get different tax treatment. Ordinary business income, capital gains, rental income, and guaranteed payments all have different tax implications that affect your calculator inputs. Mix these up and your projections are worthless.

Expense categorization requires equal attention. Business expenses reduce your taxable income, but they need to be properly classified and documented. Personal expenses mixed with business expenses will throw off your calculations and potentially create compliance issues that you don’t want to deal with.

Income Classification and Timing

Understanding income classification prevents major calculation errors that can cost you serious money. Ordinary business income from your LLC’s operations gets hit with both income tax and SE tax. Capital gains from asset sales face different rates and no SE tax. Rental income might avoid SE tax entirely—if you’re lucky.

Timing also matters for accurate projections. Cash basis LLCs recognize income when received, while accrual basis LLCs recognize it when earned. Your calculator needs to reflect your accounting method, or your projections will be completely off and you’ll be scrambling come tax time.

Guaranteed payments to LLC members create another classification challenge. These payments are subject to SE tax and need to be handled differently from profit distributions in your calculator inputs. Get this wrong and you’re looking at significant tax surprises.

Expense Categorization and Documentation

Proper expense categorization between ordinary business expenses, capital expenditures, and personal expenses ensures calculators provide accurate deduction benefits and tax projections while keeping you compliant with IRS requirements—which is kind of important.

Documentation supports your expense categorization and protects you during audits. Your calculator might show significant tax savings from business expenses, but without proper documentation, those deductions won’t survive IRS scrutiny. I keep receipts for everything, even that $3 coffee that was technically a business meeting.

Mixed-use expenses require careful allocation between business and personal use. Your home office, vehicle, and phone might be partially deductible, but you need to calculate the business percentage accurately and input it correctly into your calculator.

Here’s a real example: an LLC owner who works from home and uses their personal vehicle for business needs to properly allocate expenses. If their home office represents 15% of their home’s square footage, only 15% of mortgage interest, utilities, and maintenance can be deducted. Similarly, if 40% of vehicle mileage is business-related, only 40% of vehicle expenses qualify for deduction in the calculator.

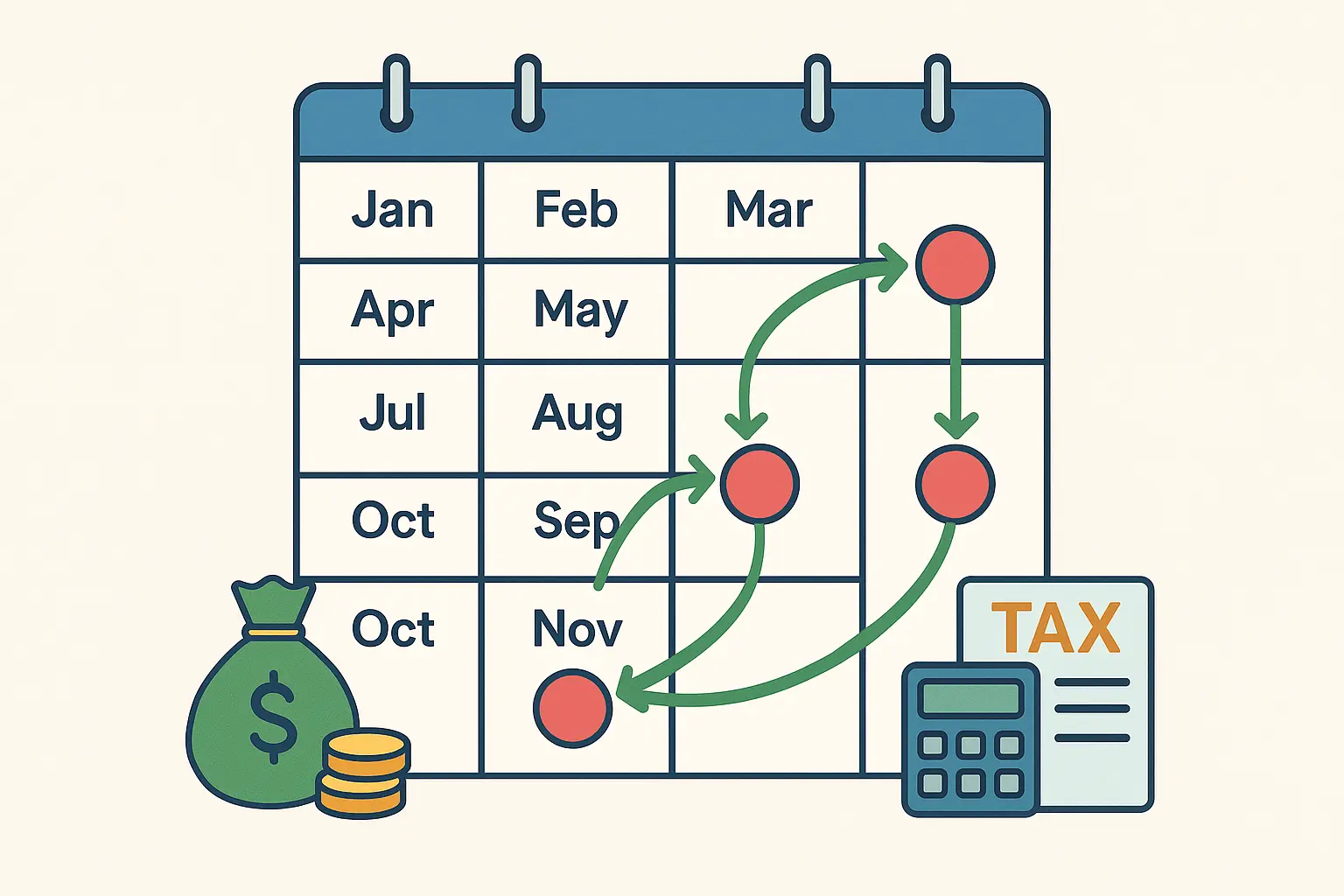

Quarterly Planning and Cash Flow Management

Creating effective quarterly tax planning requires developing systems that continuously monitor and adjust projections throughout the year. The principles outlined in our guide on creating continuously learning systems apply equally to tax planning, where regular updates and refinements improve accuracy and outcomes.

Quarterly tax planning is where LLC tax calculators provide the most value. Instead of getting surprised by a large tax bill in April—which is about as fun as a root canal—you can project your annual liability and make appropriate quarterly payments throughout the year.

Cash flow management becomes much easier when you know your tax obligations in advance. You can set aside money each month, plan for quarterly payment dates, and avoid the cash crunch that comes with unexpected tax bills. Fourth quarter estimated payments always sneak up on me, no matter how organized I think I am.

Running projections regularly, not just once per year, is essential. Your LLC’s income and expenses change throughout the year, and your tax projections should reflect these changes to remain accurate and useful.

Estimated Tax Payment Calculations

Estimated tax payment calculations require balancing current year projections with safe harbor rules based on prior year taxes. You need to pay either 90% of current year taxes or 100% of prior year taxes (110% for high earners) to avoid penalties—and trust me, you want to avoid those penalties.

Your calculator should help you determine which approach minimizes your required payments while avoiding penalties. If your current year income is significantly higher than last year, the prior year safe harbor might be better. If income is lower, current year projections might require smaller payments.

Timing matters for estimated payments. The IRS expects payments by specific quarterly deadlines, and late payments trigger penalties even if you ultimately overpay for the year. Your calculator should factor in payment timing to optimize your cash flow and keep you out of trouble.

Try finding a decent tax calculator in March when everyone’s scrambling. Good luck with that. The smart move is getting your system set up during the slower months when you can actually think clearly.

The Marketing Agency understands the complexities of LLC tax planning because we work with numerous LLC clients who need to understand how their marketing investments affect their tax obligations. Our data-driven approach to ROI-focused marketing services helps LLCs make informed decisions about business expenses and growth investments while considering tax implications. If you’re struggling to integrate tax planning with your marketing strategy, we can help you understand how marketing expenses affect your LLC tax calculations and overall business profitability.

Final Thoughts

LLC tax calculations are way more complex than most business owners realize, but the right tools and knowledge can turn this complexity into a competitive advantage instead of a constant headache. Understanding pass-through taxation, SE tax implications, and available deductions like Section 199A can save you thousands of dollars annually—real money that stays in your business.

The difference between basic and professional tax calculators often pays for itself through better accuracy, time savings, and strategic planning capabilities. Free online tools might work for simple situations, but growing LLCs need sophisticated calculators that integrate with accounting systems and handle multi-state operations without making you want to pull your hair out.

Success with LLC tax calculators comes down to proper implementation—accurate data input, regular projections, and integration with your broader business strategy. Use these tools proactively throughout the year, not just during tax season, to optimize your tax liability and cash flow management. Yeah, $500 seems like a lot for tax software until you realize one mistake costs you more than that.