Look, I’ll be honest with you. Most people think calculating discounts is simple math – and technically, they’re right. But I’ve seen way too many businesses mess this up in expensive ways. Just last month, a coffee shop owner I know discovered they’d been giving customers 35% off instead of 25% for three weeks straight. That “simple” math error cost them over $2,000.

The thing is, discount calculators are everywhere now. According to Omni Calculator, these tools handle everything from basic “20% off” deals to those confusing “buy two, get one free” promotions. But here’s what nobody tells you: getting the math right is just the beginning.

Table of Contents

-

The Basic Math (That Everyone Gets Wrong)

-

Building a Calculator People Actually Want to Use

-

Making It Work for Your Business

-

The Cool Advanced Stuff

-

My Final Take

The Quick Version (Because I Know You’re Busy)

-

The formula everyone screws up: Discount Amount = Original Price × (Discount Percentage ÷ 100). Sounds easy, but trust me, it’s not.

-

Multiple discounts don’t add up – This one kills me. A 20% discount plus 10% off doesn’t equal 30% off. It’s actually 28%. I know, weird.

-

BOGO deals are sneaky – “Buy 2 Get 1 Free” is actually 33.33% off when you buy 3 items. Most people don’t realize this.

-

Real-time calculations keep people interested – Nobody wants to hit “calculate” buttons anymore

-

Smart systems can think for themselves – The fancy ones adjust prices based on how much stuff you have in stock

-

Always double-check your numbers – Make sure discounts stay between 0-100% (unless you’re doing something really special)

-

Connect everything together – Your calculator should talk to your shopping cart and inventory system

The Basic Math (That Everyone Gets Wrong)

Okay, so I’ve been helping businesses with this stuff for years now, and I can’t tell you how many times I’ve seen the same mistakes over and over. The math looks simple, but people find creative ways to mess it up.

Every discount calculator uses the same basic formula, and if you get this wrong, everything else falls apart. I’ve literally seen businesses lose customers because their “sale” prices were higher than their regular prices. Not kidding.

The Formula That Rules Everything

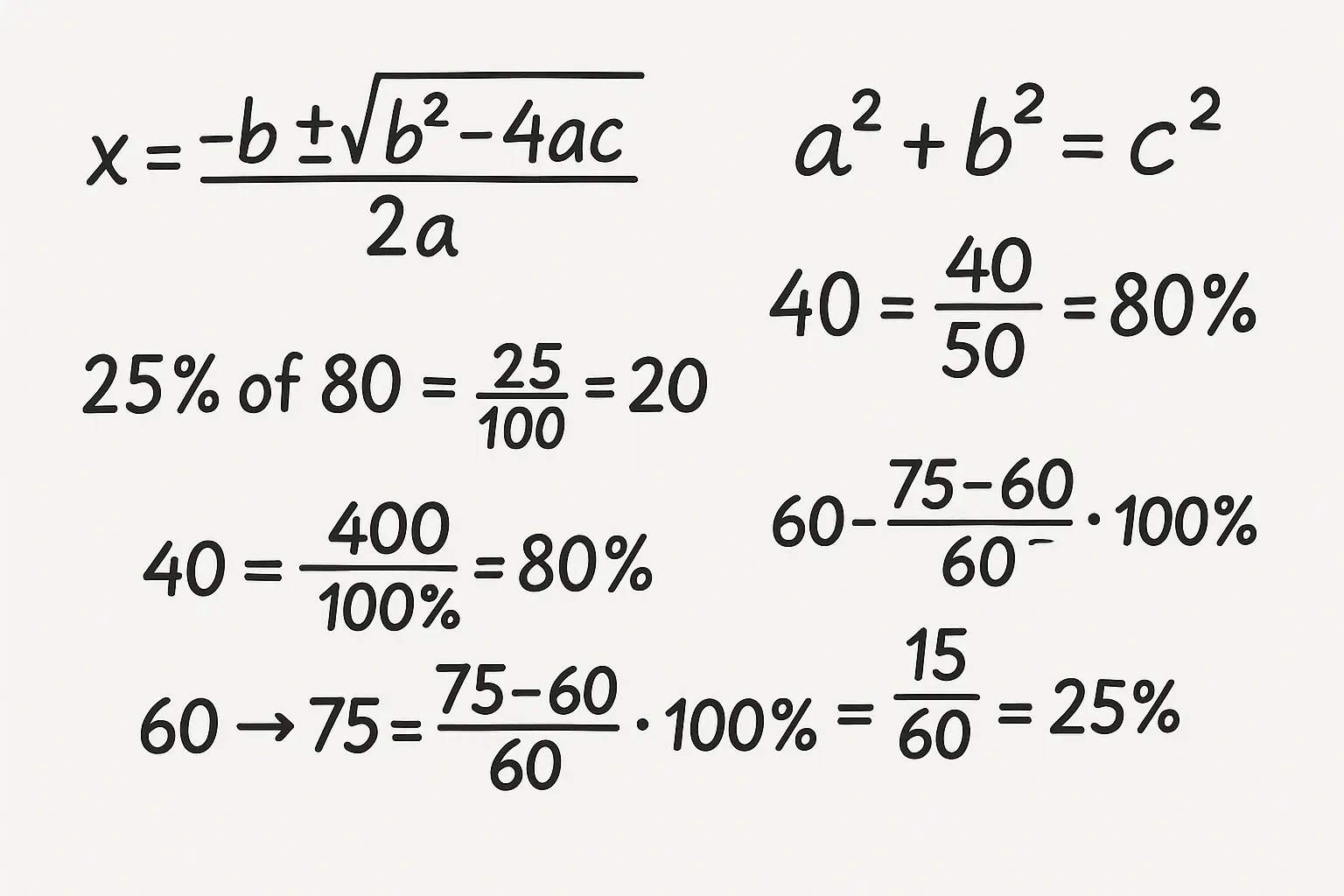

Here it is: Discount Amount = Original Price × (Discount Percentage ÷ 100)

I know it looks obvious, but stick with me. Let’s say you’ve got a $50 pair of jeans and you want to give 25% off. Most people think they can just multiply $50 by 25 and get… well, that gives you $1,250, which is clearly wrong.

The right way: $50 × (25 ÷ 100) = $50 × 0.25 = $12.50 discount. So the customer pays $37.50.

I’ve seen people skip that “divide by 100” step and wonder why their calculator is giving insane results. Don’t be that person.

Breaking Down Each Piece

The original price is straightforward – that’s what you normally charge. The discount percentage is where people get confused. When you say “25% off,” you need to enter 25, not 0.25. The formula handles converting it to a decimal.

Here’s the thing that trips everyone up: you HAVE to do the division first, then multiply. If you try to shortcut this, your calculator will give you numbers that make no sense.

Converting Percentages (Two Ways That Actually Work)

I use two methods, and both work perfectly:

Method 1: Just divide by 100. So 25% becomes 25 ÷ 100 = 0.25

Method 2: Move the decimal point two spots to the left. So 25% becomes 0.25

I prefer the first method when I’m programming calculators because it’s harder to mess up. But use whichever one makes sense to you.

|

What You See |

Method 1 (÷100) |

Method 2 (Move Decimal) |

What You Get |

|---|---|---|---|

|

10% |

10 ÷ 100 |

10. → 0.10 |

0.10 |

|

25% |

25 ÷ 100 |

25. → 0.25 |

0.25 |

|

33.5% |

33.5 ÷ 100 |

33.5 → 0.335 |

0.335 |

|

50% |

50 ÷ 100 |

50. → 0.50 |

0.50 |

|

75% |

75 ÷ 100 |

75. → 0.75 |

0.75 |

Working Backwards (When You Know the Sale Price)

Sometimes you’ll see something on sale and want to figure out what the original price was. Maybe you’re checking if you’re getting a good deal, or you’re trying to figure out your competitor’s pricing.

The formula flips around: Original Price = Sale Price ÷ (1 – Discount Percentage as decimal)

So if something costs $75 after a 25% discount, the original price was $75 ÷ (1 – 0.25) = $75 ÷ 0.75 = $100.

This is super handy for competitive research. I use it all the time to figure out what competitors are really charging before their “sales.”

The Tricky Stuff (Where Real Money Gets Lost)

Real businesses don’t just do simple “20% off everything” sales. You’ve got multiple discounts, volume pricing, special offers – and this is where the math gets interesting and expensive mistakes happen.

Understanding these complex scenarios is like mastering retail math strategies – you need to think beyond basic calculations to really maximize your profits while staying competitive.

Multiple Discounts (The Big Mistake Everyone Makes)

Here’s where I see businesses lose the most money. Someone thinks “20% off plus another 10% off equals 30% off.” WRONG.

Here’s what actually happens: You start with 100% of the price. After the first 20% discount, the customer pays 80% of the original price. Then you apply the second 10% discount to that already-reduced amount.

So they pay 90% of the 80%, which is 0.9 × 0.8 = 0.72. That means they’re paying 72% of the original price, so they’re saving 28%, not 30%.

I know it seems like a small difference, but when you’re doing thousands of transactions, that 2% adds up fast.

Volume Discounts (More Complex Than You Think)

Volume discounts are tricky because you can’t just apply the biggest discount to everything. You have to calculate each tier separately.

Let’s say you offer:

-

10% off for buying 1-10 items

-

15% off for buying 11-25 items

-

20% off for buying 26+ items

If someone orders 30 items, you calculate: (10 items × 10% discount) + (15 items × 15% discount) + (5 items × 20% discount).

Each tier gets its own discount rate, then you add up all the savings. It’s fair to the customer and maximizes your incentive for bigger orders.

Real example: A business orders 30 units at $100 each. First 10 units get 10% off (save $100), next 15 units get 15% off (save $225), last 5 units get 20% off (save $100). Total savings: $425 on a $3,000 order. Final price: $2,575.

BOGO Deals (Converting to Percentages)

“Buy One Get One” deals confuse customers because they don’t immediately see the percentage savings. I always convert these to percentages so people understand the value.

“Buy 2 Get 1 Free” equals 33.33% off when you’re buying 3 items. Here’s the math: The free item value ÷ total purchase value = discount percentage.

If each item costs $10 and you get one free on a 3-item purchase, you save $10 on a $30 total. That’s $10 ÷ $30 = 33.33% off.

This helps customers compare BOGO deals against straight percentage discounts.

Conditional Discounts (The Programming Nightmare)

Modern promotions have all sorts of conditions. “15% off orders over $100, but only on Tuesdays, and only for returning customers, and only on certain products.”

Your calculator needs to check every condition before applying the discount:

-

Is the order big enough?

-

Is today Tuesday?

-

Is this a returning customer?

-

Are the right products in the cart?

Each condition has to be true before the discount kicks in. Miss one check and you’ll either give discounts you shouldn’t or miss legitimate ones.

The automotive industry shows how complex this gets. According to Bankrate’s analysis of 0% APR deals, these zero-percent financing offers dropped below 1% availability for the first time since 2004. The conditions for these deals are incredibly specific – certain credit scores, specific models, particular time periods. That’s the level of complexity modern discount systems need to handle.

Preventing Expensive Mistakes

I’ve seen discount calculators destroy businesses. Not kidding. One wrong calculation that goes live can cost you thousands before you catch it.

Checking Everything Before It Goes Live

Your calculator needs to validate every single input. Discount percentages should be between 0-100% (though you might allow over 100% for special cases). Prices must be positive numbers.

But here’s what most people forget – what happens when someone enters weird stuff? Negative discounts? 500% off? Your system should either reject these or handle them logically.

Set reasonable limits based on your business. If you never sell anything over $10,000, don’t let someone enter $1 million as a price.

My Validation Checklist:

-

Discount percentage: 0-100% (or whatever your max is)

-

Price: greater than $0

-

No negative numbers anywhere

-

Maximum price limits that make sense

-

Decimals handled correctly

-

Currency symbols in the right place

-

Clear error messages when something’s wrong

-

Edge cases handled gracefully

Rounding (The Devil in the Details)

Rounding errors add up fast when you’re doing multiple calculations. Here’s my rule: calculate everything at full precision, then round only what you show the customer.

So if the discount comes out to $12.3456789, keep that full number for internal calculations, but show the customer “$12.35.”

Be consistent with rounding rules. When you hit exactly 50 cents, do you round up or down? Pick a method and stick with it. Document it so everyone on your team knows.

Building a Calculator People Actually Want to Use

The best calculator in the world is useless if it’s confusing or hard to use. I’ve seen brilliant mathematical tools that nobody touches because the interface is terrible.

Good calculator design follows the same principles as creating high-impact content – it needs to engage users and make their lives easier, not more complicated.

Making It User-Friendly

People think about discounts in a specific order: “This costs $X, I have a Y% off coupon, what do I pay?” Design your interface to match that thought process.

Organizing the Input Fields

Put “Original Price” first, then “Discount Percentage.” Show the results (discount amount and final price) below the inputs, clearly separated.

Label everything clearly. “Original Price” is better than just “Price” because it’s specific. “Discount Percentage” beats “Discount” because people know to enter 25, not 0.25.

Add little helper notes next to fields. Something like “Enter 25 for 25%” prevents confusion about whether to enter 25 or 0.25.

Real-Time Calculations (The Game Changer)

This is huge. Instead of making people click a “Calculate” button, update the results as they type. It transforms your calculator from a static tool into an interactive experience.

People love playing with different percentages to see how the savings change. It’s almost addictive.

Just be careful about performance. Don’t recalculate on every single keystroke – wait for a brief pause in typing. And show some kind of loading indicator, even if it’s just for a split second.

Mobile-First Design

More people will use your calculator on their phone than on a computer. Design for thumbs, not mouse clicks.

Make input fields big enough to tap easily – at least 44 pixels tall. Leave space between buttons so people don’t accidentally tap the wrong thing.

Use the number keyboard for price and percentage fields on mobile. It’s a small detail that makes a huge difference.

Making the Results Clear

How you show the results determines whether people trust and act on the information. Poor formatting kills conversions.

Formatting Money and Numbers

Always show currency with the right symbol ($, €, £) and use commas for thousands. Always show exactly two decimal places for money amounts.

If you serve international customers, consider different currency formats. Americans expect $1,234.56, but Europeans might expect €1.234,56.

Round percentages to one decimal place (25.5%) unless you need more precision.

Showing Savings Visually

Numbers alone don’t always make the savings feel real. Visual elements help.

Show savings both ways: “$50 saved (25% off)” gives people two perspectives on the value.

Consider progress bars or visual comparisons. A bar showing 75% of the original price with 25% savings highlighted makes the discount feel more substantial.

Simple vs. Detailed Views

Some people want quick answers, others want to see your work. Give them both options.

Start with a clear summary: “Original: $100, Discount: $25 (25%), You Pay: $75.”

Then add a “Show Details” button that breaks down the calculation step by step. This builds trust, especially for complex calculations with multiple discounts.

Making It Work for Your Business

A standalone discount calculator is nice, but integrating it with your actual business operations is where the real value comes from.

Integration requires the same strategic thinking as conducting a GA4 audit – you need to understand how all your systems work together and optimize the connections between them.

Connecting to Your Shopping Cart

Instead of making customers use a separate calculator, build discount calculations right into your checkout process. Show running totals with discounts applied at every step.

Make savings prominent, not hidden in fine print. Customers should see their savings clearly displayed throughout checkout.

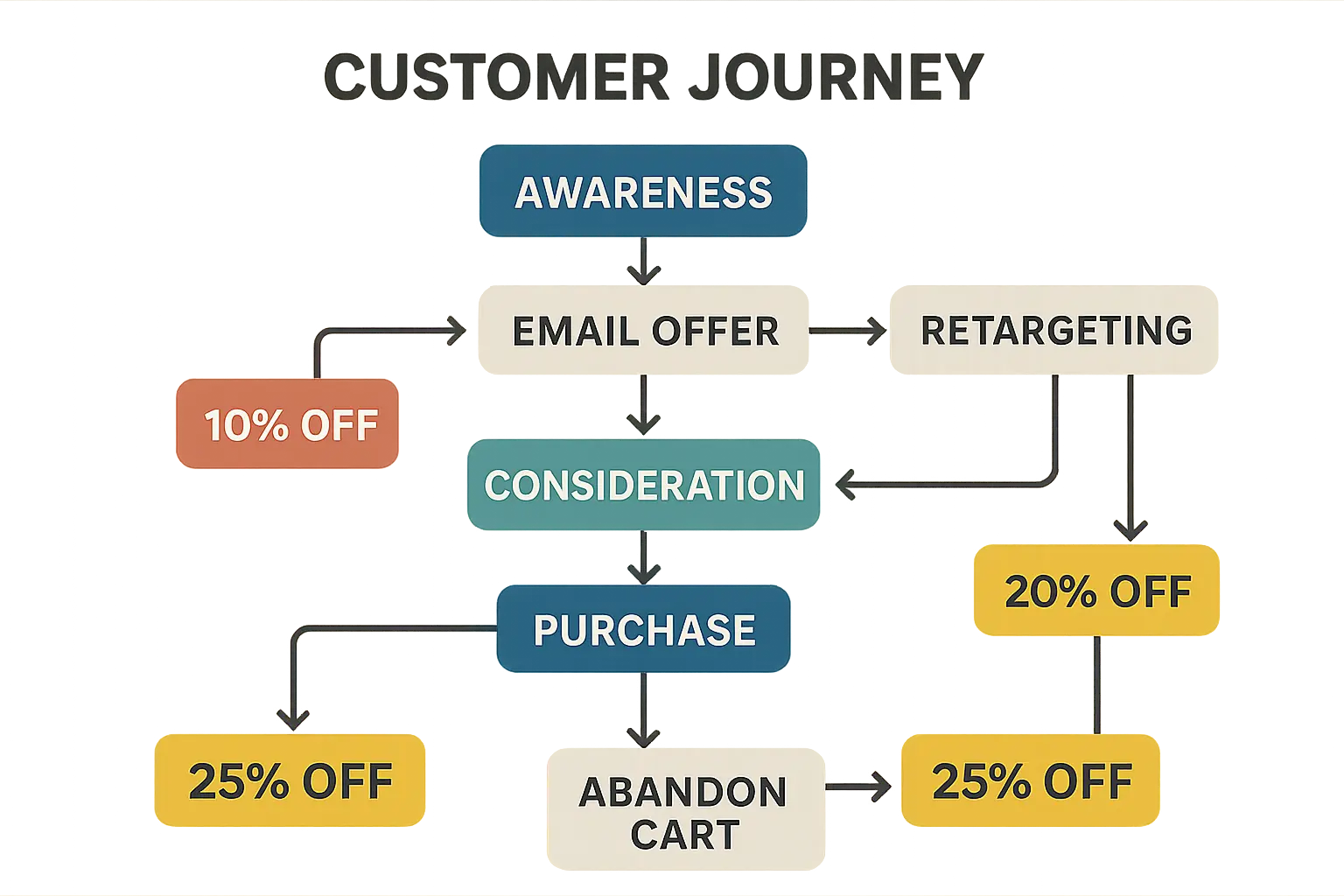

Try “savings meters” that show how close customers are to bigger discounts. “Add $25 more to save an extra 10%” encourages larger orders.

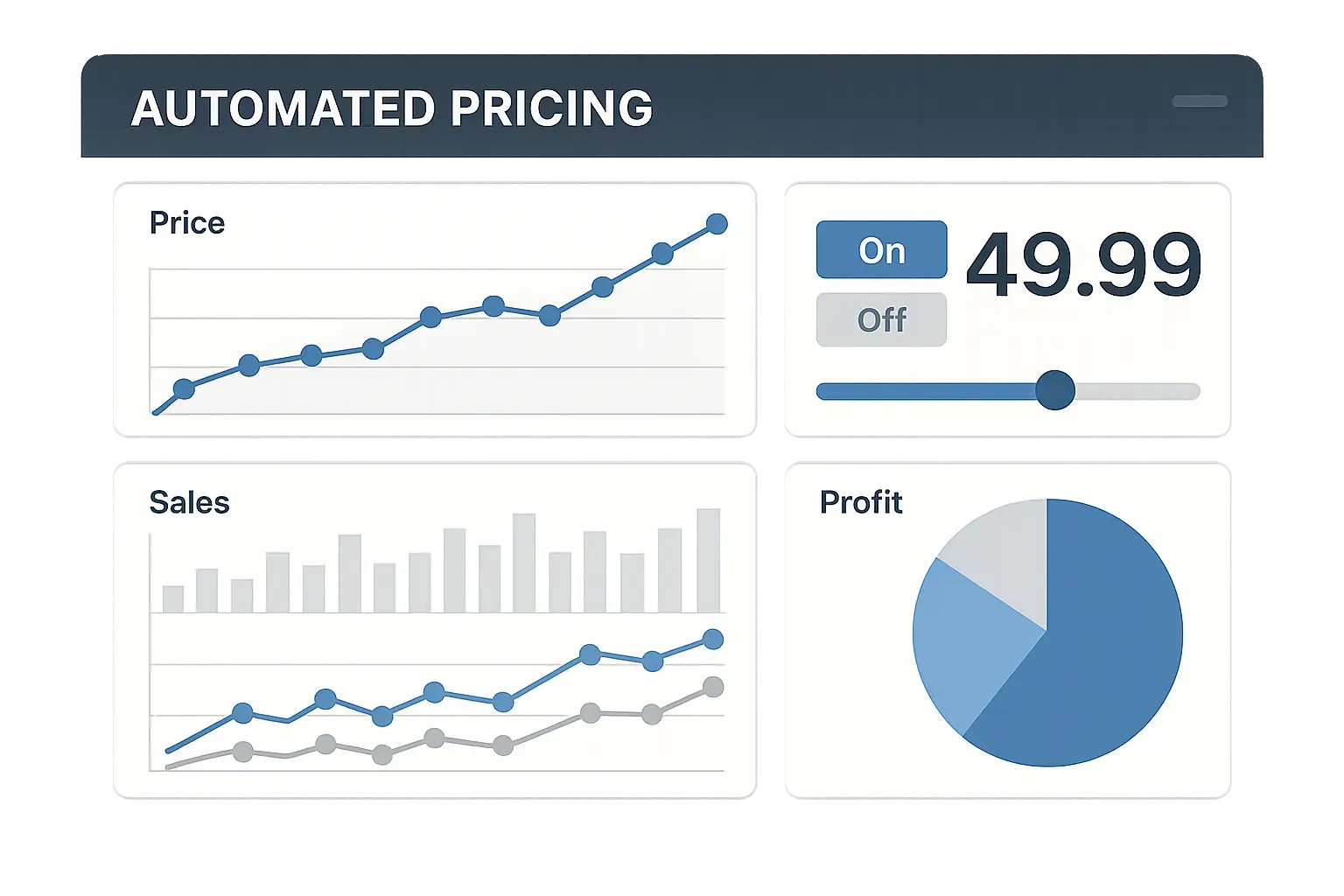

Working with Your Inventory System

Connect your discount calculator to inventory management so pricing adjusts automatically based on stock levels. Slow-moving items can get automatic discount increases, while low-stock items might reduce or eliminate discounts.

Seasonal coordination is huge. Winter coats automatically get deeper discounts as spring approaches. You clear inventory without manual intervention.

Product lifecycle integration gradually increases discounts as items age. You move inventory before it becomes obsolete while maximizing revenue from each product.

Example: An electronics store automatically increases smartphone discounts from 10% to 25% when stock levels exceed 90 days of inventory, while reducing discounts on popular items with less than 7 days of projected stock.

Using It for Marketing

Discount calculators aren’t just operational tools – they’re marketing assets that drive customer acquisition and provide valuable data.

Understanding market opportunities is crucial, similar to market sizing for business opportunities – you need to target the right segments with appropriate discount levels.

Testing Different Strategies

Test different discount percentages to find the sweet spot between conversions and profit. Sometimes 15% off works better than 20% off because it feels more genuine.

Try different presentations. Does “Save $25” work better than “25% off” for your customers? It varies by product and audience.

Test promotional structures too. BOGO deals might beat percentage discounts for some products, while volume discounts work better for others.

Research from Omni Calculator shows that clear savings visualization directly impacts purchase decisions. When customers see they’re saving $175 on a $700 item with 25% off (final price $525), that clarity drives conversions.

Understanding Customer Acquisition Costs

Discounts reduce immediate revenue, but they can lower customer acquisition costs by converting prospects who wouldn’t otherwise buy. Calculate the true acquisition cost by factoring in the discount against customer lifetime value.

Track which discount levels attract genuinely new customers versus existing customers who would have bought anyway. Deep discounts that mainly cannibalize full-price sales from existing customers hurt profitability without improving acquisition.

Monitor the quality of discount-acquired customers. Do they buy again at full price, or only during sales? This data tells you whether discount strategies actually reduce acquisition costs or just attract bargain hunters.

Measuring Lifetime Value Impact

Discounts can increase customer lifetime value by encouraging trial purchases that lead to long-term relationships. But they can also train customers to wait for sales, hurting future full-price purchases.

Track what customers do after their first discount purchase. Customers who buy again at full price within 90 days usually represent successful lifetime value growth. Those who only show up for future sales might indicate you’ve created discount dependency.

Segment customers based on price sensitivity and market to them differently. Price-sensitive customers get targeted promotions, while price-insensitive customers get full-price communications to maximize revenue.

|

Discount Type |

Revenue Hit |

New Customers |

Repeat Business |

When to Use |

|---|---|---|---|---|

|

10-15% Off |

Small hit |

Some increase |

Great retention |

Premium stuff |

|

20-30% Off |

Medium hit |

Big increase |

Okay retention |

Seasonal sales |

|

BOGO Deals |

Big hit |

Huge increase |

Poor retention |

Clear inventory |

|

Volume Discounts |

Varies |

Small increase |

Excellent retention |

B2B sales |

|

First-Timer Discounts |

Medium hit |

Massive increase |

Great retention |

Getting new customers |

The Cool Advanced Stuff

Once you’ve got the basics down, there are some really sophisticated features that can turn your simple calculator into a business intelligence tool.

Smart Pricing That Thinks for Itself

Static discounts can’t respond to changing conditions. Smart systems adapt automatically to maximize both sales and profit.

According to Calculator Soup’s research, when they analyzed a vintage lava lamp originally priced at $165.99 that sold for $89.63, that represented a 46% discount. Advanced systems need to handle these complex reverse calculations to optimize dynamic pricing.

Building these systems requires continuously learning AI approaches that adapt based on real performance data and market feedback.

Algorithms That Optimize Automatically

Machine learning can analyze thousands of variables to determine optimal discount percentages for specific situations. Sales speed, customer type, time of day, inventory levels, competitor pricing – it all factors in.

These systems learn from results and keep improving. If 15% discounts consistently beat 20% discounts for a product category, the algorithm adjusts future recommendations.

You need serious data collection and analysis capabilities, but the results can dramatically improve promotional effectiveness while reducing manual work.

Time-Based Automation

Automated time-sensitive discounts increase urgency while hitting inventory targets. Discounts automatically increase as sale end dates approach, maximizing both revenue and turnover.

Flash sales can trigger based on inventory levels or sales speed. If a product isn’t moving at current discount levels, the system automatically increases the discount or extends the promotion.

Seasonal automation aligns discounts with demand without manual work. Holiday merchandise gets deeper discounts after the holiday, while seasonal items adjust based on weather or calendar dates.

According to Knowable Magazine’s analysis, when the EPA shifted social discount rates from 3% to 2%, it increased the social cost of carbon from $51 to $190 per ton. This shows how small percentage changes in automated systems can have massive financial implications across large operations.

Customer Segmentation Integration

Different customers respond to different discount strategies. VIP customers get exclusive early access, while price-sensitive segments get targeted offers.

Purchase history analysis triggers personalized discounts. Customers who frequently buy specific categories get targeted discounts on related products, increasing cross-sells.

Behavioral segmentation enables sophisticated strategies. Cart abandoners get automatic discount emails, while loyal customers get rewards-based discounts that encourage continued engagement.

Competitive Response Automation

Automated competitive monitoring triggers discount adjustments when competitors change pricing. Your system can automatically match competitive discounts or adjust pricing to maintain position.

Price monitoring tools track competitor promotions and suggest responsive strategies. If a major competitor launches 25% off, your system might recommend 20% off plus free shipping.

Profit margin protection ensures competitive responses don’t eliminate profitability. Set minimum margin thresholds that prevent automatic discounts from dropping below acceptable levels.

My Final Take

Look, mastering discount calculators isn’t just about getting the math right – though that’s definitely where you start. The businesses that really win with these tools understand they’re strategic assets, not just number crunchers.

The math foundation matters because small errors multiply across thousands of transactions. But the real value comes from integration, automation, and optimization. Your discount calculator should connect with inventory, respond to market conditions, and provide insights that drive better decisions.

Smart implementation turns a simple percentage calculation into a competitive advantage. Real-time calculations improve user experience, dynamic pricing responds to market changes automatically, and customer segmentation ensures you’re offering the right discounts to the right people at the right time.

Don’t underestimate how complex this gets. What looks simple – calculating a percentage off – becomes sophisticated when you add compound discounts, tiered pricing, inventory coordination, and customer behavior analysis.

The businesses winning with discount calculators treat them as part of their broader marketing and sales strategy, not isolated tools. They test different approaches, measure results, and continuously optimize based on real performance data rather than assumptions about what customers want.

Here’s the thing – if you’re just starting out, focus on getting the basic math right and making sure your interface doesn’t confuse people. Once that’s solid, you can start adding the fancy features.

But whatever you do, test everything. I’ve seen too many businesses launch discount calculators that looked great but gave wrong results. Your customers will notice, and they won’t give you a second chance to get it right.

The discount calculator game is only going to get more sophisticated. The businesses that invest in understanding and implementing these systems properly will have a significant advantage over those that treat discounts as an afterthought.

Start simple, but think big. Your future self will thank you.