Look, I used to think discount math was pretty simple until I watched a friend’s coffee shop nearly go under because of a pricing mistake. She offered 30% off everything during her grand opening without realizing some items were already being sold at cost. That’s when I realized most of us are winging it when it comes to discount calculations.

According to financial experts at Omni Calculator, there are tons of complex discount scenarios where “you can get 20% off the original price, then 15% more off of that discounted price” that trip up even experienced shoppers and business owners. Getting this stuff wrong can mean the difference between smart deals and costly mistakes that eat into your money.

Last week at Target, I stood in the electronics aisle for five minutes trying to figure out if that “additional 15% off clearance prices” sign meant what I thought it meant. My neighbor runs a small bakery and asked me to help figure out pricing for her holiday sale. Turns out, she’d been losing money on every dozen cookies sold during promotions. The discount calculator became her lifeline, and understanding the right percentage discount calculator saved her business from repeating that expensive mistake.

Table of Contents

- Understanding Different Types of Discount Calculators

- Mastering Basic Discount Math (It’s Easier Than You Think)

- Online Calculator Platforms That Actually Work

- Advanced Strategies for Complex Discount Scenarios

- Implementation Tips That Prevent Costly Mistakes

TL;DR

- Basic discount formulas are simple once you understand the core math: Original Price × (Discount % ÷ 100) = Discount Amount

- Different calculator types serve different purposes – from simple percentage tools to complex tax-integrated systems

- Online platforms offer advanced features, but simple three-field calculators work fine for basic needs

- Complex scenarios (volume discounts, time-sensitive pricing) require specialized calculation approaches

- Accuracy verification and consistent rounding standards prevent pricing errors that could cost your business

- Strategic discount analysis helps optimize profit margins and competitive positioning

Understanding Different Types of Discount Calculators

Okay, so here’s the thing – choosing the right discount calculator depends entirely on what you’re trying to do. Are you standing in a store trying to figure out if that sale is actually worth it? Or are you running a business trying to set up some complex promotion without going broke?

Most people (including past me) just grab whatever calculator for discount pops up first on Google. But here’s what I’ve learned the hard way – understanding the different types available can save you time and prevent those “oh crap, I calculated that wrong” moments that might cost you money.

You’ve got everything from basic percentage calculators to these sophisticated systems that handle multiple discount layers, tax calculations, and bulk processing. Each one serves a specific purpose, and knowing which tool matches your situation prevents that frustration when the numbers just don’t look right.

The Foundation: Basic Discount Math Made Simple

Every discount calculator operates on the same fundamental math principles. Once you grasp these core concepts, you’ll have the confidence to double-check results and catch it when something seems off. I’ll break down the essential formulas that power every discount calculation tool you’ll encounter.

Understanding the mathematical foundations behind discount calculations shares similarities with retail math fundamentals that drive successful business operations and profit optimization strategies. When you master these basics, you can calculate the discount mentally while shopping or quickly verify that your business systems are working correctly.

The beauty of discount math is that it’s actually pretty simple. Once you understand the core formulas, you can calculate discount amounts for any scenario, whether you’re dealing with a basic percentage off or some crazy tiered pricing structure.

Simple Percentage Discount Formula

This is the foundation that everything else builds on. Once you understand this, you can mentally verify any calculator’s results or even do quick calculations in your head while shopping.

The math couldn’t be more straightforward: Discount Amount = Original Price × (Discount Percentage ÷ 100).

When I first learned this formula, I realized I’d been making shopping decisions without really understanding the actual savings. That $50 jacket you’ve been eyeing goes on sale for 30% off – you’re saving $15 (50 × 0.30 = 15). Simple, right?

As demonstrated by Omni Calculator’s practical example, “if an item priced at $20 comes with a 4% discount and tax is already included, the calculator will show that you pay $19.20, saving you $0.80.” This straightforward approach works for everything from grocery store sales to major business equipment purchases.

Here’s a real-world scenario: Your grocery bill is $127.50 and you’ve got a 15% off coupon. Using our formula: $127.50 × (15 ÷ 100) = $19.13 savings. Your final bill would be $127.50 – $19.13 = $108.37. This same calculation applies whether you’re buying groceries, electronics, or business equipment. The discount calculator simply automates this process, but knowing the underlying math helps you spot errors instantly.

Final Price Calculation Methods

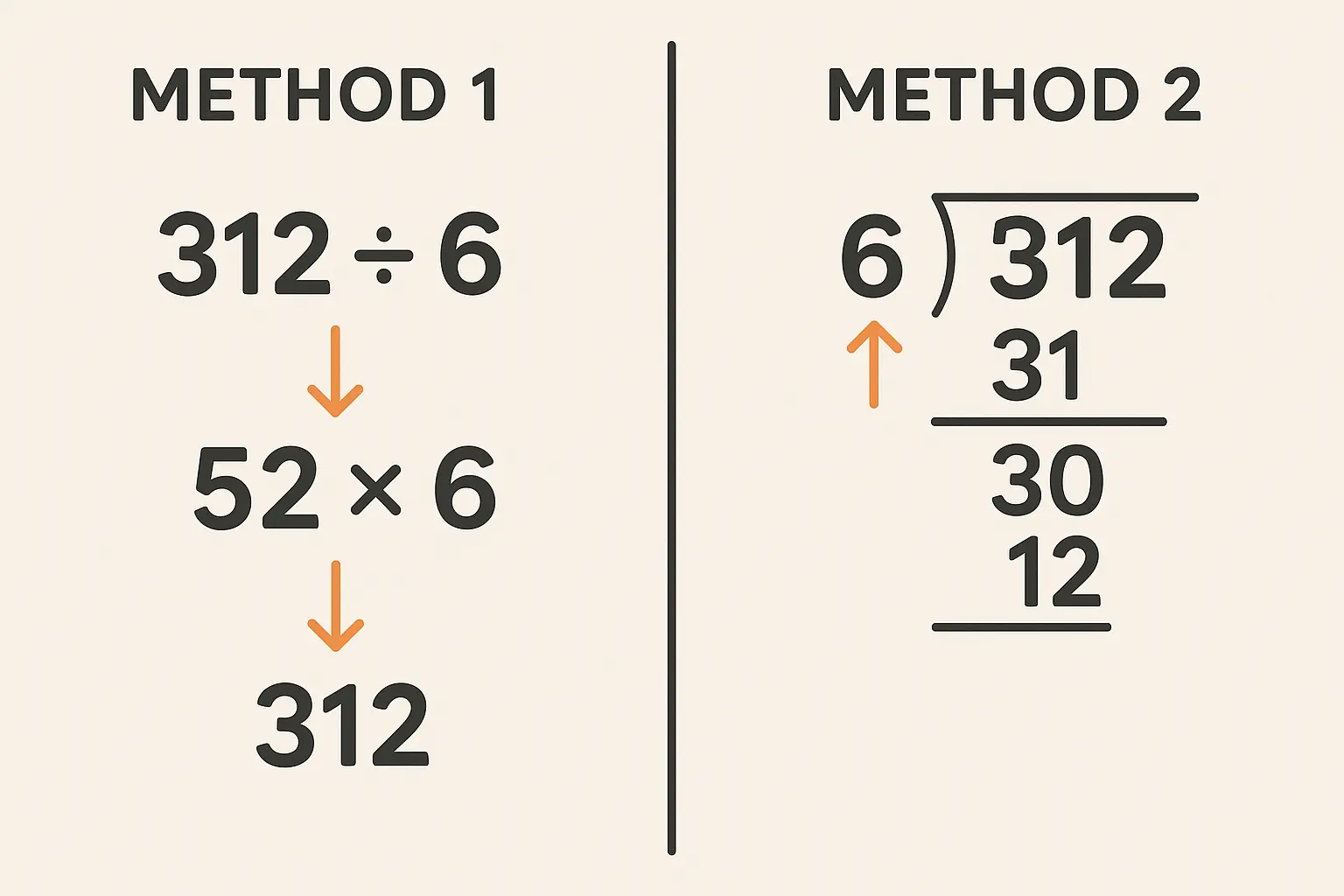

You’ve got two paths to the same destination, and knowing both helps you double-check your math and choose whichever feels easier in the moment.

Method one: Final Price = Original Price – Discount Amount. Method two: Final Price = Original Price × (1 – Discount Percentage ÷ 100).

I prefer the second method because it’s faster. That $89 sweater you’ve been eyeing with 30% off? Just calculate $89 × 0.70 = $62.30. Done.

Reverse Engineering Discount Percentages

Sometimes you know the original price and sale price but need to figure out what percentage discount was applied – this comes in handy when you’re trying to figure out if that “huge sale” is actually worth your time.

Here’s where things get interesting: Discount Percentage = ((Original Price – Sale Price) ÷ Original Price) × 100.

The kids’ back-to-school shoes are marked down from $65 to $45 – what percentage is that? Using our formula: (($65 – $45) ÷ $65) × 100 = 30.8% off. Not bad!

Following the methodology outlined by Calculator Soup’s example, “if the list price of an item is $120 and the final sale price is $90,” the discount calculation shows a specific 25% reduction from the original price. Being able to calculate discount percentages backwards helps you evaluate whether those promotional claims actually match reality.

Percent Off Calculator Variations

Different percentage-based calculators handle discounts in unique ways. Understanding these variations helps you choose tools that match your specific discount scenarios, from simple retail markdowns to those complex layered promotional structures that make your head spin.

The percent off calculator you choose should match how complicated your situation is. Simple tools work great for basic shopping, while advanced percent discount calculator options handle business scenarios with multiple variables and conditions.

Single Percentage Discount Tools

These straightforward calculators are perfect for those “25% off everything” sales or when you’re trying to figure out your employee discount savings. No complexity, no confusion.

Most discount calculators fall into this category, and honestly, they handle probably 80% of what you’ll ever need to calculate.

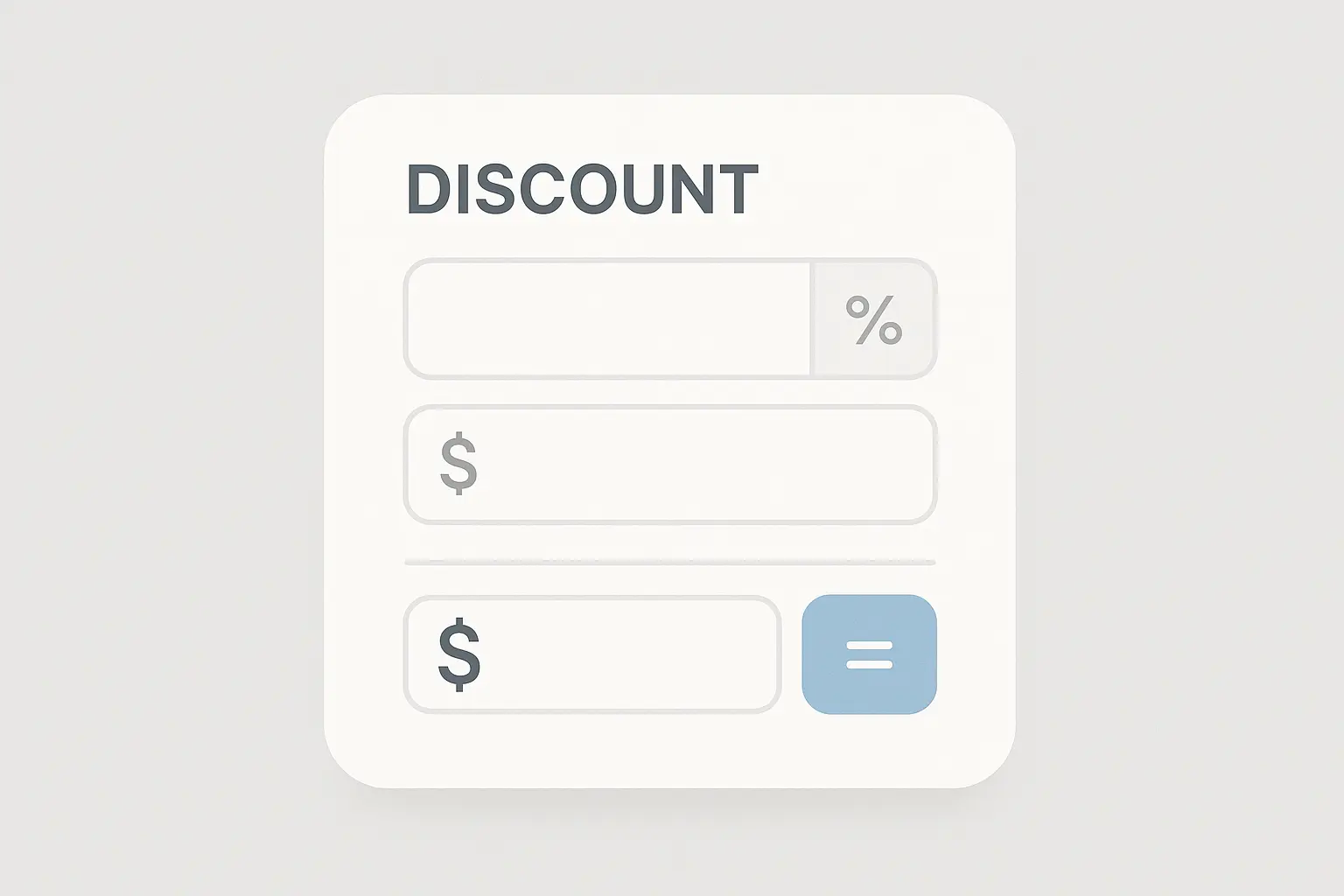

These tools typically have three input fields: original price, discount percentage, and final price. Enter two values, get the third. Clean and efficient.

| Calculator Field | Input Required | Output Generated |

|---|---|---|

| Original Price | $100.00 | – |

| Discount Percentage | 25% | – |

| Final Price | – | $75.00 |

| Savings Amount | – | $25.00 |

The simple discount calculator approach works perfectly when you’re dealing with straightforward promotional offers. No complexity, no confusion, just accurate results.

Multiple Discount Layering Systems

Here’s where most people (including past me) mess up. Advanced calculators that handle sequential discounts require more sophisticated logic because each discount applies to the already-reduced price, creating a compounding effect that many people miscalculate.

Sequential discounts don’t work the way you think they do. A 20% discount followed by a 10% discount doesn’t equal 30% off. Mind blown, right?

Here’s the reality: if you start with $100, take 20% off (leaving $80), then take 10% off that $80, you end up with $72. That’s only 28% off the original price, not 30%.

I once spent 20 minutes in Best Buy calculating whether to buy the display model with 30% off or wait for the advertised “up to 40% off” sale next week. Here’s what I learned: A $200 coat with 30% off storewide, plus an additional 15% off for loyalty members, would first be reduced to $140 (30% off), then further reduced to $119 (15% off the $140). The total discount is 40.5%, not 45% as many customers assume. These discount-calculator tools prevent the confusion that leads to customer complaints and pricing disputes.

Tax-Integrated Discount Calculators

These tools factor in sales tax calculations alongside discount computations, which eliminates the guesswork from final pricing. Trust me, you want to know the real final price before you get to the checkout.

The discount calculator with tax functionality becomes essential when you’re trying to figure out exactly what you’ll pay, especially when you’re operating in different tax areas or dealing with customers who need precise final pricing.

Pre-Tax Discount Application

This is how most stores operate, and it usually works out better for you as the customer. They subtract your discount first, then add tax to the discounted amount.

Following the standard formula of (Original Price – Discount) × (1 + Tax Rate), this typically results in lower final prices for consumers.

If you’re buying a $100 item with 20% off in an area with 8% sales tax, you’d pay: ($100 – $20) × 1.08 = $86.40.

Real-world discount programs demonstrate this complexity. Virginia’s Elizabeth River Tunnels Toll Relief Program offers residents earning $65,000 or less per year a 50% discount on up to 14 trips per week, while Portsmouth and Norfolk residents earning under $50,000 receive 100% discounts, showing how income-based discount structures require sophisticated calculation systems.

Post-Tax Discount Scenarios

Less common but important for specific business contexts, these calculators apply discounts to the total including tax. It’s usually used in B2B transactions or special promotional situations where the discount structure is different from standard retail.

Some businesses (especially in B2B contexts) apply discounts to the tax-inclusive total. It’s less common, but when it happens, the savings can be more substantial.

Using the same example: $100 × 1.08 = $108, then apply 20% discount = $86.40. Wait, that’s the same result? Not always – it depends on rounding and the specific tax rates involved.

Tax-Exempt Discount Calculations

If you’re a non-profit, government agency, or certain business that doesn’t pay sales tax, these calculators focus purely on the price reduction without any tax complications.

These calculators are refreshingly simple – just original price, discount, final price. No tax variables to complicate the math.

Online Calculator Platforms That Actually Work

The internet is packed with discount calculator online options, but honestly, not all of them deliver the same level of accuracy or user experience. I’ve tested dozens of these tools and can point you toward the ones that actually deliver reliable results without unnecessary complexity or hidden limitations.

Finding the right discount calculator online can save you hours of manual calculations and prevent costly errors. The key is knowing which platforms offer genuine value versus those that look impressive but fail when you actually need them.

Web-Based Calculator Solutions

Online discount calculators give you instant access from any device with internet, but their effectiveness varies dramatically based on design philosophy, feature sets, and how well they integrate with other business tools.

Omni Calculator Platform Features

The Omni Calculator has become my go-to recommendation for serious discount calculations. Their discount calculator doesn’t just give you numbers – it shows you the work, which builds confidence in the results.

Omni Calculator stands out because of the detailed breakdown. You input your values and get the discount amount, final price, and savings percentage. Plus, they show you the formulas they’re using, so you can understand what’s happening behind the scenes.

The platform also handles edge cases well. Try entering unusual values or testing extreme scenarios – Omni typically provides sensible results and helpful warnings when something seems off.

The platform’s sophistication is evident in its comprehensive approach. According to their development team, “Tibor, a PhD candidate in Statistical Methods in Economics, brings deep financial insight to creating the discount calculator” and “leveraging his financial background, Tibor uses the calculator himself when assessing the viability of discounts and their true value to the customer.” This level of expertise shows in the tool’s reliability and accuracy.

The omni discount calculator handles complex scenarios that trip up simpler tools, making it valuable for both personal shopping and business applications.

Mobile-Responsive Calculator Design

You know how you sometimes add items to your cart just to see the final price? Yeah, we all do that. But having a mobile calculator that actually works while you’re standing in a store aisle is a game-changer.

I can’t count how many times I’ve needed to calculate discounts while shopping. Mobile-responsive design isn’t just nice to have – it’s essential.

The best mobile calculators have large, touch-friendly input fields and buttons. They automatically adjust layouts for smaller screens without losing functionality. Some even work offline once loaded, which saves data and ensures reliability.

Simple vs. Advanced Calculator Interfaces

The choice between minimalist and feature-rich calculators depends on your specific needs, how comfortable you are with technology, and how often you’re doing these calculations.

Minimalist Calculator Design

Sometimes you just need fast results without any bells and whistles. Minimalist calculators typically show three fields: original price, discount percentage, and final price.

These tools excel at speed. No menus to navigate, no extra features to distract you. Enter your numbers, get your answer, move on with your day.

I recommend minimalist calculators for routine shopping calculations or when you’re training employees who need to perform quick discount calculations without extensive tool training.

Similar to how SEO content tools vary in complexity and functionality, discount calculators range from simple interfaces to comprehensive platforms with advanced features.

Feature-Rich Calculator Platforms

Business users often need more than basic calculations. Feature-rich platforms might include:

- Bulk calculation capabilities for processing multiple items

- Comparison tools for analyzing different discount scenarios

- Export functions for saving results to spreadsheets

- Historical tracking for monitoring discount trends

These platforms require more time to learn but pay dividends when you’re managing complex pricing strategies or need detailed documentation of your calculations.

The discount-calculator tools with advanced features become indispensable when you’re running a business that processes hundreds of discount calculations daily.

API Integration Capabilities

For businesses processing hundreds or thousands of discount calculations daily, API integration becomes crucial. Instead of manual calculations, your systems can automatically compute discounts based on predefined rules.

E-commerce platforms particularly benefit from API-integrated discount calculators. Customer sees a product, system automatically calculates applicable discounts based on their membership level, current promotions, and purchase history.

Custom Calculator Development

Standard calculators can’t handle every business model. Companies with complex tiered pricing, industry-specific discount structures, or unique promotional logic might need custom solutions.

Custom development makes sense when your discount calculations involve multiple variables, complex business rules, or integration with proprietary systems. The investment pays off through improved accuracy and workflow efficiency.

Advanced Strategies for Complex Discount Scenarios

Okay, so you’ve got the basic math down. Now let’s talk about when things get weird. Real-world discount scenarios often involve multiple variables, time constraints, and business logic that simple percentage calculations can’t handle. I’ve encountered countless situations where standard discount calculator tools fall short, requiring more sophisticated approaches and strategic thinking to achieve accurate results.

The percentage discount calculator becomes your foundation, but complex business environments demand additional layers of calculation logic and strategic analysis.

Complex Discount Scenarios

This is where most people (including past me) mess up. Advanced discount calculations encompass tiered pricing structures, time-sensitive promotions, and loyalty program benefits that require step-function logic and dynamic calculation methods beyond basic percentage reductions.

Volume-Based Discount Calculations

Volume discounts get tricky fast. You might offer 5% off orders over $100, 10% off over $500, and 15% off over $1,000. Each threshold triggers a different calculation, and I’ve seen businesses struggle with this because they’re manually calculating each tier.

Here’s a practical example that blew my mind: A customer orders $750 worth of products. They qualify for the 10% discount tier, paying $675. But what if they add another $250 to reach $1,000? Now they get 15% off the entire order, paying $850. That additional $250 purchase actually saves them money on their total order.

My barber offers 20% off haircuts for seniors on Wednesdays, but he was calculating it wrong and losing money until we figured out his volume thresholds.

| Order Value Range | Discount Percentage | Example Order | Discount Amount | Final Price |

|---|---|---|---|---|

| $0 – $99.99 | 0% | $80 | $0 | $80 |

| $100 – $499.99 | 5% | $300 | $15 | $285 |

| $500 – $999.99 | 10% | $750 | $75 | $675 |

| $1,000+ | 15% | $1,200 | $180 | $1,020 |

Understanding how to calculate the discount across these tiers prevents customer confusion and ensures your pricing strategy works as intended.

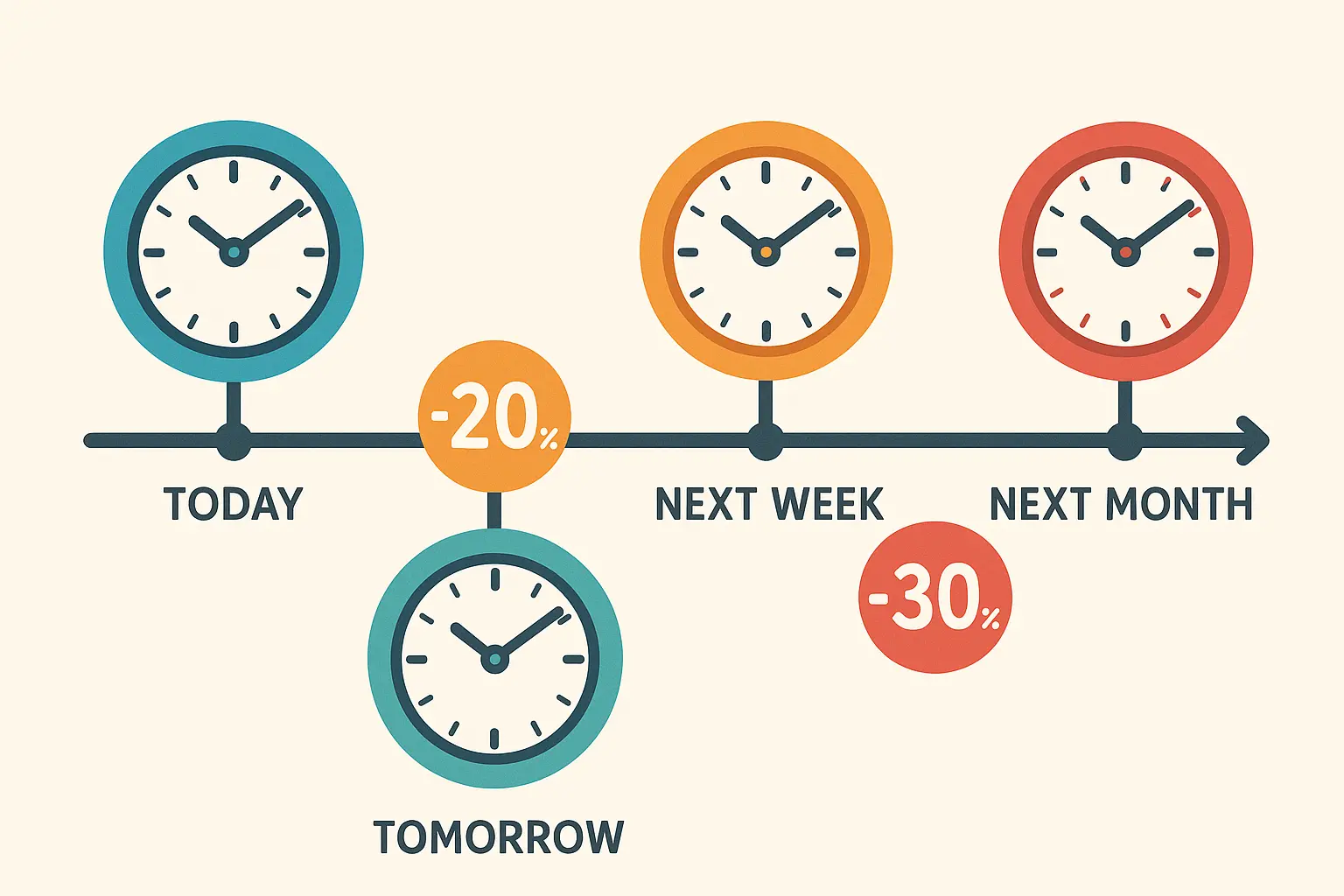

Time-Sensitive Discount Modeling

Time-based discounts create urgency but complicate calculations. Early-bird pricing might start at 10% off, increase to 20% off one week before an event, then jump to 30% off for last-minute bookings.

Flash sales present their own challenges. A 4-hour sale with escalating discounts (20% for the first hour, 30% for the second, 40% for the third, 50% for the final hour) requires real-time calculation updates.

I’ve worked with businesses that manually update their pricing throughout these promotions. Trust me on this – automated systems eliminate human error and ensure customers always see accurate pricing.

Government programs demonstrate sophisticated time-sensitive discount structures. Virginia’s ERT Toll Relief Program shows how complex eligibility criteria work in practice, where “in 2022, ERC greatly expanded their annual contribution to $3.2 million per year through 2036, with an annual increase of 3.5%” and “in July 2024, legislation provided the basis for $101 million contribution from the Commonwealth’s general fund for additional toll relief.”

Bulk and Batch Processing

When you’re dealing with extensive product catalogs or analyzing competitor pricing across multiple items, individual discount-calculator usage becomes impractical. You know how you sometimes avoid shopping somewhere because their sale signs are too confusing to figure out? That’s what happens when businesses don’t have good bulk processing systems.

Spreadsheet Integration Methods

Spreadsheets become powerful discount calculation engines with the right formulas. Here’s the setup that’s saved me countless hours.

Create a discount tier table with columns for minimum order value and discount percentage. Then use VLOOKUP to automatically apply the correct discount based on order size.

The formula looks like: =A2*(1-VLOOKUP(A2,DiscountTable,2,TRUE)/100), where A2 contains your original price and DiscountTable contains your tier structure.

For multiple items with different discount rules, you can create separate lookup tables and use IF statements to determine which table applies to each product category.

Just as GA4 audit processes require systematic data analysis and verification methods, bulk discount calculations benefit from structured spreadsheet approaches that ensure accuracy across large datasets.

Discount Calculator Verification Checklist:

- Test calculations with known values

- Verify rounding consistency across all tools

- Check edge cases (very small/large numbers)

- Confirm tax integration works correctly

- Test multiple discount scenarios

- Validate against manual calculations

- Ensure mobile compatibility

- Check for calculation speed and accuracy

Database-Driven Calculation Systems

Large-scale operations need database-driven solutions. These systems store discount rules, customer information, and product data in relational databases, then execute calculations through SQL queries.

The advantage is speed and consistency. A database can process thousands of discount calculations in seconds, applying complex business rules without human intervention.

These systems also maintain audit trails, showing exactly how each discount was calculated and when. This becomes crucial for financial reporting and customer service inquiries.

Here’s an embarrassing one – I didn’t realize that some stores calculate tax before the discount and others after. A major retailer’s Black Friday system processes 50,000 discount calculations per minute during peak hours. Their database stores customer loyalty tiers, product categories, and promotional rules. When a customer adds items to their cart, the system instantly applies the highest applicable discount from multiple overlapping promotions, ensuring customers always get the best deal while maintaining accurate inventory and profit tracking.

Strategic Discount Analysis

The discount calculator becomes a strategic tool when you understand how to apply its results within broader business contexts. The percentage discount calculator provides data that drives pricing decisions, competitive positioning, and profitability analysis.

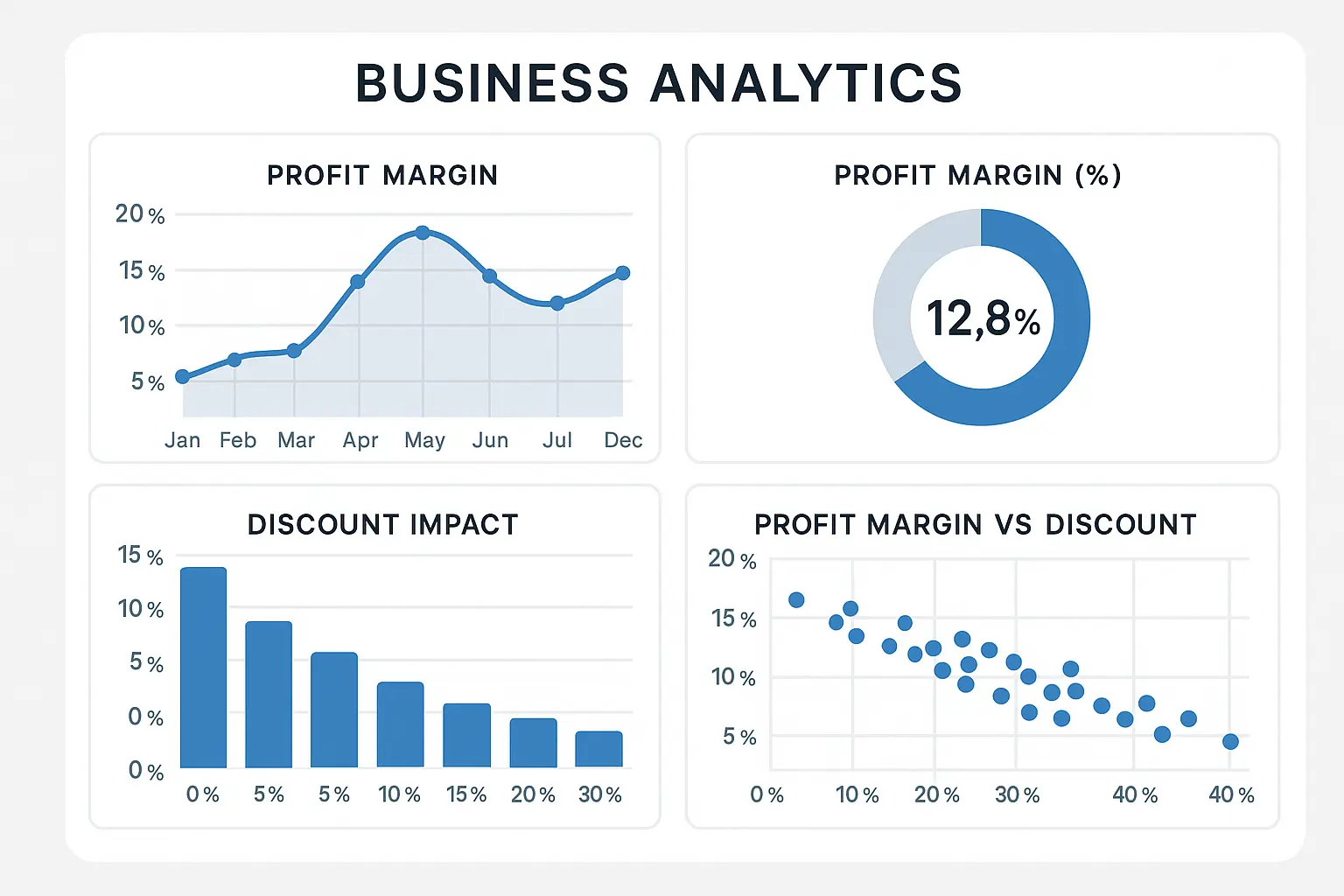

Profit Margin Impact Assessment

Every discount impacts your bottom line differently. A 20% discount on a product with 50% margins hurts less than the same discount on a product with 25% margins.

Here’s how I calculate the real impact: (Selling Price – Cost) ÷ Selling Price = Margin Percentage. Then I apply various discount scenarios to see how margins change.

For example, a $100 product costing $60 has a 40% margin. A 20% discount drops the selling price to $80, creating a 25% margin. That’s a 37.5% reduction in profit margin for a 20% price discount.

Similar to how market sizing analysis helps businesses understand revenue potential, discount impact assessment reveals how promotional strategies affect long-term profitability.

Competitive Pricing Analysis

Competitor analysis becomes systematic with the right calculation approach. I track competitor prices before, during, and after promotions to understand their discount strategies.

By reverse-engineering their discount percentages and timing patterns, you can identify gaps in the market. Maybe they never discount certain product categories, or their promotional calendar has predictable gaps you can exploit.

The key is consistent data collection and analysis. I maintain spreadsheets tracking competitor pricing across multiple promotional cycles to identify patterns and opportunities.

Customer Lifetime Value Optimization

Smart discount strategies consider customer lifetime value, not just immediate transaction profit. A 30% discount that acquires a customer worth $500 over two years makes financial sense, even if the initial transaction is unprofitable.

I calculate the break-even point for customer acquisition discounts: Customer Acquisition Cost ÷ Average Customer Lifetime Value = Maximum Acceptable Discount Percentage.

This approach transforms discounts from profit reducers into strategic investments in customer relationships.

How to Not Mess This Up – Implementation Tips

Look, implementing discount calculation systems requires careful attention to accuracy verification, standardized processes, and quality control measures that prevent the kind of pricing errors that can damage customer relationships and hurt profitability. I’ve seen too many businesses learn these lessons the hard way.

The discount-calculator you choose is only as good as your implementation process. Poor execution can turn even the most sophisticated tools into sources of confusion and financial loss.

Making Sure You Don’t Screw Up the Math

Fair warning: Don’t be the person who finds out their “amazing deal” actually costs them money. Establishing robust systems for ensuring discount calculation accuracy involves implementing multiple verification methods, quality control measures, and systematic approaches that catch errors before they impact customer pricing or business operations.

Double-Checking Your Work (Because Math is Sneaky)

I always verify discount calculations using at least two different methods. Calculate the discount amount first, then work backwards from the final price to confirm the percentage.

Manual spot-checking remains essential even with automated systems. Pick random calculations daily and verify them by hand or with a different calculator. This catches systematic errors that might affect all calculations.

Cross-training team members on different calculation methods creates human redundancy. When Sarah calculates discounts using Method A and Mike verifies using Method B, errors get caught before reaching customers.

The verification process mirrors the systematic approach used in content planning methodologies where multiple validation steps ensure quality and accuracy before publication.

Rounding Rules That Don’t Drive People Crazy

Inconsistent rounding creates customer confusion and internal accounting headaches. Establish clear rules: always round to the nearest cent, or always round down, or always round up – just be consistent.

I recommend documenting your rounding standards in writing. When a $47.33 item gets a 15% discount, do you charge $40.23 (rounded to nearest cent) or $40.20 (rounded down to nearest nickel)?

Different systems might handle rounding differently. Your POS system rounds one way, your website another, and your mobile app a third way. Customers notice these discrepancies, and they erode trust.

Test your systems with edge cases. What happens with a $0.99 item and a 50% discount? Does your system handle $0.495 consistently across all platforms?

Discount Implementation Template:

Phase 1: Planning

- Define discount structure and rules

- Identify target customer segments

- Calculate profit margin impacts

- Set implementation timeline

Phase 2: System Setup

- Configure discount calculation tools

- Establish rounding standards

- Create verification protocols

- Train team members

Phase 3: Testing

- Run test calculations with sample data

- Verify cross-platform consistency

- Check edge case scenarios

- Validate against manual calculations

Phase 4: Launch

- Monitor initial performance

- Collect customer feedback

- Track accuracy metrics

- Document lessons learned

The discount calculator becomes most valuable when integrated into a comprehensive implementation framework that addresses potential failure points before they occur.

How The Marketing Agency Can Transform Your Discount Strategy

Accurate discount calculations become exponentially more valuable when integrated with data-driven marketing strategies that maximize promotional effectiveness while maintaining clear visibility into profit margins and return on investment.

Precise discount calculations form the foundation of profitable promotional campaigns, but they’re only as effective as the marketing strategy behind them. The Marketing Agency specializes in performance-driven campaigns that turn your discount strategies into measurable business growth.

Our PPC management services ($750-$5,000 monthly) ensure your promotional ads feature accurate pricing that converts browsers into buyers. When your discount calculations are precise, your ad copy builds trust instead of creating confusion.

Email marketing campaigns ($1,200-$10,000 monthly) become significantly more effective when discount offers are mathematically sound and strategically positioned. We help you create promotional sequences that drive sales while protecting your profit margins.

Ready to turn your discount strategy into a competitive advantage? Our inbound marketing approach ($500-$3,000 monthly) can help you create educational content around savings and value that attracts customers naturally.

Contact The Marketing Agency today to discover how data-driven marketing strategies can amplify the impact of your discount calculations and promotional campaigns.

Final Thoughts

Look, you don’t need to become a math wizard overnight. Start with the simple stuff – figure out what that percentage off actually means in dollars. Then work your way up to the fancy calculations. Your wallet (and if you’re a business owner, your bank account) will thank you for taking the time to get this right.

Mastering discount calculations extends far beyond simple math – it’s about building systems that support smart business decisions, protect profit margins, and create customer value. The tools and strategies I’ve shared represent years of learning from both successes and expensive mistakes in the discount calculation world.

The difference between businesses that thrive with discount strategies and those that struggle often comes down to calculation accuracy and strategic implementation. You now have the knowledge to choose the right tools, avoid common pitfalls, and create systems that scale with your business growth.

Pro tip: Always double-check your math when the discount seems too good to be true. Before you get excited about that “additional 20% off sale prices” sign, remember – sale prices are usually already marked up. That “limited time offer” creating urgency? Take 30 seconds to actually calculate if it’s worth rushing for.

Remember that discount calculators are tools, not strategies. The real value comes from understanding how to apply these calculations within broader business contexts – whether you’re optimizing profit margins, analyzing competitor pricing, or designing promotional campaigns that actually drive profitable growth.

There’s something satisfying about instantly knowing whether that “sale” is worth your time. Start with the basics, master the fundamentals, then gradually incorporate more sophisticated approaches as your needs evolve. Your future self (and your profit margins) will thank you for building these calculation skills now.

The discount calculator you choose today shapes your pricing decisions tomorrow. Choose wisely, implement systematically, and watch your promotional strategies become profit drivers instead of margin killers.