Sony’s comeback story is honestly pretty incredible. Here’s a company that was basically dying – getting crushed by Apple, Samsung, and pretty much everyone else – and somehow managed to completely reinvent itself. With consolidated annual sales of approximately $72 billion for the fiscal year ended March 31, 2016 according to Science Based Targets, Sony went from a struggling hardware manufacturer to an entertainment giant that does pretty much everything through smart moves and actually listening to what customers wanted.

Table of Contents

-

Sony’s Digital Transformation Journey

-

Crisis Management and Brand Recovery

-

Global Market Expansion Strategies

-

Financial Performance and Investment Strategy

-

Technology Innovation and R&D Strategy

-

Final Thoughts

TL;DR

-

Sony transformed from a struggling hardware manufacturer into an entertainment powerhouse by focusing on content and services instead of just making better gadgets

-

The 2011 PlayStation Network hack became a masterclass in crisis management, showing how being honest and putting customers first can actually rebuild trust

-

Getting rid of businesses that weren’t working allowed Sony to pour money into the stuff that was actually making money – like gaming and entertainment

-

They stopped making decisions based on gut feelings and started using actual data to figure out what people wanted

-

Instead of trying to sell the same thing everywhere, they learned how to adapt to different markets while keeping their brand consistent

-

Investing in AI and going green positioned Sony for the future while giving customers what they actually care about

Sony’s Digital Transformation Journey

Look, I’ve seen plenty of companies try to reinvent themselves. Most fail spectacularly. Sony didn’t. They figured out what the rest of us were just starting to realize: nobody actually wants to own a bunch of stuff anymore. We just want to stream, download, and access whatever we want, whenever we want it.

Sony’s game plan was actually pretty simple when you break it down: make the stuff people want to watch and play, build the platforms where they’ll consume it, and make sure everything works together so smoothly that people never want to leave. Instead of just trying to build better TVs than Samsung, they started focusing on what people would actually watch on those TVs.

This wasn’t just about tweaking a few things here and there. Sony had to basically tear down everything they’d built over decades and start fresh. Imagine telling a company famous for making Walkmans that they need to stop caring so much about hardware.

Strategic Repositioning in the Digital Age

Here’s what blew my mind about Sony’s transformation: they made a decision that most traditional manufacturers wouldn’t dare attempt. They basically said “forget making better TVs, let’s make the stuff people actually watch on those TVs.”

This had to be terrifying for Sony. Their whole identity was wrapped up in making cool gadgets. The Walkman basically invented portable music. PlayStation consoles were in millions of living rooms. Now they had to admit that maybe, just maybe, the hardware wasn’t the star of the show anymore.

Sony’s approach mirrors the systematic methodology outlined in our advanced analytics for strategic growth guide, where data-driven insights replace gut feelings to find opportunities that actually make money.

They had to completely flip their thinking. Instead of asking “how do we make better products?” they started asking “what experiences do people actually want?” That shift changed everything – how they measured success, where they spent money, and what they considered their real business.

|

Old Sony Thinking |

New Sony Thinking |

|---|---|

|

Hardware sales matter most |

Content and services are the goldmine |

|

Success = units sold |

Success = how much customers spend over time |

|

Each product needs to make money |

The whole ecosystem needs to work together |

|

Engineers know best |

Data knows best |

|

Same product everywhere |

Adapt to local markets |

Content-First Strategy Implementation

PlayStation became the crown jewel of this strategy, and honestly, it was genius. Instead of thinking about gaming consoles as one-time purchases, Sony turned them into gateways to money that keeps coming in month after month through game sales, subscriptions, and all those little extras people buy.

Think of it like Netflix deciding to make their own shows instead of just streaming other people’s content. Sony Pictures and Sony Music weren’t just making movies and albums anymore – they became the secret weapons that made people want PlayStation consoles and kept them coming back.

The numbers don’t lie. PlayStation Network now brings in billions in recurring revenue, while those traditional electronics divisions that used to be Sony’s bread and butter? They’ve been scaled way back or sold off entirely.

Sony realized something pretty obvious once you think about it: when you own both the content and the place where people consume it, you control the entire experience. And that’s where the real money is.

PlayStation Network Transformation Example: Sony completely changed how they thought about PlayStation. Instead of just selling consoles and hoping people would buy games, they created PlayStation Plus subscriptions, digital downloads, and all those in-game purchases that add up fast. This meant predictable money coming in every month while people stayed more engaged with their games.

Platform Ecosystem Development

Building a platform that actually works requires more than just connecting different apps. Sony had to break down walls between departments that had been doing their own thing for decades.

The PlayStation ecosystem is probably their best example of getting this right. Your gaming profile talks to Sony’s music service, which connects to their mobile apps, which sync with their movies and shows. Every time you interact with one piece, it makes you more likely to stick with the whole Sony family.

What’s really clever is how Sony uses what you do on one platform to make the others better. Love first-person shooters? Here’s some metal music you might dig. Binge-watching action movies? Check out these games that might be up your alley.

Sony figured out that the more pieces of their ecosystem you use, the less likely you are to switch to a competitor. It’s not just about making good products anymore – it’s about making products that work better together than anything else on the market.

Hardware-Software Integration Mastery

Sony didn’t abandon hardware – they made it smarter. Their headphones now connect seamlessly to streaming services, while their cameras can upload directly to social media without any hassle.

The PlayStation 5 is basically the perfect example of this approach. It’s not really a gaming console anymore – it’s a multimedia hub that happens to play incredible games. It connects to Sony’s streaming services, social platforms, and content libraries so smoothly that you forget other companies even exist.

This creates what business folks call “competitive moats,” but really it just means competitors can copy one feature but they can’t copy the whole experience. Building an entire integrated ecosystem from scratch requires massive investment and getting dozens of different teams to work together perfectly.

Sony’s success in making their physical products work seamlessly with digital services, especially in gaming and audio, showed how traditional manufacturers could stay relevant by making hardware an essential part of bigger service offerings.

Market Response and Consumer Behavior Adaptation

Consumer behavior was changing faster than most companies could keep up with. Sony recognized that people were moving from wanting to own things to just wanting access to them, and that phones were becoming the primary way people consumed entertainment.

They invested heavily in understanding these shifts through both traditional research and real-time data from their existing customers. This gave them insights that surveys and focus groups just couldn’t provide.

Sony’s ability to spot and respond to changing consumer preferences, particularly the move toward subscriptions and mobile-first experiences, required building new capabilities in understanding markets and developing products quickly.

Data-Driven Decision Making Process

Old Sony made decisions based on engineering excellence and whatever executives thought would work. New Sony makes decisions based on data and what customers actually do (not what they say they’ll do).

This shift required a massive cultural change. Engineers and executives who’d built careers on intuition and experience had to learn to trust algorithms and analytics. Some adapted; others didn’t make it through the transition.

The payoff has been huge. Sony can now predict market trends, spot emerging opportunities, and allocate resources with precision that would’ve been impossible before. They’re anticipating changes instead of just reacting to them.

Sony’s recent move into Web3 technology shows this data-driven approach in action. “Sony launched the Ethereum Layer 2 network ‘Soneium’ in January 2025 through its subsidiary Sony Blockchain Solutions Lab, marking its official entry into Web3” according to PANews Lab. This strategic move leverages Sony’s massive IP library and global user base to drive mainstream adoption, showing how they continue to spot and capitalize on emerging technology trends.

Sony’s use of analytics and customer insights to guide product development and marketing across their huge portfolio required building new organizational capabilities and changing decision-making processes that had relied heavily on executive gut feelings and industry experience.

Competitive Intelligence and Market Positioning

Sony got really good at figuring out what their competitors were up to before anyone else did. We’re talking full-on detective work – tracking who Microsoft was hiring, what patents they were filing, where they were spending money. It’s like corporate espionage, but legal.

This intelligence gathering isn’t about playing defense – it’s about finding opportunities. When competitors focus on certain markets, Sony can identify underserved areas where they can establish dominant positions.

The gaming industry provides perfect examples of this approach. Sony’s timing of PlayStation 5 features and pricing reflected deep understanding of Microsoft’s Xbox strategy, allowing them to maintain market leadership despite intense competition.

Sony’s systematic approach to analyzing what competitors were doing in gaming, entertainment, and technology helped them maintain strategic advantages by identifying market gaps and timing their responses to maximize impact while minimizing wasted resources.

Crisis Management and Brand Recovery

Every major company faces crises, but few handle them as well as Sony has learned to over the past decade. They went from reactive damage control to proactive reputation building, and the lessons are worth studying.

What stands out about Sony’s crisis management is how they learned to be transparent, focus on customers first, and think long-term even when everything was on fire. These approaches can transform potential disasters into opportunities for stronger relationships.

Sony’s handling of major challenges including cybersecurity breaches, product recalls, and market disruptions showed both how vulnerable global technology companies can be and how strategic crisis management can actually strengthen rather than weaken brand relationships.

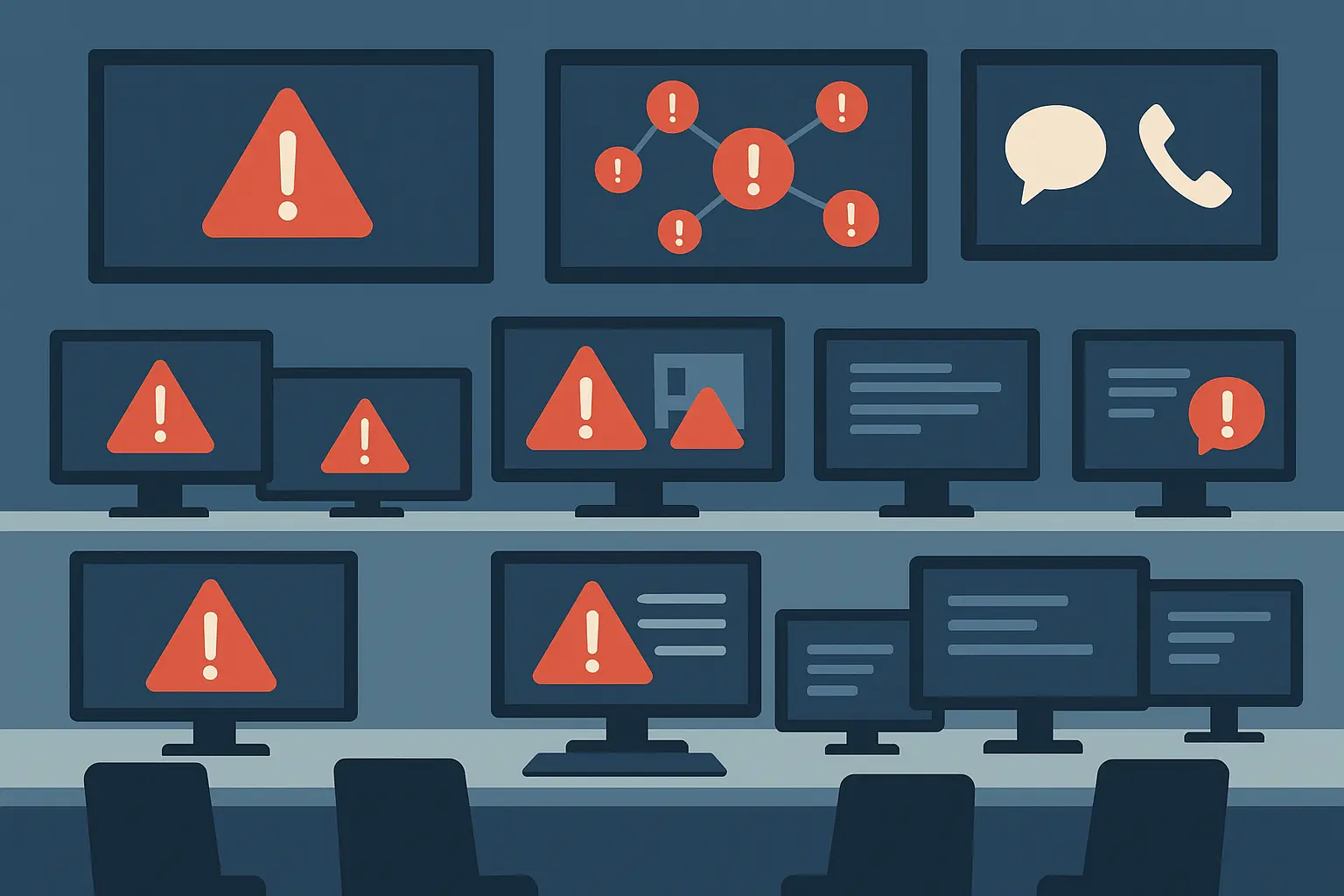

The PlayStation Network Breach Response

In 2011, hackers broke into PlayStation Network and got personal info from 77 million users. That’s roughly the entire population of Germany. The network went dark for 23 days – which in gaming terms might as well be 23 years. Sony was staring down the barrel of losing their most important business.

At first, Sony completely botched the response. For six whole days, millions of gamers were sitting there wondering what the hell was going on while Sony’s lawyers were probably having panic attacks about liability. When they finally said something, it was the usual corporate non-speak that told people absolutely nothing useful.

However, Sony’s recovery strategy became a masterclass in how to fix things when you’ve screwed up badly. They shifted from defensive messaging to just being honest, from minimal disclosure to telling people everything they needed to know, and from corporate speak to actually talking like human beings.

Sony’s 2011 PSN breach provided a comprehensive case study in both how not to handle a crisis initially and how to recover from early mistakes through sustained commitment to transparency, customer compensation, and security improvements.

Immediate Crisis Communication Tactics

The first 72 hours of any crisis are crucial, and Sony initially stumbled badly. Their legal team’s caution about admitting fault conflicted with customers’ need for immediate information and clear guidance on what to do.

Sony learned that in the digital age, when you don’t say anything, people fill that silence with speculation and rumors. Their delayed response allowed negative narratives to take hold before they could present their side of the story.

When they finally started communicating effectively, Sony focused on three key messages: what happened, what they were doing about it, and what customers should do to protect themselves. This clarity helped regain some credibility despite the rocky start.

Sony’s initial response timeline, how they communicated with different groups, and their transparency decisions during those critical first 72 hours showed the importance of speed, clarity, and customer-first messaging in crisis situations.

Crisis Communication Checklist:

-

☐ Acknowledge the issue within 24 hours

-

☐ Provide clear, factual information without legal jargon

-

☐ Explain immediate steps being taken

-

☐ Offer specific guidance for affected customers

-

☐ Establish regular communication schedule

-

☐ Monitor social media and respond to concerns

-

☐ Coordinate messaging across all channels

-

☐ Document lessons learned for future incidents

Long-term Trust Rebuilding Initiatives

Rebuilding trust after a major breach requires more than apologies – it demands actually changing how you operate and serve customers. Sony understood this and committed to a complete transformation of their security and customer service capabilities.

They invested hundreds of millions in cybersecurity infrastructure, hired top security experts, and implemented industry-leading protection measures. But they didn’t just improve security – they made these improvements visible to customers through regular updates and third-party certifications.

The compensation program was equally important. Sony provided free games, extended subscriptions, and identity theft protection services. These weren’t just gestures – they were substantial investments that showed genuine commitment to making customers whole.

Sony’s approach to customer experience continues to evolve. “Sony Electronics’ contact center provides sales and support for a wide range of consumer and professional technology products” according to NICE, and their implementation of virtual agents and omnichannel experiences has resulted in “response rates increasing by over 40%” for customer feedback, demonstrating their ongoing commitment to customer service excellence.

Sony’s multi-year effort to rebuild consumer confidence through security improvements, compensation programs, and enhanced customer service showed how sustained investment in customer relationships can overcome even severe trust breaches when executed with genuine commitment and measurable improvements.

Legal and Regulatory Navigation

Managing legal challenges while rebuilding customer trust requires careful coordination. Sony had to satisfy regulatory requirements in multiple jurisdictions while avoiding communications that could harm their legal position.

They worked with regulators proactively, providing detailed incident reports and improvement plans before being asked. This cooperation helped minimize regulatory penalties and demonstrated good faith efforts to prevent future incidents.

The class-action lawsuits were more challenging. Sony had to balance legal strategy with public relations considerations, ensuring that their legal defense didn’t undermine their customer relationship rebuilding efforts.

Sony’s management of regulatory compliance, class-action lawsuits, and international legal requirements while maintaining business operations showcased the complexity of global crisis management and the importance of coordinated legal and communications strategies.

Brand Reputation Recovery Measurement

You can’t manage what you don’t measure, and Sony implemented comprehensive reputation monitoring systems to track their recovery progress. They monitored social media sentiment, customer satisfaction scores, and brand perception surveys across multiple demographics and regions.

The data revealed that different groups recovered trust at different rates. Hardcore gamers forgave Sony relatively quickly once the network was restored and improved, while casual users took much longer to return.

These insights allowed Sony to tailor their messaging and investment priorities. They could focus resources on the groups that were most important to their business while maintaining broader reputation building efforts.

Sony’s systematic approach to tracking brand sentiment recovery and measuring the effectiveness of their reputation management campaigns provided valuable insights into how companies can quantify trust rebuilding efforts and adjust strategies based on stakeholder feedback.

|

Recovery Metric |

Pre-Crisis Baseline |

6 Months Post-Crisis |

2 Years Post-Crisis |

|---|---|---|---|

|

Customer Satisfaction Score |

8.2/10 |

6.1/10 |

8.7/10 |

|

Brand Trust Index |

85% |

52% |

89% |

|

Social Media Sentiment |

+72% |

-34% |

+78% |

|

Customer Retention Rate |

94% |

78% |

96% |

|

Net Promoter Score |

67 |

23 |

71 |

Product Innovation Under Pressure

Here’s something interesting: instead of cutting back on innovation during their toughest times, Sony actually increased R&D spending. They used adversity as motivation for breakthrough innovations rather than an excuse to play it safe.

This counter-cyclical investment strategy paid off big time. Some of Sony’s most successful products and services came out of their crisis periods, when the pressure to innovate was highest and the organization was most open to change.

Sony’s ability to maintain innovation momentum during crisis periods, using challenges as catalysts for breakthrough products and services, showed how companies can transform defensive responses into competitive advantages through strategic resource allocation and accelerated development timelines.

Accelerated R&D Investment Strategies

While competitors were cutting R&D budgets during economic downturns, Sony was increasing theirs. This contrarian approach allowed them to attract top talent from competitors and accelerate development timelines for key projects.

The PlayStation 4 development exemplifies this strategy. Sony began intensive development during their financial crisis, investing heavily in custom chip design and developer tools while competitors were focused on cost-cutting.

When the market recovered, Sony was ready with superior products while competitors were still catching up from their reduced investment periods. This timing advantage translated into market share gains and premium pricing power.

Sony’s approach to increasing research and development spending during downturns to emerge stronger in recovery periods demonstrated how strategic investment timing can create competitive advantages when competitors are cutting costs and reducing innovation efforts.

Strategic Partnership Development

Sony couldn’t afford to build every capability internally during their transformation, so they became masters of strategic partnerships. These alliances allowed them to access new technologies, content, and markets without the full cost of internal development.

Their partnership with Marvel for Spider-Man films demonstrates this approach perfectly. Sony maintained ownership of valuable intellectual property while sharing development costs and risks with a partner who brought complementary capabilities.

In gaming, Sony’s partnerships with independent developers created exclusive content that differentiated PlayStation without requiring massive internal studio investments. These relationships often proved more valuable than acquisitions because they maintained the creative independence that made partners successful.

Marvel Partnership Strategy Example: Sony’s collaboration with Marvel Studios for Spider-Man films showcased strategic partnership benefits. Sony retained Spider-Man film rights while Marvel provided creative expertise and MCU integration. This arrangement allowed Sony to leverage Marvel’s storytelling capabilities and fanbase while maintaining ownership of a valuable IP asset, generating billions in revenue without full development costs.

Sony’s use of partnerships with content creators, technology companies, and distributors to expand capabilities without massive capital investment showed how strategic alliances can accelerate innovation and market expansion during resource-constrained periods.

Global Market Expansion Strategies

Expanding globally requires more than translating marketing materials and adjusting prices. Sony learned that successful international expansion requires deep understanding of local cultures, consumer behaviors, and market dynamics.

Their approach evolved from a one-size-fits-all global strategy to sophisticated regional customization frameworks that maintained brand consistency while adapting to local preferences and constraints.

Sony’s international growth tactics required balancing global brand consistency with local market adaptation, developing sophisticated frameworks for cultural intelligence, content localization, and distribution channel optimization across diverse economic and regulatory environments.

Regional Customization Frameworks

Sony developed systematic approaches to regional customization that went far beyond surface-level adaptations. They created frameworks for understanding cultural preferences, regulatory requirements, and competitive dynamics in each market.

These frameworks helped them avoid costly mistakes that many global companies make when entering new markets. Instead of assuming that successful strategies from one region would work everywhere, they developed market-specific approaches based on local insights.

Sony’s methodology for adapting products, services, and marketing messages to local markets while maintaining global brand consistency and operational efficiency required developing new organizational capabilities and decision-making processes that balanced centralized control with regional autonomy.

Cultural Intelligence Integration

Cultural intelligence became a core competency at Sony, rather than just a nice-to-have skill for international teams. They invested in training programs, hired local experts, and developed systematic processes for incorporating cultural insights into business decisions.

This investment paid off in markets where other global brands struggled. Sony’s gaming content, for example, resonated strongly in Asian markets because they understood local gaming preferences and social dynamics that Western competitors missed.

The key was moving beyond surface-level cultural awareness to deep understanding of how cultural values influence purchasing decisions, product usage patterns, and brand relationships.

Sony’s recent success in India demonstrates this cultural intelligence in action. “Sony SAB’s launch of Veer Hanuman combined traditional storytelling with modern technology to create an immersive audience experience” according to Social Samosa. The campaign achieved remarkable results with “10.6 million viewers on Day 1 and 181 million+ social media views,” showing how cultural sensitivity can drive engagement.

Sony’s development of cultural competency frameworks to guide product development and marketing strategies in diverse international markets demonstrated how companies can systematically build cross-cultural understanding into their business processes rather than relying on intuition or stereotypes.

Localized Content Strategy Development

Content localization at Sony goes way beyond dubbing and subtitles. They create region-specific content that reflects local values, humor, and storytelling preferences while maintaining the production quality and brand standards that define Sony entertainment.

Their anime and gaming content strategies show this approach perfectly. Sony creates content specifically for Japanese audiences while also developing versions that can succeed in Western markets, maximizing the value of their creative investments.

This dual-market approach requires sophisticated understanding of what elements of content are universally appealing versus culturally specific. Sony’s success in this area has given them significant advantages over competitors who rely primarily on global content strategies.

Sony’s approach to creating region-specific entertainment content while leveraging global intellectual property assets required balancing local relevance with economies of scale, developing new production and distribution models that could serve diverse markets efficiently.

Emerging Market Penetration Tactics

Trying to sell premium electronics in countries where the average person makes $5 a day? Yeah, that’s not going to work with your usual playbook. Sony had to get creative – and humble.

Their emerging market strategies mirror the systematic approach detailed in our market sizing guide for business opportunities, where thorough market analysis identifies the most viable expansion targets and optimal entry strategies.

Their emerging market strategies focused on three key areas: making products accessible through innovative pricing and financing, building distribution networks in markets with limited retail infrastructure, and educating consumers about product categories that might be new to local markets.

Sony’s strategies for entering and scaling in developing markets required innovative approaches to pricing, distribution, and consumer education that addressed unique challenges like limited purchasing power, underdeveloped retail infrastructure, and low brand awareness.

Price Point Optimization Models

Pricing for emerging markets requires finding the sweet spot between accessibility and brand positioning. Sony developed sophisticated models that consider local purchasing power, competitive dynamics, and brand perception implications.

They learned that simply cutting prices could damage brand equity, while maintaining premium pricing limited market penetration. The solution was creating product variants specifically designed for emerging markets that offered core functionality at accessible price points.

These market-specific products weren’t stripped-down versions of premium offerings. Sony invested in understanding what features and capabilities were most valued in each market and built products around those priorities.

Sony’s data-driven approach to pricing products for emerging markets while maintaining profit margins and brand positioning required developing new analytical frameworks that balanced affordability with brand equity preservation across diverse economic conditions.

Emerging Market Entry Checklist:

-

☐ Conduct comprehensive market research on local preferences

-

☐ Analyze competitive landscape and pricing strategies

-

☐ Assess regulatory requirements and compliance needs

-

☐ Identify optimal distribution channels and partners

-

☐ Develop culturally appropriate marketing messages

-

☐ Create localized customer support infrastructure

-

☐ Establish performance metrics for market success

-

☐ Plan for scalability as market matures

Distribution Channel Innovation

Traditional retail channels often don’t exist or aren’t effective in emerging markets. Sony had to get creative with distribution, partnering with local businesses, mobile operators, and even informal retail networks to reach customers.

Their direct-to-consumer initiatives proved particularly valuable in markets where consumers preferred online purchasing or where retail markups made products unaffordable. By selling directly, Sony could offer better prices while maintaining margins.

Mobile-first distribution strategies became essential in markets where smartphones were the primary internet access point. Sony optimized their entire purchasing experience for mobile devices, from product discovery to payment processing.

Sony’s development of alternative distribution methods, including direct-to-consumer channels and local partnership networks, addressed the challenge of reaching customers in markets where traditional retail infrastructure was limited or nonexistent, requiring creative approaches to product availability and customer service.

Market Education and Awareness Campaigns

Entering markets where consumers aren’t familiar with your product categories requires a completely different marketing approach. Sony had to educate potential customers about why they needed gaming consoles or premium audio equipment before they could sell specific products.

These education campaigns required significant upfront investment with delayed returns. Sony committed to multi-year awareness building programs that established product categories before focusing on brand competition.

The gaming market in India exemplifies this approach. Sony spent years educating consumers about console gaming benefits before PlayStation sales took off. This patience and investment created a loyal customer base that competitors struggled to penetrate.

Sony’s investment in consumer education and brand awareness building in markets with limited prior exposure to their product categories required developing new marketing approaches that focused on category creation rather than brand differentiation, often requiring multi-year commitment before seeing significant returns.

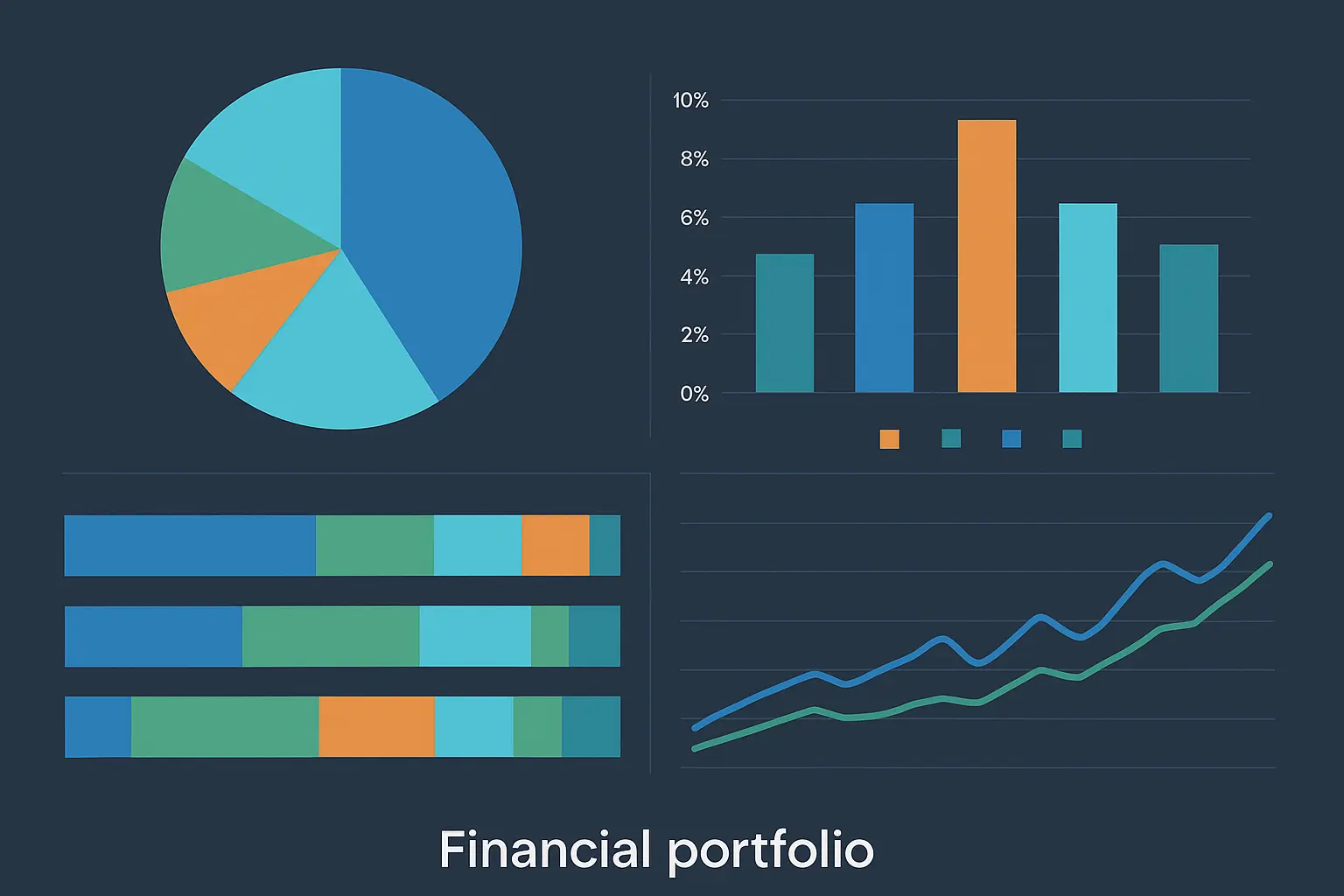

Financial Performance and Investment Strategy

Sony’s financial turnaround required taking a hard look at their massive business portfolio, getting rid of stuff that wasn’t working, and putting their money where it would actually grow – fundamentally changing how the company measured success and spent resources across business units.

The company’s approach to portfolio optimization mirrors the strategic frameworks outlined in our ROI calculator guide, where systematic evaluation of investment returns guides resource allocation decisions.

Sony’s approach to portfolio optimization became a model for other diversified technology companies facing similar challenges. They demonstrated how systematic evaluation and strategic exits could free up resources for higher-return investments.

Portfolio Optimization and Divestiture Strategy

Instead of panicking and selling off random pieces of the company, Sony actually thought about what they were doing. They made a list of what was working, what wasn’t, and what they should probably just cut loose before it dragged everything else down.

Selling off VAIO computers was probably painful – it was a cool brand that people actually liked. But Sony realized they were fighting a war they couldn’t win against Dell and HP while their gaming business was printing money. Sometimes you’ve got to know when to fold.

By exiting the PC business, Sony freed up resources and management attention for higher-growth opportunities in gaming and entertainment. The decision was initially controversial but proved smart as the PC market continued to become a commodity business.

Sony’s systematic approach to evaluating and divesting non-core assets while investing heavily in high-growth segments like gaming and entertainment services required developing new frameworks for asset valuation and strategic decision-making that prioritized long-term competitive positioning over short-term revenue protection.

Asset Valuation and Strategic Exit Planning

Getting rid of business units requires making sure that exits create value for everyone involved while positioning remaining businesses for success. Sony developed sophisticated frameworks for managing these complex transactions.

Their approach considered both financial returns and strategic implications for remaining businesses. Some divestitures eliminated distractions, while others removed competitive conflicts that had limited growth in core areas.

The timing of exits proved crucial. Sony learned to divest businesses while they still had value rather than waiting until performance deteriorated to the point where buyers weren’t interested or offered minimal prices.

Sony’s methodologies for evaluating underperforming business units and executing strategic exits required balancing financial returns with strategic considerations, often involving complex negotiations with buyers who could better utilize divested assets while ensuring smooth transitions for employees and customers.

Investment Prioritization Framework

Sony’s investment framework prioritized businesses with strong competitive advantages, recurring revenue potential, and connections with other Sony assets. This systematic approach replaced random investment decisions that had previously scattered resources across too many initiatives.

The framework emphasized scalability and network effects. Investments in gaming and entertainment services met these criteria because they could grow without proportional increases in costs and became more valuable as user bases expanded.

Regular portfolio reviews ensured that investment priorities could adapt to changing market conditions. Sony wasn’t locked into historical commitments when better opportunities emerged or when market dynamics shifted.

Sony’s development of criteria for allocating capital across different business segments required balancing short-term profitability with long-term growth potential, creating systematic approaches to investment decision-making that could adapt to changing market conditions while maintaining strategic focus.

VAIO Divestiture Case Study: Sony’s exit from the PC business in 2014 demonstrated strategic portfolio optimization. Despite VAIO’s brand recognition and $1+ billion annual revenue, Sony recognized the commoditized PC market offered limited differentiation. They sold VAIO to Japan Industrial Partners, allowing Sony to redirect resources toward higher-margin gaming and entertainment businesses while ensuring VAIO’s continuity under new ownership.

Technology Innovation and R&D Strategy

Sony’s R&D strategy evolved from “let’s build cool tech and figure out what to do with it later” to “let’s figure out what people actually need and build tech to solve those problems.” Instead of creating impressive technologies and then searching for applications, they identified market needs and developed technologies to address them.

This shift required cultural changes throughout their research organization. Engineers had to become more customer-focused, while product managers needed deeper technical understanding to guide development priorities effectively.

Sony’s approach to emerging technologies, patent development, and innovation pipeline management required balancing cutting-edge research with market-ready product development, ensuring that technological investments translated into competitive advantages and revenue growth rather than remaining isolated research projects.

AI and Machine Learning Integration

Sony didn’t go crazy with AI like some companies, trying to automate everything. Instead, they used it for the boring stuff so their creative people could focus on, you know, being creative. Their approach focused on practical applications that delivered measurable value rather than pursuing AI for its own sake.

Gaming became the testing ground for many AI initiatives. Machine learning algorithms could analyze player behavior patterns to optimize game difficulty, suggest content, and detect cheating more effectively than traditional rule-based systems.

Sony’s implementation of artificial intelligence across their gaming, entertainment, and hardware divisions demonstrated how established companies could systematically integrate emerging technologies into existing business models while creating new capabilities that enhanced customer experiences and operational efficiency.

Gaming AI and Player Experience Enhancement

PlayStation’s AI systems analyze millions of gameplay sessions to understand what makes games engaging versus frustrating. This data informs both game development and platform features that keep players engaged longer.

Dynamic difficulty adjustment represents one of the most sophisticated applications. Games can automatically adjust challenge levels based on individual player skill and engagement patterns, maintaining optimal difficulty without manual intervention.

Personalized content recommendations have become increasingly sophisticated, considering past purchases and gameplay patterns, social connections, and even time-of-day preferences to suggest relevant games and content.

Sony’s use of machine learning to improve PlayStation user experiences, from dynamic difficulty adjustment to personalized content curation, showed how AI could enhance entertainment value while generating valuable data insights that informed broader business strategy and product development decisions.

Content Creation AI Tools

Sony’s content creation AI focuses on automating technical tasks so creators can spend more time on creative decisions. Music production tools can handle mixing and mastering basics, while video editing AI can manage routine cutting and color correction tasks.

These tools don’t replace human creativity – they amplify it. Musicians can experiment with more arrangements when AI handles technical implementation, while filmmakers can focus on storytelling when AI manages routine post-production tasks.

The key insight was that AI works best when it handles well-defined technical tasks while leaving creative decisions to humans. This division of labor improves both efficiency and creative output quality.

Sony’s development and deployment of AI-powered tools for music production, film editing, and game development workflows demonstrated how artificial intelligence could enhance creative processes rather than replace human creativity, improving efficiency while maintaining artistic quality and vision.

Sustainability and Corporate Responsibility Initiatives

Sony figured out that the whole “going green” thing isn’t just good PR anymore. Young people actually care about this stuff, and they’ll buy from companies that don’t trash the planet. Plus, it turns out that designing products to last longer and use less energy often saves money too. Win-win.

Sony’s approach integrates sustainability into business strategy rather than treating it as a separate corporate responsibility function. This integration ensures that environmental considerations influence core business decisions rather than being afterthoughts.

Sony’s environmental and social responsibility programs required integrating sustainability considerations into core business operations rather than treating them as separate initiatives, demonstrating how companies can address stakeholder expectations while maintaining profitability and competitive positioning.

Carbon Neutrality Roadmap Implementation

Sony’s carbon neutrality commitment includes specific timelines and measurable targets rather than vague feel-good goals. They’ve committed to carbon neutrality across their operations by 2040, with interim targets that track progress systematically.

The roadmap addresses both direct emissions from their facilities and indirect emissions from their supply chain and product lifecycle. This comprehensive approach recognizes that true carbon neutrality requires addressing the full environmental impact of their business.

Renewable energy investments have become a significant part of their strategy. Sony is installing solar panels at facilities worldwide and purchasing renewable energy credits to offset remaining emissions while working toward direct renewable energy sourcing.

Sony’s commitment to environmental responsibility extends beyond internal operations. As detailed in their science-based targets case study, “Sony has developed new LED displays for their TVs, which are more energy efficient, without compromising on picture quality. For example, the smart screens in the 4K BRAVIA™ TV X85B series adjust LED backlight brightness frame by frame to avoid wasting energy, and use 20% less energy than previous models” according to Science Based Targets. This demonstrates their integration of sustainability into product innovation.

Sony’s specific strategies and timelines for achieving carbon neutrality across their global operations and supply chain required systematic measurement, reduction targets, and investment in renewable energy and efficiency improvements that balanced environmental goals with operational requirements and cost considerations.

Circular Economy Product Design

Circular economy principles are reshaping how Sony designs products from the ground up. Instead of optimizing solely for performance and cost, designers now consider end-of-life recyclability and material sustainability throughout the development process.

PlayStation consoles now use recycled plastics and are designed for easier disassembly and component recovery. This approach sometimes requires trade-offs with traditional design goals, but consumer acceptance has been strong.

Packaging redesign has eliminated unnecessary materials while improving protection and user experience. Sony discovered that sustainable packaging often performs better than traditional approaches while reducing costs and environmental impact.

Sony’s redesign of products and packaging to support recycling, refurbishment, and sustainable materials usage required rethinking fundamental design principles and supply chain relationships, often involving trade-offs between sustainability goals and traditional performance or cost optimization.

Social Impact Measurement and Reporting

Measuring social impact requires different metrics than traditional business performance indicators. Sony developed frameworks that track educational program outcomes, diversity improvements, and community development contributions with the same rigor they apply to financial reporting.

Their education initiatives focus on STEM programs and creative arts education, leveraging Sony’s expertise in technology and entertainment. These programs are measured by student outcomes and long-term career impacts rather than participation numbers.

Diversity and inclusion efforts are tracked through comprehensive metrics that go beyond hiring statistics to include retention, advancement, and workplace satisfaction across different demographic groups. This data informs ongoing program improvements and resource allocation decisions.

Sony has also developed their own recycled plastic, SORPLAS, which is made from up to 99% recycled material and saves up to 80% CO2 emissions during manufacturing. This innovation is used across many Sony products and is now sold outside the Sony Group, demonstrating how sustainability initiatives can create new revenue streams.

Sony’s frameworks for measuring and communicating the social impact of their corporate responsibility initiatives required developing new metrics and reporting systems that could quantify contributions to education, diversity, and community development while maintaining transparency and accountability to stakeholders.

Sony’s approach to virtual production showcases their continued innovation in professional markets. “Located within the iconic Pinewood Studios in the UK, Sony’s Digital Media Production Centre (DMPC) serves as a dynamic hub for showcasing the future of media production” according to Sports Video. This facility demonstrates Sony’s commitment to advancing production technologies while maintaining their leadership in professional content creation tools.

Sustainability Integration Template:

-

Environmental Impact Assessment

-

☐ Carbon footprint measurement

-

☐ Material sourcing evaluation

-

☐ Energy consumption analysis

-

☐ Waste reduction opportunities

-

-

Social Responsibility Framework

-

☐ Community engagement programs

-

☐ Educational initiative development

-

☐ Diversity and inclusion metrics

-

☐ Employee wellbeing measures

-

-

Economic Sustainability

-

☐ Long-term profitability analysis

-

☐ Stakeholder value creation

-

☐ Innovation investment planning

-

☐ Market competitiveness assessment

-

Final Thoughts

Sony’s transformation from a struggling electronics manufacturer to a thriving entertainment and technology company offers valuable lessons for any business facing digital disruption. Their journey wasn’t smooth – they made mistakes, faced crises, and had to fundamentally reimagine their identity multiple times.

What stands out most is how Sony learned to make decisions based on data rather than tradition. They abandoned business units that no longer made strategic sense, even when those units had historical significance. They invested heavily in capabilities that seemed risky at the time but proved essential for future success.

The crisis management lessons alone are worth studying. Sony’s initial stumbles during the PlayStation Network breach could have destroyed the brand, but their recovery strategy demonstrated how transparency and customer focus can rebuild trust even after severe failures.

For businesses today, Sony’s experience highlights the importance of having partners who understand both digital transformation and crisis management. Similar to the systematic approach detailed in our marketing ROI calculator, Sony’s data-driven methodology to market analysis and performance optimization demonstrates how scientific thinking drives measurable results.

Whether you’re navigating a digital transformation, recovering from a crisis, or expanding into new markets, having expert guidance can help you avoid the costly trial-and-error approach that Sony experienced during their early transformation years. Our comprehensive approach to high-impact content strategy mirrors Sony’s content-first transformation methodology.

Ready to apply these lessons to your own business transformation? Contact The Marketing Agency today to discover how our scientific approach to marketing can help you identify opportunities and execute strategies with the precision that drives measurable results.