Table of Contents

-

Understanding What Markup Calculators Actually Do

-

The Math Behind Markup Calculations (It’s Simpler Than You Think)

-

Different Types of Markup Strategies You Can Use

-

Free vs. Premium Markup Calculator Tools

-

How to Integrate Markup Calculators Into Your Business

-

Industry-Specific Markup Applications That Work

-

Common Markup Calculator Mistakes (And How to Avoid Them)

-

Measuring Your Markup Calculator Success

-

Final Thoughts

TL;DR

-

Markup calculators automatically figure out selling prices by adding set percentages or dollar amounts to your original costs

-

The basic formula is: Selling Price = Cost + (Cost × Markup Percentage) – but markup differs from margin calculations

-

You can choose between percentage-based, fixed dollar, or variable markup strategies depending on what works for your business

-

Free tools handle basic needs perfectly, while premium calculators offer advanced features like inventory integration and real-time market analysis

-

Smart integration with e-commerce platforms, inventory systems, and accounting software maximizes efficiency

-

Different industries need tailored markup approaches – retail, services, and manufacturing each have unique considerations

-

Common mistakes include overlooking hidden costs, using rigid strategies, and ignoring what customers actually think your stuff is worth

-

Success metrics include gross profit margin trends, competitive positioning, and sales volume impact assessment

Understanding What Markup Calculators Actually Do

Last year, I was pricing products by adding what felt like a reasonable amount to my costs. Sometimes 30%, sometimes 50% – whatever seemed right that day. Then I realized I was basically gambling with my business. That’s when I discovered markup calculators, and honestly, they saved my sanity (and my profit margins).

These digital tools automatically figure out what you should charge by adding a set percentage or dollar amount to what something costs you. The markup calculator is a business tool most often used to calculate your sale price – Omnicalculator. Just enter the cost and markup, and boom – the price you should charge gets computed instantly. They’re basically your pricing safety net, making sure you’re making money while keeping you competitive.

The thing that blew my mind was how precise they are. Instead of my old method of “eh, this feels about right,” you get actual numbers that guarantee you’re making money. And trust me, after accidentally selling custom logos for less than minimum wage for three months, precision became my best friend.

I remember staying up until 2 AM trying to figure out if I was charging enough for my freelance graphic design work. Spoiler alert: I wasn’t. A markup calculator would’ve saved me from those “I’m basically paying clients to let me work for them” moments.

Understanding proper pricing calculations becomes even more critical when you’re implementing comprehensive retail math strategies that maximize both profit margins and market competitiveness across your entire product line.

Take my buddy who runs a small electronics shop. He buys wireless earbuds for $50 each. With his 60% markup (which his calculator spits out instantly), he knows to charge $80. No guesswork, no wondering if he’s leaving money on the table. Just consistent profit across everything he sells.

The Math Behind Markup Calculations (It’s Simpler Than You Think)

The Core Formula That Drives Everything

Okay, don’t panic when you see math. I promise this is easier than figuring out the tip at dinner.

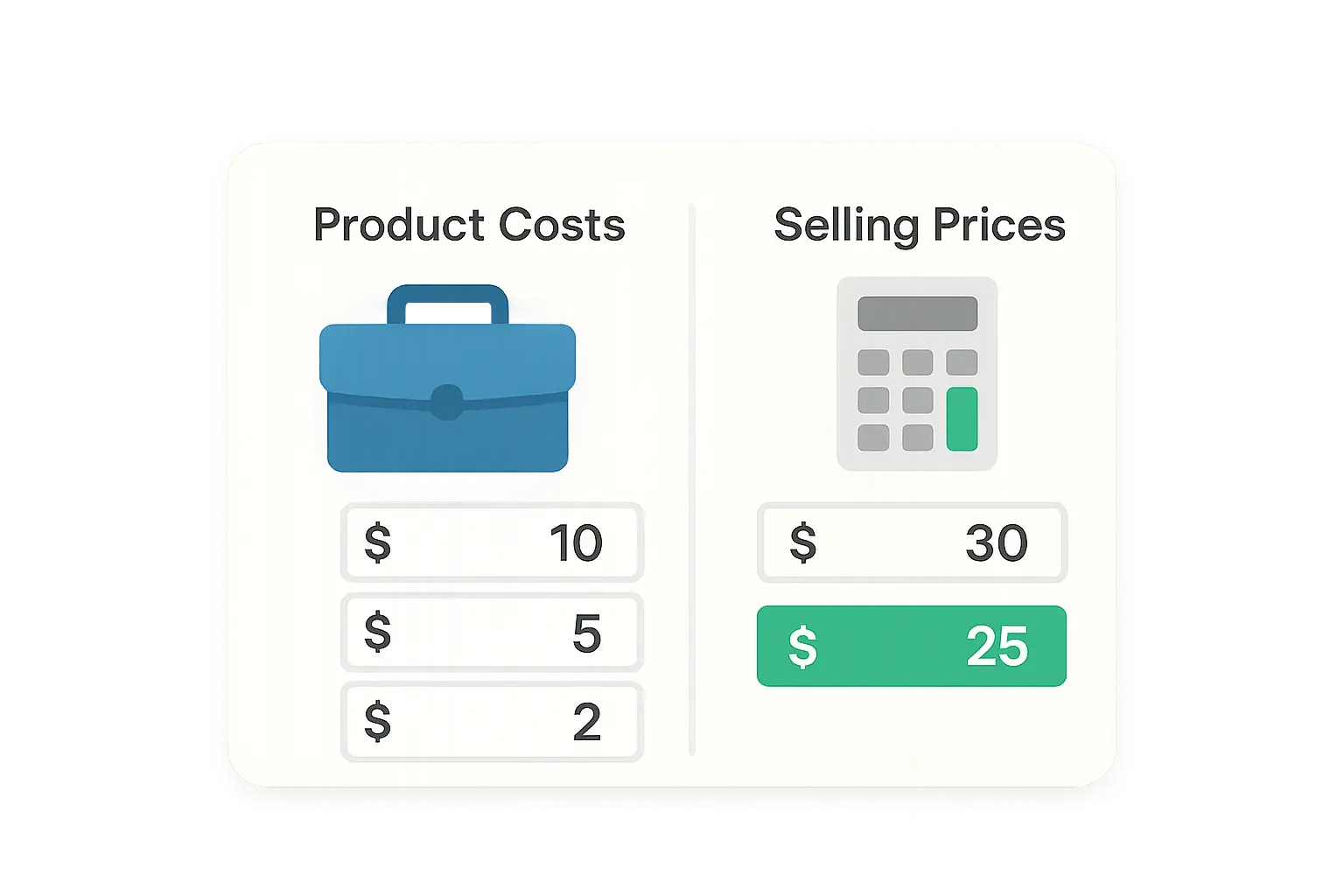

The basic markup calculator formula is: Selling Price = Cost + (Cost × Markup Percentage).

Let’s say you buy something for $100 and want a 50% markup. Here’s what happens: $100 + ($100 × 0.50) = $150. That’s it. That’s your selling price.

I used to overthink this so much. I’d sit there with a calculator, second-guessing myself, recalculating three times. Now? I just plug the numbers in and move on with my life.

This formula becomes your pricing backbone. Once you nail down your markup percentage, everything becomes automatic. No more “hmm, what should I charge for this?” moments that keep you up at night.

|

Product Cost |

Markup % |

Markup Amount |

Selling Price |

Profit Margin |

|---|---|---|---|---|

|

$50 |

40% |

$20 |

$70 |

28.6% |

|

$100 |

50% |

$50 |

$150 |

33.3% |

|

$200 |

60% |

$120 |

$320 |

37.5% |

|

$500 |

30% |

$150 |

$650 |

23.1% |

Why Markup Isn’t the Same as Margin (This Trips Everyone Up)

This one confused the heck out of me for months, so let me save you the headache I went through.

Markup is your profit as a percentage of what you paid. Margin is your profit as a percentage of what you sell it for.

Using that example from before: 50% markup on a $100 item gives you a $150 selling price. But your margin? Only 33.3% because you’re calculating that $50 profit against the $150 selling price, not the original $100 cost.

I cannot tell you how many awkward conversations I had with my accountant before I figured this out. We’d be talking about completely different things while using the same numbers. Don’t be me. Learn this distinction now, and you’ll save yourself from some seriously confusing meetings down the road.

Different Types of Markup Strategies You Can Use

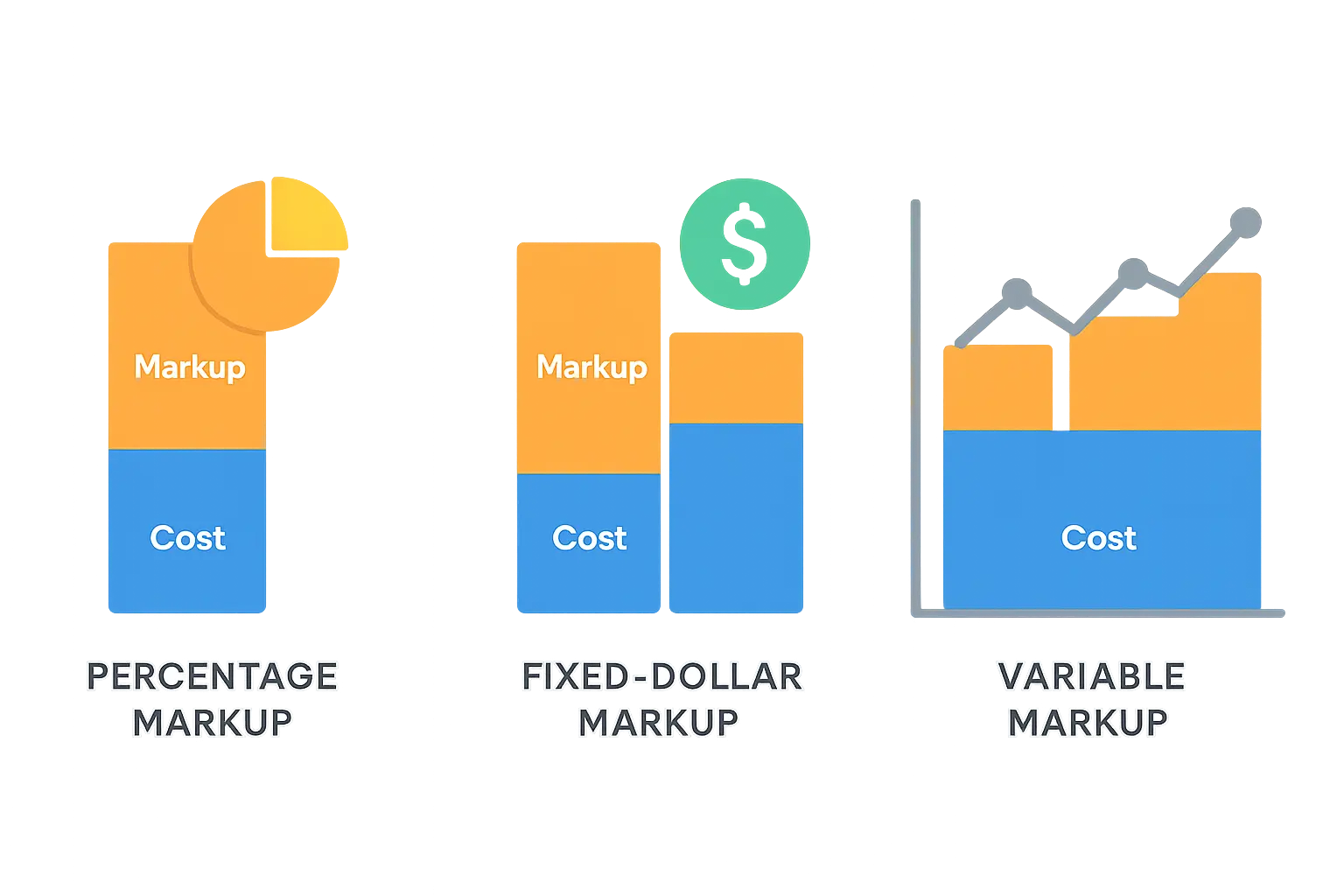

Percentage-Based Systems for Consistent Profits

Most businesses I know swear by percentage-based markup. You pick a rate – let’s say 40% – and apply it to everything. Done.

The beauty here is consistency. Your team doesn’t need to memorize different rules for different products. Sarah in accounting doesn’t have to call you every time she needs to price something. Everything gets the same 40% markup, which makes training new people a breeze and reduces those pricing errors that make you want to hide under your desk.

Plus, your profit margins become predictable. When you know every single item carries a 40% markup, forecasting becomes way less stressful. Budgeting gets easier too.

The reality of imprecise profit calculations has become a significant issue in B2B selling. According to “The Most Dangerous Number in B2B: ‘About 20%'” – Harlem World Magazine, teams often rely on vague profit estimates without understanding what goes into that number, highlighting why you need precise markup calculation tools.

Fixed Dollar Amount Approaches

Sometimes adding the same dollar amount to everything makes more sense than percentages. This works great for service businesses because your overhead stays pretty much the same whether a project costs $1,000 or $5,000 to deliver.

When I was consulting, I’d add $500 to every project regardless of the base cost. My time investment was similar, my overhead was the same, so why shouldn’t my profit be consistent too?

This approach really shines when your handling costs don’t change much across different price points. A wedding planner spends roughly the same amount of time coordinating whether it’s a $5,000 or $15,000 wedding, so a fixed markup makes perfect sense.

Variable Markup Strategies for Market Flexibility

Here’s where smart businesses separate themselves from the pack – they don’t stick to one markup forever.

High-demand items can handle higher markups because people will pay premium prices. But competitive products? You need to be more careful to stay in the game.

Seasonal stuff is huge here. I know a guy who sells Halloween costumes. October? He’s marking up 80%. November 1st? Everything’s 20% off just to move it out. Variable strategies let you maximize profits when times are good and stay competitive when they’re tough.

Your markup calculator should handle these changes easily. The last thing you want is to manually recalculate prices every time the market shifts or your competitor drops their prices.

Free vs. Premium Markup Calculator Tools

What Free Calculators Actually Offer

Don’t sleep on free tools. They’re not just watered-down versions of expensive software – they’re legitimate solutions for a lot of businesses.

You get basic percentage calculations, clean interfaces, and instant results without spending a dime. For small businesses just starting out, this is often exactly what you need. Complex features can actually make things more confusing when you’re trying to nail down the basics.

I started with a free calculator I found online. It did everything I needed: took my cost, applied my markup percentage, and gave me a selling price. Simple, effective, and it didn’t cost me anything while I was figuring out my business model.

The reporting might be basic, but it covers the essentials – profit margins, markup percentages, the stuff you actually need to know. Sometimes simple is better, especially when you’re just trying to get your pricing right without getting lost in fancy features you don’t understand yet.

Premium Features That Justify the Investment

Premium calculators earn their keep through advanced features that can transform how you handle pricing across your entire operation.

Inventory integration is a game-changer. When your wholesale costs change, your prices update automatically. No more logging in to update hundreds of products one by one at midnight because your supplier just raised prices.

Customer-specific pricing tiers let you offer different markups to different types of clients. Your bulk buyers might get lower markups while premium customers pay more for white-glove service. It’s like having different pricing rules for different relationships, all managed automatically.

The analytics often reveal opportunities you never knew existed. I had a client discover that their highest-margin products were also their fastest sellers – they just needed the data to see it clearly.

When you’re evaluating premium features, think about your actual pain points. If you’re not spending hours on manual price updates, don’t pay for automation features you won’t use. But if you’re drowning in spreadsheets and pricing mistakes, those premium features might save your sanity.

When evaluating premium features, consider how they align with your broader business intelligence needs, similar to how you’d assess comprehensive content tool capabilities for their ability to streamline and optimize your marketing operations.

How to Integrate Markup Calculators Into Your Business

E-commerce Platform Integration Made Simple

Integration with your online store eliminates the tedious work of updating prices across hundreds of products. Shopify, WooCommerce, Magento – they all play nice with advanced markup systems.

When your wholesale costs change, prices update automatically. No more staying up late updating your entire catalog because your supplier raised prices. The system handles it based on your markup rules, and you can actually get some sleep.

The error reduction alone makes this worthwhile. I used to make typos all the time when updating prices manually. Miss a decimal point and suddenly you’re selling $500 items for $50. Ask me how I know (and how much that mistake cost me).

Markup Calculator Integration Checklist:

-

☐ Make sure it actually works with your platform

-

☐ Test everything before going live (seriously, test everything)

-

☐ Set up backup pricing rules for when things go wrong

-

☐ Get notifications when prices change

-

☐ Know who can override prices when needed

-

☐ Schedule regular check-ups to catch problems early

-

☐ Have a plan for rolling back when something breaks

Inventory Management Synchronization

Your inventory system has all the cost information that should drive your pricing decisions. Advanced markup calculator tools sync with these systems so your prices always reflect current costs without you having to babysit the process.

Stock level triggers can automatically adjust pricing. When inventory runs low, the system might bump up markups to slow demand and save stock for your best customers. It’s like having a smart assistant that knows when to raise prices without you having to watch inventory levels like a hawk.

Real-time cost tracking means your prices stay accurate even when supplier costs bounce around like a pinball. This becomes especially valuable for businesses dealing with imported goods where costs change constantly due to currency fluctuations or shipping issues.

Accounting System Connectivity for Better Insights

Connecting your markup calculator to QuickBooks or Xero creates a smooth flow of financial information that makes decision-making way easier across your entire business.

Profit margin reporting happens automatically, giving you real-time insights into which products and strategies generate the best returns. You’ll spot trends and opportunities much faster than manual analysis would allow, and you won’t need a degree in accounting to understand what’s happening.

Cost tracking becomes more accurate when all your systems talk to each other. Changes in your accounting system automatically update your pricing calculations, keeping everything consistent without you having to manually sync data between different platforms.

Just as you’d implement comprehensive tracking for digital campaigns, establishing proper analytics audit procedures ensures your markup calculator integrations provide accurate, actionable data for business decision-making.

Industry-Specific Markup Applications That Work

Retail and E-commerce Strategies

Retail markup needs to be flexible because consumer demand and competition change constantly. Fast-moving items often carry lower markups because volume makes up for reduced per-unit profit – you make it up in quantity.

Seasonal changes require different approaches throughout the year. Holiday merchandise might support 60% markups in November but need 20% markdowns in January just to move it out of your warehouse. Your markup calculator should handle these variations automatically so you’re not scrambling to reprice everything when seasons change.

Inventory turnover matters too. Slow-moving items need higher markups to cover carrying costs (rent, insurance, opportunity cost), while quick-turn products can operate on thinner margins because they don’t sit around eating into your profits.

|

Industry Sector |

Typical Markup Range |

Key Things to Consider |

What Actually Works |

|---|---|---|---|

|

Electronics Retail |

15-40% |

Stuff goes obsolete fast, competition is brutal |

Variable markup based on product lifecycle |

|

Fashion/Apparel |

50-100% |

Seasonal demand, brand positioning matters |

High markup with planned markdown strategy |

|

Grocery/Food |

10-30% |

Things spoil, volume-based business |

Low markup, high turnover focus |

|

Home Improvement |

25-50% |

Project-based sales, expertise premium |

Bundle services with product markup |

|

Automotive Parts |

20-60% |

Brand loyalty, technical complexity |

Higher markup for specialized/complex parts |

Service Industry Considerations

Service businesses are tricky because you’re selling expertise, time, and results rather than physical products with clear cost structures that you can easily plug into a calculator.

Overhead allocation becomes crucial when determining base costs for your markup calculator inputs. Office rent, insurance, equipment, administrative costs – all of this needs factoring into your pricing foundation before you even think about markup percentages.

Expertise premiums justify higher markups for specialized knowledge or unique capabilities. A marketing consultant with proven results in a specific industry can command way higher markups than generalists because the value they deliver is demonstrably higher.

Here’s a real example: A digital marketing agency calculates their base cost for a social media campaign at $2,000 (including staff time, software tools, and overhead allocation). Using a 150% markup for their specialized expertise, they price the service at $5,000, ensuring adequate profit while reflecting their premium positioning in the market.

Manufacturing and Wholesale Models

Manufacturing markup calculations get complex because cost structures change based on production volumes and raw material prices. Your markup calculator needs sophistication to handle these variables accurately without requiring a PhD in manufacturing economics.

Direct materials, labor costs, and overhead allocation all contribute to your base cost before markup application. Missing any component leads to inadequate pricing that slowly erodes profitability until you’re wondering why you’re working so hard for so little profit.

Production volume economics mean your per-unit costs decrease as quantities increase. Your markup calculator should adjust pricing automatically based on order sizes to maintain consistent profit margins whether someone orders 100 units or 10,000.

Understanding market dynamics becomes crucial for manufacturers, much like conducting thorough market sizing analysis to identify optimal pricing opportunities and competitive positioning within your industry sector.

Common Markup Calculator Mistakes (And How to Avoid Them)

The Hidden Costs That Kill Your Profits

I’ve watched too many businesses calculate markup based only on product cost, completely ignoring all the other expenses that eat into profits like hungry little profit monsters. Shipping costs, payment processing fees, storage expenses, customer service time – these are all real costs that need inclusion in your base calculations before you even think about markup.

Payment processing fees alone can consume 2-3% of your revenue. If you’re not factoring these into your base costs before applying your markup calculator formulas, you’re essentially giving away profit margin to Stripe or PayPal.

Storage and handling costs accumulate over time, especially for slow-moving inventory. I once underpriced a custom website project by $2,000 because I forgot to factor in revisions and phone calls. Your markup calculator should account for these carrying costs to ensure long-term profitability, not just break-even math.

The healthcare industry provides a stark example of how systematic calculation errors can have devastating consequences. According to “race-based medical calculations delayed Black patients access to life-saving kidney transplants” – The Markup, flawed algorithmic approaches in medical calculations demonstrate how seemingly minor computational biases can compound into major systemic problems, emphasizing the critical importance of accuracy in all business calculation systems.

Hidden Cost Reality Check:

-

Product/Service Base Cost: $______

-

Shipping & Handling: $______

-

Payment Processing (2-3%): $______

-

Storage/Warehousing: $______

-

Customer Service Time: $______

-

Returns/Exchanges: $______

-

Insurance & Risk: $______

-

Your Actual Total Cost: $______

Static Strategies in Dynamic Markets

Markets change all the time, but lots of businesses set their markup calculator percentages once and never look at them again. This rigid approach costs money both ways – you lose sales when competitors undercut you and miss profit opportunities when demand is hot.

I learned this lesson during COVID when demand for home office equipment went crazy. Businesses that kept static markups missed out on huge profit opportunities, while others that adjusted their strategies made absolute bank during the work-from-home boom.

Competitive analysis should influence your markup decisions regularly. What worked last quarter might be completely wrong for current market conditions. The worst part? That sinking feeling when you realize you’ve been leaving money on the table for months because you were too lazy to review your pricing strategy.

Ignoring Customer Value Perception

Look, I get it – math isn’t everyone’s favorite thing. I used to break out in a cold sweat every time I had to set prices. But here’s the thing: your markup calculator might suggest a 75% markup based on costs and desired margins, but customers might only accept 50% based on what they think your stuff is worth.

Long-term customer relationships often matter more than maximizing individual transaction profits. Sometimes accepting lower markups builds loyalty that generates more total profit over time. It’s like dating – sometimes you invest in the relationship rather than trying to extract maximum value from every interaction.

Market research helps balance mathematical optimization with customer psychology. Understanding what customers will actually pay prevents pricing mistakes that damage relationships or market position.

Real example: A software company’s markup calculator suggested pricing their new analytics tool at $500/month based on development costs and a 200% markup. However, market research revealed competitors charged $300-400/month for similar features. They adjusted to $399/month, accepting a 160% markup to maintain competitive positioning while still achieving strong profitability.

Measuring Your Markup Calculator Success

Tracking Gross Profit Margin Trends

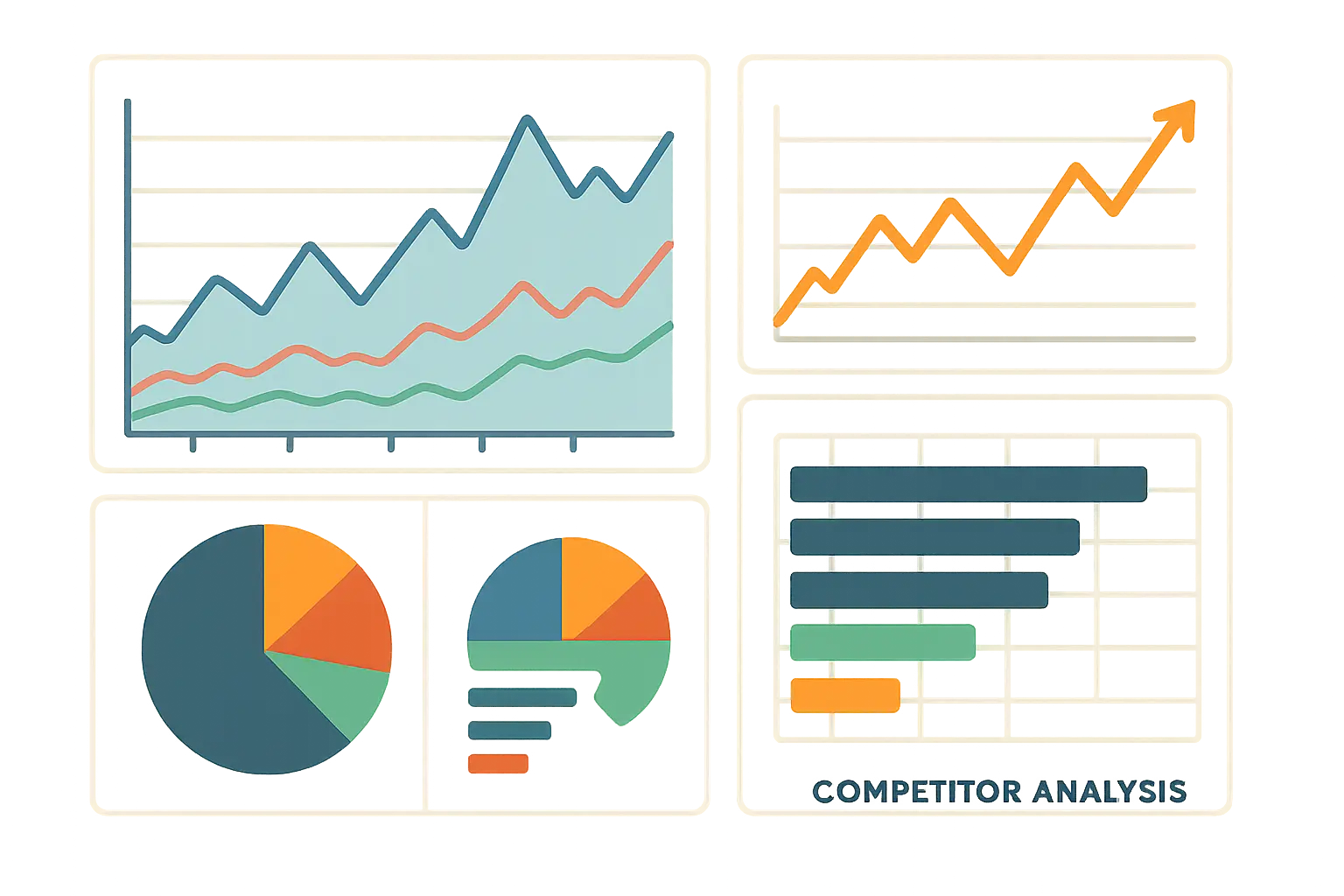

Your gross profit margins tell the real story about whether your markup calculator effectiveness is actually working in the real world. Tracking these numbers across different product lines and time periods reveals whether your pricing strategy is working or needs serious adjustment.

Declining margins are red flags that need immediate attention. Either your costs are increasing faster than your prices, or competitive pressures are forcing markdowns that erode profitability. Both scenarios require action, not hope that things will magically improve.

Product line analysis often reveals surprising insights that challenge your assumptions. Some items you thought were profitable might actually be margin killers, while others exceed expectations and deserve more marketing focus and inventory investment.

Competitive Position Analysis

Staying competitive requires constant monitoring of how your markup-driven prices compare to market alternatives. You need competitive intelligence to validate that your markup calculator settings keep you in the game while maintaining profitability.

Market share trends indicate whether your pricing strategy supports business growth or creates barriers to customer acquisition. Losing share might signal the need for markup adjustments, or it might mean your value proposition needs work.

Customer acquisition costs relative to your pricing reveal whether your markups support sustainable growth. High acquisition costs combined with low markups create unsustainable business models that look good on paper but fail in practice.

Competitive analysis requires the same systematic approach you’d use when evaluating different tool options for optimization, comparing features, pricing, and value propositions to make informed strategic decisions.

Sales Volume Impact Assessment

Volume changes following markup adjustments reveal customer price sensitivity and help optimize the balance between per-unit profit and total sales volume. Sometimes lower markups generate higher total profits through increased volume – counterintuitive but mathematically sound.

Price elasticity varies significantly across different products and customer segments. Testing different markup levels helps identify optimal ranges for each category without destroying relationships or market position.

Total profit optimization often requires accepting lower per-unit margins in exchange for higher volume. Your markup calculator should help identify these opportunities through scenario analysis rather than rigid adherence to preset percentages.

Markup Success Reality Check:

-

☐ Check gross profit margins monthly by product category

-

☐ Track competitor pricing changes quarterly

-

☐ Test customer price sensitivity with A/B tests

-

☐ Measure sales volume impact of markup changes

-

☐ Calculate customer lifetime value relative to pricing

-

☐ Review market share trends against pricing strategy

-

☐ Look for total profit optimization opportunities

-

☐ Document what you learn for future markup decisions

How’s your current pricing strategy working out? Are you confident you’re capturing all the profit you could while staying competitive? Been there with the uncertainty – it’s not fun.

The Marketing Agency understands that effective pricing strategies require the same data-driven approach we bring to digital marketing campaigns. Our performance-focused methodology can help you implement markup calculator strategies that optimize both your pricing and your marketing ROI. When your pricing strategy aligns with your marketing efforts, you create a powerful combination that drives sustainable business growth.

Final Thoughts

Markup calculators turn pricing from guesswork into actual strategy, but their real value comes from smart implementation, not just mathematical precision. The businesses that succeed with these tools understand that markup calculations are starting points for pricing decisions, not the final word that you follow blindly.

Your markup calculator success depends on picking the right tool for your business size and complexity, integrating it properly with your existing systems, and maintaining flexibility to adjust strategies based on what the market tells you. Free tools work perfectly for straightforward pricing needs, while premium solutions justify their cost through automation and advanced analytics that save time and reveal profit opportunities you missed.

The most successful implementations I’ve seen combine mathematical precision with market intelligence and customer psychology. Your calculator might suggest a 60% markup, but if customers won’t pay those prices or competitors are significantly undercutting you, that mathematical perfection becomes business suicide. Smart pricing requires balancing all these factors, not just following formulas.

Remember that markup calculators are tools, not strategies. They execute your pricing decisions with precision and consistency, but you still need to make the strategic choices about markup levels, competitive positioning, and market approach. The businesses that treat these tools as decision-support systems rather than decision-makers consistently outperform those that rely on automation alone.

Start with your current pricing headaches and work backward to find the right markup calculator solution. If you’re spending hours manually updating prices, integration features become priorities. If you’re losing money on hidden costs, comprehensive cost tracking becomes essential. Match the tool to your specific pain points rather than buying features you don’t need.

The bottom line? Good markup calculator strategy isn’t about perfect math – it’s about consistent profitability that supports sustainable business growth. Get the basics right, stay flexible, and adjust based on real-world feedback. Your future self will thank you when you’re not staying up until 2 AM wondering if you’re charging enough.