Table of Contents

-

Understanding FBA Revenue Calculators: Your Profit Protection System

-

Strategic Implementation and Optimization: Making Numbers Work for You

-

Integration with Business Operations: Beyond Basic Calculations

-

Amazon Fee Calculator Mastery: Decoding the Complex Fee Maze

TL;DR

-

FBA revenue calculators aren’t just nice-to-have tools—they’re essential profit protection systems that reveal hidden costs eating into your margins

-

Most sellers underestimate Amazon’s complex fee structure, leading to pricing decisions that slowly bleed their business dry

-

Advanced calculators with real-time data integration can mean the difference between profitable growth and expensive mistakes

-

Strategic implementation requires systematic processes, not just plugging numbers into a tool once and forgetting about it

-

Integration with inventory and pricing decisions transforms calculators from reactive tools into proactive profit drivers

-

Mastering Amazon’s fee variations across categories and seasons is crucial for maintaining accurate profitability projections

Understanding FBA Revenue Calculators: Your Profit Protection System

Just last week, I got a panicked call from Mark, a seller who’d been celebrating his “profitable” product for six months. Turns out, after we calculated all the fees properly, he was losing $1.50 on every single unit. We’ve all been there – you find what looks like an amazing product, plug it into a basic calculator, see decent margins, and think you’ve struck gold. Three months later, you’re wondering why your bank account looks like a crime scene.

Look, Amazon’s fee structure is like trying to solve a Rubik’s cube blindfolded while riding a unicycle. It’s designed to be confusing, and honestly, I think they like it that way. The good calculators today pull in data from everywhere – your costs, Amazon’s fees, shipping, storage, even that weird return processing fee nobody talks about. It’s like having a really smart accountant who never sleeps and actually understands Amazon’s nonsense.

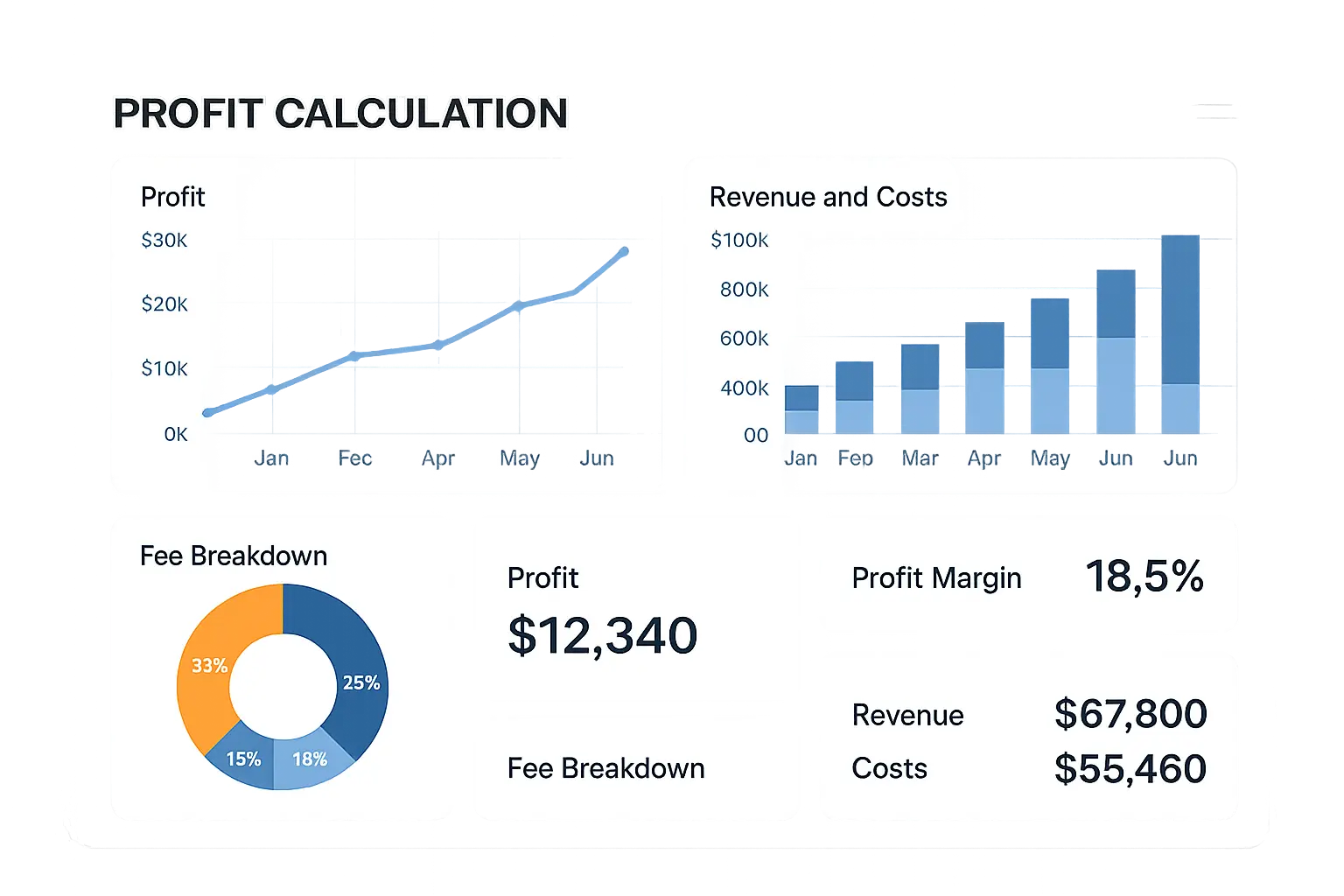

The numbers tell a stark story about eCommerce growth and complexity. It is estimated that sales from global eCommerce will hit $6.3 trillion this year, with $1.1 trillion coming from the US. With this explosive growth comes increased competition and tighter margins, making accurate profit calculations more critical than ever.

I used to think I was pretty smart with numbers. Then I started selling on Amazon and felt like I needed a PhD in Advanced Fee Mathematics just to figure out if I was making money. Every successful seller I know treats their amazon fba calculator as seriously as their inventory management system. Just as successful businesses need comprehensive Understanding market sizing fundamentals helps validate business opportunities before investment, mastering your revenue calculator ensures you’re making data-driven decisions about product profitability.

Core Calculator Components: The Engine Behind Accurate Profit Analysis

Here’s the thing nobody tells you about FBA calculators – most of them suck. Sorry, not sorry. They give you basic math when what you really need is a crystal ball that can predict Amazon’s next fee increase. The good ones integrate multiple data points including product pricing, comprehensive Amazon fees, shipping costs, and storage fees to deliver complete profit analysis. The sophistication of these components determines whether you’re getting accurate insights or dangerous oversimplifications that could cost you thousands.

My first big inventory purchase? Complete disaster. I thought I’d make 30% margins. Reality check: I made about 3%. The calculator I was using didn’t account for half the fees Amazon charges. What separates professional-grade calculators from basic ones is their ability to handle nuanced scenarios.

Can it account for seasonal storage fee spikes? Does it factor in return processing costs? These details matter more than you might think when building an accurate revenue calculator system.

Revenue Input Variables: Getting Your Foundation Right

Your selling price isn’t just a number you plug in once and forget. Market dynamics shift constantly, and your calculator needs to reflect these changes in real-time. I’ve seen sellers lose significant money because they based major inventory decisions on outdated pricing assumptions that didn’t account for fluctuating amazon revenue patterns.

Here’s what I’ve learned about units sold projections – they require more sophistication than most sellers realize. Seasonal variations can swing your numbers by 300% or more, depending on your product category. Your calculator should handle these fluctuations, not treat every month as identical.

The mistake I see repeatedly? Sellers input their “hoped for” numbers instead of realistic projections. Your calculator is only as good as the data you feed it, and wishful thinking doesn’t pay the bills.

Let me tell you about my friend Jake and his Christmas lights fiasco. He calculated steady sales of 100 units per month. Reality? He sold 800 units in November and December, then exactly 3 units in January. His storage fees in the off-season nearly killed his profits from the holiday rush.

Amazon Fee Structure Integration: Navigating the Complexity

Amazon changes their fees more often than I change my socks. Okay, that’s probably not saying much, but you get the point. Referral fees vary by category, FBA fees depend on size and weight classifications, and storage fees fluctuate seasonally. Manual tracking of these changes is practically impossible at scale.

The best calculators pull fee data directly from Amazon’s systems, ensuring you’re always working with current rates. This isn’t just convenient—it’s essential for maintaining profitability as Amazon adjusts their fee structure (which they do regularly). An effective amazon fee calculator becomes indispensable when navigating these complexities, while a dedicated fba fees calculator helps you understand the full cost structure.

Can we talk about storage fees for a second? These things are like compound interest, but in the worst possible way. What starts as pocket change turns into a mortgage payment if you’re not careful.

|

Fee Type |

Variation Factor |

Impact Level |

Update Frequency |

|---|---|---|---|

|

Referral Fees |

Product Category |

High (8-45%) |

Annually |

|

FBA Fulfillment |

Size/Weight Tier |

Medium (15-30%) |

Semi-annually |

|

Storage Fees |

Seasonal Period |

High (300%+ in Q4) |

Monthly |

|

Long-term Storage |

Inventory Age |

Critical (365+ days) |

Monthly |

|

Return Processing |

Product Category |

Medium (5-15%) |

Quarterly |

Cost Basis Calculations: The Full Picture of Your Investment

Your product cost is just the beginning. Inbound shipping rates vary by carrier, season, and volume. Prep fees add up quickly, especially for products requiring special handling. These “small” costs can easily represent 15-20% of your total investment.

I remember my first year when I proudly told my wife we made $10,000 in profit, only to realize later it was actually $2,800. That was a fun conversation. The difference? They weren’t tracking the full cost basis in their calculations, which directly impacted their amazon profit calculations.

One seller I know thought prep fees were no big deal until he realized his bamboo cutting boards needed special handling. Those “small” fees added up to $4,000 in his first quarter. Professional calculators help you capture these often-overlooked expenses. Similar to how retail math fundamentals reveal hidden costs in traditional retail, comprehensive cost tracking in Amazon FBA requires attention to every expense component.

Advanced Profit Analysis Features: Beyond Basic Math

Basic profit calculations tell you what happened. Advanced analysis features tell you what could happen and help you make better decisions moving forward. This distinction separates successful sellers from those who struggle to scale profitably.

What-if calculators that let you play around with different numbers let you test different pricing strategies, volume projections, and cost scenarios before committing real money. It’s your strategic planning partner when you need to evaluate multiple scenarios simultaneously. A sophisticated amazon fba calculator with these features becomes your strategic planning partner, while an amazon profit calculator helps you evaluate multiple scenarios simultaneously.

Break-Even Analysis Tools: Finding Your Safety Net

Break-even analysis isn’t just about covering costs—it’s about understanding your risk tolerance and safety margins. How many units do you need to sell to cover your initial investment? What’s the minimum price you can accept and still make money?

Market conditions change rapidly on Amazon. Competitors drop prices, Amazon adjusts fees, or demand shifts unexpectedly. Break-even analysis helps you understand how much cushion you have before these changes start hurting your bottom line. Your fba revenue calculator should make these calculations automatic and update them as market conditions change.

The most valuable insight from break-even analysis? Understanding your flexibility. If you know your break-even point is $15 and you’re selling at $25, you have room to compete on price. If your break-even is $23, you don’t.

ROI and Margin Optimization: Maximizing Your Returns

ROI calculations reveal which products deserve more of your attention and investment. A product with 15% margins might seem less attractive than one with 25% margins, but if the first one turns inventory 6 times per year while the second turns twice, the ROI story changes dramatically.

Margin optimization isn’t just about raising prices. Sometimes it’s about reducing costs, improving efficiency, or focusing on higher-velocity products. Your revenue calculator should help you identify all these opportunities while maintaining focus on overall amazon profitability.

The key insight most sellers miss? Absolute profit matters more than percentage margins when you’re trying to build a business. A product that makes $5 per unit with 20% margins beats one that makes $2 per unit with 40% margins every time.

Sarah, one of my coaching clients, was about to order 5,000 units of a product that would have bankrupted her business. Good thing we ran the numbers first. Product A generated $5 profit per unit with 20% margins, selling 200 units monthly ($1,000 total profit). Product B generated $8 profit per unit with 40% margins but only sold 50 units monthly ($400 total profit). Despite Product B’s higher margins, Product A contributed 2.5x more to her bottom line and deserved more investment attention.

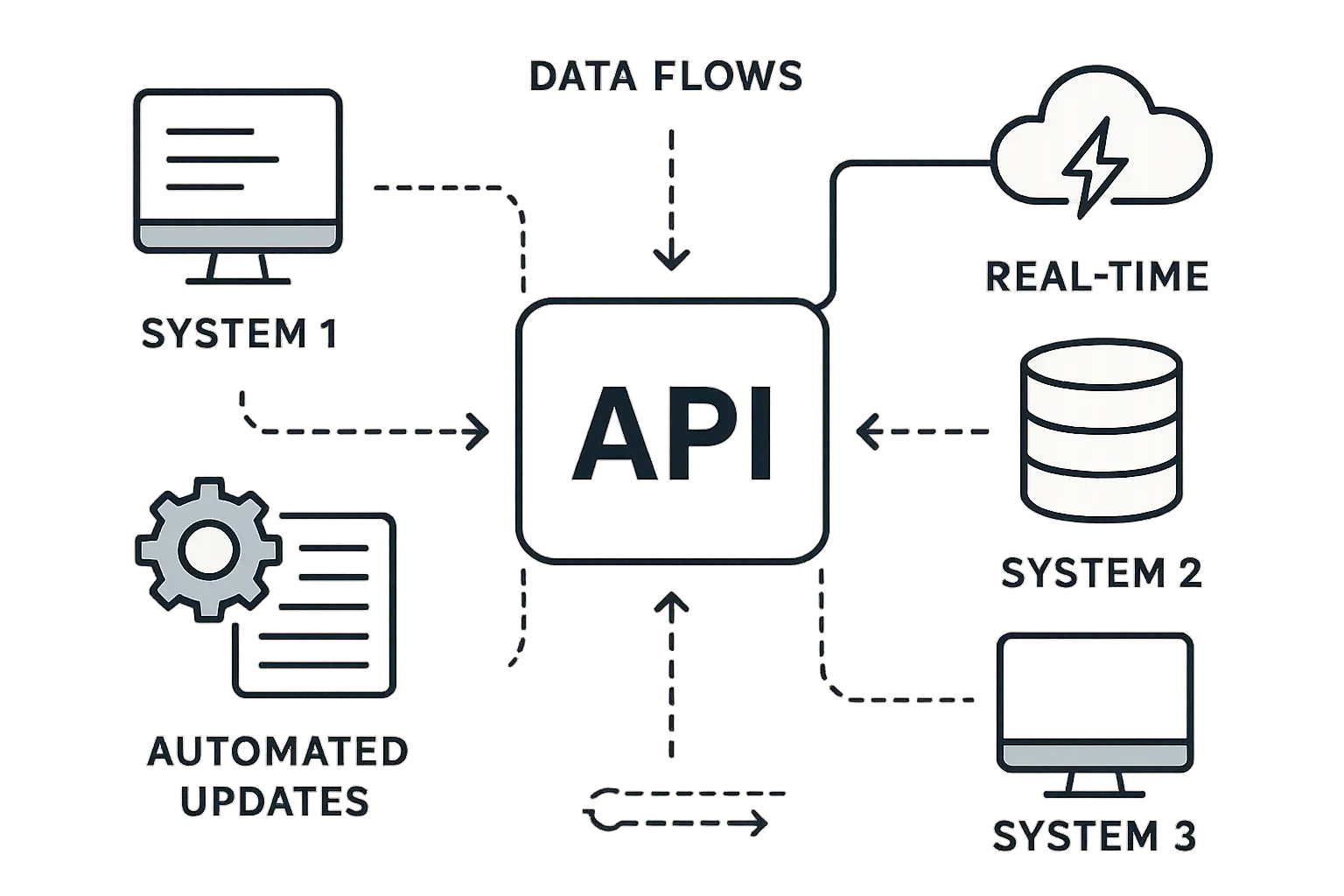

Real-Time Data Integration: Staying Current in a Dynamic Market

Static calculators using last month’s data are dangerous in Amazon’s fast-moving marketplace. Prices change daily, competitor landscapes shift weekly, and Amazon’s algorithms can impact your visibility overnight. Numbers that update automatically so you’re not working with last month’s guesses keeps your calculations relevant.

Market intelligence integration goes beyond just pricing data. The best amazon fba calculator platforms incorporate demand trends, seasonal patterns, and competitive analysis to provide context for your profit projections. This transforms your revenue calculator from a simple math tool into a comprehensive business intelligence system.

API Connectivity and Updates: Automation That Protects Your Profits

When your calculator hooks up to Amazon’s system automatically, it’s like having a personal assistant who updates all your numbers while you sleep. No more manual updates, no more “oops, forgot about the fee increase.” Fee changes get updated automatically, competitor price movements trigger alerts, and market demand shifts become visible in real-time.

The automation aspect is crucial for scaling your business. You can’t manually update dozens or hundreds of product calculations daily, but automated systems can handle this seamlessly while you focus on strategy and growth. A properly integrated amazon calculator becomes an extension of your business intelligence rather than a separate tool requiring constant manual updates.

Manual updates aren’t just time-consuming—they’re error-prone. One missed fee change or outdated competitor price can throw off your entire profit analysis and lead to costly decisions.

Strategic Implementation and Optimization: Making Numbers Work for You

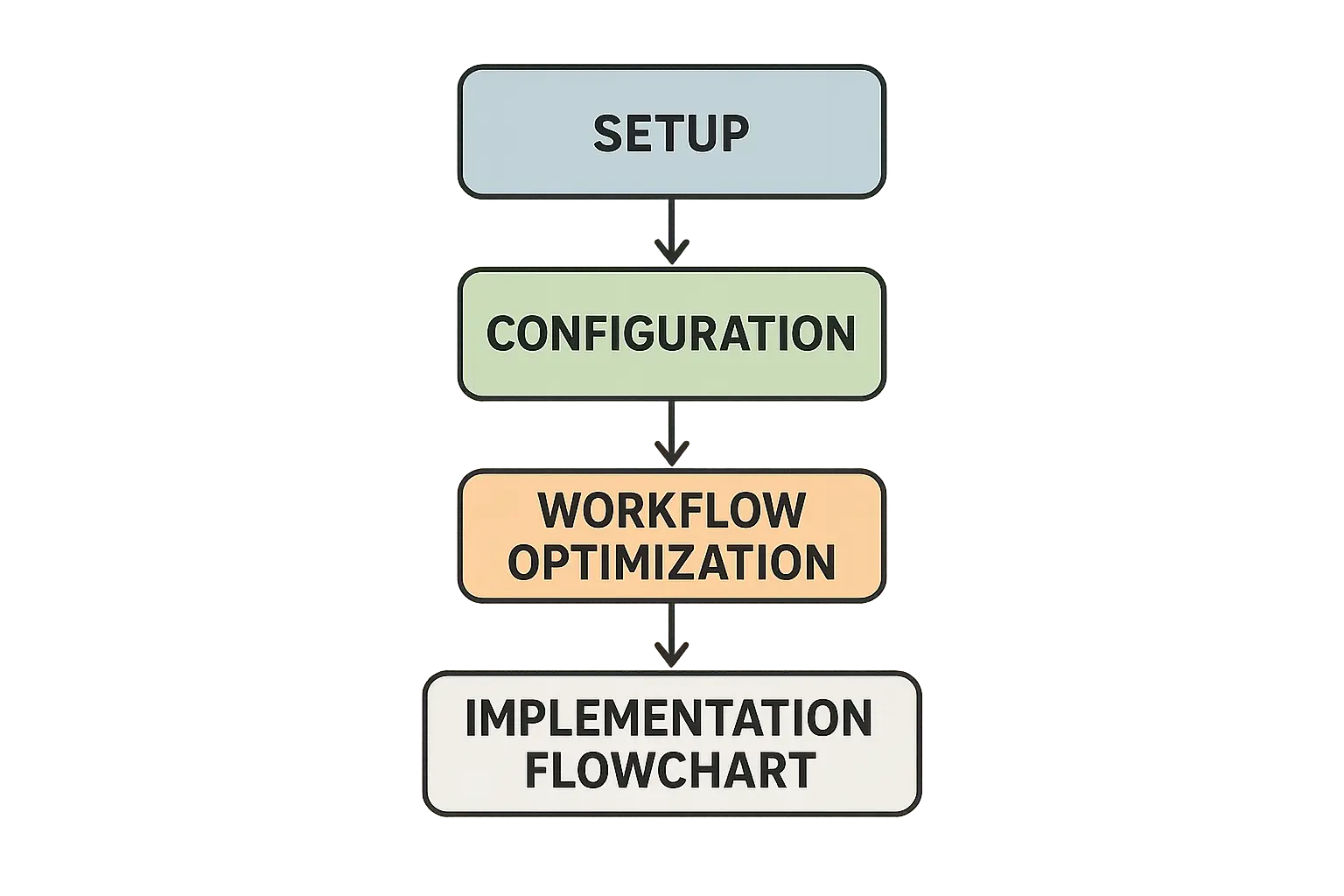

Implementation strategy separates successful sellers from those who struggle with profitability analysis. Having a great calculator means nothing if you’re not using it systematically or if your processes are inconsistent.

Look, I’m not trying to scare you, but ignoring this stuff is expensive. The goal isn’t just accurate calculations—it’s actionable insights that drive better business decisions. Your implementation strategy should focus on creating reliable processes that generate consistent, useful data for decision-making. Whether you’re using a basic fba revenue calculator or an advanced amazon fba calculator platform, the implementation approach determines your success more than the tool itself.

Calculator Selection and Setup Process: Building Your Foundation

Calculator selection isn’t a decision you want to revisit frequently. Migration between systems is time-consuming and disruptive, so getting it right the first time saves significant headaches down the road.

Your business needs will evolve as you grow. The calculator that works for 10 products might not scale to 100 products. Consider your growth trajectory when evaluating options, not just your current situation. A scalable revenue calculator amazon solution should accommodate your expansion plans.

Recent market developments highlight the importance of choosing tools with strong support systems. Jungle Scout does not officially offer a free trial and has stated this clearly on their website, though they provide a 7-day money-back guarantee. This trend toward paid-only models means sellers need to be more selective in their tool choices.

Evaluation Criteria for Calculator Tools: What Actually Matters

Fee accuracy should be your top priority. A calculator that’s off by even 2-3% on fees can lead to significant profit miscalculations when you’re dealing with thin margins. Verify accuracy against your actual Amazon statements before committing.

How well it talks to your other tools determines how much manual work you’ll need to do ongoing. Can it pull data from your inventory management system? Does it integrate with your accounting software? These connections save hours of manual data entry. A comprehensive fba fee calculator should seamlessly connect with your existing business systems.

Reporting features matter more as you scale. Basic profit calculations work for a few products, but portfolio analysis becomes essential as you grow. Make sure the reporting capabilities match your analytical needs.

Scalability isn’t just about handling more products—it’s about maintaining performance and accuracy as complexity increases. Test the system with realistic data volumes before making your final decision. Just as choosing the right SEO tools requires evaluating features against your specific needs, selecting an FBA calculator demands careful assessment of your business requirements.

Calculator Evaluation Checklist:

-

Fee accuracy verified against actual Amazon statements

-

Real-time fee updates from Amazon API

-

Integration with existing inventory management systems

-

Bulk product analysis capabilities

-

Scenario modeling an

-

Scenario modeling and “what-if” analysis tools

-

Export capabilities for further analysis

-

Mobile accessibility for on-the-go calculations

-

Customer support responsiveness and quality

-

Pricing structure alignment with business size

-

User interface intuitiveness and learning curve

Implementation Steps and Best Practices: Getting Started Right

Start with a small subset of your products to test and refine your processes before rolling out to your entire catalog. This approach helps you identify issues and optimize workflows without overwhelming yourself.

Product categorization needs to be consistent and logical. Develop a system that makes sense for your business and stick to it. Inconsistent categorization makes portfolio analysis nearly impossible when using your amazon fba profit calculator effectively.

Cost tracking systems need to capture all relevant expenses, not just the obvious ones. Create standardized processes for recording prep fees, shipping costs, and other variable expenses that impact profitability.

Documentation is crucial during implementation. Record your setup decisions, categorization logic, and process workflows. This documentation becomes invaluable when training team members or troubleshooting issues later.

Data Validation and Accuracy Checks: Maintaining Reliability

Validation isn’t a one-time activity—it’s an ongoing process that maintains the integrity of your profit analysis. Set up regular checks against your actual Amazon statements to verify fee calculations and identify any discrepancies in your amazon revenue calculator results.

Market performance validation involves comparing projected profits with actual results. Significant variances indicate either calculation errors or unrealistic assumptions that need adjustment.

Create validation checklists to ensure consistency in your accuracy checks. These checklists help maintain quality control and make it easier to delegate validation tasks as your team grows.

Here’s what I want you to do right now: Pick three of your best-selling products and run them through whatever calculator you’re using. Then check those numbers against your actual Amazon statements from last month. I bet you’ll find some surprises.

Performance Monitoring and Optimization: Continuous Improvement

Keeping an eye on whether your calculations match reality transforms your calculator from a static tool into a dynamic business intelligence system. Regular monitoring helps you identify trends, validate assumptions, and adjust strategies based on real market feedback.

The optimization process should be data-driven, not based on gut feelings or assumptions. Your revenue calculator should inform decisions, not make them for you.

Regular Calculation Reviews: Staying on Track

Monthly reviews should focus on accuracy and immediate adjustments. Are your calculations matching actual results? Have any fees changed? Are your cost assumptions still valid?

Quarterly reviews should take a broader strategic view. Which products are performing better or worse than projected? What market trends are impacting your profitability? How should you adjust your product mix or pricing strategy? Your amazon fba revenue calculator data should drive these strategic discussions.

Review cycles need to be calendar-driven, not event-driven. It’s too easy to skip reviews when you’re busy, but that’s exactly when you need them most. Consistent review schedules maintain the discipline necessary for accurate profit analysis.

Set a calendar reminder right now – first Monday of every month, review your top 10 products. Takes 30 minutes and could save you thousands. Do it now before you forget.

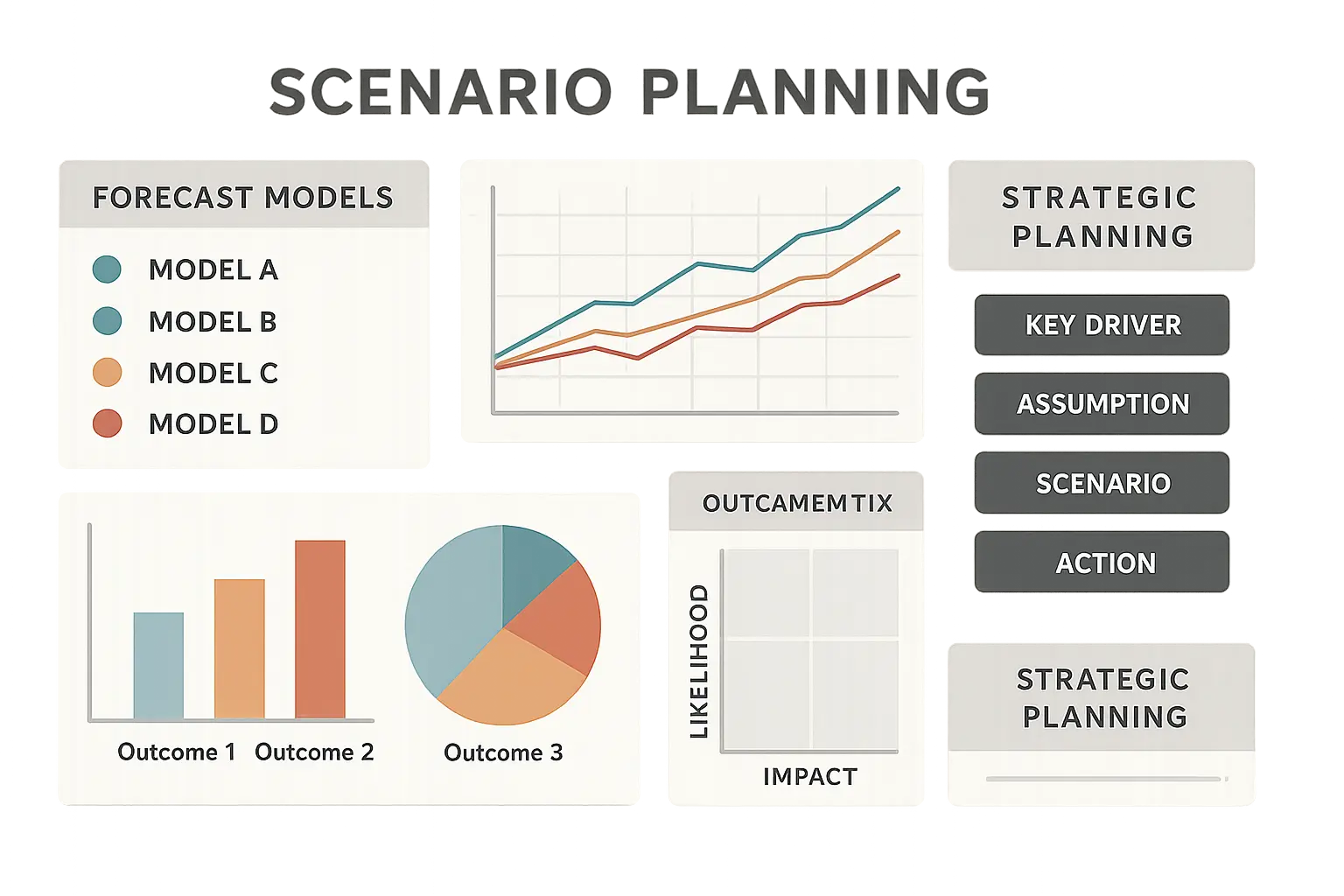

Scenario Planning and Forecasting: Preparing for What’s Next

What-if calculations help you prepare for different market conditions before they occur. What happens if Amazon raises FBA fees by 10%? How would a 20% price reduction impact your profitability? These scenarios help you develop contingency plans.

Forecasting capabilities let you model growth scenarios and resource requirements. If you want to double your sales volume, what will that do to your storage costs and cash flow requirements? An effective amazon price calculator should handle these complex projections seamlessly.

The most valuable scenarios to model are the ones that make you uncomfortable. What if your main competitor drops prices by 30%? What if Amazon changes their algorithm and your sales drop by 50%? Planning for these scenarios helps you respond quickly when they occur.

Maybe I’m paranoid, but I’ve been burned too many times by not thinking through the worst-case scenarios. Better to plan for problems you don’t have than get blindsided by ones you should have seen coming.

Integration with Business Operations: Beyond Basic Calculations

Integration is where calculators prove their real value. Standalone profit calculations are interesting, but integrated analysis drives better business decisions across every aspect of your Amazon operations.

This isn’t sexy stuff, but it’s the difference between making money and losing your shirt. The goal is to make your fba revenue calculator data actionable across all business functions—from inventory purchasing to pricing strategy to growth planning. This requires systematic integration with your existing business processes. Your amazon fba calculator should become as integral to your operations as your inventory management system.

Inventory and Pricing Strategy Integration: Making Data-Driven Decisions

Inventory decisions based on accurate profit calculations prevent costly mistakes. You’ll avoid over-investing in low-margin products and under-investing in high-profit opportunities.

Pricing strategy integration means your prices reflect true profitability requirements, not just competitive positioning or gut feelings. This approach maintains margins while remaining competitive and maximizes your amazon profit potential across your entire product portfolio.

Purchase Decision Framework: Smart Inventory Investments

Minimum profit thresholds create discipline in your purchasing decisions. If a product doesn’t meet your profitability requirements, you don’t buy it—regardless of how “promising” it looks.

ROI requirements help you compare different investment opportunities objectively. Should you invest $10,000 in more inventory for Product A or launch Product B? Your fba revenue calculator amazon data provides the answer.

Inventory replenishment decisions should be profit-driven, not just velocity-driven. Fast-moving products aren’t always the most profitable, and your purchasing decisions should reflect this reality.

The framework should include risk assessment based on your profit margins. Products with higher margins can tolerate more risk, while thin-margin products require more conservative approaches. Similar to how comprehensive auditing processes ensure data accuracy in analytics, systematic purchase decision frameworks maintain profitability discipline in inventory management.

Purchase Decision Framework Template:

Minimum Thresholds:

-

Gross margin: ___% minimum

-

Net profit per unit: $___

-

ROI target: ___% annually

-

Break-even volume: ___ units

Risk Assessment Criteria:

-

High margin (>30%): Moderate risk acceptable

-

Medium margin (15-30%): Conservative approach

-

Low margin (<15%): High caution required

Decision Matrix:

-

Meets minimum profit threshold

-

Achieves target ROI

-

Break-even volume realistic

-

Risk level appropriate for margin

-

Market demand validated

-

Competition analysis completed

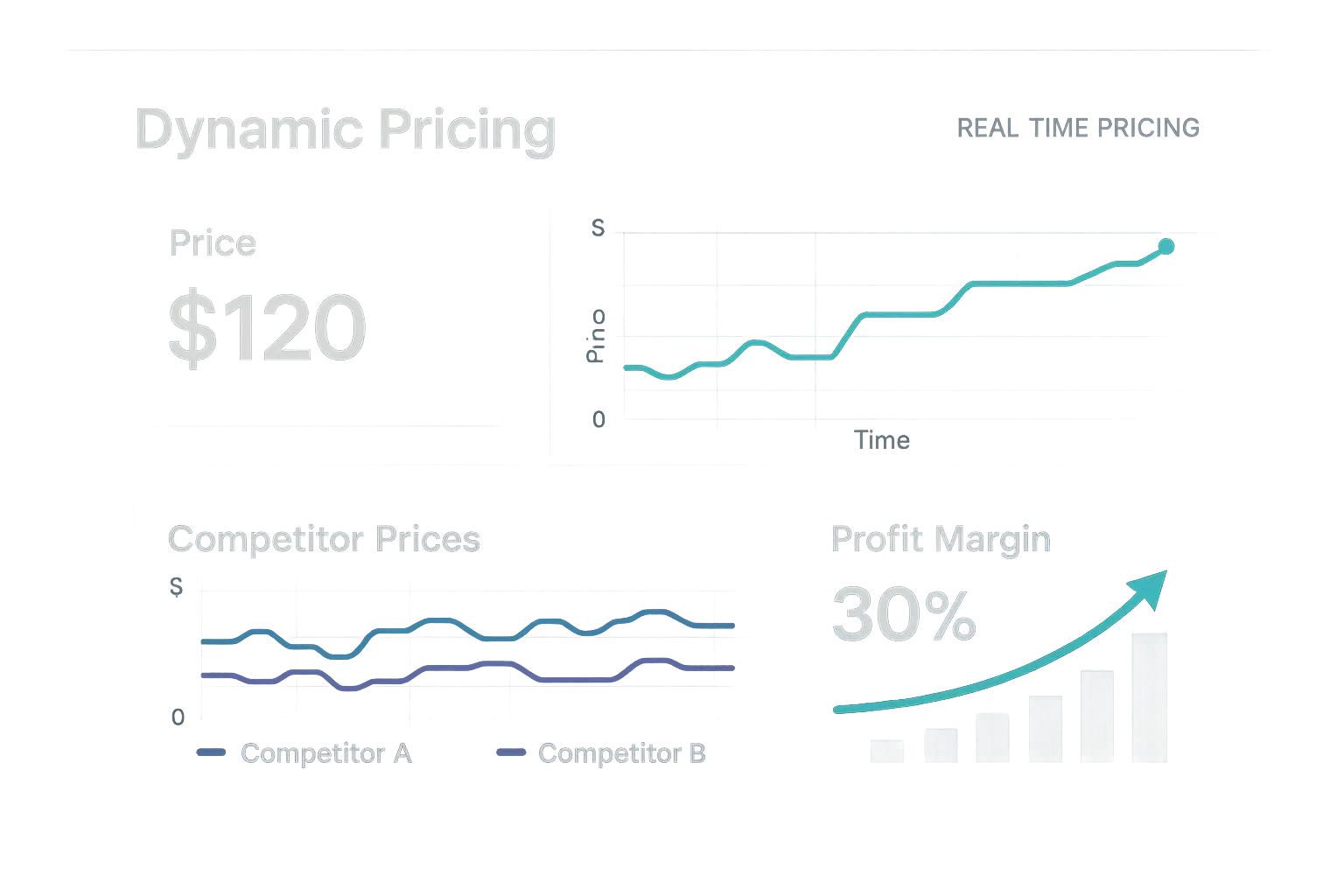

Dynamic Pricing Strategies: Responding to Market Changes

Dynamic pricing isn’t about changing prices randomly—it’s about making calculated adjustments based on profitability data. When competitors drop prices, you need to know immediately whether you can match them and still make money.

Cost fluctuations require immediate pricing responses. If your supplier raises prices by 15%, your selling price needs to adjust accordingly, or your margins disappear overnight. Your amazon fba profit calculator should trigger these adjustments automatically.

Demand changes create pricing opportunities that profit-focused sellers can capitalize on. When demand spikes, your calculator helps you determine optimal pricing that maximizes revenue without leaving money on the table.

The key is automation. Manual price adjustments based on profit calculations are too slow for Amazon’s marketplace. Your systems need to make these adjustments automatically based on predefined profit parameters.

I had a client selling phone cases who didn’t realize that Amazon classifies them differently based on thickness. Her “thin” cases were actually in the next size tier up, adding $2 per unit in fees she never saw coming. But once we figured it out, we could price accordingly and stay competitive.

Scaling and Growth Planning: Building for the Future

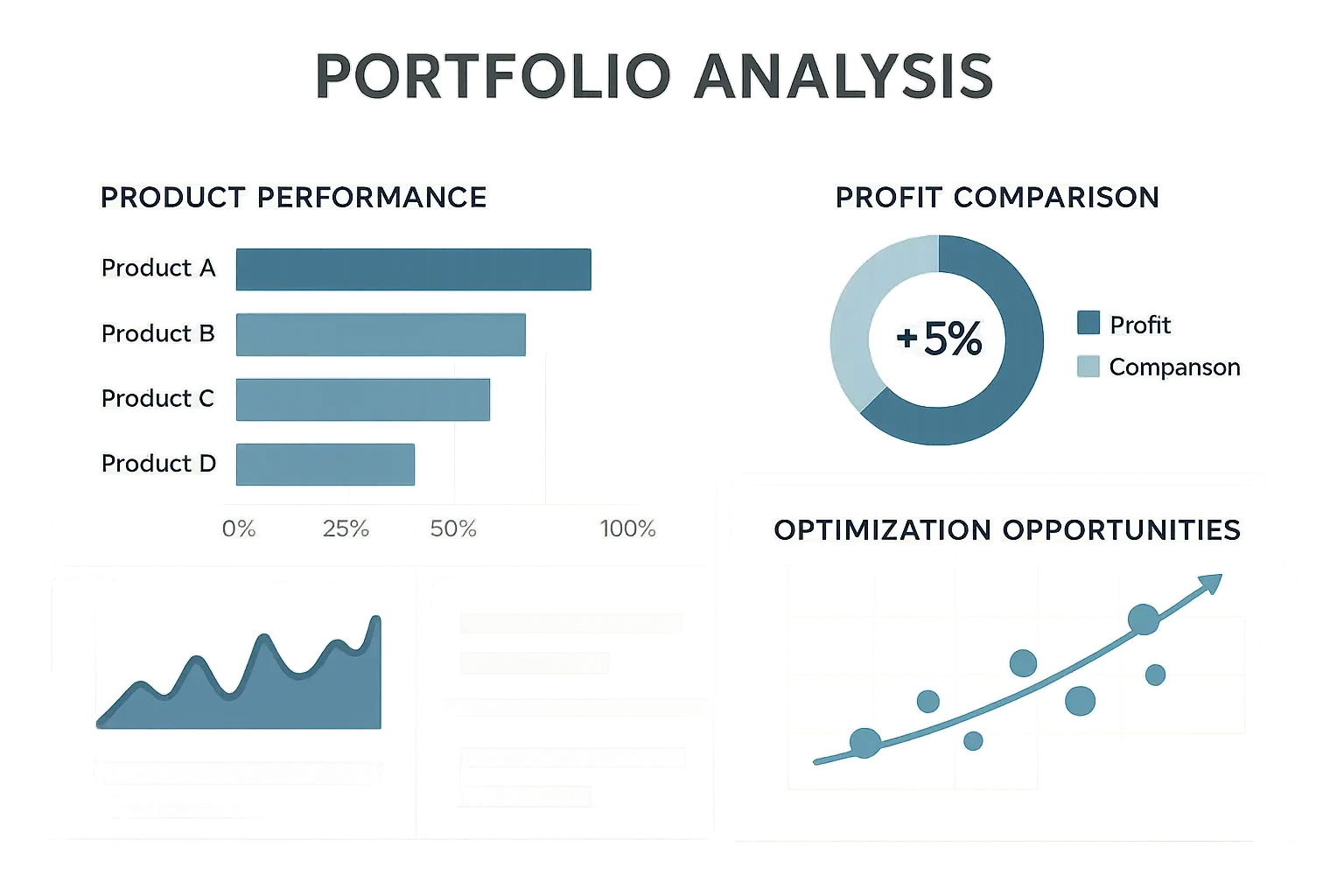

Growth planning requires portfolio-level analysis that goes beyond individual product profitability. You need to understand how your entire product mix performs and where to focus your expansion efforts.

Strategic decisions about market expansion, new product categories, and resource allocation all depend on accurate profitability analysis. Your revenue calculator data should drive these high-level business decisions while supporting sustainable amazon revenue growth.

Amazon’s fee structure continues evolving, with recent announcements showing no new Amazon seller fees for 2025: Instead, Amazon announced select fee reductions and new incentives, such as waived FBA inbound placement fees for new listings and discounts for high-demand products. These changes create opportunities for strategic sellers who can quickly adapt their calculations and strategies.

Portfolio Performance Analysis: Optimizing Your Product Mix

Portfolio analysis reveals patterns that individual product analysis misses. You might discover that certain product categories consistently outperform others, or that seasonal patterns affect your entire business differently than expected.

Top-performing products deserve more investment and attention. Your calculator data should identify these winners clearly so you can double down on what’s working and maximize amazon profit across your portfolio.

Underperforming SKUs drain resources and attention from profitable opportunities. Regular portfolio analysis helps you identify these problems early and make tough decisions about discontinuation or improvement.

Product line optimization involves more than just eliminating poor performers. Sometimes it’s about finding complementary products that improve your overall portfolio performance or identifying gaps in your current offerings. Just as identifying high-impact content topics requires systematic analysis of performance data, optimizing your Amazon product portfolio demands regular review of profitability metrics.

The analysis should consider both absolute profits and resource efficiency. A product that generates $1,000 monthly profit but requires minimal attention might be more valuable than one generating $2,000 but consuming significant time and resources.

|

Performance Tier |

Profit Margin |

Monthly Volume |

Action Required |

|---|---|---|---|

|

Star Performers |

>25% |

>100 units |

Scale investment |

|

Solid Contributors |

15-25% |

50-100 units |

Maintain/optimize |

|

Marginal Products |

8-15% |

25-50 units |

Improve or monitor |

|

Problem Children |

<8% |

<25 units |

Fix or eliminate |

|

Seasonal Winners |

Variable |

Variable |

Time-based strategy |

Amazon Fee Calculator Mastery: Decoding the Complex Fee Maze

Amazon’s fee structure is intentionally complex, and mastering it gives you a significant competitive advantage. Most sellers underestimate the impact of fees on their profitability, leading to pricing decisions that slowly erode their margins.

Fee mastery isn’t just about understanding current rates—it’s about anticipating changes, understanding category variations, and planning for seasonal fluctuations that can dramatically impact your bottom line. A comprehensive amazon fba calculator becomes your weapon against Amazon’s complexity, while a sophisticated fba revenue calculator helps you navigate the fee maze systematically.

Fee Structure Complexity and Variations: Understanding the Full Picture

The complexity isn’t accidental—Amazon benefits from sellers who don’t fully understand their fee structure. Mastering these details gives you pricing power that less informed competitors lack.

Size and weight classifications have dramatic impacts on FBA fees. Understanding these thresholds helps you make better sourcing decisions and avoid products that fall into expensive fee categories.

I’ve seen grown men cry over storage fees. Not kidding. Amazon’s Q4 storage spike has broken more than a few sellers. Storage duration fees compound over time and can transform profitable products into money losers. Long-term storage fees are particularly brutal and require careful inventory management to avoid. Similar to how understanding complex analytical frameworks helps optimize business systems, mastering Amazon’s fee structure requires systematic analysis and continuous learning.

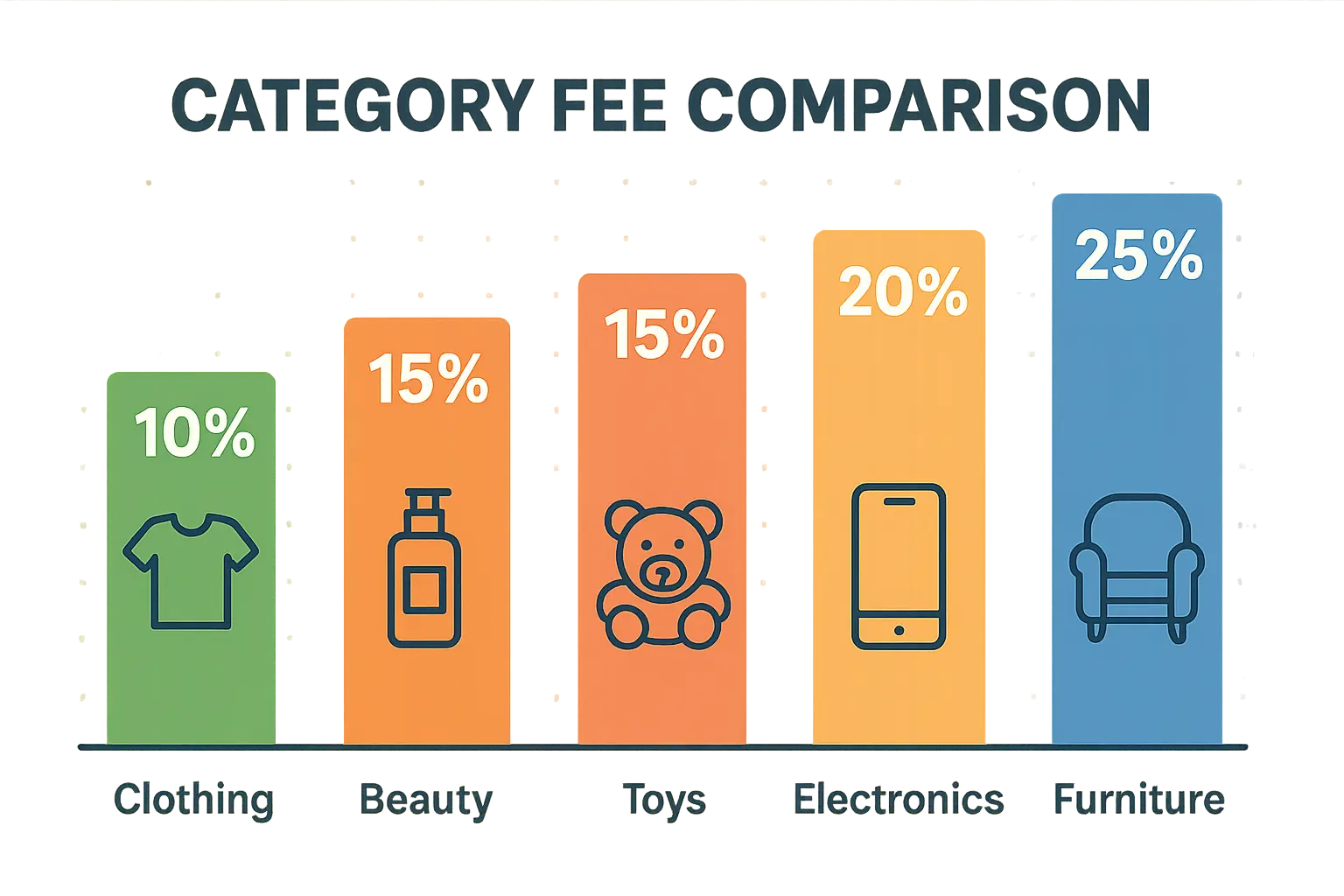

Category-Specific Fee Calculations: Navigating the Variations

The fee variations are substantial and can make or break product profitability. Referral fees range from 8% to 15%, with some categories reaching as high as 45%. A minimum referral fee of $0.30 per item ensures a baseline revenue for Amazon, regardless of the item price.

Some categories have minimum referral fees that disproportionately impact low-priced items. These minimums can make certain price points completely unviable from a profitability standpoint.

FBA fee structures also vary by category, with some products incurring additional handling fees or special processing charges. These variations need to be factored into your profitability calculations from the beginning.

Category changes aren’t always possible once you’re established, making initial category selection crucial for long-term profitability. Research fee implications thoroughly before launching in any category.

Now, this is where most people screw up – they assume all categories are created equal. They’re not. Not even close.

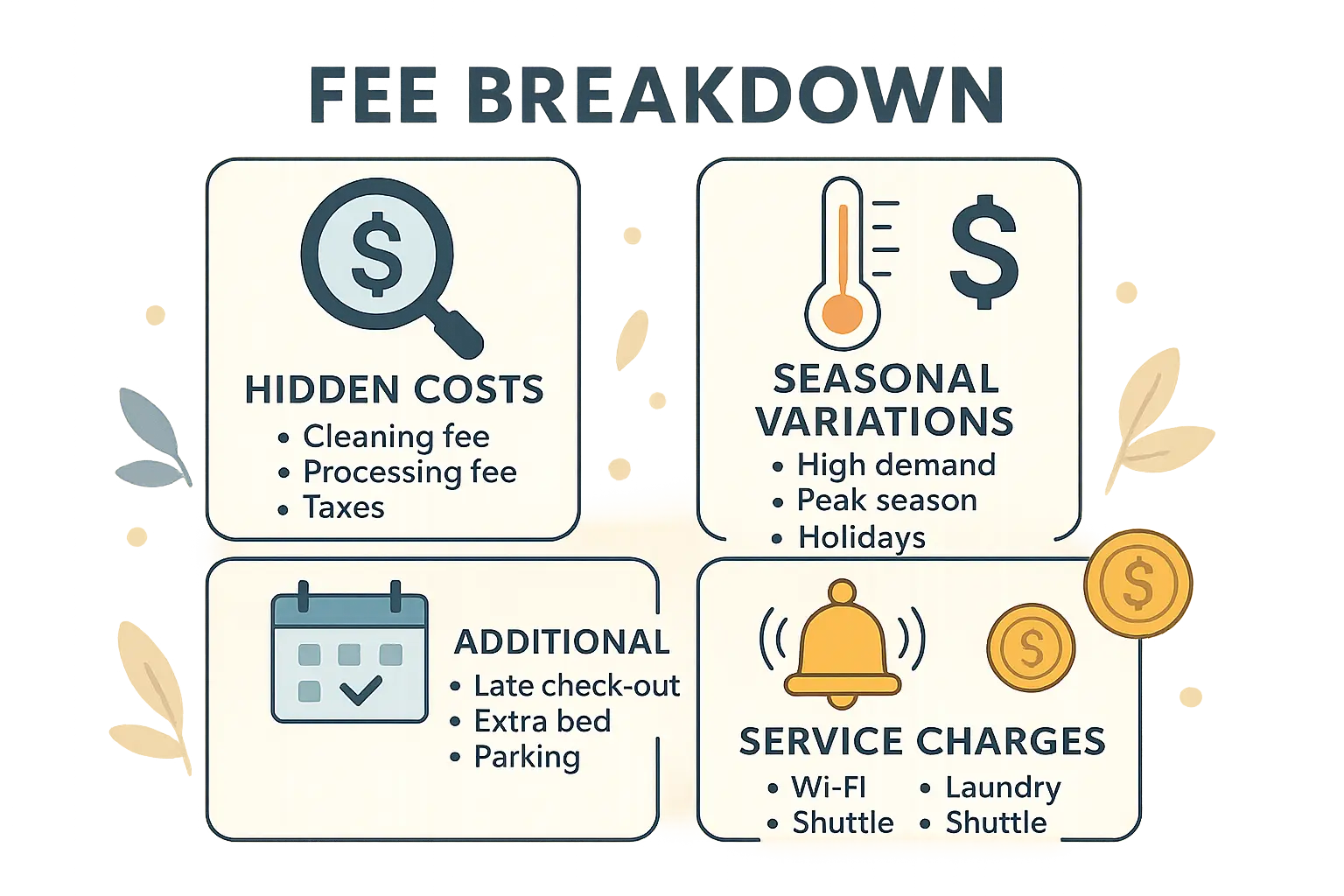

Seasonal and Storage Fee Impacts: Planning for Fluctuations

Seasonal storage fee spikes occur predictably but still catch many sellers off guard. Q4 storage fees can be 3-4 times higher than other periods, turning profitable products into losers if you’re not prepared.

Long-term storage fees kick in at 365 days and are designed to be punitive. Products that don’t sell within a year become extremely expensive to store, requiring aggressive pricing or removal strategies.

Inventory planning needs to account for these seasonal variations. Sending too much inventory before Q4 can result in massive storage fees, while sending too little means missing sales opportunities.

The key is timing your inventory shipments to minimize storage fees while maintaining adequate stock levels. This requires sophisticated planning that factors in sales velocity, seasonal patterns, and fee structures.

Stop what you’re doing and go check your long-term storage fees. Seriously. Go to your Amazon dashboard and look. If you see anything over 300 days old, deal with it today. Your future self will thank you.

Additional Service Fee Integration: The Hidden Costs

Prep service fees add up quickly, especially for products requiring special handling, labeling, or packaging. These costs need to be factored into your initial profitability calculations, not discovered after the fact.

Removal fees become relevant when products don’t sell as expected or when you need to clear inventory for seasonal reasons. Understanding these costs helps you make better decisions about when to remove versus when to liquidate through pricing.

Return processing fees vary by product type and can be substantial for certain categories. Electronics, apparel, and other high-return categories need to factor these costs into their profitability models.

Disposal fees apply when returned products can’t be resold. These fees represent total loss of your investment plus additional costs, making return rates a crucial factor in product selection and profitability analysis.

The most successful sellers build these additional fees into their profit calculations from the beginning rather than treating them as unexpected costs that erode margins.

Hidden Cost Tracking Template:

Prep Services:

-

Labeling: $____ per unit

-

Packaging: $____ per unit

-

Special handling: $____ per unit

Return/Removal Costs:

-

Return processing: ____% of sales

-

Removal fees: $____ per unit

-

Disposal fees: $____ per unit

Seasonal Adjustments:

-

Q4 storage multiplier: ___x

-

Peak season prep delays: $____

-

Holiday return rate increase: ____%

Running an Amazon FBA business without mastering profit calculations is driving blindfolded—you might get lucky for a while, but eventually, you’ll crash. The sellers who consistently succeed are those who treat their FBA revenue calculators as essential business tools, not optional accessories.

The complexity of Amazon’s marketplace rewards sellers who invest time in understanding the financial mechanics of their business. While your competitors are guessing at their profitability, you can make data-driven decisions that protect and grow your margins.

If you’re struggling to get clear visibility into your marketing ROI across different channels, The Marketing Agency’s data-driven approach to performance analysis can help. Just as FBA calculators reveal hidden profit killers in your Amazon business, our systematic approach to marketing analysis uncovers opportunities and inefficiencies in your digital marketing spend. We obsess over the numbers that matter—conversion rates, customer acquisition costs, and lifetime value—because we know that’s where real business growth happens.

Ready to apply the same analytical rigor to your marketing that successful Amazon sellers use for their FBA calculations? We can discuss how our performance-focused approach can optimize your marketing ROI across PPC, email, and inbound marketing channels.

Final Thoughts

Listen, I know this stuff isn’t fun. I’d rather be sourcing new products or optimizing listings too. But here’s the thing – every successful Amazon seller I know treats their calculator like their best friend. Not because they love math, but because they love making money more than they hate doing math.

You don’t need to become an accountant, but you do need to know if you’re making money or just playing an expensive game. Start small, be consistent, and don’t let Amazon’s complexity intimidate you into making blind decisions.

Your future self is counting on you to figure this out. Don’t let them down.