I remember when Uber first launched in my city. Like most people, I was skeptical – why would I get in a stranger’s car? But after my first ride (which arrived faster than any taxi I’d ever called), I was hooked. Since then, I’ve watched dozens of companies try to copy what Uber did, and most completely miss the point.

Uber didn’t just change transportation – it rewrote the entire playbook for platform businesses. With 156 million monthly active users, they’ve created one of history’s most successful marketplaces by making experiences simple, intuitive, and personalized while removing every possible friction from the customer journey.

Table of Contents

-

Platform Economics Revolution: Building Two-Sided Marketplaces That Actually Work

-

Technology Infrastructure: The Engine Behind Uber’s Global Domination

-

Regulatory Warfare: Surviving Government Battles Across 70+ Countries

-

Marketing Mastery: From Growth Hacking to Billion-Dollar Brand Building

-

Financial Reality Check: The Long Road to Profitability

-

Competitive Combat: Outmaneuvering Rivals in a Cutthroat Market

TL;DR

-

Uber transformed transportation by creating powerful network effects where more drivers attracted more riders, and vice versa

-

Real-time matching algorithms and surge pricing became the secret weapons for balancing supply and demand

-

Regulatory battles shaped Uber’s strategy more than any competitor – they had to reinvent their business model multiple times

-

Growth hacking tactics like referral programs drove early adoption, but brand building became crucial for long-term success

-

Unit economics took years to perfect – profitability required diversifying beyond rides into delivery and freight

-

Competition forced constant innovation in pricing, features, and market expansion strategies

Platform Economics Revolution: Building Two-Sided Marketplaces That Actually Work

Here’s what’s really interesting about Uber’s story: they cracked the code that kills most two-sided marketplaces – the chicken-and-egg problem. You need drivers to attract riders, but you need riders to attract drivers. It’s brutal.

As someone who’s helped launch several marketplace businesses, I can tell you this problem is absolutely devastating. Neither side wants to join an empty platform. Uber’s solution? Strategic market entry with heavy subsidies on both sides until network effects kicked in.

The genius wasn’t in the technology – it was in understanding that each new driver made the service more valuable for riders, and each new rider made driving more attractive. This created a self-reinforcing cycle that became incredibly difficult for competitors to break.

Driver Supply Chain Optimization: Turning Anyone Into an Entrepreneur

The genius of Uber’s driver strategy wasn’t just making it easy to sign up (though that helped). They created a system where drivers could actually make decent money, especially in the early days when incentives were generous.

Surge pricing became their secret weapon. When demand spiked, prices increased, which pulled more drivers onto the road. This wasn’t just about maximizing revenue – it was about maintaining service reliability. Nobody wants to wait 20 minutes for a ride.

Their smart system that figures out which driver should pick you up optimized everything from pickup locations to route efficiency. Drivers didn’t need to know the city like traditional taxi drivers. The app handled navigation, payment processing, and even customer service issues.

But here’s what most people don’t realize: their driver economics had to work in dozens of different regulatory environments. In some cities, they could treat drivers as independent contractors. In others, they faced minimum wage requirements and benefits obligations.

|

Driver Optimization Strategy |

Implementation Method |

Business Impact |

|---|---|---|

|

Dynamic Incentives |

Real-time bonus adjustments based on supply/demand |

Maintained 90%+ service availability during peak hours |

|

Algorithmic Dispatch |

AI-powered matching considering distance, traffic, ratings |

Reduced average pickup time by 40% |

|

Flexible Onboarding |

Streamlined signup process with background checks |

Increased driver acquisition rate by 300% |

|

Performance Tracking |

Rating systems and feedback loops |

Improved service quality scores by 25% |

|

Market-Specific Adaptation |

Localized payment methods and regulations |

Enabled expansion to 70+ countries |

Demand Generation Mechanisms: Making Rides Irresistible

Remember the last time you waited 30 minutes for a taxi that never showed up? That’s the exact frustration Uber solved.

Getting people to try Uber was one challenge. Getting them to abandon taxis, public transit, and their own cars was another entirely. Convenience became their primary value proposition. One-tap booking, cashless payments, and real-time tracking weren’t just nice features – they were game-changers for urban transportation.

Pricing strategy varied dramatically by market. In some cities, Uber undercut taxis significantly. In others, they competed on convenience and reliability rather than price. They learned that different markets had different pain points with existing transportation options.

Market-specific customization went beyond pricing. When Uber entered the Indian market, they discovered that only 2% of the population had credit cards. Instead of abandoning the market, they quickly pivoted to accept cash payments – a feature that seemed contradictory to their cashless value proposition in Western markets. This adaptation allowed them to capture millions of users who would have been excluded by a credit-card-only model.

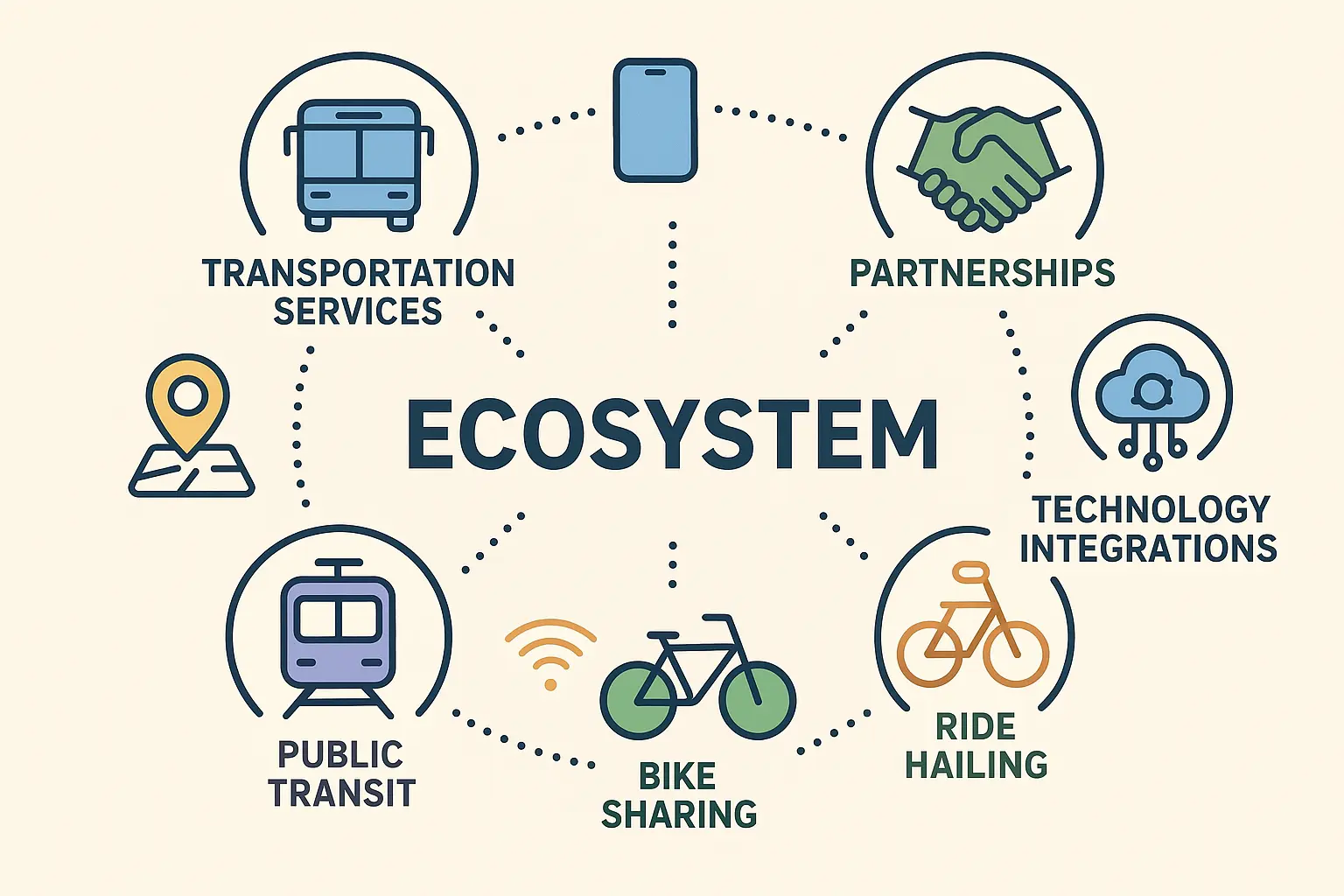

Cross-Platform Synergies: From Rides to Everything

Once Uber had drivers and riders on their platform, expanding into adjacent markets became almost inevitable. The same driver who gave you a ride could deliver your dinner. The same app interface could handle multiple services.

Uber Eats launched by leveraging existing driver supply during off-peak hours. Lunch and dinner delivery filled the gaps between morning and evening commute demand. This improved driver utilization and created additional revenue streams.

The technology infrastructure scaled beautifully across verticals. Real-time tracking, payment processing, and matching algorithms worked just as well for food delivery as they did for rides. Customer acquisition costs dropped because they could cross-sell services to existing users.

Uber Freight represented a bigger leap – moving from consumer services to B2B logistics. But the core platform mechanics remained similar: match supply (truck drivers) with demand (shipping needs) through technology-enabled marketplaces.

Technology Infrastructure: The Engine Behind Uber’s Global Domination

Most people see Uber as a transportation company, but honestly? They’re fundamentally a technology company that happens to move people and things around. Their competitive advantages came from superior algorithms, not superior cars or drivers.

Every aspect of their service depended on algorithms, data processing, and real-time decision making at massive scale. Without these technological capabilities, Uber would have remained a local taxi service rather than becoming a global platform.

Real-Time Matching Algorithms: The Magic Behind Every Ride

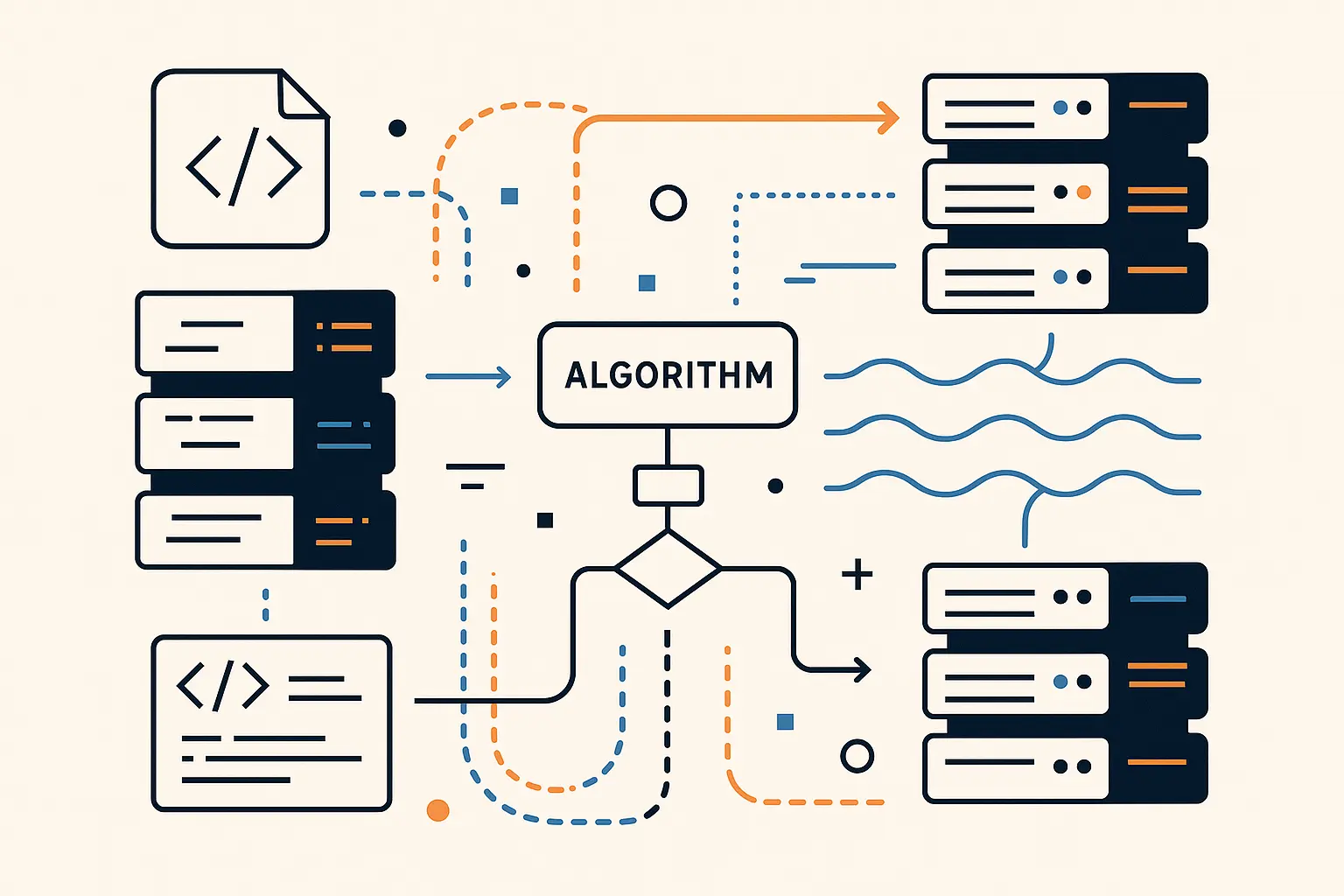

The matching algorithm sounds simple: find the closest available driver for each ride request. In reality, it’s incredibly complex optimization happening in real-time across thousands of variables.

Distance isn’t the only factor. The algorithm considers traffic conditions, driver ratings, vehicle type preferences, and even predicted demand patterns. If a driver is heading toward a high-demand area, they might get matched with a rider going in that direction, even if they’re not the absolute closest.

Route optimization happens continuously throughout each trip. The system monitors traffic conditions and can suggest alternate routes to drivers. This isn’t just about getting riders to their destinations faster – it’s about maximizing the number of trips each driver can complete per hour.

Demand prediction became crucial for positioning drivers before requests came in. The algorithm learned that certain locations would have high demand at specific times (airports during business hours, entertainment districts on weekends) and could incentivize drivers to position themselves accordingly.

Understanding how advanced analytics drive strategic growth helps explain why Uber’s data-driven approach to matching algorithms created such a significant competitive advantage over traditional transportation services.

Data Analytics and Machine Learning: Turning Information Into Intelligence

Data became Uber’s most valuable asset. Every trip generated dozens of data points: pickup and drop-off locations, time of day, route taken, driver and rider ratings, payment method, and much more.

Surge pricing algorithms processed this data in real-time to balance supply and demand. When ride requests exceeded available drivers in a specific area, prices increased automatically. This served two purposes: it encouraged more drivers to come online and reduced demand from price-sensitive riders.

Fraud detection systems protected against fake accounts, payment fraud, and driver gaming of the system. Machine learning models could identify suspicious patterns – like drivers taking unnecessarily long routes or riders creating multiple accounts to abuse promotions.

Predictive analytics optimized operations in ways that weren’t visible to users. The system could predict when drivers would need vehicle maintenance, which markets would have supply shortages, and even which drivers were likely to churn.

The feedback loop was continuous. Every trip made the algorithms smarter. Every market entry provided new data to improve global operations.

Recent research from “Gaining transparency in Uber’s algorithmic management” reveals how Uber’s algorithms organize driver work into three distinct time units: searching for passengers, approaching passengers, and driving with passengers. The study found that drivers in Paris spent increasingly more time searching for passengers after 2020, with this unpaid time significantly impacting their earnings while providing valuable market data to Uber’s algorithms.

Regulatory Warfare: Surviving Government Battles Across 70+ Countries

Turns out, dealing with city hall was just as hard as building the app. Regulatory battles defined Uber’s expansion strategy more than market research or competitive analysis. They entered markets first and dealt with legal challenges later – a strategy that worked in some places and backfired spectacularly in others.

Traditional taxi regulations weren’t designed for app-based ride-hailing. Uber operated in legal gray areas, arguing they were technology platforms connecting independent contractors, not transportation companies subject to taxi regulations.

Legal compliance costs sometimes exceeded technology investments in challenging markets. I’ve seen companies spend millions on lawyers and lobbyists just to operate legally in a single city.

Legal Framework Navigation: Fighting City Hall (And Winning Sometimes)

London became Uber’s highest-profile regulatory battle. Transport for London initially refused to renew their license, citing safety concerns and corporate culture issues. Uber had to completely overhaul their approach – improving driver background checks, implementing new safety features, and changing their corporate governance.

California’s AB5 law forced Uber to reclassify drivers as employees rather than independent contractors. This fundamentally changed their unit economics in their largest market. They spent over $200 million on a ballot initiative (Proposition 22) to create a third category of worker classification.

Each market required different strategies. In some European cities, Uber partnered with existing taxi companies rather than competing directly. In others, they focused on premium services that faced fewer regulatory restrictions.

The pattern was consistent: enter aggressively, face regulatory pushback, then adapt the business model to achieve compliance while maintaining profitability. This process could take years and cost millions in legal fees and lobbying expenses.

Compliance Strategy Evolution: Learning to Play by the Rules

Early Uber operated on the “ask for forgiveness, not permission” principle. They’d launch in new markets without regulatory approval, build user demand, then negotiate from a position of strength when governments tried to shut them down.

This strategy worked until it didn’t. High-profile incidents, negative media coverage, and organized opposition from taxi unions forced a more collaborative approach. Uber hired former government officials, invested in safety technology, and began engaging with regulators before entering new markets.

Safety features became central to their compliance strategy. They added driver background checks, real-time trip monitoring, emergency buttons, and insurance coverage that exceeded traditional taxi requirements. These weren’t just regulatory requirements – they became competitive advantages.

Pricing transparency addressed concerns about surge pricing exploitation. Uber implemented caps on surge multipliers, clearer communication about pricing, and alternative fixed-price options during high-demand periods.

The compliance evolution was expensive but necessary. Markets where Uber maintained adversarial relationships with regulators remained unstable and unprofitable. Collaborative approaches led to more sustainable long-term growth.

Public Relations and Government Relations: Winning Hearts and Minds

Public opinion became a crucial battleground in regulatory fights. Uber mobilized their user base to pressure politicians and regulators. When cities threatened bans, Uber users would receive push notifications encouraging them to contact their representatives.

These grassroots campaigns were remarkably effective. Politicians discovered that Uber had passionate defenders among their constituents – people who relied on the service for transportation to work, medical appointments, and social activities.

I was in London when Transport for London tried to ban Uber. The outcry from regular people was incredible – suddenly everyone realized how much they relied on the service. Media strategy shifted from defensive to proactive. Instead of just responding to criticism, Uber began highlighting positive stories: drivers earning income, improved transportation access in underserved areas, and reduced drunk driving incidents.

Government relations became a core competency. Uber hired experienced lobbyists and former government officials who understood local political dynamics. They learned that regulatory success required building relationships before crises occurred.

The transformation wasn’t just tactical – it reflected a fundamental shift in corporate culture. The aggressive “growth at all costs” mentality gave way to a more sustainable approach that prioritized stakeholder relationships alongside financial metrics.

Market-Specific Customization: When in Rome, Do as the Romans Do

Global expansion taught Uber that one size doesn’t fit all. Each market had unique transportation needs, regulatory requirements, and cultural preferences that required customized approaches.

Payment methods varied dramatically by market. While credit cards dominated in the US, many international markets required cash payment options, mobile money integration, or local payment platforms. Uber had to rebuild their payment infrastructure for each region.

Service offerings adapted to local transportation patterns. In some markets, Uber focused on premium services competing with taxis. In others, they introduced lower-cost options competing with public transit. Motorcycle taxis worked in Southeast Asia but not in European cities.

Regulatory customization went beyond compliance to competitive strategy. In markets with strict taxi regulations, Uber emphasized their technology platform benefits. In markets with safety concerns, they highlighted their tracking and insurance features.

Cultural adaptation affected everything from app interface design to customer service approaches. What worked in Silicon Valley didn’t necessarily work in Mumbai, São Paulo, or Lagos.

Uber’s evolving approach to public-private partnerships is demonstrated in Wellington County, Canada, where “Ride Well has integrated Uber into its public transit platform” to serve over 107,000 residents. Since the integration in June 2024, the service has seen consistent month-over-month ridership growth and a 50% increase in new riders, showing how Uber now collaborates with rather than competes against public transportation systems.

Marketing Mastery: From Growth Hacking to Billion-Dollar Brand Building

Here’s where things get really interesting. Uber’s marketing journey is like watching someone grow up – they went from scrappy startup tactics to sophisticated brand campaigns, and honestly, they made plenty of mistakes along the way.

I remember their early days when they’d just show up at events with free rides and branded water bottles. It sounds simple now, but back then? Revolutionary. Most companies were still buying newspaper ads while Uber was literally putting their service in people’s hands.

The transformation from growth hacking to real marketing wasn’t smooth. They had to learn that what works when you’re the new kid on the block doesn’t work when you’re fighting established competitors with deep pockets and government connections.

Growth Hacking and Viral Marketing: The Early Days Playbook

Uber’s referral program became legendary – and for good reason. Both riders and drivers got credits for successful referrals. Sounds obvious now, but this was before everyone and their grandmother had a referral program.

The genius wasn’t just the free money (though that helped). It was making sharing feel natural. When you had a great Uber experience, telling friends about it came with a built-in reward. No awkward sales pitch required.

Launch events in new cities were masterclasses in creating buzz. Uber would partner with local influencers, host exclusive events, and offer free rides during major conferences or festivals. These weren’t just marketing stunts – they were market research disguised as parties.

The timing was everything. Uber often launched during events when regular transportation was a nightmare. SXSW, major conferences, New Year’s Eve – anywhere people were frustrated with taxis, Uber showed up with a better solution.

The growth hacking mentality permeated everything. Every feature was evaluated for its viral potential. Every user interaction was optimized for sharing and referrals. The app itself became a marketing channel through features like trip sharing and driver ratings.

Referral Program Mechanics: Engineering Word-of-Mouth

The referral program’s brilliance lay in its simplicity. Existing users got ride credits for successful referrals. New users got discounted or free first rides. Everyone won, which is why it worked so well.

But here’s what most people miss – the tracking was incredibly sophisticated. Uber could measure not just immediate referrals but the long-term value of referred users. Turns out, people who joined through referrals stuck around longer and spent more money.

They added game-like elements that made it addictive. You could track your referral progress, compete with friends, and unlock bonus rewards for multiple successful referrals. It felt more like playing a game than traditional marketing.

The program constantly evolved based on real user behavior. Uber discovered that referred users had higher lifetime value and lower churn rates than users from paid advertising. This insight justified spending more on referrals and less on Facebook ads.

Uber’s launch strategy in Austin during SXSW 2014 is still talked about in marketing circles. They offered free rides during peak festival hours when taxis were impossible to find, positioned branded vehicles at high-traffic spots, and partnered with venues for exclusive transportation. The result? Frustrated festival-goers became instant evangelists, sharing their positive Uber experiences all over social media. User growth exploded 10x in just one week.

Strategic Partnerships and Integrations: Capturing High-Value Customers

Airport partnerships became gold mines for business traveler acquisition. Getting dedicated pickup areas and integrating with airport apps meant capturing travelers at their most frustrated moments – when they’re tired, loaded with luggage, and just want to get to their hotel.

Hotel integrations created seamless experiences. Guests could book Uber rides directly through hotel apps or concierge services. Hotels loved it because it improved guest satisfaction without any work on their part.

Event partnerships generated massive demand spikes and brand exposure. Becoming the “official transportation partner” for conferences and festivals meant thousands of people trying Uber during high-stress situations where it could really shine.

Corporate partnerships opened up B2B revenue streams. Uber for Business let companies provide rides for employees and clients. This created predictable revenue and introduced Uber to users who might never have tried it personally.

The partnership strategy evolved from grabbing any opportunity to building strategic relationships. Uber developed dedicated teams and technology platforms that made integrations easier for partners to implement.

Digital Advertising Evolution: From Performance to Brand

When growth hacking hit its limits, Uber had to learn traditional marketing. And let me tell you, the transition was painful. Suddenly they needed brand campaigns, emotional messaging, and all that “soft” marketing stuff that tech companies usually hate.

Performance marketing dominated early efforts. Uber optimized paid search campaigns for app downloads and first rides. Pretty straightforward – someone searches “taxi alternative,” they see an Uber ad.

Brand building became essential when competition heated up. You couldn’t compete solely on features anymore – everyone had apps, everyone had cars, everyone had drivers. Uber needed people to feel something about their brand.

Attribution got complicated fast. Users might see display ads, search for ride options, read reviews, and download multiple apps before taking their first Uber ride. Figuring out which ads actually worked became a full-time job.

Performance Marketing Optimization: Making Every Dollar Count

Paid search campaigns targeted high-intent keywords. “Airport transportation,” “taxi alternative,” location-specific searches – basically anywhere people were actively looking for rides. Keyword strategy varied by market because search behavior was totally different in different cities.

Mobile app install campaigns became crucial as smartphones took over. But Uber learned to optimize for completed rides, not just downloads. Turns out, lots of people download apps they never use.

Social media advertising leveraged detailed targeting. Uber could reach users based on location, demographics, interests, and behaviors. Campaign creative was customized for different audience segments – business travelers saw different ads than college students.

Bid management required constant optimization. Uber used automated bidding and machine learning to optimize campaigns across thousands of keywords and audience segments simultaneously. No human could manage that complexity.

Creative testing was systematic and data-driven. Uber tested ad copy, images, video content, and landing pages to identify what actually worked. Winning elements were scaled across campaigns and adapted for different markets.

Their sophisticated approach to campaign optimization mirrors the strategies outlined in our marketing ROI calculator guide, where measuring true return on advertising spend requires understanding lifetime value beyond initial conversions.

Brand Positioning and Creative Strategy: Beyond Features and Benefits

Brand positioning evolved from “taxi alternative” to “your personal driver” to “movement that ignites opportunity.” Each shift reflected different competitive landscapes and business priorities.

Creative strategy addressed emotional benefits beyond just getting from point A to point B. Campaigns highlighted freedom, convenience, and time savings. Uber wasn’t selling rides – they were selling lifestyle improvements and peace of mind.

Storytelling became central to brand campaigns. Instead of talking about features, Uber featured real drivers and riders sharing personal stories. These authentic narratives were way more compelling than “we have an app that calls cars.”

Visual identity and brand consistency became important as Uber expanded globally. The app interface, marketing materials, and physical presence needed to create cohesive brand experiences across markets.

Campaign themes addressed specific market challenges. In markets with safety concerns, campaigns emphasized security features. In markets with economic challenges, campaigns highlighted earning opportunities for drivers.

Attribution and ROI Measurement: Connecting Dots Across Touchpoints

Multi-touch attribution became essential as customer journeys grew complex. Users might see multiple ads before converting, and Uber needed to understand each touchpoint’s contribution to make smart budget decisions.

Incrementality testing measured true marketing impact by comparing exposed and control groups. This helped distinguish between marketing-driven conversions and organic growth that would have happened anyway.

Lifetime value calculations informed customer acquisition spending. Uber could justify higher acquisition costs for users with higher predicted lifetime value based on demographics, usage patterns, and acquisition channels.

Cross-channel measurement required sophisticated data integration. Uber needed to connect online advertising exposure with offline app usage and ride behavior. This required advanced tracking and data management capabilities.

Marketing mix modeling helped optimize budget allocation across channels. Uber could understand how different marketing activities interacted and identify the optimal spending mix for different business objectives.

Understanding complex attribution models became as crucial as the techniques described in our ROAS calculator analysis, where measuring true return on ad spend requires accounting for multiple touchpoints and long-term customer value.

Customer Retention and Lifecycle Marketing: Maximizing Long-Term Value

Customer retention became increasingly important as acquisition costs rose and markets matured. Uber discovered that keeping existing users was way more profitable than constantly acquiring new ones to replace people who churned.

Lifecycle marketing addressed different user segments and behavior patterns. New users got onboarding sequences encouraging second and third rides. Inactive users got re-engagement campaigns with special offers. High-value users got VIP treatment.

Personalization and User Experience: Making Every Interaction Count

Personalization started with the app interface. Frequent destinations appeared as shortcuts. Preferred ride types were highlighted. The app learned your patterns and made relevant suggestions.

Communication personalization went way beyond using names in emails. Uber sent targeted messages based on usage patterns, location data, and preferences. Frequent business travelers got different messages than occasional weekend users.

Promotional targeting became sophisticated. Instead of blanket discounts, Uber offered personalized incentives based on user behavior. Price-sensitive users might get discount codes, while convenience-focused users might get priority pickup offers.

Location-based personalization addressed local needs. Users in different cities saw relevant local features, payment options, and service types. The app felt native to each market rather than a generic global product.

Predictive personalization anticipated user needs. If you regularly took rides to the airport on Monday mornings, the app might proactively suggest booking a ride or offer relevant promotions.

Loyalty Programs and Gamification: Turning Rides Into Rewards

Uber Rewards (later Uber One) created a points-based loyalty system that encouraged frequent usage. Users earned points for rides and deliveries, which could be redeemed for discounts, upgrades, and exclusive perks.

Tier-based benefits provided increasing value for higher usage levels. Gold and Platinum members got priority pickup, flexible cancellations, and exclusive customer support. These benefits created switching costs and encouraged increased usage.

Gamification elements made the service more engaging. Users could track points, progress toward tier upgrades, and unlock special achievements. The loyalty program felt more like a game than a traditional rewards system.

Cross-platform integration meant loyalty benefits worked across Uber’s services. Ride points could be used for Uber Eats orders. Delivery activity counted toward ride tier status. This integration increased engagement across all services.

Program optimization was data-driven. Uber tested different point values, redemption options, and tier benefits to maximize engagement while maintaining profitability. The program evolved based on user behavior and competitive responses.

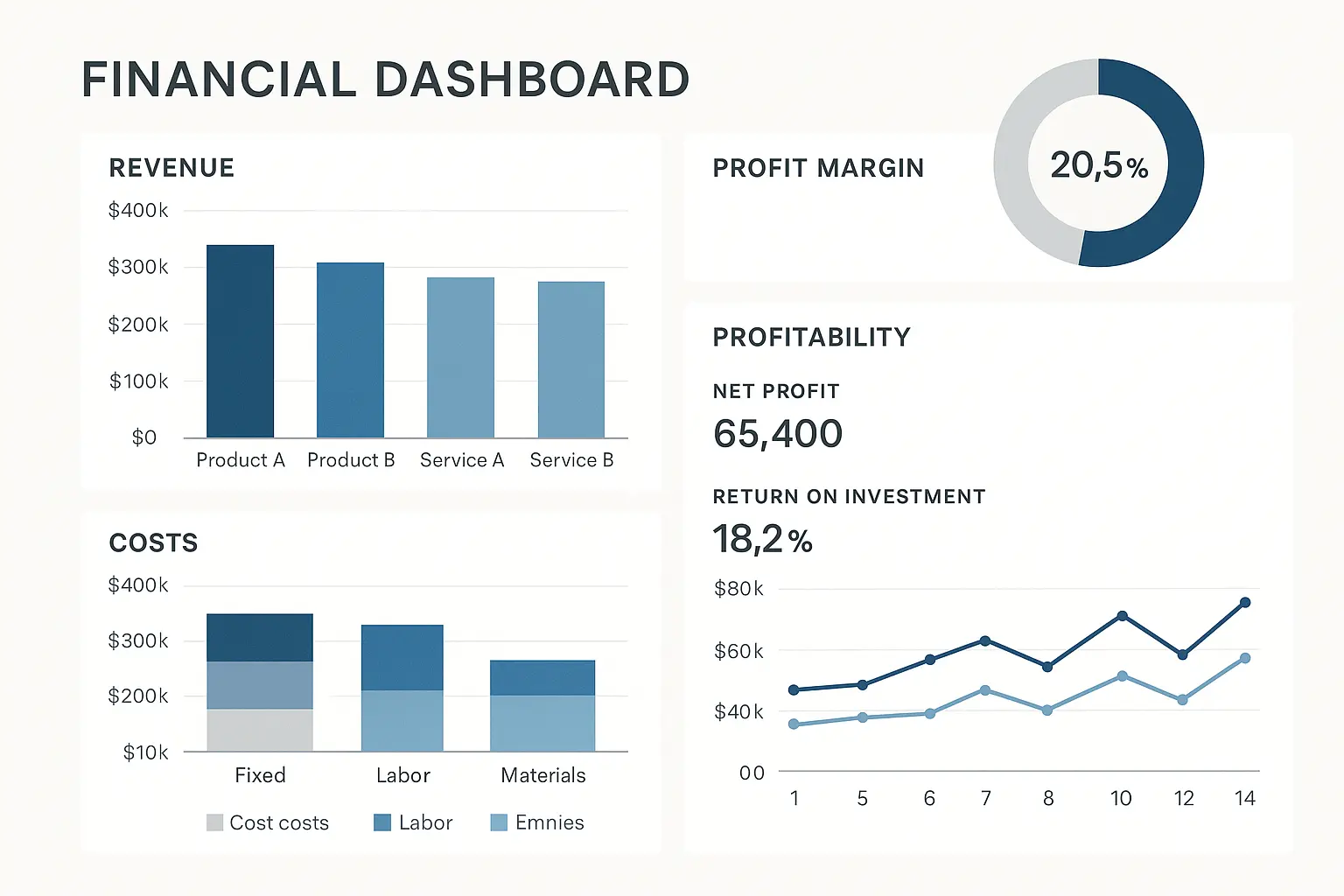

Financial Reality Check: The Long Road to Profitability

Let’s be honest – Uber’s financial story is pretty wild. They burned through billions (with a B) of dollars before making consistent money. For years, every ride was subsidized by venture capital, which sounds crazy until you understand the strategy.

The math was brutal from the beginning. Pay drivers enough to keep them happy, charge riders prices competitive with taxis, add customer acquisition costs, technology infrastructure, and regulatory compliance – and you’re losing money on every transaction.

The path to profitability required multiple strategic shifts: diversifying revenue, cutting costs, picking better markets, and fundamentally changing the business model in some regions.

I’ve seen plenty of platform companies fail because they couldn’t bridge the gap between growth and profitability. Uber’s story shows it’s possible, but it takes way longer than anyone expects.

Revenue Model Diversification: Beyond Just Rides

Revenue diversification became essential when ride-hailing alone couldn’t justify Uber’s massive valuation. The company leveraged its platform and brand to enter adjacent markets with better economics.

Uber Eats became the most successful diversification effort. Food delivery had higher frequency than rides, better margins in some markets, and used existing drivers during off-peak hours. Eventually it became profitable in markets where rides were still losing money.

Subscription services created predictable recurring revenue while increasing customer lifetime value. Subscribers used Uber services more frequently and had lower churn rates than regular users.

Premium services (Uber Black, Uber Comfort) commanded higher prices and better margins than standard rides. These services appealed to business travelers and customers willing to pay more for enhanced experiences.

Advertising revenue emerged as Uber scaled. Restaurants paid for promoted placement in Uber Eats. Local businesses advertised to riders during trips. These high-margin revenue streams improved overall profitability.

Since launching its advertising division in 2022, Uber’s advertising platform has already surpassed an impressive US$1 billion in annual revenue run rate, showing how diversification beyond core ride-hailing can create significant new revenue streams with higher margins.

Commission Structure Optimization: Finding the Sweet Spot

Commission rates (Uber’s cut of each transaction) became a critical profitability lever. Higher rates improved margins but risked driver dissatisfaction and competitive disadvantage.

Market-specific optimization meant different take rates in different cities. Mature markets with strong demand could support higher commissions. New markets required lower rates to attract drivers and build supply.

Service differentiation allowed varied commission structures. Premium services commanded higher take rates due to better customer willingness to pay. Delivery services had different economics than rides, requiring different approaches.

Dynamic commission adjustments responded to market conditions. During driver shortages, Uber might reduce take rates temporarily. During demand surges, higher commissions helped fund driver incentives.

Transparency improvements addressed driver concerns about commission changes. Uber began showing drivers exactly how much they earned versus total trip cost, reducing confusion and building trust.

Subscription and Premium Services: Recurring Revenue Gold

Uber One combined benefits across rides and delivery into a single subscription. Members got discounts, priority service, and exclusive features for a monthly fee. The subscription model created predictable revenue and increased customer stickiness.

Premium ride services (Uber Black, Uber Comfort) targeted business travelers and customers willing to pay more for enhanced experiences. These services had better margins and helped differentiate Uber from lower-cost competitors.

Corporate subscriptions (Uber for Business) created B2B revenue streams with different economics than consumer services. Business customers were less price-sensitive and provided more predictable demand patterns.

Subscription optimization required careful benefit design. Benefits needed to be valuable enough to justify the monthly fee while maintaining positive unit economics for Uber. The company tested different benefit combinations and pricing levels.

Cross-selling opportunities increased with subscription services. Uber One members were more likely to try new services and use Uber more frequently across all categories.

Cost Structure Management: Controlling the Burn Rate

Cost management became crucial as investor patience for losses decreased. Uber needed to optimize spending across driver incentives, technology development, marketing, and expansion while maintaining competitive positioning.

Driver incentives represented the largest variable cost. Uber used sophisticated algorithms to minimize incentive spending while maintaining adequate driver supply. This required balancing short-term costs with long-term driver satisfaction.

Technology infrastructure costs scaled with usage but required significant upfront investment. Uber optimized cloud computing costs, improved algorithm efficiency, and automated manual processes to reduce operational expenses.

Regulatory compliance costs varied dramatically by market. Some cities required expensive licensing, insurance, and safety measures. Uber had to evaluate whether compliance costs made certain markets unprofitable.

|

Cost Category |

Optimization Strategy |

Impact on Unit Economics |

|---|---|---|

|

Driver Incentives |

Dynamic algorithms, targeted bonuses |

Reduced incentive costs by 30% while maintaining supply |

|

Technology Infrastructure |

Cloud optimization, automation |

Decreased per-trip technology costs by 45% |

|

Customer Acquisition |

Performance marketing, referral programs |

Improved CAC payback period from 18 to 8 months |

|

Regulatory Compliance |

Market-specific strategies, partnerships |

Varied by market: $0.50-$3.20 per trip |

|

Market Expansion |

Selective entry, partnership models |

Reduced market entry costs by 60% |

Driver Economics and Incentive Design: Balancing Supply and Profitability

Driver incentives were Uber’s largest controllable cost. The company needed enough drivers to maintain service quality while minimizing incentive spending that hurt profitability.

Dynamic incentive systems adjusted payments based on real-time supply and demand. During driver shortages, incentives increased automatically. When supply was adequate, incentives decreased to improve unit economics.

Geographic optimization meant different incentive levels in different areas of the same city. High-demand areas might require surge pricing and driver bonuses. Low-demand areas might have minimal incentives.

Long-term driver retention became more cost-effective than constantly recruiting new drivers. Uber invested in driver satisfaction programs, better support systems, and career development opportunities to reduce churn.

Incentive effectiveness measurement helped optimize spending. Uber tracked which incentive types drove the most additional supply and focused spending on the most effective programs.

Market Entry and Expansion Costs: Investing for Future Returns

Market entry costs were substantial and required years to recover. Uber needed to invest in driver recruitment, customer acquisition, local operations, and regulatory compliance before generating meaningful revenue.

Geographic prioritization became essential as capital became more expensive. Uber focused on markets with favorable unit economics and regulatory environments while exiting or reducing investment in challenging markets.

Local competition required market-specific strategies and costs. In some markets, Uber faced well-funded local competitors that required aggressive pricing and incentive spending to gain market share.

Regulatory costs varied dramatically by market. Some cities required minimal compliance investment, while others demanded expensive licensing, insurance, and operational changes that affected long-term profitability.

Payback period analysis helped prioritize market investments. Uber developed models to predict how long it would take to recover market entry costs and achieve profitability in different geographic areas.

Technology and Infrastructure Scaling: Building for Global Operations

Technology infrastructure costs scaled with global operations but offered economies of scale. Core platform development could serve multiple markets, while local customization required additional investment.

Cloud computing optimization reduced operational costs as Uber’s usage patterns became more predictable. The company negotiated better rates with cloud providers and optimized resource utilization.

Automation reduced manual operational costs. Uber automated customer service, driver onboarding, payment processing, and many other functions that previously required human intervention.

Data infrastructure costs grew with the volume of transactions and analytics requirements. Uber invested in efficient data storage and processing systems that could handle millions of daily transactions while providing real-time insights.

Development efficiency improved through better engineering practices and tool investments. Uber could deploy new features faster and with fewer bugs, reducing the cost of maintaining and updating their platform.

Uber’s technology optimization efforts have yielded significant results, with their advertising operations alone seeing a nearly 70% increase in the speed of their end-to-end ad sales process after moving and modernizing over 100 processes in the cloud, demonstrating how technology investments can drive operational efficiency at scale.

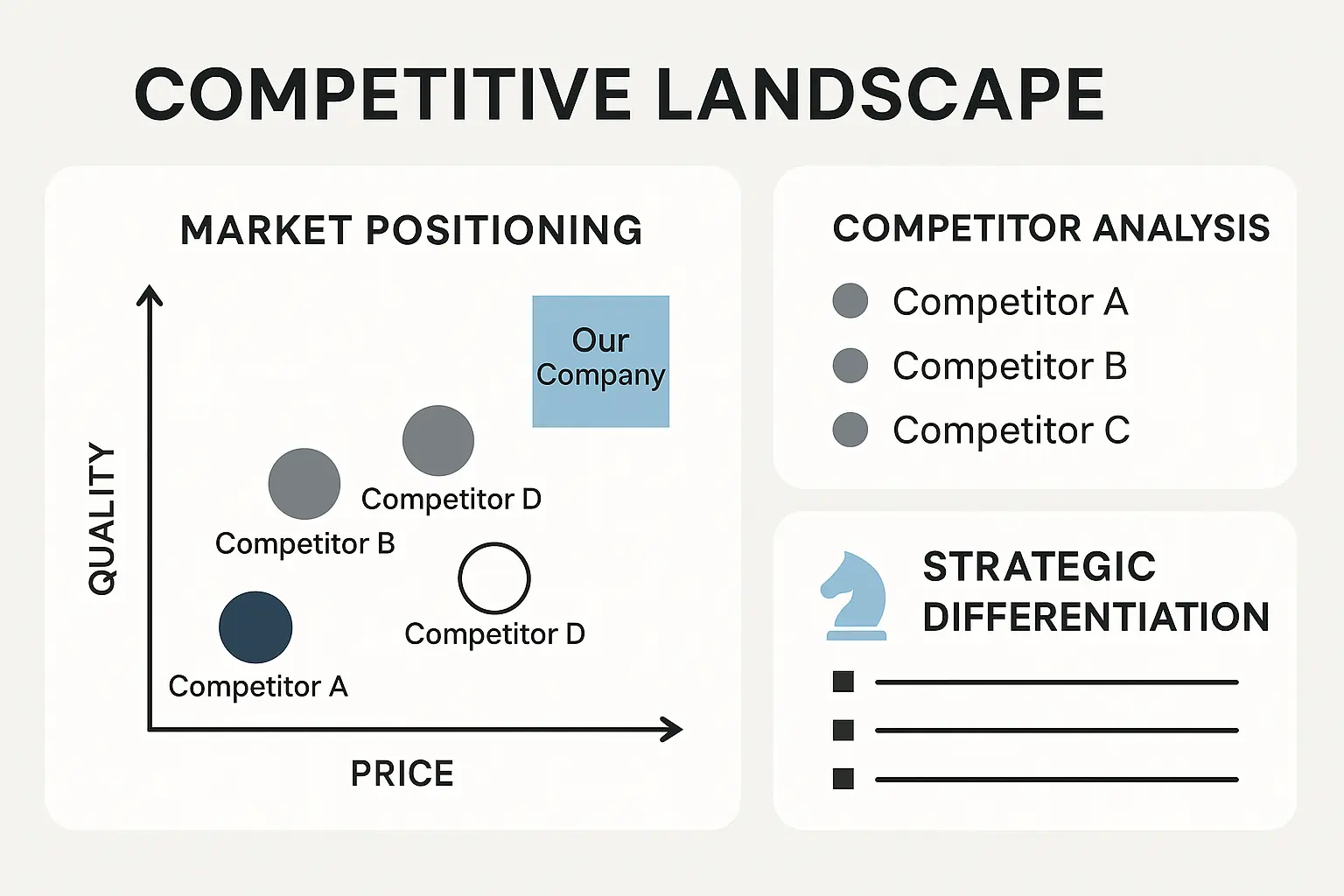

Competitive Combat: Outmaneuvering Rivals in a Cutthroat Market

Competition shaped everything Uber did. Early battles were about market share and driver supply. Later competition focused on service differentiation, customer experience, and ecosystem integration.

The competitive landscape was completely different depending on where you were. In the US, Lyft was the main rival. In other markets, Uber faced well-funded local competitors with government support and better regulatory relationships.

As markets matured, competition evolved too. Early on, it was just about having cars available when people needed them. Later, it became about premium features, loyalty programs, and integrated service offerings.

I’ve watched companies get comfortable with early market leadership only to lose ground when they stopped innovating. Uber’s story shows why you can never stop competing.

Direct Competition Analysis: The Battle for Market Share

Lyft became Uber’s primary US competitor, positioning itself as the friendlier, more driver-focused alternative. This forced Uber to improve their brand image and driver relations while maintaining operational efficiency.

Market share battles were expensive. Both companies spent heavily on driver incentives and rider promotions to gain market share. These price wars hurt profitability but were necessary to maintain competitive position.

Feature differentiation became crucial as basic ride-hailing became commoditized. Uber invested in safety features, premium services, and integrated experiences that competitors couldn’t easily replicate.

Regional competitors often had advantages in local market knowledge and regulatory relationships. Uber had to adapt their global playbook to compete effectively against locally-optimized services.

Competitive intelligence became a core capability. Uber monitored competitor pricing, features, and market moves to respond quickly to competitive threats and opportunities.

When Lyft launched their “Round Up & Donate” feature allowing riders to round up fares for charity, Uber quickly responded with their own “UberGiving” program. But instead of just copying the feature, Uber differentiated by partnering with local nonprofits in each market and letting riders choose specific causes. This shows how successful companies don’t just match competitor features—they improve upon them while staying true to their unique value.

Market Share Dynamics: The Numbers Game

Market share measurement was complex in ride-hailing. You could measure by rides, revenue, active users, or geographic coverage. Different metrics told different stories about competitive position.

Geographic concentration affected competitive dynamics. Uber might dominate business districts while competitors were stronger in residential areas. Airport access became a crucial competitive battleground.

Driver supply often determined market share. The platform with more available drivers could provide better service (shorter wait times, broader coverage) which attracted more riders and created positive feedback loops.

Seasonal and temporal variations affected competitive position. Some competitors were stronger during peak demand periods, while others excelled during off-peak times when efficiency mattered more than availability.

Market share defense required constant investment. Competitors could quickly gain share through aggressive pricing or superior service, forcing continuous competitive responses.

Differentiation Strategies: Standing Out in a Crowded Market

Service variety became a key differentiator. While competitors focused on basic rides, Uber offered multiple service tiers, delivery options, and specialized services (wheelchair accessible, pet-friendly) that appealed to different customer segments.

Technology leadership provided sustainable competitive advantages. Uber’s superior algorithms, user interface, and operational systems created better experiences that were difficult for competitors to replicate quickly.

Brand positioning evolved to emphasize reliability and professionalism rather than just price. Uber positioned itself as the premium option in markets where competitors competed primarily on cost.

Ecosystem integration created switching costs. Users who relied on both Uber rides and Uber Eats were less likely to switch to competitors that offered only one service.

Operational efficiency allowed competitive pricing while maintaining better margins. Uber’s scale advantages and operational optimization enabled them to compete on price when necessary while preserving profitability.

Ecosystem Competition and Partnerships: Playing the Long Game

Ecosystem competition became more important than direct service competition. Uber competed with integrated mobility platforms, public transportation systems, and technology companies entering the transportation space.

Partnership strategies balanced competition and collaboration. Uber partnered with public transit agencies in some markets while competing with them in others. These relationships required careful navigation of competitive dynamics.

Platform integration created new competitive advantages. Uber’s integration with mapping services, payment platforms, and travel booking systems made their service more convenient and harder to replace.

Autonomous Vehicle Strategy: Preparing for the Future

Autonomous vehicles represented both the biggest opportunity and threat to Uber’s business model. Self-driving cars could eliminate driver costs but required massive technology investment and regulatory navigation.

Partnership strategies balanced internal development with external collaboration. Uber partnered with automotive manufacturers and technology companies while developing their own autonomous vehicle capabilities.

Transition planning addressed the challenge of moving from human drivers to autonomous vehicles. This transition would happen gradually and unevenly across markets, requiring flexible operational strategies.

Regulatory preparation became crucial for autonomous vehicle deployment. Uber invested in government relations and safety testing to prepare for regulatory approval of self-driving services.

Economic modeling helped evaluate autonomous vehicle investments. Uber needed to understand how self-driving technology would affect unit economics, competitive positioning, and market dynamics.

Integration with Public Transportation: Complement or Compete?

Public transportation relationships were complex. Uber competed with transit for some trips while complementing it for others (first/last mile connections, off-peak service, areas with poor transit coverage).

Partnership opportunities emerged in markets where Uber could solve public transit challenges. Ride-hailing could provide service in low-density areas where fixed-route transit was inefficient.

Policy implications affected competitive dynamics. Some cities encouraged ride-hailing as a complement to public transit, while others viewed it as harmful competition that reduced transit ridership and increased congestion.

Integration strategies included partnerships with transit agencies, integrated payment systems, and multimodal trip planning that combined ride-hailing with public transportation options.

Long-term positioning required balancing competitive and collaborative approaches. Uber needed to compete effectively while maintaining relationships with public sector partners and avoiding regulatory backlash.

University of Kentucky’s Wildcab program demonstrates successful public-private partnerships, where “Wildcab trips nearly quadrupled from the previous semester” in Spring 2024, followed by an additional 29% increase in Fall 2024 with 8,180 rides, showing how Uber’s integration with institutional transportation can create win-win scenarios that expand market reach while serving public needs.

How The Marketing Agency Can Help You Build Your Own Platform Success

Studying Uber’s journey reveals crucial insights for any business trying to build platform effects or scale rapidly in competitive markets. The biggest lesson? Success requires sophisticated marketing operations that most companies struggle to build internally.

The Marketing Agency specializes in the exact capabilities that made Uber’s marketing evolution possible. Their approach to “extracting multiple narratives to validate initial hypotheses” mirrors how Uber tested and optimized their customer acquisition strategies across different markets and channels.

Whether you’re launching a new platform business or trying to scale an existing service, The Marketing Agency’s performance-based approach ensures you’re not gambling on marketing investments. Their expertise in PPC campaigns, email marketing automation, and inbound marketing strategies provides the foundation for sustainable growth.

Just as Uber required sophisticated market sizing analysis to evaluate expansion opportunities, The Marketing Agency helps businesses identify and prioritize the most valuable growth opportunities through data-driven market research and competitive analysis.

Ready to build your own platform success story? The Marketing Agency’s scalable solutions grow with your business, from initial market testing to full-scale customer acquisition campaigns.

Final Thoughts

Uber’s story isn’t just about disrupting transportation – it’s about building a business that could adapt and survive in an incredibly complex, competitive environment. They made mistakes, burned through billions of dollars, and faced regulatory battles that could have killed the company. But they also demonstrated how platform businesses can create sustainable competitive advantages when executed properly.

The most important lesson from Uber’s journey is that success requires constant evolution. Their marketing strategies, business model, technology infrastructure, and competitive positioning all changed dramatically over time. Companies that try to replicate Uber’s early tactics without understanding this evolution are likely to fail.

For businesses studying this case study, the key insight is that platform success requires sophisticated operational capabilities across multiple disciplines. You need excellent technology, effective marketing, strong financial management, and the ability to navigate complex regulatory environments. Most importantly, you need the data and analytics capabilities to make informed decisions quickly as market conditions change.

Uber’s path to profitability took over a decade and required fundamental changes to their business model. This timeline should inform expectations for any company trying to build similar platform effects. Success is possible, but it requires patience, significant investment, and the ability to adapt strategies based on market feedback.

Understanding how to measure success across complex customer journeys becomes essential, much like the methodologies outlined in our GA4 audit guide, where tracking multi-touchpoint conversions requires sophisticated attribution modeling similar to what Uber developed for their marketing operations.

Platform Success Checklist:

✓ Network Effects Foundation

-

Identify your two-sided marketplace opportunity

-

Design incentive structures for both supply and demand sides

-

Plan for chicken-and-egg problem resolution

-

Build viral mechanics into core product features

✓ Technology Infrastructure

-

Invest in real-time matching algorithms

-

Implement comprehensive data analytics capabilities

-

Design for global scale from day one

-

Build fraud detection and security systems

✓ Regulatory Strategy

-

Research legal frameworks in target markets

-

Develop compliance-first market entry approach

-

Build government relations capabilities early

-

Plan for market-specific customizations

✓ Marketing Evolution Framework

-

Start with growth hacking for rapid user acquisition

-

Build referral programs with strong viral coefficients

-

Transition to brand building as markets mature

-

Implement sophisticated attribution modeling

✓ Financial Management

-

Monitor unit economics obsessively

-

Plan revenue diversification beyond core service

-

Optimize cost structures continuously

-

Build sustainable path to profitability

✓ Competitive Positioning

-

Differentiate beyond price and basic features

-

Build ecosystem integrations for switching costs

-

Monitor competitive intelligence systematically

-

Prepare for future technology disruptions