Table of Contents

-

The No-Frills Revolution That Changed Everything

-

Stripping Away the Extras: When Less Became More

-

Operational Genius: Making Every Second Count

-

Marketing Mayhem: Controversy as a Business Strategy

-

Digital Domination: Cutting Out the Middleman

-

Crisis Mode: Surviving When Everything Goes Wrong

-

The Green Challenge: Balancing Profits with Planet

-

Financial Wizardry: Turning Pennies into Pounds

-

What This Means for Your Business

TL;DR

-

Ryanair transformed European aviation by ditching traditional airline services and focusing purely on cheap point-to-point flights

-

Their success comes from ruthless cost-cutting: one plane type, cheap airports, lightning-fast turnarounds, and charging for everything that used to be “free”

-

Controversial marketing gets them millions in free publicity while hammering home their budget brand message

-

Going digital-first cuts out the middleman and puts customers in control of their own experience

-

When crises hit, they adapt fast and keep their cost advantages intact

-

They tackle environmental challenges through efficiency rather than expensive green tech

-

All those extra fees now make up over 30% of their income, proving that the “pay for what you use” model can be incredibly profitable

The No-Frills Revolution That Changed Everything

I’ve seen plenty of companies try to completely reinvent themselves, but Ryanair’s transformation stands out for one simple reason: they had the guts to disappoint people. Starting in 1985 with just 57 staff and a tiny 15-seat plane serving 5,000 passengers on one route, Ryanair has grown to become Europe’s largest low-cost airline carrying millions of passengers across hundreds of routes.

Most businesses try to make everyone happy. Ryanair did the opposite. They spotted millions of Europeans who wanted to fly but couldn’t afford regular airline prices, then built their entire operation around serving exactly that need. The genius wasn’t in what they offered – it was in everything they deliberately threw out the window.

This meant being brutally honest about what customers actually cared about. While competitors obsessed over comfort and fancy lounges, Ryanair discovered something revolutionary: for their target market, price beat everything else. People would put up with cramped seats, no meals, and even some attitude if it meant they could actually afford to visit places they’d only dreamed of.

The transformation created an entirely new type of traveler. Suddenly, college students could spend weekends in Barcelona. Small businesses could send people to meetings in Dublin without breaking the bank. Retirees could visit grandkids across Europe without choosing between travel and groceries. The market didn’t just grow – it exploded.

What Ryanair did mirrors what smart companies do when they’re sizing up business opportunities – they find the underserved segments and build something specifically for them.

As Ryanair hits its 40th birthday, the smart money says they’re not slowing down. “Ryanair will take some bold steps after turning 40” according to Travel Weekly, with predictions that they might buy up major holiday booking sites like Loveholidays and On The Beach to control even more of the travel market.

Stripping Away the Extras: When Less Became More

The no-frills thing went way beyond just removing peanuts and pillows. What fascinates me is how methodical they were about it. They looked at every single thing that happened when someone flew with them and asked: “Does this help us move people cheaper and faster?” If the answer was no, it either got cut or turned into a money-maker.

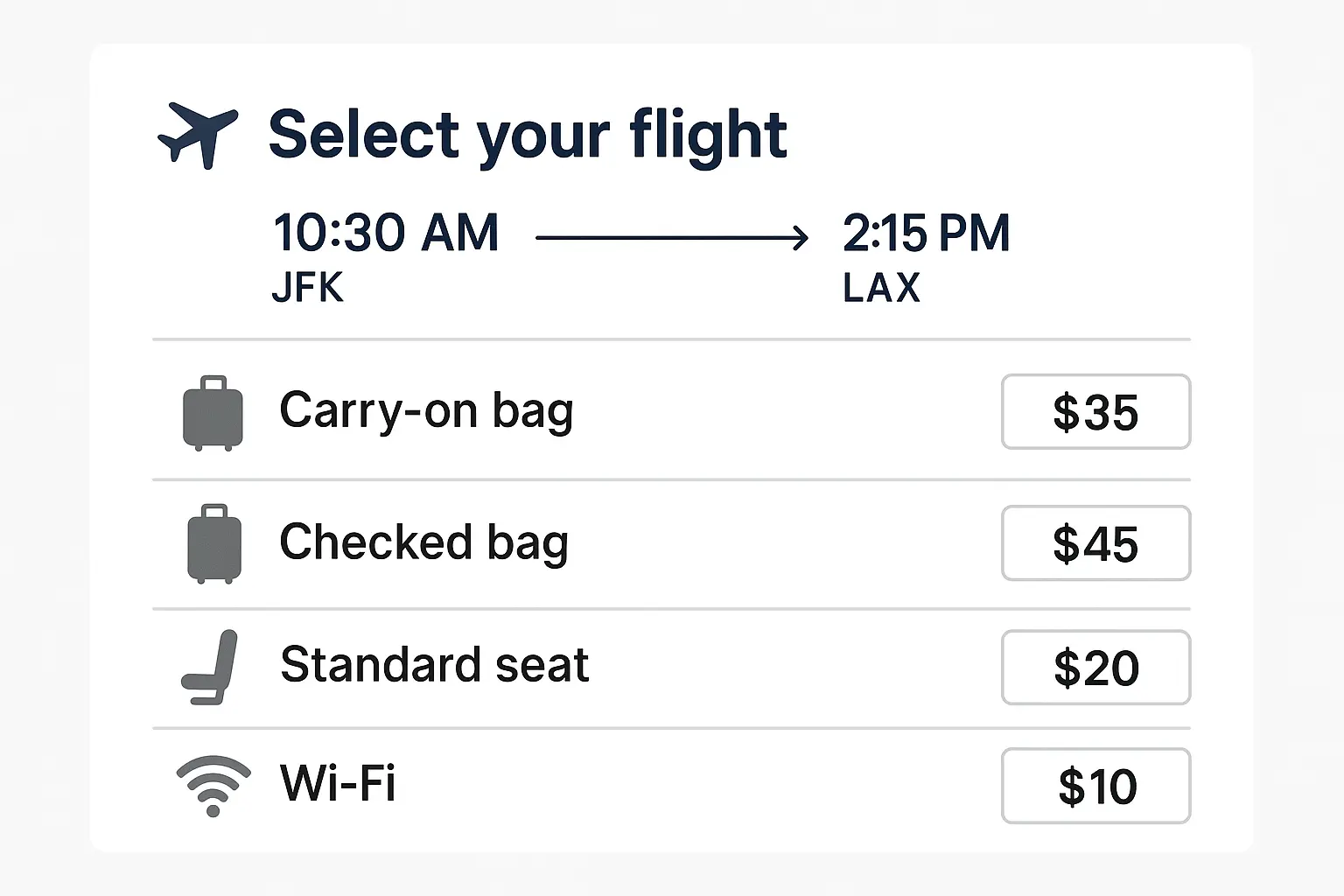

Free baggage? Gone, replaced by fees that sometimes cost more than the ticket itself. Picking your seat? That’ll be extra. Heck, they even charged you for printing your boarding pass at the airport. Critics called it nickel-and-diming, but honestly? I’d rather pay €6 for priority boarding than have it buried in a €200 ticket price and pretend it’s “free.”

The psychological shift completely messed with people’s heads. Regular airlines had trained passengers to expect “free” services built into higher ticket prices. Ryanair flipped this completely, making the base price incredibly attractive while clearly pricing every add-on. It was transparency instead of hidden costs, even if customers didn’t always appreciate the honesty at first.

Turning Freebies into Money Machines

Here’s the genius part that most people miss – instead of forcing everyone to pay for services whether they wanted them or not, Ryanair let customers build their own experience. Want to board first? Pay for it. Need a meal? Buy one. Want a specific seat? That’ll cost you.

This approach makes crazy good margins because it costs them almost nothing extra to provide these services. A €6 priority boarding fee might seem reasonable, but Ryanair’s actual cost is basically zero – they’re just changing the order people get on the plane.

Take my friend Sarah’s typical journey: she books a €19.99 flight from London to Barcelona. Sounds great, right? But then she adds priority boarding (€6), picks a window seat (€8), gets a 20kg checked bag (€25), and buys travel insurance (€12). Her total becomes €70.99, but here’s the kicker – Ryanair just made €51 in extras from a €20 base fare. That’s a 255% markup on stuff that costs them virtually nothing to provide.

The food service became particularly brilliant. Instead of serving mediocre “free” meals that actually cost the airline a fortune, they partnered with suppliers to sell decent food at premium prices. Passengers got better quality if they chose to buy, and Ryanair made profit instead of eating costs.

The beauty is in letting people choose. Budget travelers can fly for ridiculously low prices by skipping extras, while passengers who want additional services can buy them. Everyone gets exactly what they’re willing to pay for.

This whole approach to finding multiple ways to make money from the same customers is exactly what we talk about in our revenue calculator guide – identifying and optimizing different income streams from people you’re already serving.

Setting Expectations So Nobody Gets Surprised

The no-frills model only worked because they were crystal clear about what you were getting upfront. I’ve seen too many companies fail because they surprised customers with limitations after taking their money. Ryanair learned early that disappointed customers create expensive headaches – angry phone calls, terrible reviews, and potential legal problems.

Their booking process became incredibly detailed about what was and wasn’t included. Multiple warnings about baggage rules, seat assignments, and which airports they actually flew to appeared throughout the purchase process. Some people called it excessive, but it protected both the company and customers from nasty surprises.

The messaging was consistent everywhere: “We’re not trying to be fancy. We’re trying to be cheap.” This attracted customers who cared more about price than service while scaring away people who expected traditional airline treatment.

Customer education went beyond just booking. Gate announcements, website content, and even how the crew talked to you reinforced the deal. You’re paying for transportation, period. Everything else costs extra and the prices are right there in black and white.

Operational Genius: Making Every Second Count

The operational side is where the real magic happens. While competitors struggled with complicated operations involving different plane types, connecting flights, and premium services, Ryanair built what’s basically a flying bus service designed for one thing: moving people efficiently and cheaply.

Watching their operation reminds me of a well-run McDonald’s during lunch rush – everything’s choreographed, everyone knows their job, and there’s zero wasted motion. The key insight was recognizing that complexity kills profits in the airline business. Every extra variable – different aircraft types, connecting flights, fancy services – adds costs that have to be recovered through higher prices. Ryanair chose simplicity and executed it perfectly.

|

What They Do |

Industry Average |

Ryanair’s Advantage |

|---|---|---|

|

Aircraft flying time |

8-10 hours/day |

11-13 hours/day (+30% more revenue) |

|

Turnaround time |

45-60 minutes |

25 minutes (50% faster) |

|

Seats filled |

82% |

95% (13% more passengers) |

|

Plane types |

Mixed fleet |

100% Boeing 737 (way simpler) |

|

Cheap airports |

40% |

85% (much lower costs) |

One Plane Type: Keeping It Simple

The decision to fly only Boeing 737s was brilliant in its simplicity. While other airlines operated different aircraft types for different routes and passenger loads, Ryanair bet that keeping everything the same would outweigh any route optimization benefits.

Pilot training costs plummeted because every pilot could fly every plane in the fleet. No need for separate training programs, different certifications, or scheduling headaches based on aircraft type. A pilot qualified on one Ryanair plane could operate any plane they owned.

Maintenance became incredibly efficient. Mechanics only needed to know one aircraft type inside and out. Spare parts could be optimized for a single model. Maintenance schedules, procedures, and training all focused on keeping 737s reliable and minimizing downtime.

The buying power was enormous too. Ordering hundreds of identical aircraft gave Ryanair incredible leverage with Boeing, securing better prices and more favorable terms than airlines buying smaller quantities of different plane types.

Ground operations got way simpler. Gate requirements, baggage handling, and turnaround processes could be standardized across their entire network. Every airport operation looked identical, reducing training needs and screw-ups.

Secondary Airports: Avoiding the Expensive Crowds

The secondary airport strategy was controversial but incredibly smart. Instead of fighting for expensive slots at Heathrow or Charles de Gaulle, Ryanair found smaller airports desperate for traffic and willing to make deals.

Landing fees at these airports were often 70-80% lower than major hubs. These airports also offered faster turnarounds because they weren’t jammed with competing traffic. Less congestion meant more predictable schedules and fewer delays – both crucial for keeping costs down.

Sure, you might end up at an airport that’s technically “near” your destination but requires a two-hour bus ride to get there. But when you’re paying €20 for a flight that used to cost €200, suddenly that bus ride doesn’t seem so bad.

Frankfurt-Hahn Airport shows exactly what I mean. Located 120 kilometers from Frankfurt city center, this former military base became Ryanair’s second continental European hub in 2002. Despite being nowhere near actual Frankfurt, Ryanair’s low fares attracted millions of passengers willing to travel the extra distance, while the airport offered landing fees 75% lower than Frankfurt’s main airport and guaranteed 25-minute turnaround times.

These airport partnerships became strategic relationships rather than simple vendor deals. Secondary airports often provided marketing support, ground handling deals, and other incentives to attract Ryanair’s traffic. Some airports basically built their entire growth strategies around having Ryanair there.

Maximizing Aircraft Use: Every Hour Making Money

Here’s where Ryanair really separates itself from the pack. While other airlines might have their planes sitting around like expensive paperweights for half the day, Ryanair consistently gets 11-13 hours of daily use out of theirs. Those extra hours translate directly to more revenue without proportional cost increases.

The rapid turnaround process is almost choreographed. The moment a plane touches down, ground crews spring into action. Passengers get off from the front while cleaning crews enter from the rear. Fuel trucks, minimal catering, and baggage handlers all work at the same time rather than waiting for each other.

Twenty-five minute turnarounds became standard when competitors needed 45-60 minutes. This efficiency allowed Ryanair to schedule more flights per day with the same aircraft, dramatically improving how much money each plane made.

Extended operating hours meant flights from early morning until late night. While competitors focused on business-friendly schedules, Ryanair recognized that leisure travelers and price-sensitive passengers would accept less convenient times for lower fares.

Crew scheduling was optimized around aircraft use rather than crew convenience. Flight attendants and pilots worked longer days but fewer days per month, maximizing productivity while controlling labor costs.

Marketing Mayhem: Controversy as a Business Strategy

Ryanair’s marketing approach breaks every rule in the traditional playbook, yet it’s been incredibly effective. While competitors spent millions on polished ad campaigns, Ryanair’s CEO became the airline’s primary marketing weapon, generating headlines with outrageous statements and publicity stunts.

Their CEO became basically the Donald Trump of airlines – you either loved him or wanted to throw something at your TV when he came on the news. The approach was risky but calculated. Every controversial statement reinforced their core message: “We’re cheap, and we don’t pretend to be anything else.” The controversy got attention from people who might never have considered flying with them otherwise.

Traditional marketing wisdom says you should never alienate potential customers. Ryanair flipped this completely, recognizing that trying to appeal to everyone meant appealing to no one. They’d rather have 70% of people hate them and 30% love them than have everyone feel indifferent.

The free publicity was enormous. A single controversial statement could generate coverage worth millions in advertising spend. While competitors paid for TV commercials that viewers ignored, Ryanair dominated news cycles and social media conversations.

Want to see a masterclass in creating content that gets people talking? Their approach shows exactly what I mean when I talk about high-impact content that drives engagement – provocative but authentic messaging can seriously amplify your reach.

Turning Outrage into Brand Awareness

The media manipulation was sophisticated despite looking crude. Ryanair’s leadership knew exactly which buttons to push to generate coverage. Statements about charging for toilets, standing seats, or eliminating co-pilots created perfect storms of outrage and discussion.

Each controversy followed a predictable pattern: outrageous statement, media frenzy, public outrage, clarification (sometimes), and ultimately increased brand awareness. Even negative coverage reinforced their positioning as the airline that put low prices above everything else.

The timing was often strategic. Controversial statements frequently coincided with competitor price increases, new route launches, or quarterly earnings announcements. The “free” publicity amplified their marketing messages at crucial moments.

Social media amplified everything exponentially. Controversial statements spread organically as people shared, commented, and argued. Ryanair’s social media team learned to fan these flames carefully, engaging with critics and supporters alike to keep conversations going longer.

The key was making sure controversies aligned with their brand. Statements about poor service or high fees actually reinforced their value proposition rather than hurting it. Customers who chose Ryanair weren’t expecting luxury – they were expecting cheap flights.

Building Recognition Without Big Budgets

The cost-effectiveness of their marketing was staggering. While competitors spent 2-3% of revenue on marketing and advertising, Ryanair spent a fraction of that while achieving higher brand recognition in many markets.

Building a brand through controversy required accepting that some people would hate you. Traditional marketing aims for broad appeal, but Ryanair recognized that strong negative reactions from some people often meant strong positive reactions from their target customers.

The approach worked because it was authentic to their business model. Luxury airlines couldn’t credibly use controversial marketing because it would contradict their premium positioning. For Ryanair, controversy reinforced their “we’re cheap and proud of it” message.

Consistency was crucial. The controversial marketing had to match the actual customer experience. If they promised no-frills service and delivered exactly that, customers weren’t disappointed. The marketing set appropriate expectations rather than creating unrealistic ones.

Employee buy-in became essential. Crew members and customer service reps needed to understand and embrace the brand positioning. They weren’t trying to provide luxury service – they were providing transportation at unbeatable prices.

Digital Domination: Cutting Out the Middleman

The digital revolution gave Ryanair another huge advantage. While traditional airlines relied heavily on travel agents and booking sites that charged commissions, Ryanair invested early in direct digital channels that eliminated middleman costs.

Their website became a money-making machine rather than just a booking tool. The entire customer journey was optimized to encourage direct bookings while presenting add-on services at exactly the right moments. Every click was analyzed and optimized to squeeze out more revenue. Mobile-first development recognized that their target customers – often younger, price-sensitive travelers – preferred mobile interactions. The app handled everything from initial booking to boarding pass generation, reducing airport staffing needs while improving customer convenience.

The success of Ryanair’s digital strategy is evident in their booking statistics: 99 percent of bookings now take place via the Internet, eliminating traditional travel agent fees and giving the airline complete control over the customer experience.

The data collection opportunities were enormous. Direct digital relationships provided insights into customer behavior, preferences, and price sensitivity that third-party bookings couldn’t offer. This data informed everything from route planning to pricing strategies.

Direct Bookings: Keeping Control and Cash

The direct booking strategy was about way more than just saving commission fees. By controlling the entire booking experience, Ryanair could present add-on services at optimal moments, increasing the chances of additional purchases.

Website optimization became a science. They constantly tested different ways to present seat upgrades, baggage options, and travel insurance. The booking flow guided customers toward higher-margin choices while staying transparent about base fares.

Third-party booking sites often stripped away opportunities to sell extras, presenting only basic fares without additional services. Direct bookings allowed Ryanair to capture the full revenue potential of each customer interaction.

The customer data was invaluable for route planning and pricing optimization. Understanding booking patterns, seasonal demand, and customer preferences enabled more accurate capacity planning and dynamic pricing strategies.

Mobile-First Strategy: Putting Control in Customers’ Hands

The mobile app became Ryanair’s secret weapon for cutting costs. Every function customers could handle themselves meant one less interaction requiring staff time. Check-in, seat selection, boarding pass generation, and even customer service inquiries moved to mobile platforms.

Push notifications replaced expensive email campaigns and direct mail. The app could alert customers about flash sales, remind them about upcoming flights, and promote relevant add-on services based on their booking history and preferences.

Integration with airport systems streamlined the entire travel experience. Customers could navigate airports, find gates, and get real-time updates without needing additional staff support. The app essentially became a personal travel assistant that cost Ryanair almost nothing to operate.

Offline functionality ensured the app worked even in areas with poor connectivity. Boarding passes, booking confirmations, and essential travel information stayed accessible without internet access, reducing customer service calls and airport desk interactions.

Crisis Mode: Surviving When Everything Goes Wrong

Crisis management revealed the true strength of Ryanair’s business model. When external shocks hit the aviation industry, their low-cost structure and operational flexibility provided significant advantages over traditional carriers with higher fixed costs and more complex operations.

The 2010 volcanic ash crisis tested every airline’s adaptability. While competitors struggled with complex rebooking procedures and expensive passenger accommodations, Ryanair’s point-to-point network and simplified operations allowed faster recovery once airspace reopened.

Labor strikes became almost routine challenges requiring systematic responses. Ryanair developed playbooks for managing crew strikes, air traffic control disruptions, and airport closures while minimizing passenger compensation costs and maintaining schedule integrity where possible.

Financial reserves and low debt levels provided crucial flexibility during crises. While competitors faced bankruptcy or needed government bailouts, Ryanair’s conservative financial management allowed them to weather storms and even capitalize on competitors’ weaknesses.

Recent legal challenges continue to test Ryanair’s operational model. “Ryanair fights ruling in high-stakes appeal over pilots’ worker status” according to HR Grapevine, as the airline battles tribunal rulings that could reclassify contracted pilots as employees rather than self-employed contractors.

COVID-19: Adapting to the Unthinkable

The pandemic was unlike any previous crisis because it essentially shut down the entire industry at once. Ryanair’s response showed both the strengths and limitations of their business model when faced with complete demand destruction.

Capacity cuts were swift and dramatic. Routes were suspended, aircraft were grounded, and schedules were slashed to match drastically reduced demand. The operational flexibility that enabled rapid expansion also allowed rapid contraction when necessary.

During COVID-19, Ryanair showed remarkable adaptability by cutting their flight schedule by 80% in April 2020 while keeping a skeleton network of essential routes running. They grounded 95% of their fleet, negotiated rent deferrals with aircraft lessors, and secured €600 million in additional cash. This decisive action let them survive the crisis with minimal government support while positioning for rapid expansion as demand recovered, ultimately gaining market share from financially weaker competitors.

Cash preservation became the primary focus. Non-essential spending stopped immediately, capital expenditures were deferred, and negotiations with suppliers, airports, and lessors aimed to reduce fixed costs during the crisis period.

Government support programs were used strategically. While maintaining their independence, Ryanair accessed available support schemes to preserve jobs and maintain operational capability for eventual recovery.

The recovery strategy positioned Ryanair to capture market share as travel resumed. Competitors’ financial difficulties and capacity reductions created opportunities for route expansion and market consolidation that Ryanair was financially positioned to exploit.

Managing Disruptions: When Plans Fall Apart

Operational disruptions are inevitable in aviation, but Ryanair’s response systems were designed around cost minimization rather than customer satisfaction. This approach aligned with their overall value proposition but required careful legal compliance.

Weather-related delays and cancellations triggered standardized procedures focused on rebooking passengers on the next available flights while minimizing accommodation and meal costs. The point-to-point network simplified rebooking compared to hub-and-spoke systems.

EU261 compensation regulations required systematic compliance procedures. Ryanair developed systems to handle passenger claims efficiently while ensuring legitimate compensation was paid promptly and fraudulent claims were rejected.

Communication during disruptions balanced legal requirements with cost control. Automated systems handled routine notifications while human intervention focused on complex situations requiring individual attention.

Staff training emphasized regulatory compliance and cost control during disruptions. Crew members understood their obligations under various scenarios while maintaining focus on operational recovery and expense minimization.

The Green Challenge: Balancing Profits with Planet

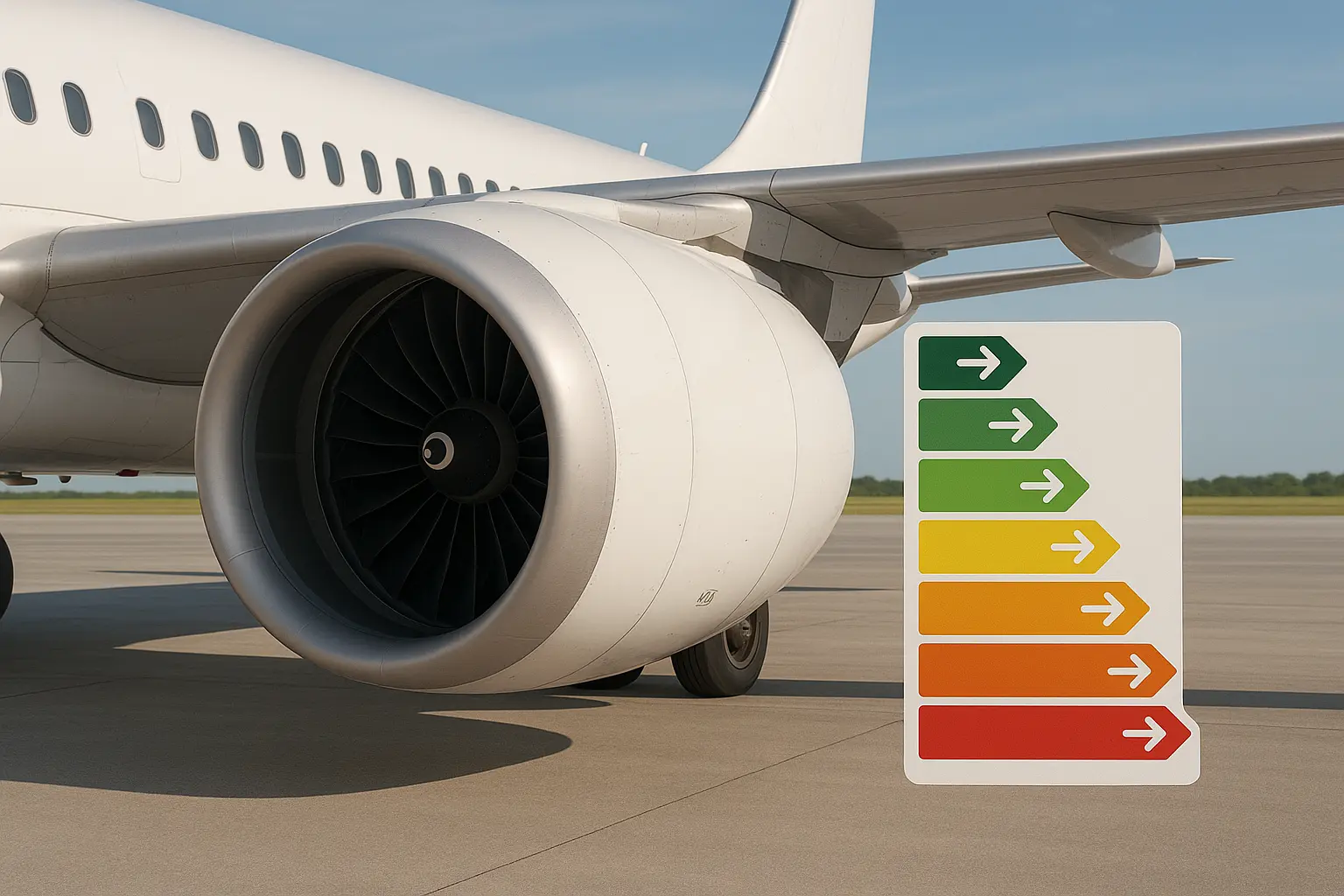

Environmental pressures present real challenges to Ryanair’s low-cost model. Their approach focuses on operational efficiency improvements and fleet modernization rather than expensive green initiatives, arguing that higher passenger loads and newer aircraft already provide environmental benefits.

The environmental stuff? Look, they’re trying, but let’s not pretend flying millions more people around Europe is saving the planet. Their efficiency argument became central to their environmental positioning. Ryanair’s high passenger loads and fuel-efficient operations resulted in lower per-passenger emissions than many traditional carriers, even without expensive green technology investments.

Fleet modernization provided environmental benefits while maintaining cost discipline. Newer Boeing 737 MAX aircraft offered improved fuel efficiency and reduced emissions compared to older models, delivering environmental improvements through normal fleet renewal cycles.

Regulatory compliance with environmental standards required careful cost management. EU carbon pricing and emission regulations added operational costs that needed to be absorbed without significantly impacting fare competitiveness.

Carbon Reduction Through Smart Operations

The operational efficiency approach to carbon reduction made financial sense. Fuel represents a huge cost, so measures that reduced fuel consumption delivered both environmental and economic benefits.

Weight reduction initiatives eliminated unnecessary items from aircraft to reduce fuel consumption. Everything from seat materials to catering equipment was evaluated for weight savings that could reduce emissions while cutting costs.

Route optimization algorithms considered fuel efficiency alongside profitability. Direct routing, optimal altitudes, and efficient taxi procedures reduced emissions while minimizing operational costs.

Ground operations improvements included electric ground support equipment and optimized airport procedures that reduced fuel consumption during taxi and ground operations.

Passenger behavior modifications encouraged practices that reduced environmental impact. Policies discouraging checked baggage reduced aircraft weight, while digital boarding passes eliminated paper waste.

Sustainable Aviation Fuel: Investing in Tomorrow

Sustainable Aviation Fuel (SAF) represented both an opportunity and a challenge. While SAF could significantly reduce carbon emissions, the cost premiums were substantial and could undermine Ryanair’s pricing strategy.

Partnership strategies allowed participation in SAF development without massive upfront investments. Collaborations with fuel suppliers and airports enabled gradual adoption as costs decreased and availability increased.

Regulatory requirements for SAF blending created compliance obligations that affected all airlines equally. Ryanair’s approach focused on meeting requirements efficiently while advocating for policies that didn’t disproportionately impact low-cost carriers.

Customer communication about environmental initiatives balanced authenticity with cost consciousness. Environmental messaging emphasized efficiency improvements and operational measures rather than expensive green technology that could increase fares.

Financial Wizardry: Turning Pennies into Pounds

The financial results speak for themselves. While many airlines were burning money like it was going out of style, Ryanair was printing it. The key lies in their systematic approach to squeezing every euro out of operations and finding new ways to make money.

Revenue diversification beyond ticket sales created multiple profit streams. All those extra fees from baggage, seat selection, food sales, and third-party services now represent over 30% of total revenues, providing stability when fare competition gets intense.

Capital efficiency metrics consistently beat industry averages. Return on invested capital, asset utilization, and profit margins show the effectiveness of their operational strategies and financial discipline.

Conservative debt levels and strong cash generation provide financial flexibility during downturns while enabling opportunistic investments during recovery periods. This financial strength allows Ryanair to capitalize on competitors’ weaknesses during industry stress periods.

The company boosted its revenue by roughly 37 percent from 2013 to 2019, showing the effectiveness of their cost leadership and market expansion strategies.

All Those Extra Fees: The Hidden Money Machine

Here’s what blew my mind – they’re making more money from charging you for stuff than from selling you the actual plane ticket. The transformation was gradual but systematic. What started as basic baggage fees evolved into a sophisticated money-making machine that squeezed profit from every customer interaction.

The psychology behind the pricing was brilliant. Services were priced to seem reasonable individually while generating massive aggregate revenues. A €6 priority boarding fee might seem modest, but multiply that across millions of passengers, and you’re talking serious money.

Cross-selling opportunities were built into every step of the customer journey. Travel insurance, car rentals, and hotel bookings provided commission income with minimal operational requirements. The booking platform became a travel marketplace generating revenue from multiple sources.

Dynamic pricing extended to add-on services. Seat selection fees varied based on demand, route popularity, and booking timing. Popular routes and peak travel periods commanded premium prices for preferred seats and services.

Revenue management systems optimized pricing in real-time. Machine learning algorithms analyzed booking patterns, customer behavior, and competitive dynamics to maximize revenue from each service offering.

This sophisticated approach to optimizing multiple revenue streams mirrors what we explore in our marketing ROI calculator – measuring and optimizing different income sources from existing customer relationships.

|

Extra Fee Category |

Average Price |

Profit Margin |

Annual Money Made |

|---|---|---|---|

|

Priority Boarding |

€6-12 |

95% |

€180M |

|

Seat Selection |

€4-25 |

90% |

€320M |

|

Baggage Fees |

€15-70 |

85% |

€890M |

|

Food & Drinks |

€3-15 |

70% |

€125M |

|

Travel Insurance |

€8-35 |

60% |

€85M |

|

Car Rental Kickbacks |

€25-45 |

100% |

€45M |

Smart Money Management: Making Every Euro Count

Capital allocation decisions reflected the same discipline applied to operational costs. Every investment required clear justification based on expected returns and strategic value. No emotional or prestige-driven investments – everything was data-driven.

Fleet expansion followed strict financial criteria. New aircraft orders were based on route profitability projections, financing costs, and operational efficiency gains. The standardized fleet strategy simplifie d these calculations while ensuring consistent returns.

Route development investments considered multiple factors beyond passenger demand. Airport deals, competitive dynamics, and operational synergies influenced route selection. Unprofitable routes got axed quickly rather than subsidized for strategic reasons.

Technology investments focused on operational efficiency and cost reduction rather than passenger amenities. Systems that reduced labor costs, improved fuel efficiency, or enhanced revenue generation got priority over customer-facing improvements.

Shareholder returns balanced growth requirements with investor expectations. Dividend policies and share buybacks returned excess cash to shareholders while maintaining sufficient reserves for operational flexibility and growth opportunities.

What This Means for Your Business

The lessons from Ryanair’s transformation go way beyond aviation. Their systematic approach to cost optimization, customer segmentation, and operational efficiency provides a blueprint for businesses in any industry looking to improve profitability and market position.

Cost structure analysis should be where any business transformation starts. Ryanair’s success came from questioning every expense and eliminating anything that didn’t directly contribute to their core value proposition. What services are you providing that customers don’t actually value?

Customer expectation management prevents disappointment and reduces service costs. By clearly communicating what customers get for their money, businesses can avoid expensive misunderstandings while attracting customers who value their specific offering.

Revenue diversification reduces dependence on core products while improving margins. Ryanair’s success with all those extra fees shows how businesses can monetize previously free services or create new revenue streams from existing customer relationships.

Digital transformation should focus on cost reduction and customer control rather than just convenience. Ryanair’s mobile-first strategy eliminated operational costs while improving customer satisfaction – a win-win that many businesses can copy.

Just like Ryanair optimized their digital marketing spend, businesses can benefit from understanding effective Google Ads strategies that maximize ROI while keeping costs under control across all marketing channels.

Ryanair Business Model Implementation Checklist:

-

Look at all your processes to find non-essential services you can cut

-

Make pricing transparent for all service components

-

Standardize operations to reduce complexity and training costs

-

Build direct customer relationships to cut out middleman fees

-

Find multiple ways to make money from existing customers

-

Invest in technology that reduces operational costs

-

Set crystal-clear customer expectations to prevent complaints

-

Focus on efficiency metrics rather than premium features

-

Build financial reserves for crisis management and opportunistic growth

-

Develop authentic marketing that generates free publicity

Ready to apply Ryanair’s performance-focused approach to your marketing strategy? Let’s talk about how data-driven marketing can transform your customer acquisition and retention efforts.

Final Thoughts

Ryanair’s journey from struggling traditional airline to Europe’s most profitable carrier shows the power of radical business model innovation. Their success wasn’t built on superior technology or exceptional service – it was built on ruthless focus, operational discipline, and unwavering commitment to their value proposition.

The controversy surrounding their approach often overshadows the business brilliance behind their strategy. While critics focus on poor customer service or aggressive fee structures, the numbers tell a different story: consistent profitability, industry-leading margins, and millions of satisfied customers who put price above amenities.

Here’s what I learned from studying Ryanair: sometimes the best business strategy is just being brutally honest about what you’re actually selling. They’re not selling a pleasant experience – they’re selling cheap transportation. And millions of people are perfectly happy with that trade-off.

Look, nobody *enjoys* flying Ryanair. But when you’re a college student who wants to see Prague for the weekend, or a small business owner trying to get to a meeting without blowing your quarterly budget, suddenly those hard plastic seats don’t seem so bad.

The bottom line? Ryanair figured out that millions of people would put up with a lot of inconvenience if it meant they could actually afford to travel. Whether you love them or hate them, you’ve got to respect the results. The aviation industry will keep evolving, with environmental pressures, changing customer expectations, and new technologies creating fresh challenges. Ryanair’s ability to adapt while sticking to their core principles will determine whether their success story continues or becomes a cautionary tale about the limits of cost-focused strategies.