Look, when I first heard about three guys renting out air mattresses in 2008, I thought they were desperate. Who would actually sleep on a stranger’s floor? Turns out, they were onto something massive. As of February 2024, Airbnb’s gross booking was valued at approximately $73.25 billion, and they don’t own a single property. This airbnb case study breaks down how three broke roommates turned a simple idea into a platform that completely disrupted the travel industry.

Table of Contents

-

The Original Hustle: From Air Mattresses to Global Domination

-

Building the Perfect Two-Sided Marketplace

-

Revenue Streams That Actually Work

-

Going Global Without Losing Your Soul

-

The Art of Strategic Pivoting

-

Beating Hotels at Their Own Game

-

Growth Hacking Before It Was Cool

-

The Numbers Game: Making Sure the Math Works

-

What This Means for Your Business

TL;DR

-

Airbnb solved the classic startup problem by targeting events where hotels were already failing people

-

Their fee structure charges both sides but keeps everyone happy

-

Quality control through mutual ratings weeds out bad actors naturally

-

Multiple revenue streams beyond booking fees maximize each user relationship

-

International expansion requires playing politics and adapting to local cultures

-

Strategic pivots from spare rooms to entire homes unlocked massive growth

-

Viral marketing through clever integrations and referral programs drove organic growth

-

Smart tracking of what actually works optimizes marketing spend

-

Professional hosts create tension between authenticity and scale

The Original Hustle: From Air Mattresses to Global Domination

The original airbnb story starts with three guys who couldn’t make rent during the 2008 Democratic National Convention. Hotels were completely booked in San Francisco, so they threw some air mattresses on their apartment floor and charged $80 a night. Breakfast included. Honestly, it sounds like something you’d do in college when you’re broke.

But here’s the thing – the timing was perfect. The 2008 financial crisis wasn’t just background noise; it created the exact conditions their crazy idea needed to work. People desperately needed extra cash, and travelers were looking for anything cheaper than $400-a-night hotel rooms.

Finding the Sweet Spot in Market Chaos

The financial crisis wasn’t just bad luck – it was the perfect storm that made their business model actually viable. Your neighbor suddenly needs an extra $200 a month to pay bills, and you’re trying to find a place to stay that doesn’t cost more than your car payment. Match made in heaven.

These guys were smart enough to realize that big events create temporary insanity in hotel pricing. Ever tried booking a room during Comic-Con or the Super Bowl? It’s absolutely nuts. That’s when people start thinking, “You know what? Maybe that spare room doesn’t sound so terrible.”

Understanding when markets are ripe for disruption is crucial, which is why smart market sizing analysis helps identify these opportunities before competitors catch on.

During that 2008 Democratic Convention in Denver, hotels were charging $300-500 per night for rooms that normally cost $120. The founders capitalized on this pricing insanity by offering their air mattresses for $80 including breakfast. Simple arbitrage, but it proved people would actually do this.

Solving the Chicken-and-Egg Problem

Every marketplace faces this nightmare: you need hosts to attract guests, but you need guests to attract hosts. It’s like trying to start a party – nobody wants to be the first one there.

Airbnb cracked this by focusing on situations where hotels had already failed people. Democratic conventions, music festivals, big conferences – times when travelers literally had no other choice. Smart move, because it guaranteed their early users would find immediate value.

Instead of trying to compete with hotels on a random Tuesday in March, they went after the times when hotels were already screwing people over. Once people saw it worked, using Airbnb for normal travel became an easier sell.

|

Event Type |

Hotel Occupancy |

Average Price Increase |

Airbnb Opportunity |

|---|---|---|---|

|

Political Conventions |

95-100% |

200-400% |

High |

|

Music Festivals |

85-95% |

150-300% |

High |

|

Sporting Events |

80-90% |

100-250% |

Medium |

|

Business Conferences |

75-85% |

50-150% |

Medium |

|

Regular Travel |

60-75% |

0-50% |

Low |

Building the Perfect Two-Sided Marketplace

Here’s where things get really tricky. Building a marketplace isn’t just about connecting people – it’s about making sure everyone stays happy while you make money. And trust me, keeping both hosts and guests satisfied while taking your cut is way harder than it looks.

Making Network Effects Actually Work

Everyone talks about network effects like they’re magic, but making them work in real life takes serious strategy. More hosts means better options for guests. More guests means more money for hosts. Sounds simple, right?

The trick is getting to that tipping point where the whole thing becomes self-sustaining. You need enough density in each city so guests actually have choices and hosts can count on regular bookings. It’s like reaching critical mass in a nuclear reaction – once you hit it, everything accelerates.

Fee Structure That Doesn’t Piss Everyone Off

Airbnb does something clever with their fees – they charge both sides, but in a way that doesn’t feel unfair to anyone. Hosts pay around 3-5%, guests pay 6-12% plus taxes.

The psychology here is brilliant. Hosts see their fee as a cost of doing business (and it’s lower than most alternatives anyway). Guests see their fee as part of the total price, which usually still beats hotel rates. Everyone feels like they’re getting a deal.

They also adjust fees based on market conditions. High-demand periods? Fees go up slightly. Slow periods? Promotional pricing keeps bookings flowing. It’s dynamic pricing that actually makes sense.

Smart fee structures require understanding the real economics, similar to how businesses need accurate revenue calculation to ensure all sides of the marketplace stay profitable.

Quality Control Without Scaring People Away

This is the really hard part – how do you maintain quality without creating so much friction that new users run away? Their solution is pretty elegant: everyone rates everyone. Hosts rate guests, guests rate hosts. Bad actors get weeded out naturally.

They also offer professional photography services to help hosts make their places look good. Smart move – better photos mean more bookings, which makes hosts happy and attracts more guests. Win-win.

The key is using technology to catch obvious problems (fake listings, safety issues) while letting humans handle the weird edge cases that pop up in any global marketplace.

Revenue Streams That Actually Work

Smart companies don’t put all their eggs in one basket. Airbnb figured out how to squeeze more money from their existing users without making anyone feel ripped off. That’s the holy grail of platform economics.

Beyond Booking Fees: The Experience Economy

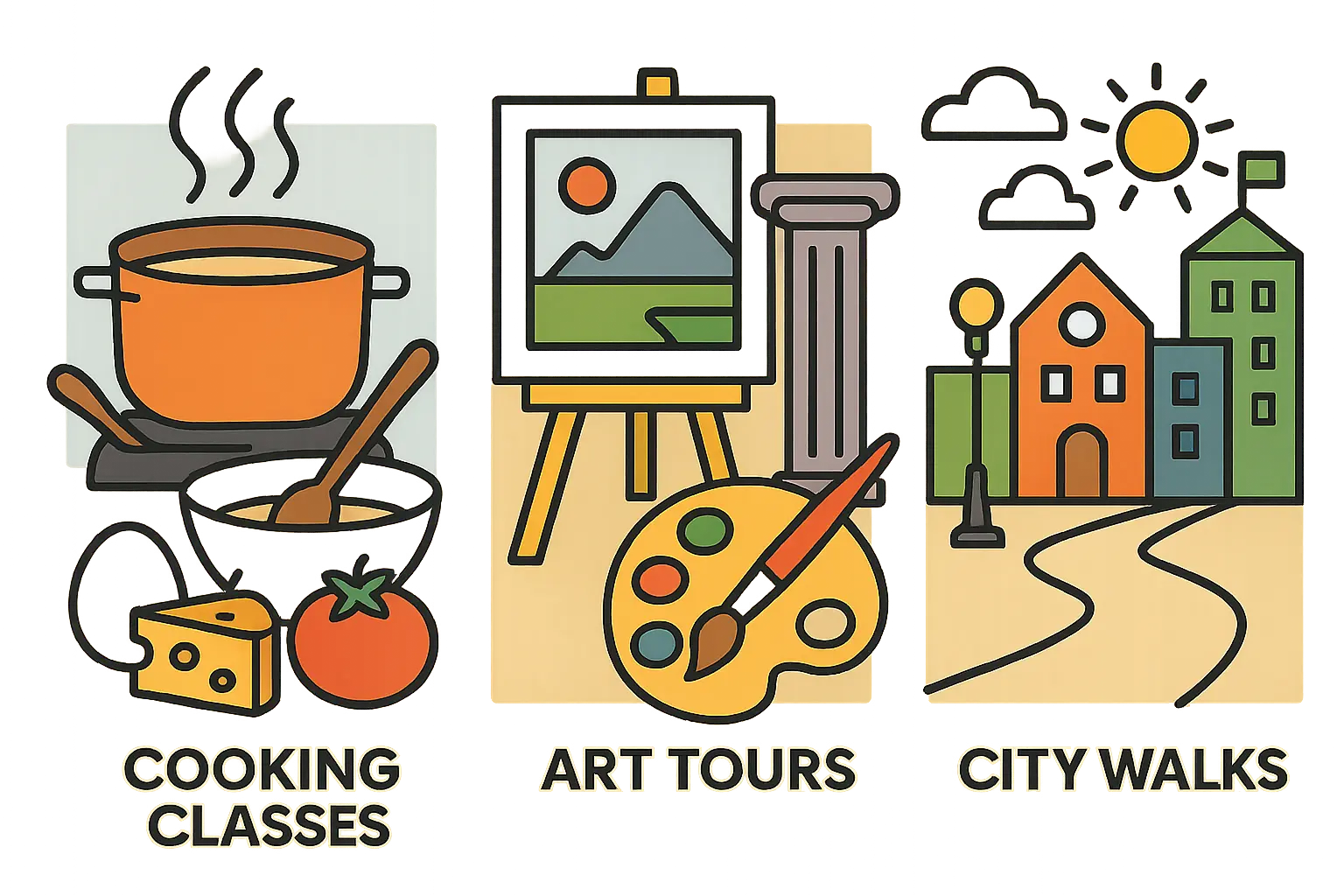

Airbnb Experiences was such a natural next step I’m surprised it took them so long. Think about it – you’re already staying with locals who know their city inside and out. Why not pay them to show you around too?

Local hosts offer cooking classes, city tours, weird niche experiences you literally can’t get anywhere else. Airbnb takes their cut, hosts make extra money, and travelers get authentic local experiences instead of tourist traps. Everyone wins.

Plus, people who book both stays and experiences are way stickier customers. They’re much more likely to come back to Airbnb instead of shopping around with competitors next time they travel.

Turning Infrastructure Into Cash

All that booking technology, payment processing, and user verification stuff they built for their core business? Turns out other companies need the exact same capabilities. So why not license it out?

It’s basically found money – they had to build these systems anyway for their marketplace. Finding other ways to monetize that investment is just smart business. Plus it helps offset the massive infrastructure costs of running a global platform.

Payment processing alone generates serious revenue through transaction fees, while their trust and safety systems have value for any platform dealing with peer-to-peer transactions.

|

Revenue Stream |

Percentage of Total Revenue |

Growth Rate |

Market Potential |

|---|---|---|---|

|

Booking Fees |

85% |

Stable |

High |

|

Experiences |

8% |

25% annually |

Medium |

|

Technology Licensing |

4% |

40% annually |

High |

|

Advertising |

2% |

60% annually |

Medium |

|

Insurance Products |

1% |

15% annually |

Low |

Going Global Without Losing Your Soul

Taking a business global isn’t just about translating your website into different languages. Every country has different rules, different cultures, different ways of doing business. And some of those differences will absolutely blindside you if you’re not careful.

Playing Politics in Complex Markets

Here’s the thing nobody talks about – home-sharing exists in this weird legal gray area in most places. Local governments are still figuring out how to handle it, which means Airbnb has to play politics while building their business.

In some cities, they work directly with regulators to create brand new frameworks for home-sharing. In others, they follow existing rules while lobbying hard for changes. And sometimes? They just push forward and deal with the legal backlash later. Not always pretty, but that’s how disruption actually works in the real world.

The legal challenges are inevitable when you’re messing with established industries. Hotels have been lobbying local governments for decades. Airbnb had to build those same relationships from scratch while fighting off attacks from entrenched competitors.

Cultural Adaptation That Actually Matters

You absolutely cannot just copy-paste your American business model everywhere and expect it to work. Payment preferences alone will kill you in most markets – Americans love credit cards, but other countries prefer bank transfers, digital wallets, or even cash payments.

Communication styles matter way more than you’d think too. What feels friendly and direct in the US might come across as rude in Japan. Customer service expectations vary wildly between cultures – some want immediate responses, others prefer formal processes.

The challenge is adapting to local preferences without making your operations so complex you can’t manage them efficiently. Too much customization creates operational nightmares. Too little kills your market penetration.

In Japan, Airbnb had to completely redesign their host onboarding process to comply with ryokan licensing requirements. This meant automated guest registration systems, partnerships with local cleaning services that understood Japanese hospitality standards, and communication templates that matched Japanese business etiquette. Massive operational complexity, but necessary for market entry.

The Art of Strategic Pivoting

Here’s something most people don’t realize – Airbnb didn’t start out renting entire homes. That pivot from air mattresses and spare rooms to whole properties? That’s what transformed them from a niche startup into a platform that could compete with the entire hotel industry.

From Weird Niche to Mass Market

The shift to entire home rentals changed absolutely everything. Suddenly they weren’t just competing for budget backpackers and college students – they were going after family vacations, business trips, group getaways, extended stays. Way, way bigger market.

But it also meant completely different challenges. Entire homes face way more regulatory scrutiny than someone renting out their spare room. Neighbors get more upset about short-term rentals when the whole house is constantly turning over. The community dynamics change entirely.

This pivot required major platform changes too. Entire homes need different search filters, pricing models, and quality standards than shared spaces. The user experience had to evolve to handle families with kids instead of just solo travelers looking for cheap beds.

Building the Professional Host Ecosystem

As the platform grew, a completely new type of user emerged – people treating this as a real business, managing multiple properties, hiring cleaning services, the whole nine yards. This created serious tension with their “authentic local experience” brand promise.

Professional hosts need totally different tools than casual hosts. Bulk listing management, automated pricing, professional cleaning coordination, revenue analytics – basically property management software built into the platform.

The tricky balance is supporting these serious hosts (who generate way more bookings and revenue) without alienating the individual hosts who built the platform’s reputation for authentic experiences. Too much professionalization and you start looking like just another hotel booking site.

According to research by Omnius, Airbnb has over 18 million monthly organic visitors, showing how their expansion from niche to mass market drove massive organic growth through smart SEO and content strategies.

Beating Hotels at Their Own Game

Disrupting hotels required way more than just being cheaper. Airbnb had to create entirely new value that hotels literally couldn’t copy, then defend that position when the hotel industry started fighting back.

Creating New Expectations

They didn’t just offer cheaper rooms – they completely redefined what accommodation could be. Want to stay in a treehouse? A converted church? Someone’s boat? Hotels can’t compete with that kind of variety and uniqueness.

Group travel became absolutely huge for them. Hotels charge per room, so a family reunion or bachelor party gets expensive really fast. One big Airbnb house for everyone? Way cheaper and way more fun. Plus you get kitchens, living rooms, and the ability to actually hang out together.

The neighborhood experience mattered too. Instead of being stuck in some generic hotel district, you could stay in actual neighborhoods where real people live. Local coffee shops, authentic restaurants, the whole deal.

Fighting Back Against Hotel Industry Adaptation

When hotels started launching their own home-sharing platforms and trying to get more “local” and “authentic,” Airbnb doubled down on what hotels literally couldn’t replicate – truly unique properties and genuine local connections.

Hotels have real advantages in consistency, professional service, and business traveler amenities like loyalty programs and corporate booking systems. But they struggle hard with authenticity and that personal touch that comes from staying in someone’s actual home.

The response strategy was smart – focus on the stuff hotels physically can’t do. Unique properties create Instagram moments that generic hotel rooms never will. Local hosts provide insider knowledge that no hotel concierge can match, no matter how well-trained they are.

Platform competition from other home-sharing services required different tactics focused on network density, feature innovation, and getting to new markets first.

Growth Hacking Before It Was Cool

Airbnb’s early marketing moves were creative, aggressive, and sometimes ethically questionable. But they worked incredibly well and became templates that tons of startups have tried to copy since.

Viral Marketing That Actually Worked

Creating viral growth isn’t about hoping something magically goes viral – it’s about systematically building sharing mechanisms into your user experience. Air bnb made it easy and rewarding for users to create and share content naturally.

The professional photography program was pure genius. Help hosts take better photos, which improves listing quality and gives people Instagram-worthy content to share. Everyone wins – hosts get more bookings, guests get better experiences, and Airbnb gets free marketing.

User reviews became content marketing gold. People love sharing their travel experiences anyway, and detailed reviews help other travelers while promoting the platform. It’s user-generated content that actually serves a purpose.

Understanding how to measure and optimize these viral mechanisms requires tracking engagement across platforms, similar to calculating Instagram engagement rates to measure social media performance.

The Craigslist Integration Controversy

This one was sketchy but incredibly effective. They built tools that let hosts automatically cross-post their Airbnb listings on Craigslist, basically hijacking traffic from Craigslist’s much larger user base.

Craigslist definitely didn’t allow this, but it took them a while to shut it down. By then, Airbnb had built enough scale to survive on their own organic growth. Aggressive? Absolutely. Effective? You bet.

It’s the kind of growth hack that works in the early days but would be impossible to pull off now. Sometimes being first means playing by different rules and asking for forgiveness rather than permission.

As noted in recent growth marketing analysis, “Airbnb’s users could post ads for their rentals on the popular classified ads platform, which wasn’t actually what Craiglist allowed to do”, highlighting how they pushed boundaries during their early growth phase.

Referral Programs That Scale

Their referral program was brilliantly designed – $25 credits for both the referrer and new user, but only after the new user actually completed their first booking. This delayed gratification model ensured quality users while creating a viral loop.

Timing mattered enormously. They prompted for referrals when users were already having positive experiences – after successful trips, during good interactions with customer service. Way more effective than random popup requests that annoy people.

The double-sided incentive structure worked because both people got real value. The referrer got credits for future trips, the new user got a discount on their first booking. Much better than one-sided programs that only reward the referrer.

The Numbers Game: Making Sure the Math Works

Behind all the growth hacking and viral marketing, the fundamental math has to work. You need to acquire customers for less than they’re worth over their lifetime relationship with your platform. Sounds simple, but getting it right is incredibly complex.

Customer Acquisition Cost vs Lifetime Value

For marketplaces, this calculation gets really complicated because value comes from both sides of every transaction. A single guest might book multiple trips over several years, while hosts generate ongoing commission revenue from every booking they get.

Geographic differences matter a ton too. Customers in expensive cities like San Francisco or New York generate way higher booking values than those in smaller markets. But acquisition costs vary just as much, so you have to optimize for each market separately.

The platform’s network effects add another layer of complexity – each user makes the marketplace more valuable for everyone else, but how do you quantify that in your LTV calculations?

Understanding these economics requires sophisticated tracking, similar to how businesses need detailed marketing ROI calculations that account for lifetime value across different customer segments.

The scale they achieved is impressive – over one million Superhosts across more than 200 countries and territories, who collectively earned $23 billion between October 2021 and September 2022, proving their economics work at massive scale.

Marketplace Liquidity Economics

The balance between host supply and guest demand determines everything about market health. Too many hosts, not enough guests? Hosts get frustrated with low occupancy rates and start leaving the platform. Too much demand, not enough supply? Guests face high prices and limited options.

Getting this balance right requires constant monitoring and adjustment across hundreds of markets. It guides major strategic decisions about when to enter new cities, what types of properties to promote, and how to split marketing budgets between host and guest acquisition.

Liquidity metrics also determine when a market is healthy enough to support higher marketing investments. Markets with good supply-demand balance can absorb more marketing spend without creating imbalances.

Operational Scalability Framework

Maintaining service quality while scaling across hundreds of countries requires serious automation. Machine learning algorithms detect fraudulent listings, assess photo quality, flag potential safety issues, and handle customer service routing. Without this technology, managing millions of listings would be impossible.

Dynamic pricing algorithms help hosts optimize their revenue while staying competitive in local markets. AI-powered pricing recommendations create value for both sides through data analysis that individual hosts could never do themselves.

The challenge is building systems that work across different cultures and regulatory environments while maintaining the human touch that makes the platform feel personal rather than corporate.

Smart analytics and tracking systems are essential for this kind of scale, similar to how businesses use GA4 audit processes to optimize their data collection across multiple markets.

Their current scale demonstrates the success of this approach – 400M+ guests since inception and 5M+ listings in 100K+ cities, showing how operational scalability enabled massive global expansion.

Host Success Checklist:

-

☐ Complete profile with professional photos

-

☐ Maintain 90%+ response rate within 24 hours

-

☐ Keep cancellation rate below 1%

-

☐ Achieve minimum 4.8-star rating

-

☐ Complete at least 10 bookings annually

-

☐ Implement dynamic pricing strategy

-

☐ Optimize listing for local SEO keywords

-

☐ Provide essential amenities (WiFi, clean linens, toiletries)

-

☐ Create detailed house rules and check-in instructions

-

☐ Monitor competitor pricing weekly

What This Means for Your Business

The Airbnb story offers real lessons for anyone trying to build something that scales beyond their local market. The most important takeaway? Success comes from systematic experimentation and paying attention to what the data actually tells you, not what you hope it says.

Whether you’re building a marketplace, launching a service business, or trying to expand internationally, the core principles are similar: solve genuine problems people actually have, build systems that get stronger as they grow, make sure your unit economics work, and don’t be afraid to change direction when the numbers tell you to.

The key insight is that sustainable growth comes from measuring what actually matters and being willing to pivot when something isn’t working. Airbnb succeeded because they paid obsessive attention to their metrics and adapted quickly when they learned something new about their market.

If you’re struggling to scale your marketing or optimize your customer acquisition costs, The Marketing Agency specializes in implementing these same data-driven strategies that made Airbnb successful. Our PPC services ($750-$5,000 monthly) can help you test new markets efficiently before major investment, while our email marketing optimization ($1,200-$10,000 monthly) maximizes ROI from existing customers through sophisticated retention programs.

The tracking and optimization principles that guided Airbnb’s marketing decisions are exactly what we implement for clients who want marketing investments based on actual data rather than hope and guesswork.

Marketplace Launch Framework:

-

☐ Identify solution for initial user acquisition

-

☐ Design value proposition for both sides

-

☐ Implement mutual rating system

-

☐ Create automated quality control processes

-

☐ Establish clear fee structure

-

☐ Build viral sharing mechanisms

-

☐ Develop local market density strategy

-

☐ Plan regulatory compliance approach

-

☐ Design scalable customer support system

-

☐ Implement data-driven pricing model

Final Thoughts

Airbnb’s journey from air mattresses to global platform shows that successful disruption takes way more than just a clever idea – it demands relentless execution, smart pivoting when the data tells you to, and obsessive focus on making sure the economics actually work at scale.

Their success came from solving real problems for both hosts and guests while building sustainable advantages through network effects and operational excellence. Most importantly, they demonstrated how data-driven decision making beats gut instinct every time when it comes to scaling a business.

Sure, they got lucky with timing and made some ethically questionable moves along the way. The Craigslist thing was pretty sketchy, and their impact on housing markets in some cities has been genuinely problematic. But they also made smart decisions when it mattered most.

Not every startup can replicate their exact path, but the underlying principles – focus on unit economics, build viral mechanisms, solve real problems, measure everything, pivot when necessary – those lessons are absolutely worth stealing for your own business.