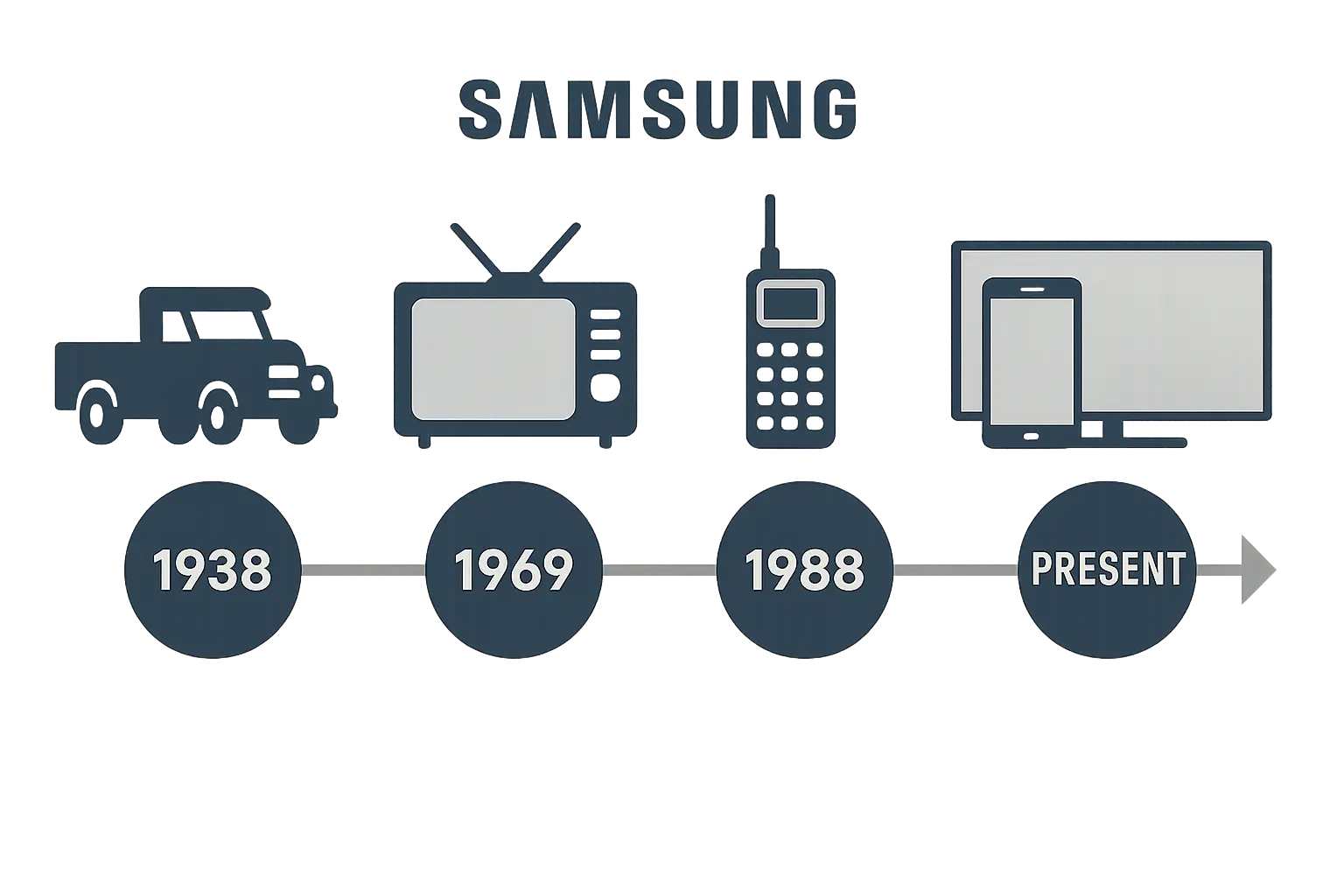

Here’s what blows my mind about Samsung: back in 1938, they were selling groceries and noodles in Korea. Fast forward to today, and they’re going toe-to-toe with Apple while secretly making the chips that power iPhones. Talk about a plot twist.

Samsung’s transformation shows how smart moves, bold bets, and learning from every mistake can create sustained competitive advantage across multiple technology sectors. The company now operates in over 80 countries and employs more than 270,000 people worldwide – that’s some serious global reach.

Table of Contents

-

Strategic Evolution and Market Positioning

-

Crisis Management and Organizational Resilience

-

Innovation Ecosystem and R&D Strategy

-

Competitive Strategy and Market Dynamics

-

Operational Excellence and Manufacturing Strategy

-

Corporate Culture and Human Resources Strategy

-

Final Thoughts

TL;DR

-

Samsung went from selling groceries in 1938 to becoming a global tech giant through smart diversification and aggressive technology acquisition

-

Their vertical integration strategy – controlling everything from semiconductors to displays – creates massive competitive advantages and cost savings

-

The Galaxy Note 7 crisis showed how transparent communication and swift action can actually preserve brand reputation during major disasters

-

Olympic sponsorship strategy built global brand recognition, transforming Samsung from unknown Korean manufacturer to premium technology competitor

-

Heavy R&D investment (typically 6-7% of revenue) drives innovation leadership across multiple technology sectors

-

Direct competition with Apple pushed Samsung to elevate product quality and premium positioning across all product lines

-

Six Sigma implementation and global manufacturing network optimization enabled large-scale production without sacrificing quality

-

Innovation culture balances creative risk-taking with operational discipline across 280,000+ employees worldwide

Strategic Evolution and Market Positioning

Look, Samsung’s story is wild when you really think about it. In 1938, Lee Byung-chul was basically running a corner store in Korea, selling groceries and noodles. Now his company is making the screens you’re probably reading this on. That’s not just growth – that’s complete reinvention.

From Trading Company to Tech Giant (1938-1990s)

What I find crazy about Samsung’s early days is how they jumped from industry to industry like they were collecting trading cards. Groceries, then textiles, then insurance, then electronics. Most companies would call that unfocused, but Samsung was actually building a masterclass in business education.

Think about it – every industry taught them something different. Textiles showed them manufacturing at scale. Insurance taught them risk management (which came in handy later). Securities gave them a crash course in financial markets. They were basically getting an MBA in real-world business operations across multiple sectors.

Understanding how to measure business growth and opportunity is crucial for companies undergoing transformation, which is why comprehensive market sizing analysis becomes essential when evaluating strategic expansion opportunities during major business pivots. Samsung has maintained consistent growth through strategic expansion, with the company now operating 48 direct management stores nationwide and plans to install two more, according to VCA Technology’s Samsung case study. This retail expansion shows their commitment to direct customer engagement and market presence optimization.

Diversification Strategy Implementation

The diversification wasn’t random either. Each move was calculated, building on what they’d learned before. During the 1950s and 60s, they moved into textiles, insurance, securities, and retail. This wasn’t just about spreading risk (though that helped). Each industry taught them different aspects of business operations, supply chain management, and customer relationships.

What strikes me most about this period is how Samsung used each venture as a learning laboratory. The textile business taught them manufacturing processes. Insurance showed them risk management. Securities gave them financial market insights. Every industry added another layer to their business intelligence.

|

Era |

Industry Focus |

Key Learning Outcomes |

|---|---|---|

|

1938-1950s |

Trading (groceries, noodles) |

Basic business operations, supply chain fundamentals |

|

1950s-1960s |

Textiles, Insurance, Securities |

Manufacturing processes, risk management, financial markets |

|

1960s-1970s |

Electronics, Shipbuilding |

Technology integration, heavy industry expertise |

|

1980s-1990s |

Semiconductors, Mobile |

Advanced technology, global market positioning |

Technology Acquisition and Reverse Engineering

Here’s where Samsung got really smart – instead of trying to invent everything from scratch, they became masters of strategic learning. They’d license foreign technology, buy products from competitors, then take them apart piece by piece to understand how they worked.

This wasn’t copying – it was reverse engineering with a purpose. They’d study a television or radio, figure out the principles behind it, then ask themselves: “How can we make this better, cheaper, or both?” The Korean government was backing them on technology transfer, which made this approach even more effective.

What’s brilliant is they didn’t stop at just understanding existing products. They used that knowledge as a foundation to build something better. By the 1990s, they weren’t following anymore – they were leading.

Digital Transformation and Innovation Leadership

The 1990s were when Samsung really hit their stride. All those years of learning and building capability started paying off big time. They began pumping billions into R&D – we’re talking serious money here – and it showed in breakthrough innovations that put them ahead of the competition.

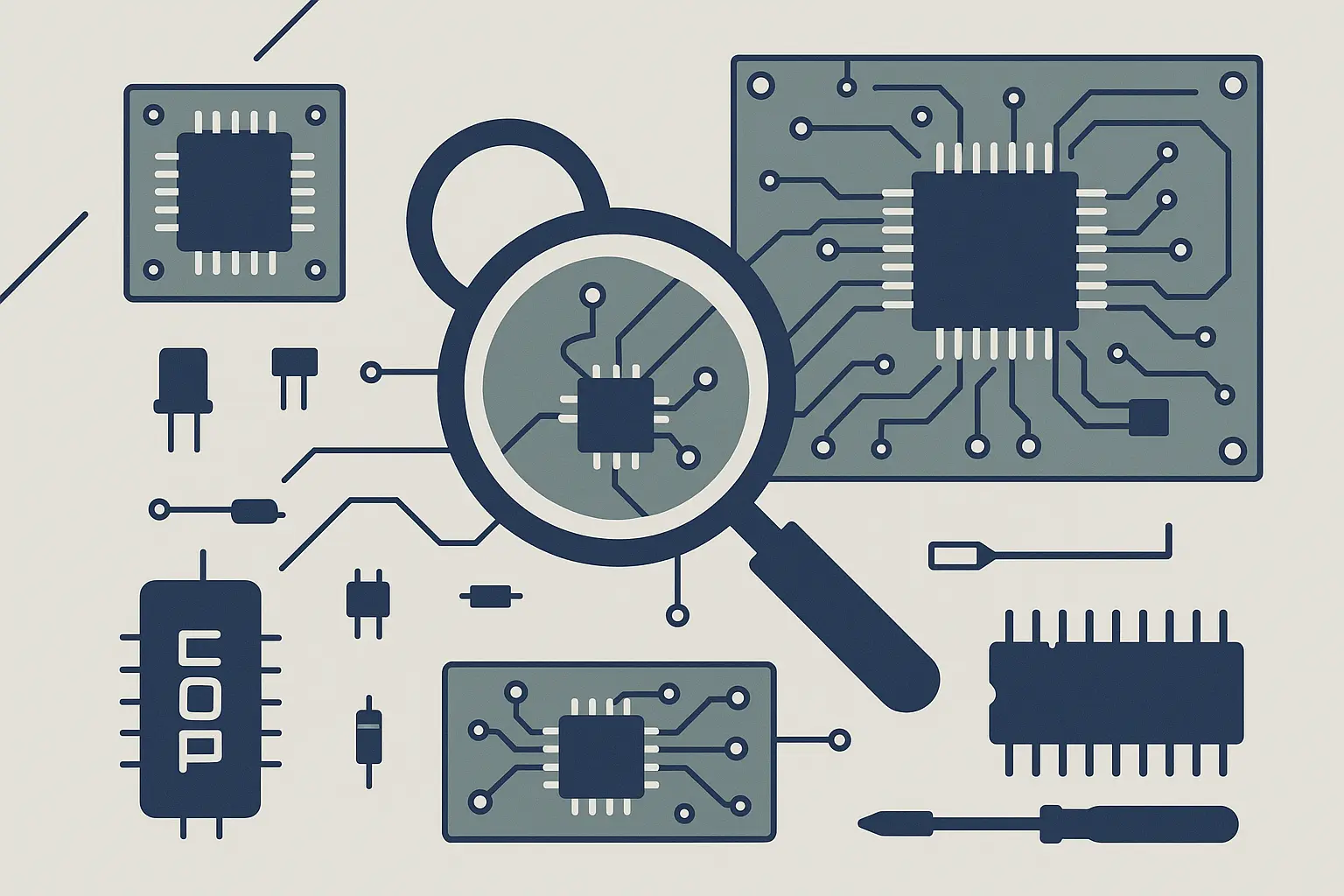

Memory Chip Market Domination

Samsung’s memory chip strategy was gutsy as hell. During the 1980s semiconductor crash, while everyone else was cutting costs and laying people off, Samsung did the opposite. They doubled down with massive investments in new facilities and top talent.

Everyone thought they were crazy. But Samsung understood something their competitors missed – memory chips are the foundation of everything digital. Control memory production, and you control a critical piece of the entire tech ecosystem.

Today? They own about 40% of the global memory market. That “crazy” investment looks pretty genius now.

Smartphone Revolution Participation

When Apple dropped the iPhone in 2007, Samsung could’ve panicked. Instead, they played it perfectly. They were already supplying chips and displays for early iPhones (talk about being inside your competitor’s operation), so they knew exactly what they were up against.

The Galaxy launch in 2010 wasn’t just another Android phone – it was Samsung saying “We can play in the premium league too.” The S Pen for the Note series? Pure genius. Apple couldn’t match that, and it became Samsung’s signature feature.

What I love about their smartphone strategy is how they didn’t just compete on price. They went premium with better materials, cutting-edge displays, and features that actually mattered to users. That takes guts when you’re known as the “cheaper alternative.”

Display Technology Innovation

Samsung’s OLED bet is another example of their long-term thinking. While everyone else was making incremental improvements to LCD screens, Samsung invested heavily in organic light-emitting diode technology.

That investment is paying off huge now. Their displays are in everything from smartphones to TVs, and those foldable phones? That’s only possible because they control the display technology. Try doing that when you’re buying screens from someone else.

Global Brand Building and Marketing Excellence

Building a global brand when you’re starting from “Made in Korea” in the 1990s? That’s a tough sell. Back then, Korean products didn’t exactly scream “premium quality” to most consumers worldwide.

Samsung’s social media presence shows their global reach effectiveness, with their Facebook page garnering 162 million likes, according to Simplilearn’s marketing strategy analysis. This massive digital following reflects their successful transformation from regional manufacturer to globally recognized premium brand.

Olympic Sponsorship Strategy

The Olympic sponsorship starting with Seoul in 1988 was marketing gold. Think about it – the Olympics are about excellence, international cooperation, and cutting-edge technology. Perfect fit for a tech company trying to build global credibility.

But here’s what’s really smart – they stuck with it. Over 30 years of Olympic partnerships means multiple generations associate Samsung with excellence and global reach. That’s brand building with serious staying power.

Premium Brand Positioning

Moving from “cheap Korean knockoff” to “premium Apple competitor” required completely reimagining how they presented themselves. New store designs in premium locations. Advertising focused on innovation instead of price. Even the packaging got the luxury treatment.

Effective brand positioning requires comprehensive measurement and optimization strategies, which is why companies benefit from sophisticated marketing ROI tracking to evaluate the effectiveness of their premium brand positioning investments across different markets and channels.

This wasn’t just marketing fluff – they had to back it up with products that were genuinely better in meaningful ways. And they did.

Crisis Management and Organizational Resilience

Every major company faces disasters, but how you handle them separates the winners from the losers. Samsung’s had their share of crises, and honestly, their responses have been pretty impressive.

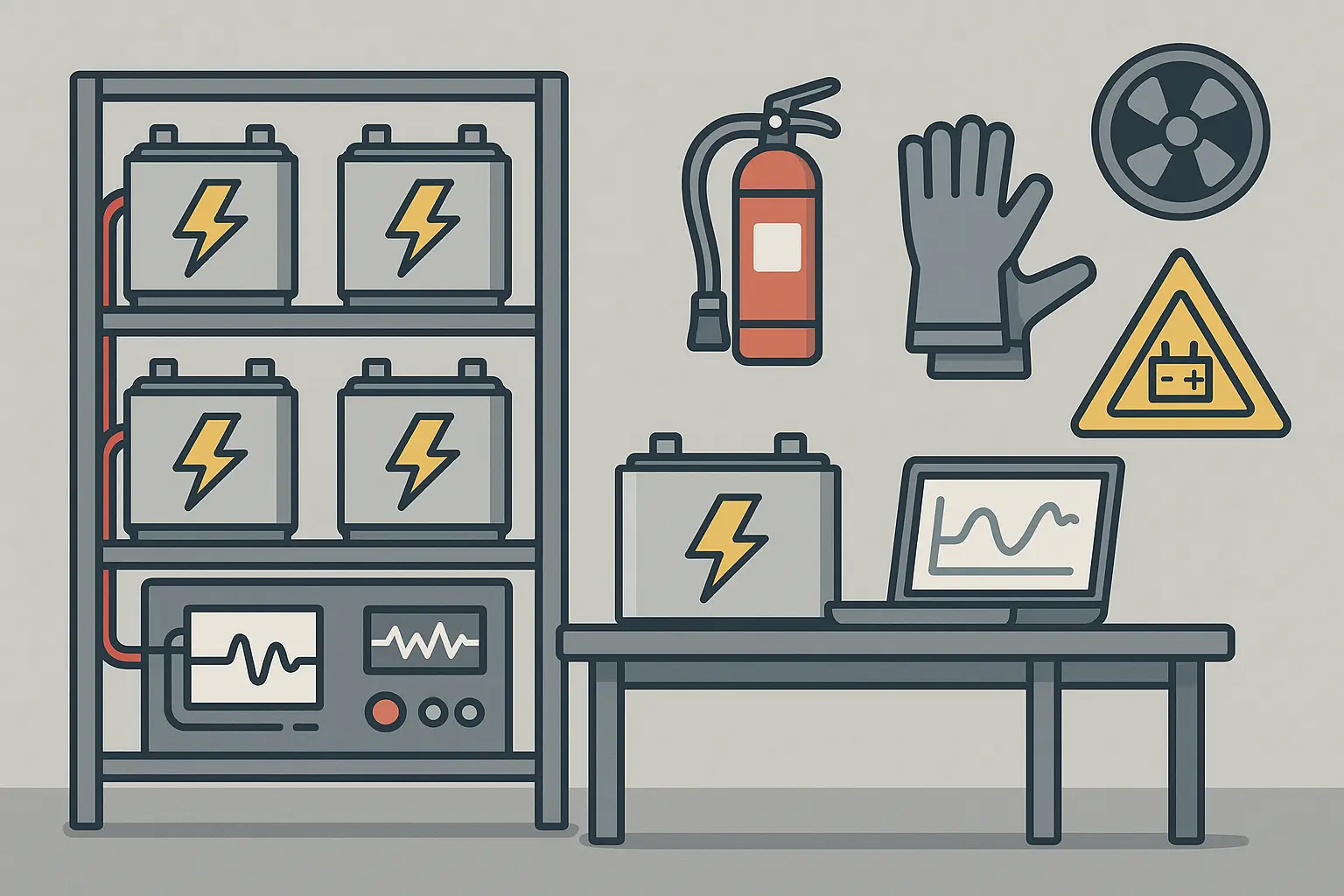

Galaxy Note 7 Crisis Response

The Note 7 battery situation in 2016 could’ve killed Samsung’s smartphone business. Phones were literally catching fire and exploding. Airlines banned them. The media was having a field day.

But Samsung’s response? Textbook crisis management.

Crisis Communication Strategy

Instead of making excuses or pointing fingers, Samsung owned it completely. Full responsibility, regular updates, clear instructions for returns. No corporate BS or legal double-speak.

The decision to halt production and recall millions of devices worldwide sent a clear message: customer safety beats short-term profits. That’s expensive integrity, but it saved their reputation.

During the Galaxy Note 7 crisis, Samsung implemented a comprehensive crisis communication checklist that included: immediate acknowledgment of the issue, clear safety instructions for customers, regular updates through multiple channels, coordination with airlines and regulatory bodies, and transparent reporting of investigation findings. This systematic approach helped maintain consumer confidence despite the severity of the product failure.

Product Safety Protocol Overhaul

After the crisis, Samsung didn’t just patch things up – they rebuilt their entire safety testing process from the ground up. Eight-point battery safety checks, extended testing periods, new organizational structures focused specifically on product safety.

These weren’t just reactive changes either. They now test batteries under more extreme conditions than industry standards require. That’s going above and beyond to make sure it never happens again.

Leadership Succession and Governance

Managing family business transitions while running a global tech empire? That’s tricky territory. Samsung’s navigated multiple generational changes while keeping things professional and strategic.

The Lee family’s approach has evolved smart over three generations. They maintain family control for long-term vision and continuity, but rely on professional managers for day-to-day operations. Best of both worlds – family commitment with professional expertise.

Innovation Ecosystem and R&D Strategy

Samsung doesn’t just throw money at research and hope for the best. They’ve built an entire machine that turns scientific breakthroughs into products that dominate markets. We’re talking $15-20 billion annually in R&D spending – that’s serious commitment to innovation.

Samsung’s commitment to AI innovation continues to evolve, as shown by their recent development of SKE-GPT, an AI-based cluster diagnostic tool for their Samsung Cloud Platform. According to Samsung SDS’s exploration of AI-based services, this tool shows how they’re integrating generative AI technology into existing services to enhance customer technical support and operational efficiency.

Vertical Integration Excellence

Here’s what sets Samsung apart from most tech companies – they make their own stuff. While competitors are buying components from suppliers, Samsung controls their entire supply chain from semiconductors to displays to batteries.

Component Manufacturing Mastery

This creates a fascinating situation where Samsung supplies components to competitors. Apple, their biggest smartphone rival, still buys billions worth of chips and displays from Samsung every year.

So Samsung profits when Apple succeeds, then uses that revenue to fund products that compete directly with Apple. That’s next-level strategic positioning.

Understanding revenue streams and profitability across different business units is essential for complex organizations, which is why comprehensive revenue calculation methodologies help evaluate the financial impact of their dual-role strategy as both competitor and supplier in the technology ecosystem.

Supply Chain Control Benefits

When COVID-19 messed up global supply chains, Samsung’s vertical integration was a huge advantage. While competitors struggled with component shortages, Samsung could prioritize their own production needs.

The quality control benefits are just as important. When you make your own components, you can optimize them specifically for your products instead of using generic parts designed for everyone.

Future Technology Investment

Samsung doesn’t just follow trends – they try to create them. Their research teams work on technologies that won’t hit the market for 5-10 years. That’s thinking way ahead of the curve.

Samsung’s technical support analysis reveals significant opportunities for AI integration, with approximately 68% of container product support cases on their Samsung Cloud Platform being resolved by users themselves through guides, according to Samsung SDS’s AI innovation report. This data drives their development of AI-powered diagnostic tools to improve customer service efficiency.

5G Infrastructure Leadership

While everyone talks about 5G phones, Samsung’s been building the infrastructure that makes 5G networks possible. They’re one of the few companies providing complete end-to-end 5G solutions.

This positions them perfectly as 5G enables new applications in autonomous vehicles, smart cities, and industrial automation. They’re not just selling phones – they’re enabling entire ecosystems.

Competitive Strategy and Market Dynamics

Tech competition is brutal, and Samsung faces attacks from multiple directions. Premium competition from Apple, cost competition from Chinese manufacturers, and specialized competition in component markets.

Apple Competition Framework

The Samsung-Apple rivalry has been defining smartphone competition for over a decade. What makes it fascinating is they’re simultaneously fierce enemies and major business partners.

Patent Warfare and Legal Strategy

The patent battles have been legendary – billions in lawsuits, countersuits, and settlements. But Samsung’s used these strategically. Their extensive patent portfolio serves as both shield and sword in cross-licensing negotiations.

Rather than avoiding patent conflicts, Samsung has used them strategically. Their extensive patent portfolio serves both as a defensive shield and an offensive weapon, giving them negotiating leverage in cross-licensing agreements.

|

Competition Aspect |

Samsung Strategy |

Key Advantages |

|---|---|---|

|

Premium Smartphones |

Feature differentiation, S Pen innovation |

Larger screens, stylus functionality, foldable technology |

|

Component Supply |

Dual role as competitor and supplier |

Revenue from competitors, technology insights |

|

Patent Portfolio |

Defensive and offensive IP strategy |

Cross-licensing leverage, innovation protection |

|

Marketing Approach |

Direct comparison advertising |

Brand awareness through competitive messaging |

Chinese Market Competition

Chinese manufacturers disrupted everything by offering premium features at budget prices. Huawei, Xiaomi, OnePlus – they forced Samsung to completely rethink their strategy.

Market Share Defense Tactics

Samsung’s response has been smart – expand the mid-range lineup to compete on price while maintaining premium positioning for flagship devices. They’ve also leveraged their component manufacturing advantages for better cost structures.

Geographic focus matters too. While Chinese brands gained ground in Asia and Europe, Samsung strengthened their position in markets where brand reputation and carrier relationships trump pure price competition.

Operational Excellence and Manufacturing Strategy

Samsung’s manufacturing capabilities don’t get enough credit, but they’re crucial to their global dominance. They’ve built one of the world’s most sophisticated manufacturing networks while maintaining quality across diverse product lines.

Six Sigma Implementation

Samsung didn’t just adopt Six Sigma – they customized it for technology manufacturing challenges. Their version focuses on reducing defects in complex electronics where tiny variations can cause major failures.

Quality Management Systems

Their quality control goes beyond industry standards. They test products under extreme conditions that exceed normal usage scenarios. This closed-loop approach uses data from manufacturing, customer feedback, and field performance to continuously improve.

Crisis Management Checklist Template:

-

Immediate issue acknowledgment within 24 hours

-

Customer safety assessment and communication

-

Regulatory body notification and coordination

-

Internal investigation team activation

-

Public communication strategy implementation

-

Product recall procedures if necessary

-

Root cause analysis completion

-

Process improvement implementation

-

Stakeholder update and follow-up communication

Global Manufacturing Network

Samsung operates facilities across multiple continents, each optimized for specific products and markets. This geographic distribution provides cost advantages, reduces shipping times, and helps navigate trade restrictions.

Samsung’s focus on employee engagement through technology is evident in their partnership implementations, as shown by Envoy Air’s deployment of Samsung digital signage solutions. According to AV Network’s case study on employee engagement, Samsung’s All-in-One IAC 130-inch 2K displays and centralized content management systems are helping companies transform internal communications and strengthen corporate culture.

Cost Optimization Strategies

Maintaining competitive pricing while investing heavily in R&D requires sophisticated cost management. Samsung achieves this through manufacturing scale, process automation, and strategic material sourcing.

But it’s not just about cutting costs – it’s about improving value. Sometimes spending more on better components actually reduces total cost by improving reliability and reducing warranty claims.

Effective cost management requires sophisticated financial analysis tools, which is why companies benefit from comprehensive ROI calculation methodologies to evaluate manufacturing investments and optimize resource allocation across their global production network.

Automation and Industry 4.0 Integration

Samsung’s factories are like something from science fiction – advanced robotics, AI-powered quality control, real-time production optimization. This automation reduces human error while improving consistency and efficiency.

Industry 4.0 integration allows them to customize products at scale, respond quickly to demand changes, and maintain quality standards impossible with manual processes.

Samsung’s Noida facility in India is a perfect example of their global manufacturing strategy. Opened in 2018 as the world’s largest mobile factory, it shows how they adapt manufacturing capabilities to local markets while maintaining global quality standards. The facility reduces costs through local production, enables faster market response, and aligns with government initiatives.

Corporate Culture and Human Resources Strategy

Managing 280,000+ employees across dozens of countries requires more than good HR policies. Samsung’s developed a culture that balances innovation with operational discipline.

Innovation Culture Development

Creating a culture that encourages innovation while maintaining operational excellence is challenging. Samsung’s systems reward creative thinking and calculated risk-taking while ensuring quality and customer satisfaction remain paramount.

Employee Training and Development Programs

Samsung’s investment in employee development is substantial – they operate their own universities and training centers worldwide. These don’t just teach technical skills; they develop leadership capabilities and cross-cultural competencies needed for global operations.

The company’s approach to training emphasizes both depth and breadth. Engineers learn business principles, managers understand technical constraints, and everyone develops appreciation for different cultural perspectives and market requirements.

Global Talent Management

Recruiting and retaining top talent in competitive technology markets requires more than competitive salaries. Samsung’s developed comprehensive strategies addressing career development, work-life balance, and meaningful contribution to innovative projects.

Performance Management Systems

Samsung’s performance management goes beyond traditional annual reviews. They use continuous feedback, project-based evaluations, and peer assessments for comprehensive performance insights.

Effective performance measurement requires sophisticated analytics capabilities, which is why organizations implement comprehensive advanced analytics systems to track employee performance, identify development opportunities, and optimize talent allocation across their global operations.

The system aligns individual goals with corporate strategic objectives, ensuring employee efforts contribute directly to business success while providing clear career development pathways.

Innovation Culture Development Template:

-

Establish innovation metrics and KPIs

-

Create cross-functional collaboration opportunities

-

Implement idea submission and evaluation systems

-

Develop risk-taking reward structures

-

Provide innovation training and workshops

-

Foster external partnership and learning

-

Measure and communicate innovation success stories

-

Balance creativity with operational requirements

Knowledge Transfer Mechanisms

With operations spanning multiple continents and business units, Samsung’s developed sophisticated systems for capturing, sharing, and applying knowledge across the organization. This includes both formal documentation systems and informal knowledge-sharing networks.

These mechanisms ensure innovations developed in one division can benefit the entire organization, maximizing return on R&D investments and operational improvements.

Cultural Integration Challenges

Managing cultural differences across global operations requires sensitivity and systematic approaches. Samsung’s built strategies for unified corporate culture while respecting local customs and business practices.

The cultural integration process includes extensive cross-cultural training, international assignment programs, and communication systems that bridge language and cultural barriers while maintaining consistent corporate values and standards.

Modern organizations increasingly rely on AI-powered systems for talent management and cultural integration, which is why Samsung’s approach aligns with emerging trends in creating continuously learning systems that adapt to diverse workforce needs and optimize human resource allocation across global operations.

Final Thoughts

Samsung’s journey from corner store to global tech powerhouse offers serious lessons for any business thinking long-term. This isn’t just about making great products – it’s about strategic thinking, building capabilities systematically, and staying focused on market leadership across multiple dimensions.

What gets me most about Samsung’s approach is how they consistently bet on the future while nailing operational excellence in the present. Whether investing in memory chips during downturns, building vertical integration, or transforming from low-cost to premium brand – they repeatedly chose long-term advantage over short-term profits.

The crisis management lessons alone are worth studying. Samsung’s Note 7 response proves that transparency, swift action, and genuine commitment to customer safety can actually strengthen brand trust. In our social media age, this authentic crisis response is more critical than ever.

Most importantly, Samsung shows that innovation isn’t just about great ideas – it’s about building systems and cultures that consistently turn those ideas into market-leading products. Their R&D investments, manufacturing excellence, and talent development create sustainable competitive advantages competitors can’t easily copy.