Table of Contents

-

The Ignition Switch Disaster That Nearly Destroyed GM

-

From Crisis to Accountability: Legal Battles and Leadership Changes

-

Building a Safety-First Culture After the Fallout

-

GM’s $35 Billion Electric Vehicle Gamble

-

Competing Against Tesla and the EV Revolution

-

Financial Recovery: Rising from Bankruptcy Ashes

-

The Cruise Acquisition: Betting Big on Self-Driving Cars

-

Global Operations and Supply Chain Lessons

-

Labor Relations During Industry Transformation

-

What This Means for Your Business

TL;DR

-

GM’s ignition switch crisis killed 124 people and exposed a broken safety culture that put saving money over saving lives

-

Mary Barra’s congressional testimony was brutal but showed how owning your mistakes can actually rebuild trust

-

The company got hit with $900 million in criminal penalties and had to completely rebuild how they handle safety

-

GM threw $35 billion at electric vehicles through their Ultium platform, going head-to-head with Tesla

-

After bankruptcy, GM cut from 8 brands down to 4, focusing their money on what actually made sense

-

The Cruise autonomous vehicle deal is GM’s biggest bet on where transportation is headed

-

When the chip shortage hit, GM learned the hard way that just-in-time manufacturing has some serious weaknesses

-

Thousands of workers had to learn completely new skills for electric vehicle manufacturing

The Ignition Switch Disaster That Nearly Destroyed GM

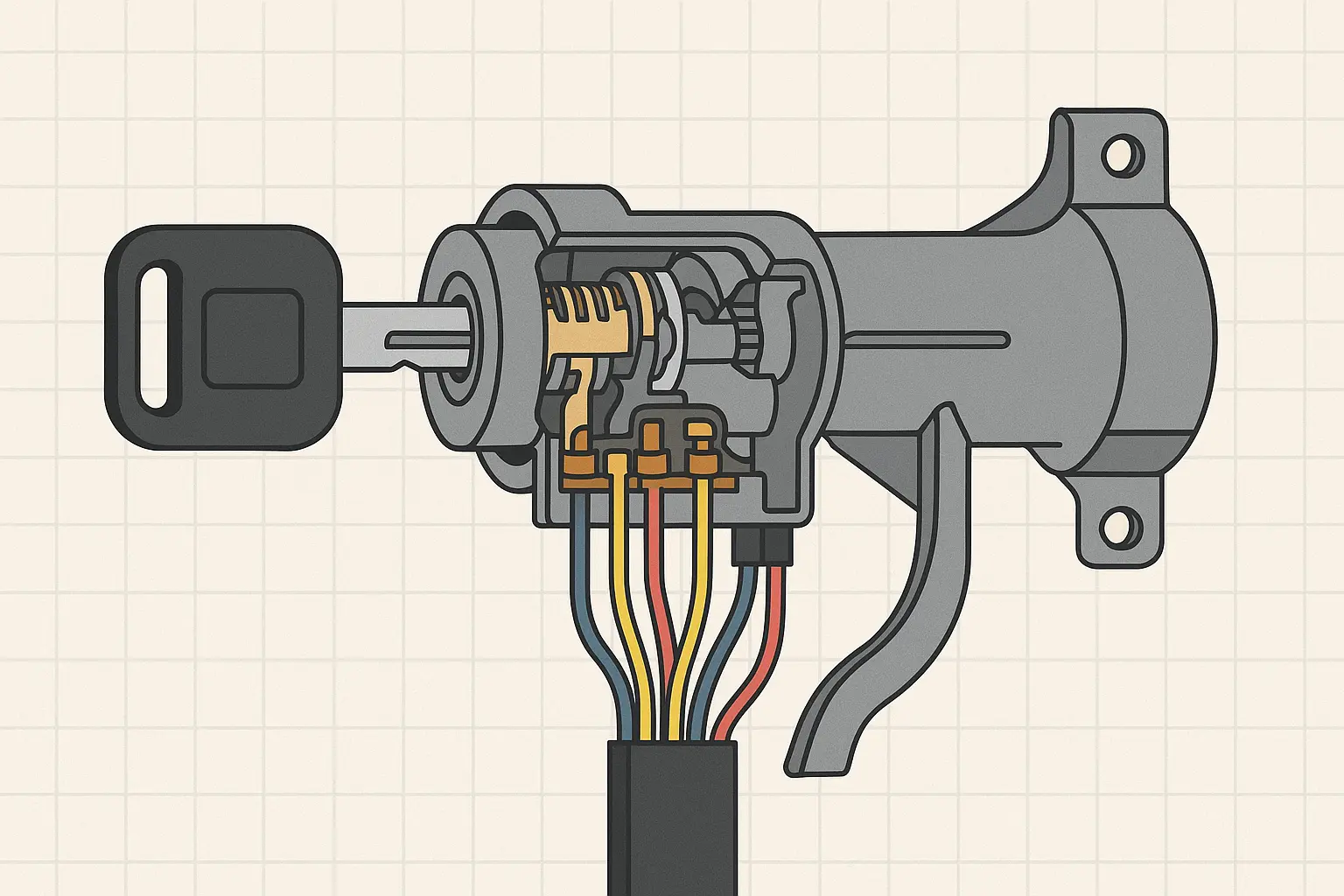

I still remember when this story first broke. You probably do too – it was everywhere. Cars just shutting off while people were driving down the highway. Airbags that wouldn’t work during crashes. Families losing loved ones because of a part that cost less than a dollar to fix.

When I dug into the timeline, I couldn’t believe what I found. GM engineers knew about ignition switch problems back in 2001 during pre-production testing. Twenty-one years before the crisis became public knowledge. That’s not an oversight – that’s a complete failure of corporate responsibility.

What really gets me is how the company handled those early warning signs. Instead of treating safety concerns as urgent priorities, they got buried in bureaucratic processes. Engineers who raised red flags found their concerns stuck in committee reviews and cost-benefit analyses. The culture basically taught people that speaking up about safety issues was career suicide.

Despite everything falling apart, GM still managed to hold onto a 17.3% market share of cars in the United States, which honestly shows just how massive this company is. What GM figured out later is that advanced analytics could’ve identified patterns in safety data much earlier, potentially stopping this whole disaster from getting so out of control.

When the Media Caught Wind of the Story

The real disaster started when journalists began connecting the dots between seemingly isolated incidents. Suddenly, GM wasn’t dealing with individual accident reports – they were facing a pattern of preventable deaths that the company had known about for over a decade.

GM’s initial response made everything worse. They went into full defensive mode, denying responsibility and downplaying how bad things really were. Every press release felt calculated to protect the company rather than acknowledge that real people had died. This backfired spectacularly because it made GM look callous and dishonest when families were grieving preventable losses.

The media coverage got worse because GM’s story kept changing. First, they claimed the defect only affected certain model years. Then more vehicles got added to the recall list. The death toll kept climbing as investigators uncovered more cases. Each new revelation made the company’s previous statements look like straight-up lies.

The Human Cost Behind the Headlines

We’re talking about 124 confirmed deaths and 275 injuries from crashes linked to these faulty ignition switches. But those numbers don’t capture the full impact. Families lost parents, children, siblings – all because GM chose to save money instead of fixing a known safety defect.

Picture this: you’re driving down the highway with a heavy keychain. You hit a pothole, and suddenly your ignition switch slips out of place. Your engine dies. No power steering. No brakes. And if you crash? Your airbags won’t work because the whole electrical system just shut down.

What makes this even more heartbreaking is how preventable it was. The fix cost less than a dollar per vehicle. GM spent more money on legal fees fighting lawsuits than it would’ve cost to replace every defective switch in 2001.

Here’s a typical scenario that happened way too many times: A driver with a heavy keychain hits a pothole on the highway. The jolt causes the ignition switch to slip from “run” to “accessory,” immediately shutting off the engine. The driver loses power steering and brakes while traveling at 65 mph, and if a crash occurs, the airbags won’t deploy because the electrical system is disabled. This exact sequence led to multiple fatalities that could’ve been prevented with a $0.57 part replacement.

From Crisis to Accountability: Legal Battles and Leadership Changes

Mary Barra became GM’s CEO just months before the ignition switch scandal exploded into public view. Talk about inheriting a nightmare scenario. She had to walk into congressional hearings and answer for decisions made years before she took the top job.

I mean, can you imagine being in her shoes? Her testimony before Congress was a masterclass in crisis leadership, though it came at an enormous personal and professional cost. Barra didn’t try to deflect blame or hide behind corporate lawyers. She acknowledged the company’s failures, took responsibility for fixing them, and committed to transparency going forward.

The optics were brutal. Here’s the first female CEO of a major automaker, sitting at a witness table, getting grilled by angry congresspeople about preventable deaths. But her handling of that moment actually started rebuilding trust with regulators and the public. She showed that GM was finally taking accountability seriously.

What GM figured out is that effective crisis communication requires more than just messaging – it demands the kind of systematic data analysis and reporting frameworks that can provide transparency and accountability to stakeholders during critical moments.

The $900 Million Wake-Up Call

Nine hundred million dollars. That’s not exactly couch cushion money, even for GM. But honestly? It was the wake-up call they desperately needed.

More importantly, the settlement included a deferred prosecution agreement that put GM under federal monitoring. The government basically put the company on corporate probation, with oversight of their safety processes and reporting requirements.

The victim compensation fund was separate from the criminal penalty, and it showed how companies can handle crisis aftermath responsibly. Instead of forcing families through years of litigation, GM created a streamlined process for compensating victims and their families. It wasn’t perfect, but it showed they were actually trying to make things right.

|

Legal Consequence |

Amount/Impact |

Timeline |

Long-term Effect |

|---|---|---|---|

|

Criminal Penalty |

$900 million |

2015 |

Established precedent for safety violations |

|

Victim Compensation Fund |

$625 million |

2014-2017 |

Streamlined victim compensation process |

|

Civil Settlements |

$2.5 billion+ |

2014-2018 |

Individual lawsuit resolutions |

|

Deferred Prosecution Agreement |

3-year monitoring |

2015-2018 |

Enhanced federal oversight |

|

Recall Costs |

$4.1 billion |

2014-2016 |

Complete ignition switch replacement program |

Regulatory Changes That Stuck

The crisis triggered the most significant automotive safety reforms in decades. The FAST Act (Fixing America’s Surface Transportation) increased NHTSA’s authority and funding while imposing stricter reporting requirements on automakers.

Companies now have to report safety defects within five business days instead of the previous system that allowed months of delay. The penalties for not complying increased dramatically, and executives can face personal criminal liability for safety violations.

These changes matter because they completely flipped the incentive structure. Before the GM crisis, companies could often delay recalls and minimize liability through legal maneuvering. Now, the cost of hiding safety problems is way higher than the cost of fixing them quickly.

Building a Safety-First Culture After the Fallout

GM had to completely tear down and rebuild how they thought about safety – and I mean everything. The cultural transformation was massive, from the factory floor to the executive suite.

The “Speak Up for Safety” program became the centerpiece of this change. Any employee – from assembly line workers to senior engineers – can now stop production if they identify a potential safety issue. No questions asked, no career consequences, no bureaucratic approval process.

This was revolutionary for GM’s culture. Previously, raising safety concerns meant navigating multiple layers of management, cost-benefit committees, and risk assessments. By the time a safety issue reached decision-makers, it had been filtered through so many processes that the urgency got lost.

Crisis Management Checklist for Safety Issues:

-

Immediate assessment of potential safety impact

-

Direct escalation to senior leadership within 24 hours

-

Cross-functional safety team activation

-

External regulatory notification (within 5 business days)

-

Customer communication strategy development

-

Legal and compliance review initiation

-

Media response preparation

-

Victim/customer support system activation

Removing the Bureaucratic Barriers

The old GM had what they called “the GM nod” – a cultural phenomenon where people would nod in meetings to show agreement, but then nothing would actually change. Safety concerns would get acknowledged, studied, and then buried in committee processes.

Breaking this pattern required structural changes, not just policy updates. GM flattened their safety reporting structure so critical issues could reach executives within hours instead of months. They created direct communication channels that bypass traditional hierarchies when safety is involved.

The company also changed how they measure success. Instead of just tracking production numbers and cost savings, safety metrics became primary performance indicators for managers and executives. Your career advancement now depends partly on how well you handle safety issues in your area of responsibility.

Employee Empowerment in Practice

What does this look like day-to-day? Assembly line workers can literally shut down a multi-million-dollar production line if they spot something that might affect safety. Engineers can escalate concerns directly to senior leadership without going through their immediate supervisors.

The company backs this up with legal protections for employees who raise safety concerns. They can’t be fired, demoted, or retaliated against for stopping production or reporting potential problems. GM learned that protecting whistleblowers is essential for maintaining a safety-first culture.

Training became a huge focus too. Every employee goes through safety awareness programs that teach them how to identify potential issues and use the new reporting systems. The message is clear: everyone’s responsible for safety, regardless of their job title or department.

GM’s $35 Billion Electric Vehicle Gamble

GM’s commitment to electric vehicles isn’t just about following trends – it’s about survival. They’re betting the entire company on a complete transformation from gas engines to electric powertrains.

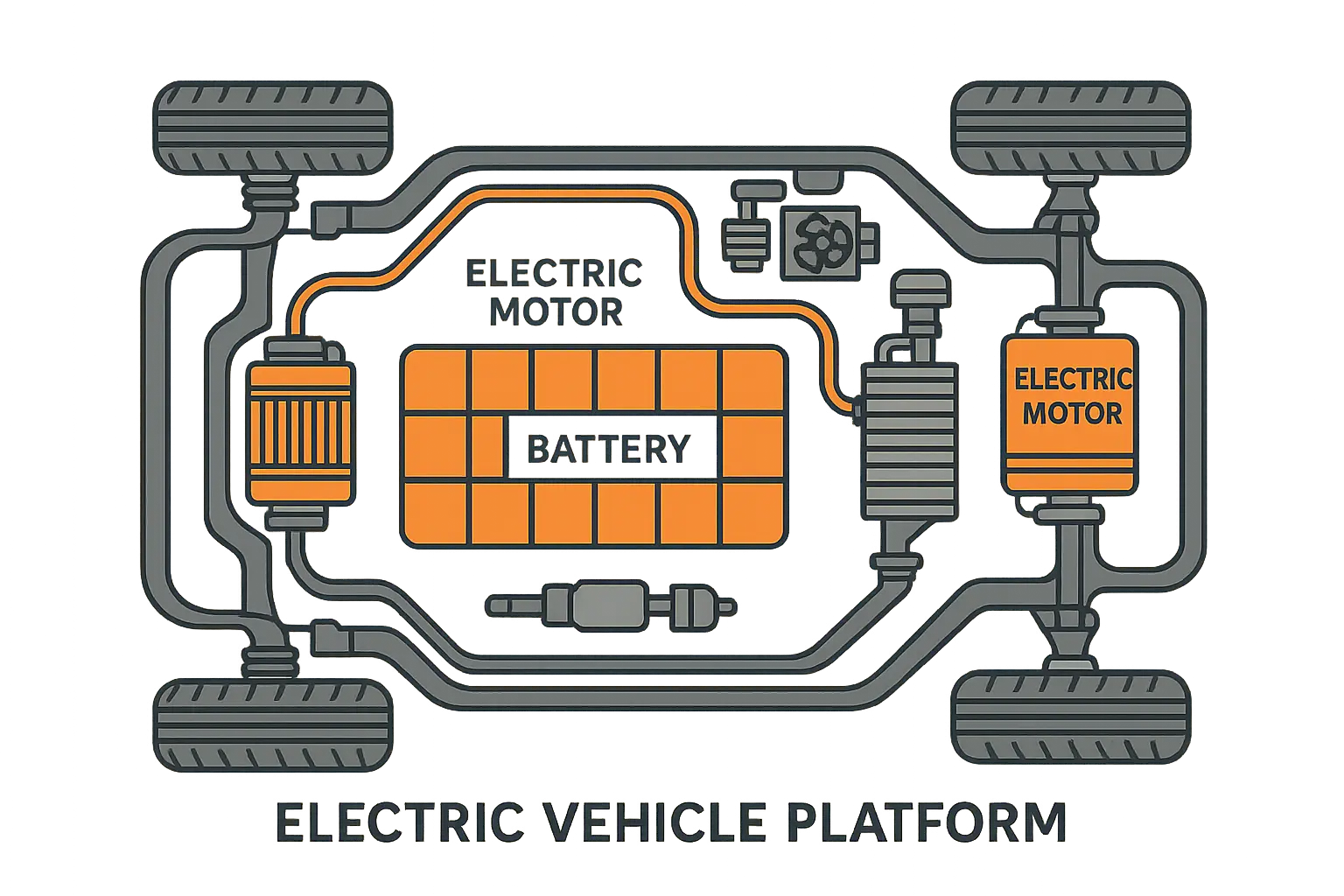

The Ultium platform is the foundation of this strategy. GM basically said “screw it, we’re starting over.” Instead of trying to cram batteries into cars designed for gas engines, they built a whole new foundation – the Ultium platform – specifically for electric vehicles. This approach costs more upfront but gives them flexibility to build everything from compact cars to heavy-duty trucks on the same basic architecture.

We’re talking about $35 billion here – that’s more than the entire GDP of countries like Bolivia or Jordan. GM literally bet everything on going electric, with the investment timeline running through 2025, covering battery development, manufacturing facility conversions, and new product development.

GM’s transformation is backed by serious financial muscle – they pulled in revenue of 122 billion USD in the fiscal year 2020, giving them the foundation to support this massive EV investment. And it’s starting to pay off. The latest numbers show that “GM reported a substantial 111% year-over-year increase in EV sales in Q2 2025, securing 15% of the U.S. EV market share” according to Market Minute, proving their Ultium platform strategy is actually working.

When you’re trying to completely change your business like this, you need precise ROI calculations and budget allocation to make sure massive investments like GM’s $35 billion EV commitment actually deliver measurable returns across multiple business units.

The Battery Technology Challenge

Partnering with LG Energy Solution made sense because GM needed world-class battery expertise fast. Building that capability internally would’ve taken years they didn’t have, especially with Tesla already dominating the premium EV market.

The partnership covers everything from battery cell chemistry to manufacturing processes. They’re building dedicated battery plants in Ohio, Tennessee, and Michigan – creating an entirely new supply chain for electric vehicle production.

Cost parity with traditional powertrains remains the holy grail. Right now, electric vehicles cost more to manufacture than comparable gas-powered cars, mainly because of battery costs. GM’s betting that scale and technological improvements will flip this equation within the next few years.

Supply chain security became critical after recent disruptions showed how vulnerable global manufacturing can be. GM’s trying to source battery materials from North American suppliers when possible, reducing dependence on overseas supply chains that can get disrupted by geopolitical tensions or natural disasters.

Manufacturing Transformation Reality

Converting traditional assembly plants to electric vehicle production sounds straightforward, but it’s incredibly complex. Electric vehicles have fewer moving parts than gas cars, but they require completely different manufacturing processes and quality control systems.

Workforce retraining became a massive undertaking. Assembly line workers who spent decades installing engines and transmissions now need to understand high-voltage electrical systems and battery pack assembly. The skillset is completely different, and the safety requirements are much more stringent.

The company had to redesign entire factories while keeping them operational. You can’t just shut down a billion-dollar facility for months while you install new equipment. GM developed phased conversion processes that gradually transition production lines from gas to electric vehicles.

Take GM’s Orion Assembly Plant in Michigan. The facility that once built the Chevrolet Sonic and Bolt EV got completely retooled to manufacture the Chevrolet Silverado EV and GMC Sierra EV pickup trucks. The conversion required installing new battery pack assembly equipment, high-voltage electrical systems, and retraining over 1,000 workers in electric vehicle manufacturing processes – all while maintaining production schedules for existing models.

Competing Against Tesla and the EV Revolution

Tesla changed the rules of automotive retail, and GM had to figure out how to compete without completely screwing over their existing dealer network. It’s a delicate balance between innovation and maintaining relationships that took decades to build.

The direct-to-consumer model works great for Tesla because they started from scratch. GM has thousands of dealer relationships and state franchise laws that prevent direct sales in many markets. Instead of fighting this system, they’re trying to improve it by upgrading dealer capabilities and customer experience.

Charging infrastructure became a critical competitive factor. Tesla’s Supercharger network gave them a huge advantage because customers knew they could reliably charge their vehicles on long trips. GM had to decide whether to build their own network or partner with existing charging companies.

Learning from Tesla’s Playbook

Tesla proved that electric vehicles could be desirable, not just environmentally responsible. Their cars became status symbols, which completely changed how consumers think about EVs. GM studied this transformation carefully and applied those lessons to vehicles like the Cadillac Lyriq and GMC Hummer EV.

The software-first approach was another Tesla innovation that GM had to adopt. Modern electric vehicles are essentially computers on wheels, with over-the-air updates and advanced driver assistance systems. GM invested heavily in software development capabilities that didn’t exist in traditional automotive companies.

Customer experience became a differentiator. Tesla customers can configure, order, and track their vehicles entirely online. GM’s dealer network needed to match this convenience while adding the personal service that traditional dealers provide.

Traditional Automaker Competition

The race among legacy automakers got intense quickly once everyone realized electric vehicles weren’t just a niche market anymore. Ford’s F-150 Lightning, Volkswagen’s ID series, and GM’s Ultium-based vehicles all launched within months of each other.

This competition actually benefits consumers because it’s driving rapid innovation and price reductions. When only Tesla made premium electric vehicles, they could charge premium prices. Now that GM, Ford, and others offer comparable alternatives, pricing pressure is forcing everyone to improve value propositions.

Market share battles are just beginning. Tesla dominated early EV adoption, but traditional automakers have manufacturing scale and dealer networks that could give them advantages as the market expands beyond early adopters to mainstream consumers.

Financial Recovery: Rising from Bankruptcy Ashes

GM’s 2009 bankruptcy was traumatic, but it also gave the company a clean slate to rebuild their business model. They emerged as a fundamentally different organization – smaller, more focused, and financially disciplined.

The brand portfolio rationalization was painful but necessary. Pontiac, Saturn, and Hummer got the axe not because they were bad brands, but because GM couldn’t afford to support eight different brands with distinct identities and dealer networks.

Focusing on Chevrolet, Buick, GMC, and Cadillac allowed GM to concentrate resources on brands with clear market positions and growth potential. Each brand now has a specific role in GM’s portfolio instead of competing against each other for the same customers. The company’s recovery is pretty remarkable when you consider they owned 43 brands throughout its 112 years tenure before strategically consolidating to focus on their most profitable operations.

When you’re restructuring operations and allocating resources across multiple business units and geographic markets, you need accurate revenue forecasting and budget management – exactly what GM had to master during their recovery.

Post-Bankruptcy Business Model

The streamlined operations that emerged from bankruptcy were dramatically more efficient than the old GM. They closed underperforming plants, renegotiated supplier contracts, and eliminated redundant administrative functions.

Geographic focus became a key strategy. Instead of trying to compete in every global market, GM concentrated on regions where they could achieve profitable scale. This meant exiting some markets entirely while doubling down on others like North America and China.

The new GM also changed how they think about profitability. Instead of chasing market share at any cost, they focused on profitable growth and return on invested capital. This shift in mindset helped them avoid the financial mistakes that led to bankruptcy in the first place.

|

Financial Metric |

Pre-Bankruptcy (2008) |

Post-Bankruptcy (2015) |

Current Performance (2020) |

|---|---|---|---|

|

Annual Revenue |

$148.9 billion |

$152.4 billion |

$122 billion |

|

Net Income |

-$30.9 billion |

$9.7 billion |

$6.4 billion |

|

Number of Brands |

8 brands |

4 brands |

4 brands |

|

Global Markets |

120+ countries |

60+ countries |

37+ countries |

|

Debt-to-Equity Ratio |

89% |

23% |

35% |

Capital Allocation Framework

Balancing traditional automotive investments with future technologies requires careful resource allocation. GM can’t stop investing in current products while they develop electric and autonomous vehicles, but they also can’t ignore the industry transformation happening around them.

R&D investment priorities shifted dramatically toward electrification and autonomous driving. The company still improves internal combustion engines, but most new development resources go toward future technologies that’ll define the next generation of vehicles.

Shareholder value creation became more disciplined after bankruptcy. GM now returns cash to shareholders through dividends and share buybacks, but only after ensuring they have adequate resources for strategic investments and maintaining financial flexibility.

The Cruise Acquisition: Betting Big on Self-Driving Cars

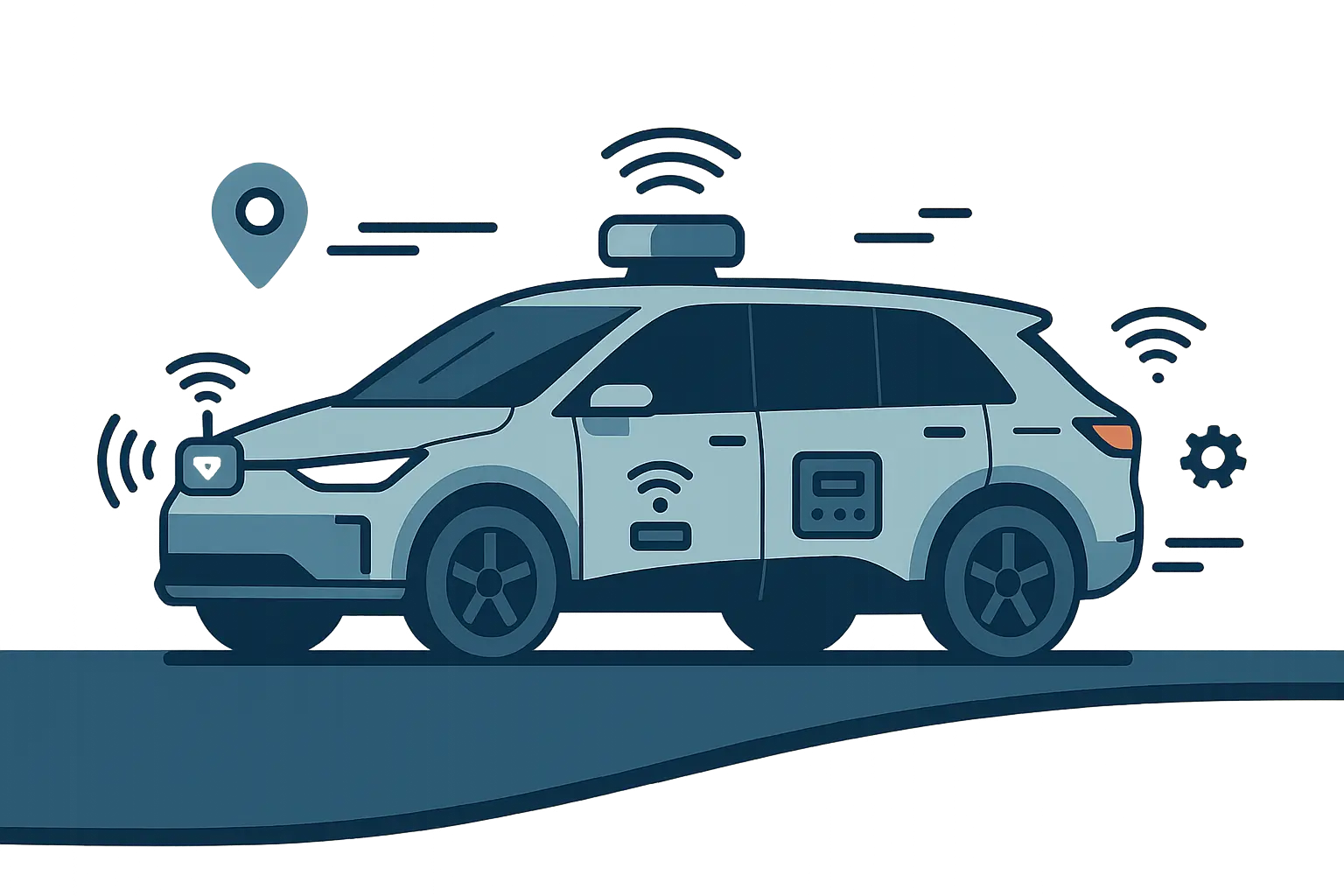

The Cruise acquisition was GM’s biggest bet on the future of transportation. Autonomous vehicles could completely change how people think about car ownership, and GM wanted to be a leader in that transformation rather than a follower.

Integrating a Silicon Valley startup with a century-old manufacturing company created interesting cultural challenges. Cruise engineers think in terms of software iterations and rapid prototyping, while GM engineers focus on safety, reliability, and mass production. Merging these approaches required new management structures and communication processes.

The technology development approach combines Cruise’s AI expertise with GM’s vehicle integration capabilities. Building autonomous vehicles isn’t just about software – you need hardware that can reliably execute software decisions in real-world conditions.

Real-World Testing in San Francisco

Testing autonomous vehicles in San Francisco is like throwing them into the deep end of urban driving complexity. The city has steep hills, dense pedestrian traffic, cyclists, construction zones, and weather conditions that challenge every sensor and algorithm.

Regulatory challenges are immense. Each city and state has different rules about autonomous vehicle testing, and federal regulations are still evolving. GM has to work with multiple government agencies to establish safety standards and deployment frameworks.

Safety protocols for testing require redundant systems and human safety drivers who can take control instantly if something goes wrong. The vehicles collect massive amounts of data from every test drive, which gets analyzed to improve the autonomous driving algorithms.

Commercial Model Development

The business model for autonomous vehicles is still evolving. GM initially focused on ride-sharing applications through partnerships with companies like Lyft, but they’re also exploring direct consumer sales of autonomous vehicles.

Ride-sharing makes sense as an initial market because it allows GM to maintain control over the vehicles and gather operational data. Fleet operators can justify the higher costs of autonomous technology through reduced labor expenses and increased utilization rates.

Consumer sales of autonomous vehicles face different challenges. Regulatory approval, insurance questions, and consumer acceptance all need to be resolved before people can buy fully autonomous cars for personal use.

Global Operations and Supply Chain Lessons

GM’s global footprint looks completely different today than it did before bankruptcy. The company made tough decisions about which markets to prioritize and which ones to exit entirely.

Selling Opel and Vauxhall to PSA Group was controversial, but it allowed GM to focus resources on more profitable regions. European operations were consistently losing money, and the regulatory environment made it difficult to achieve sustainable profitability.

China became GM’s largest market through joint ventures with SAIC Motor. These partnerships gave GM access to the world’s biggest automotive market while helping them navigate complex regulatory requirements and local competition.

Here’s what Fortune found when they looked at GM’s global strategy: “GM’s experience highlights the pitfalls of not thinking about its implementation carefully. Throwing technology at problems without understanding how work gets done day-to-day is a surefire way to waste money and breed cynicism”. That’s a harsh but accurate assessment of how not to handle global operations.

International Market Strategy

The joint venture approach in China worked because it combined GM’s technology and brand strength with SAIC’s local market knowledge and manufacturing capabilities. Both companies benefit from shared resources and risk.

Geopolitical tensions between the US and China created new challenges for GM’s operations. Trade disputes, technology transfer restrictions, and supply chain disruptions forced the company to develop more flexible international strategies.

Emerging markets like Mexico and South America offer manufacturing cost advantages, but they also present supply chain risks and political instability. GM has to balance cost savings against operational reliability when making location decisions.

Global operations require sophisticated market analysis and opportunity assessment to figure out which international markets actually justify investment and resource allocation.

Supply Chain Resilience Building

The semiconductor shortage of 2020-2021 nearly shut down automotive production worldwide. GM learned the hard way that just-in-time manufacturing works great until supply chains get disrupted – then it becomes a major vulnerability.

Strategic supplier relationships became more important than just getting the lowest prices. GM now evaluates suppliers based on their financial stability, geographic diversity, and ability to maintain production during disruptions.

Raw materials strategy for electric vehicles requires completely new supply chains. Lithium, cobalt, and rare earth elements come from different sources than traditional automotive materials, and many of these materials are concentrated in politically unstable regions.

Semiconductor Shortage Response

GM’s response to the chip shortage showed how quickly the company could adapt to supply chain disruptions. They prioritized production of their most profitable vehicles while temporarily shutting down less profitable lines.

The company also worked directly with semiconductor manufacturers to secure supply allocations, bypassing traditional supplier relationships when necessary. This required new procurement strategies and supplier relationship management.

Long-term contracts and strategic partnerships with chip manufacturers became essential for ensuring future supply security. GM learned that automotive companies can’t treat semiconductors like commodity purchases anymore.

Supply Chain Risk Assessment Checklist:

-

Supplier financial health evaluation

-

Geographic diversification analysis

-

Alternative supplier identification

-

Critical component inventory buffers

-

Force majeure contingency planning

-

Supplier relationship management protocols

-

Technology dependency mapping

-

Regulatory compliance monitoring

Labor Relations During Industry Transformation

The 2019 UAW strike lasted 40 days and cost GM over $3 billion in lost production. But honestly? The resolution actually strengthened the relationship between the company and union by establishing frameworks for managing technological transition together.

Healthcare and benefits negotiations became more complex as GM tried to control costs while maintaining competitive compensation packages. The union understood that unsustainable labor costs contributed to GM’s bankruptcy, but they also wanted job security during industry transformation.

Workforce retraining programs became essential as electric vehicle production requires different skills than traditional automotive manufacturing. GM and the UAW developed joint training programs that prepare workers for new technologies while maintaining employment levels.

Future of Work Strategy

Plant modernization creates both opportunities and challenges for workers. Electric vehicle production requires fewer workers per vehicle, but it also creates new types of jobs that require higher skill levels and better compensation.

Automation and AI integration will continue changing how vehicles are manufactured. GM’s approach focuses on using technology to augment human capabilities rather than simply replacing workers with machines.

The company learned that successful technological transformation requires worker buy-in and participation. Employees who understand and support changes are more likely to help implement them successfully than workers who feel threatened by new technologies.

Workforce Transformation Challenges

Converting traditional assembly lines to electric vehicle production requires extensive retraining. Workers who spent decades installing engines and transmissions need to learn high-voltage electrical systems and battery pack assembly.

Safety requirements for electric vehicle manufacturing are way more stringent than traditional automotive production. High-voltage systems can literally kill you if handled incorrectly, so training programs focus heavily on electrical safety protocols.

The company also had to address concerns about job security as electric vehicles require fewer parts and less assembly labor than traditional cars. GM committed to retraining workers for new roles rather than simply eliminating positions.

At GM’s Spring Hill Assembly Plant in Tennessee, traditional powertrain workers went through 160 hours of specialized training to work with the Ultium battery system. The program covered high-voltage safety protocols, battery cell handling procedures, and new quality control processes. Workers who previously assembled V6 engines now install battery packs that weigh over 2,000 pounds and operate at 400+ volts, requiring completely different skills and safety awareness.

What This Means for Your Business

GM’s journey from crisis to transformation offers lessons that apply way beyond the automotive industry. Whether you’re dealing with a reputation crisis, planning a major strategic pivot, or managing operational disruptions, GM’s experience provides a roadmap for navigating complex business challenges.

Crisis communication is critical when your company faces serious problems. GM’s initial defensive response made their ignition switch crisis worse, while Mary Barra’s transparent leadership approach helped rebuild trust. The lesson is clear: acknowledge problems quickly, take responsibility, and focus on solutions rather than blame.

Strategic transformation requires massive resource commitments and cultural change. GM’s $35 billion electric vehicle investment shows how companies must sometimes bet their entire future on new technologies and business models. Half-measures don’t work when entire industries are being disrupted.

This is where you need marketing partners who prioritize measurable outcomes over vanity metrics. When you’re facing a crisis or planning a major strategic shift, you need people who understand that companies going through transformation need marketing support that ties directly to growth, conversions, and brand visibility – not just awareness campaigns that look good in presentations.

Just like GM needed comprehensive analysis during their transformation, businesses today require strategic content planning and topic selection to communicate effectively during periods of change and maintain stakeholder engagement throughout complex business transformations.

Business Transformation Framework:

-

Crisis assessment and figuring out who gets hurt and how badly

-

Leadership accountability and communication strategy

-

Cultural change management implementation

-

Strategic resource allocation planning

-

Technology integration and workforce development

-

Supply chain resilience building

-

Ways to track if this is actually working

-

Long-term sustainability planning

Look, if you’re trying to apply these lessons to your own business transformation, you need partners who actually measure results instead of just talking about brand awareness.

Final Thoughts

GM’s transformation from a crisis-ridden company to an electric vehicle leader proves that even the largest corporations can fundamentally change when they commit to transparency, accountability, and strategic focus. The ignition switch crisis could’ve destroyed the company, but instead it became the catalyst for building a stronger, more responsible organization.

The lessons from GM’s experience apply to businesses of all sizes. Crisis management requires immediate transparency and accountability rather than defensive positioning. Strategic transformation demands massive resource commitments and cultural change that goes way beyond surface-level adjustments. Supply chain resilience and workforce development become critical capabilities during periods of technological disruption.

Most importantly, GM’s story proves something important: you can survive almost anything if you stop making excuses and start fixing problems. But it’s going to hurt, it’s going to cost you, and you better be ready to change everything about how you operate. The alternative is often irrelevance or failure in rapidly changing markets.