Table of Contents

-

Understanding Price Elasticity Fundamentals

-

Digital Calculator Tools That Actually Work

-

Real-World Implementation Strategies

-

Advanced Analytics for Strategic Growth

TL;DR

-

Here’s the thing about pricing – your customers aren’t as unpredictable as you think. There’s actually a pattern to how they react when you change your prices, and you can measure it

-

Five different types of customer reactions exist: some bolt at the first price increase, others barely notice – knowing which type you’re dealing with changes everything

-

That basic formula everyone talks about is just the starting point – there are smarter ways to crunch these numbers that’ll actually give you reliable answers

-

Modern calculators hook directly into your business systems, so you’re not stuck manually updating spreadsheets every week

-

Your data quality makes or breaks everything – garbage in, garbage out isn’t just a saying, it’s expensive reality

-

AI-powered tools can spot patterns in customer behavior that you’d never catch manually, giving you a serious competitive edge

Understanding Price Elasticity Fundamentals

Look, I’ve spent years watching businesses make the same pricing mistakes over and over. They either panic and slash prices hoping to boost sales, or they get greedy and jack them up assuming customers will pay anything. Both approaches ignore a fundamental truth that can make or break your business: customer behavior follows predictable patterns.

Here’s what most people don’t realize – you can actually measure exactly how your customers respond to price changes. It’s not guesswork, and it’s not some mystical art form. According to Good Calculators, price elasticity measures the extent to which a customer is sensitive to the prices of a product or service, with analysts frequently using it to determine what impact a change in the price of something will have on demand.

Think of price elasticity like a sensitivity meter for your customers. Some products have customers who are super touchy about price – raise it a penny and they’re gone. Others have customers who barely blink at significant increases because they really need what you’re selling.

Once you understand this relationship, you stop throwing darts at a board and start making decisions based on actual data. Your elasticity calculator becomes like having a crystal ball that tells you how customers will react before you change anything.

The Five Types That Determine Your Pricing Power

Your product fits into one of five categories, and figuring out which one is like discovering whether you’re playing poker or solitaire – the rules are completely different.

I’ve seen companies destroy their revenue because they completely misunderstood which category they were in. It’s painful to watch, but totally preventable.

Perfectly elastic demand is like trying to sell ice to Eskimos. The moment you raise your price even a penny, customers vanish. This happens in commodity markets where your product is identical to fifty other options. You have zero pricing power here – you’re basically stuck taking whatever the market will give you.

Elastic demand means your customers are price shoppers. A 10% price increase might cause a 15% drop in sales, which actually hurts your total revenue. I worked with a boutique clothing store that learned this the hard way – they raised prices thinking they’d make more per item, but sales dropped so much their overall income went down. Most luxury items and things people can live without fall into this category.

Unit elastic demand is the sweet spot where everything balances out. Price goes up, sales go down, but your total revenue stays the same. It’s rare, but when you find it, you’ve got some interesting strategic options.

Inelastic demand is where you want to be. Customers need what you’re selling enough that they’ll pay more without dramatically cutting back on purchases. I remember working with a coffee shop owner who was convinced raising prices would kill his business. Turns out, his regulars barely blinked at a 50-cent increase because they needed their morning fix.

Perfectly inelastic demand is the holy grail – customers buy the same amount regardless of price. Think life-saving medications or essential utilities. You have maximum pricing flexibility, though obviously there are ethical and regulatory considerations.

Using an elasticity calculator helps you figure out exactly where your product sits on this spectrum. The results tell you whether you should be competing on price or focusing on making your product more valuable to customers.

|

Elasticity Type |

PED Value Range |

Price Increase Impact |

Revenue Impact |

Example Products |

|---|---|---|---|---|

|

Perfectly Elastic |

PED = ∞ |

Complete demand loss |

Revenue drops to zero |

Commodity markets |

|

Elastic |

PED > 1 |

Proportionally larger demand decrease |

Revenue decreases |

Luxury electronics |

|

Unit Elastic |

PED = 1 |

Proportional demand decrease |

Revenue unchanged |

Mid-range products |

|

Inelastic |

0 < PED < 1 |

Smaller demand decrease |

Revenue increases |

Essential goods |

|

Perfectly Inelastic |

PED = 0 |

No demand change |

Revenue increases proportionally |

Life-saving medications |

Economic Forces That Shape Customer Sensitivity

Four big factors determine how price-sensitive your customers are. Understanding these helps you predict elasticity before you change anything, which is way better than learning through expensive trial and error.

Substitute availability is huge. When customers can easily switch to alternatives, you’re in trouble if you raise prices. When you’re the only game in town, you’ve got options. This alone explains why monopolies can charge whatever they want while businesses in competitive markets are stuck in price wars.

I’ve seen this play out dramatically. A local pizza place had a captive audience until three new competitors opened within two blocks. Suddenly their loyal customers became very price-sensitive because they had options.

Necessity versus luxury shapes behavior in ways that might surprise you. People will pay almost anything for insulin, but they’ll skip the fancy coffee when prices rise. Where your product sits on this spectrum directly impacts how much pricing flexibility you have.

Income proportion matters more than most people realize. A $5 increase on a $20 item feels massive, but the same increase on a $500 purchase barely registers. Think about what percentage of your customer’s income your product represents – it’ll give you clues about price sensitivity.

Time periods add complexity because people adapt. Short-term, your demand might seem inelastic because customers haven’t had time to find alternatives or change their habits. Long-term, elasticity often increases as people figure out workarounds.

Netflix is a perfect example of how these factors interact. When they raised subscription prices from $7.99 to $9.99 in 2014, hardly anyone canceled because there weren’t good alternatives. Fast-forward to today with Disney+, Hulu, and Amazon Prime everywhere, and Netflix customers have become much more price-sensitive. Same service, different market conditions, completely different elasticity.

Mathematical Foundation You Actually Need

Okay, I know math isn’t everyone’s favorite thing. But this particular equation is like having a crystal ball for your business, so stick with me here.

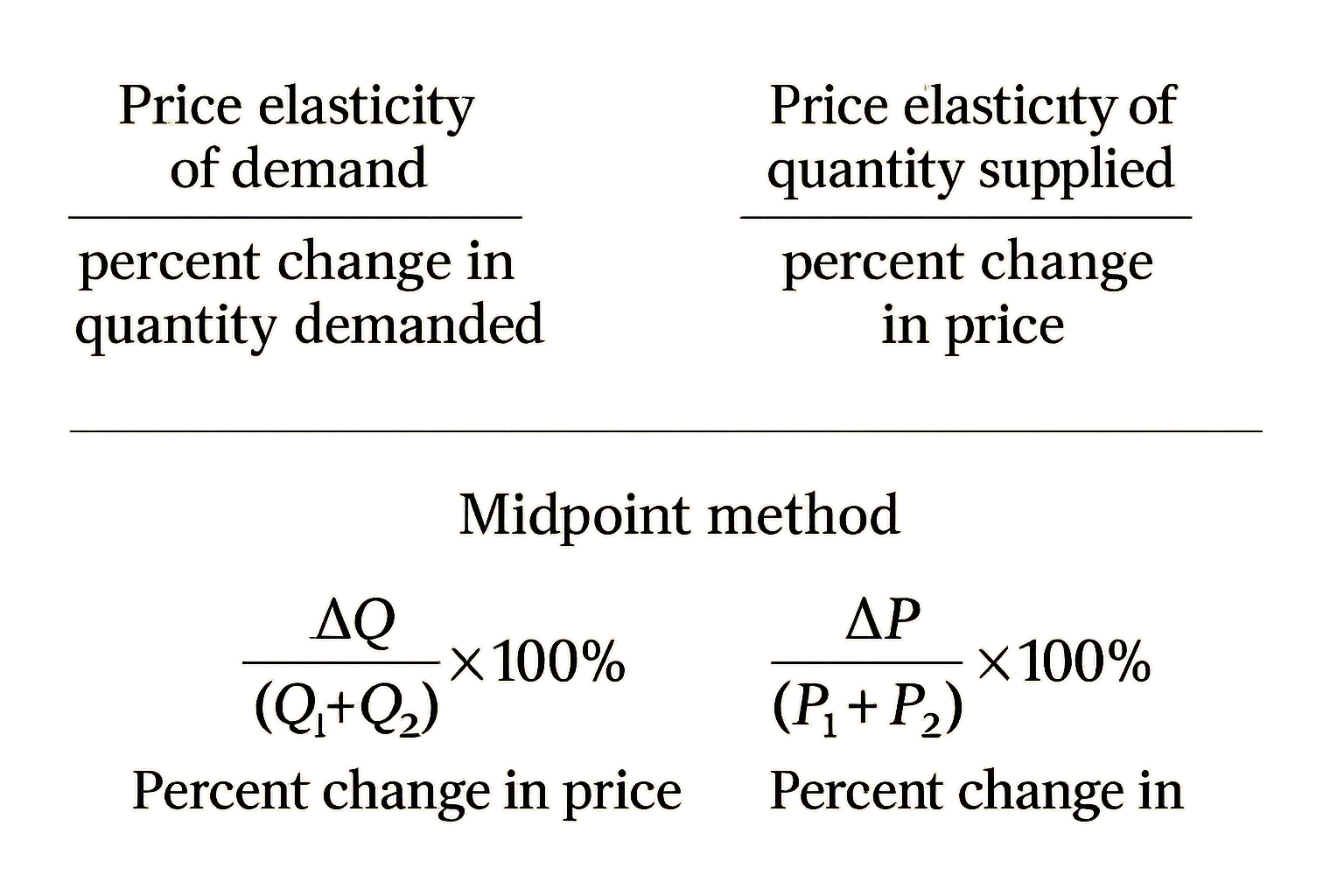

The basic formula looks simple: PED = (% Change in Quantity Demanded) / (% Change in Price). Don’t let the simplicity fool you – this ratio reveals exactly how your customers will respond to price changes.

Here’s what trips people up: calculating percentage changes correctly. Use this: ((New Value – Original Value) / Original Value) × 100. This standardization lets you compare elasticity across different products and time periods, which is incredibly valuable for strategic planning.

Let me make this real for you. If your calculation gives you -2, that means a 10% price increase causes a 20% decrease in sales. The negative sign is normal – price and quantity usually move in opposite directions. Understanding these numbers gives you the foundation for smart pricing decisions.

Here’s your elasticity calculation checklist:

-

Gather sales data for at least two different price points

-

Calculate percentage change in quantity sold

-

Calculate percentage change in price

-

Apply the formula: (% Change in Quantity) ÷ (% Change in Price)

-

Figure out if you’re elastic or inelastic

-

Consider what else might have influenced demand during that period

-

Double-check your work against market conditions

I can’t stress this enough – small errors in data collection or calculation can lead to dramatically wrong pricing decisions. I always double-check my work and validate results against what’s actually happening in the market.

Advanced Methods That Improve Accuracy

Here’s where it gets interesting. Basic percentage calculations have a sneaky problem – they give you different results depending on which price point you use as your starting point. That’s not exactly helpful when you’re trying to make strategic decisions.

The midpoint method solves this by using average values instead. The formula looks more complicated: PED = [(Q2-Q1)/(Q2+Q1)/2] / [(P2-P1)/(P2+P1)/2], but it eliminates that direction bias and gives you consistent results. According to Omni Calculator, the midpoint formula for elasticity of demand provides more accurate results, with their calculator allowing users to find any of the values in the equation (P₀, P₁, Q₀, or Q₁) by simply inputting all remaining variables for automatic calculation.

Arc elasticity is another approach that measures elasticity over a price range rather than between two specific points. This works great when you’re analyzing bigger price changes or want more stable estimates across different market conditions. I find it especially useful for seasonal businesses where demand swings around a lot.

Point elasticity uses calculus to calculate elasticity at a specific price point: PED = (dQ/dP) × (P/Q). This gets technical, but it’s incredibly precise when you’re working with continuous demand functions and need exact measurements for specific pricing scenarios.

Cross-price elasticity adds another dimension by measuring how one product’s demand responds to another product’s price changes. This helps you identify which products are substitutes or complements, which is gold for pricing strategy across your entire product line.

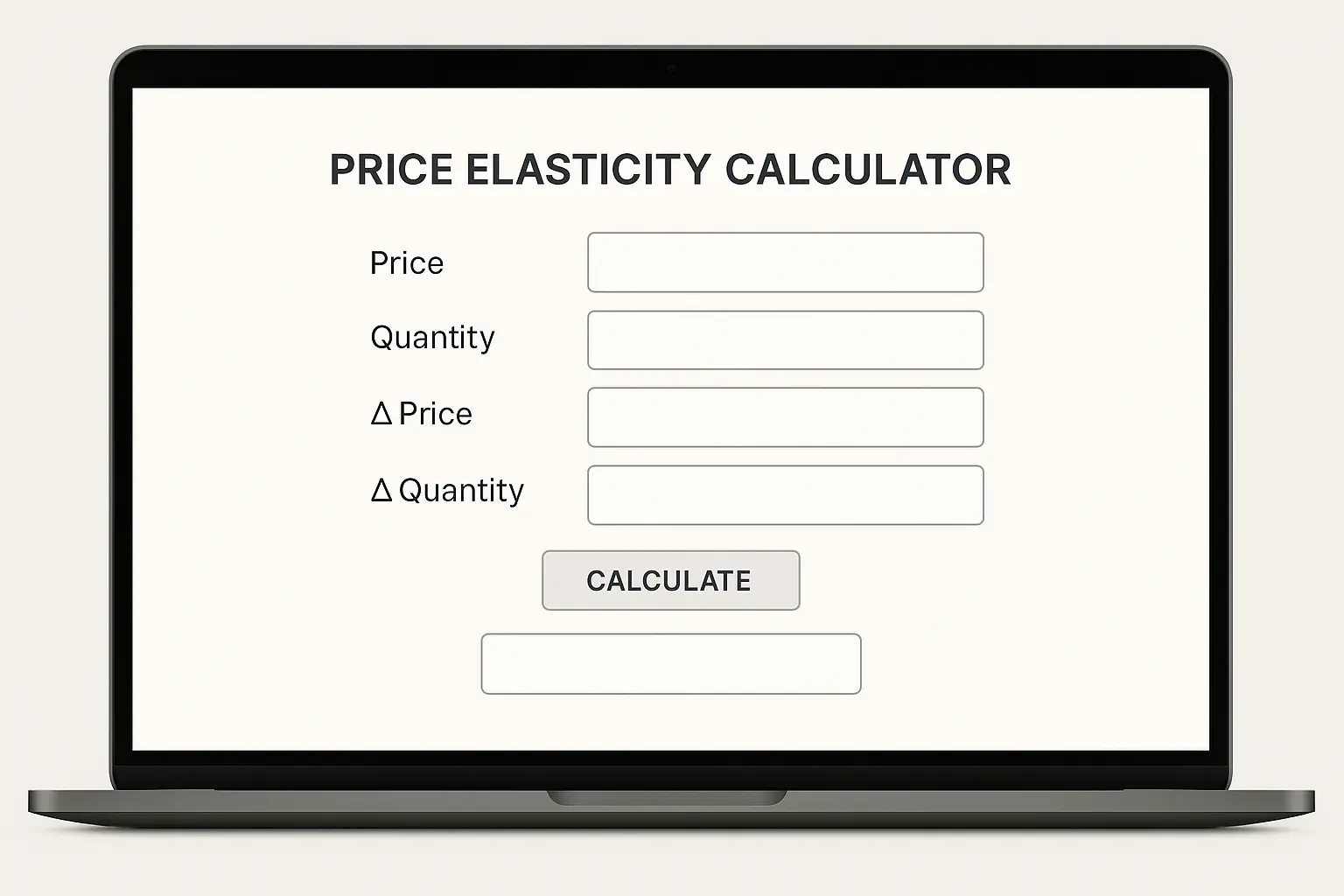

Digital Calculator Tools That Actually Work

Look, I get it. Doing elasticity math by hand is about as fun as watching paint dry. I’ve been there – hunched over spreadsheets at 2 AM, second-guessing every calculation. That’s why I’m obsessed with finding tools that actually make this stuff manageable.

Here’s the reality: you can spend hours crunching numbers manually, or you can let technology do the heavy lifting while you focus on what really matters – making smart business decisions. I’ve tested probably every calculator tool out there, and trust me, they’re not all created equal.

Think of it like this – you wouldn’t do your taxes with a pencil and paper when TurboTax exists, right? Same principle applies here. The right calculator tool is like having a pricing consultant on speed dial.

Just as businesses benefit from comprehensive SEO content tools review to optimize their content strategy, picking the right elasticity calculator requires evaluating features, accuracy, and how well it plays with your existing systems.

Free Online Calculators vs Premium Platforms

Free tools are great when you’re just getting your feet wet. I always tell people to start there. They’ll handle your basic calculations, help you understand the concepts, and won’t cost you a dime. Perfect for that “let me see if this elasticity thing actually works” phase.

But here’s what I’ve learned after years of using these tools – free calculators are like training wheels. They get you started, but eventually you’ll want something with more horsepower.

I remember helping a local restaurant owner who was stuck using a basic online calculator. Every week, he’d manually input his sales data, run the numbers, then try to figure out what it all meant. It was eating up hours of his time, and honestly, he was making mistakes because the process was so tedious.

Premium platforms changed everything for him. Suddenly, his point-of-sale system was talking directly to his elasticity calculator. Real-time updates, automated reports, charts that actually made sense – it was like upgrading from a flip phone to a smartphone.

The sweet spot seems to be around $100-200 per month for most small to medium businesses. Yeah, it’s an investment, but when you consider how much a single pricing mistake can cost you, it pays for itself pretty quickly.

Here’s my honest take on when to upgrade: if you’re running elasticity analysis more than once a month, or if pricing decisions significantly impact your revenue, invest in a proper platform. Your time is worth more than the subscription cost.

|

Feature |

Free Online Calculators |

Premium Platforms |

|---|---|---|

|

Basic PED Calculation |

✓ |

✓ |

|

Multiple Calculation Methods |

Limited |

✓ |

|

Data Visualization |

Basic charts |

Advanced dashboards |

|

Historical Analysis |

None |

✓ |

|

Business System Integration |

None |

✓ |

|

Export Functionality |

Limited |

Multiple formats |

|

Real-time Updates |

None |

✓ |

|

Custom Reporting |

None |

✓ |

|

Cost |

Free |

$50-500+/month |

Business Intelligence Integration That Changes Everything

This is where things get really exciting. When your elasticity calculator can pull data directly from your business systems, you’re not just calculating – you’re predicting.

I worked with an e-commerce company that was manually exporting sales data every week to run their analysis. By the time they finished their calculations, the market had already shifted. It was like driving by looking in the rearview mirror.

Once we integrated their calculator with their e-commerce platform, inventory management system, and customer database, everything changed. They could see in real-time how price changes were affecting different customer segments, which products were becoming more or less elastic, and what their competitors were doing.

This integration ensures your calculations use current, accurate market data instead of outdated spreadsheet information. Real-time data feeds mean your elasticity estimates stay current with market conditions. The difference in decision quality is remarkable when you’re working with live data versus static historical information.

Here’s a reality check that shows how critical accurate elasticity calculations are in high-stakes situations. Fortune reports that “Trump’s tariff formula was rigged to get inflated rates,” where economists found the White House used the wrong elasticity value (0.25 instead of 0.945) when calculating tariff impacts, resulting in rates roughly four times higher than they should have been.

The AI-powered tools are honestly mind-blowing. They’re not just calculating your current elasticity – they’re learning from patterns you can’t even see. One client discovered that their product became more elastic during certain weather patterns. Who would have thought to look for that connection manually?

But here’s the thing about integration – it’s only as good as your data quality. I’ve seen businesses get excited about fancy dashboards and real-time updates, only to realize their underlying data was garbage. Clean up your data first, then worry about the fancy features.

Real-World Implementation Strategies

Alright, here’s where the rubber meets the road. You can have the most sophisticated elasticity calculations in the world, but if you can’t implement them effectively, you’re just playing with expensive math.

I’ve watched too many businesses nail the theory and completely botch the execution. It’s like knowing exactly how to bake a perfect cake but burning it because you didn’t preheat the oven properly.

The companies that actually succeed with elasticity analysis treat it like a process, not a one-time calculation. They build systems, collect quality data, and most importantly, they’re prepared to act on what they learn.

Data Collection That Actually Matters

Let me be brutally honest about data – most businesses think they have good data, but they really don’t. I can’t tell you how many times I’ve started working with a company only to discover their sales records are incomplete, their pricing history is scattered across different systems, or they’ve been tracking the wrong metrics entirely.

Good data collection is like building a house – you need a solid foundation, or everything else falls apart. I always start with a data audit. What information do you actually have? How reliable is it? What’s missing?

Here’s a story that’ll make you cringe: I once worked with a retail chain that had been making pricing decisions based on data that excluded their biggest sales channel. For two years, they thought their premium products were highly elastic when they were actually quite inelastic. They’d been leaving money on the table because of incomplete data.

Historical sales data forms your foundation, but you need sufficient data spanning multiple price points and time periods to identify reliable patterns. Sales volumes, prices, and relevant market conditions should all be captured consistently. The quality of this data directly impacts how accurate your elasticity calculations will be.

The fix isn’t always complicated, but it requires discipline. Set up proper tracking systems, establish data validation processes, and for the love of all that’s holy, back up your data regularly. I’ve seen businesses lose months of valuable pricing data because of a simple system failure.

Customer surveys and focus groups are goldmines if you do them right. Don’t just ask “would you pay more for this?” Ask about their decision-making process, what alternatives they consider, and how price fits into their overall evaluation. The insights you get will make your elasticity calculations way more accurate.

Data Quality Assessment Checklist:

-

Verify data completeness across all time periods

-

Check for outliers and weird data points that don’t make sense

-

Make sure price and quantity measurements are consistent

-

Document external factors that might have influenced sales

-

Cross-reference multiple data sources when possible

-

Look for seasonal or cyclical patterns

-

Double-check that all your measurement units are the same

Strategic Applications That Drive Results

Revenue optimization is the name of the game, but it’s trickier than most people think. I’ve seen businesses get so focused on maximizing revenue that they forget about profitability, cash flow, and long-term customer relationships.

Here’s what works: start with small price tests on a subset of your products or customers. See how the market actually responds before making big moves. I call it “dipping your toe in the water” – you get real data without risking your entire business.

For elastic products, lower prices often increase total revenue despite reduced per-unit margins. The volume increase more than compensates for the price reduction. For inelastic products, you can usually sustain higher prices without significant demand loss. Your elasticity calculator helps you figure out which strategy applies to your specific situation.

One of my favorite success stories involves a software company that discovered their enterprise customers were much less price-sensitive than their small business customers. Instead of one-size-fits-all pricing, they created tiered pricing that captured more value from enterprises while staying competitive for small businesses. Revenue increased 40% without losing customers.

Amazon’s dynamic pricing strategy is a masterclass in sophisticated elasticity application. They adjust prices on millions of products multiple times daily based on real-time demand elasticity calculations. During peak shopping seasons, they raise prices on inelastic items (like popular electronics with limited alternatives) while lowering prices on elastic products (like books and media) to maximize overall revenue across their platform.

Competitive positioning gets interesting when you understand elasticity. If your product is inelastic, you might have more pricing power than you realize. If it’s elastic, you need to focus on differentiation rather than price competition.

Market segmentation is where elasticity analysis gets really powerful. Different customer groups often have completely different price sensitivity. Business customers might be less price-sensitive than consumers. Premium segments might show different elasticity than value-conscious buyers. Understanding these differences enables targeted pricing strategies that optimize revenue across diverse customer groups.

Overcoming Implementation Challenges

Let’s talk about the stuff that goes wrong, because it will go wrong. Markets change, competitors respond, and your carefully calculated elasticity coefficients suddenly don’t match reality.

I learned this lesson the hard way when a client’s main competitor went out of business overnight. All our elasticity calculations were based on a competitive market, but suddenly they had much less elastic demand. Our pricing strategy needed a complete overhaul in about two weeks.

Data quality and availability issues plague most elasticity implementations. Incomplete or unreliable data skews calculations and leads to poor pricing decisions. The solution involves implementing robust data validation processes and considering multiple data sources when possible.

Don’t rely on single data sources if you can help it. Cross-reference sales data with market research, competitor analysis, and customer feedback. When things don’t line up, it often reveals data problems or market changes that affect elasticity.

Here’s another reality check about how critical accurate elasticity calculations are. Axios reports that conservative economists found the administration used wrong elasticity values, with the correct import price elasticity being 0.945 rather than 0.25, meaning tariffs on countries like Vietnam should have been 12.2% instead of 46%.

Dynamic market conditions change continuously, affecting elasticity measurements. What worked six months ago might not work today. Regular recalculation and monitoring ensure your elasticity estimates remain current and relevant for decision-making.

Competitive responses complicate things because competitors don’t stand still when you change prices. Your elasticity calculations assume other factors remain constant, but real markets don’t work that way. Monitor competitor reactions and adjust your analysis accordingly. Sometimes apparent elasticity changes actually reflect competitive responses rather than fundamental demand shifts.

Uber’s surge pricing demonstrates real-time elasticity implementation challenges perfectly. During high-demand periods, they increase prices to balance supply and demand. However, they must constantly adjust their algorithms because competitor services like Lyft respond with their own pricing changes, customer behavior adapts to surge patterns, and regulatory responses in different cities create varying elasticity conditions that require localized calculations.

Advanced Analytics for Strategic Growth

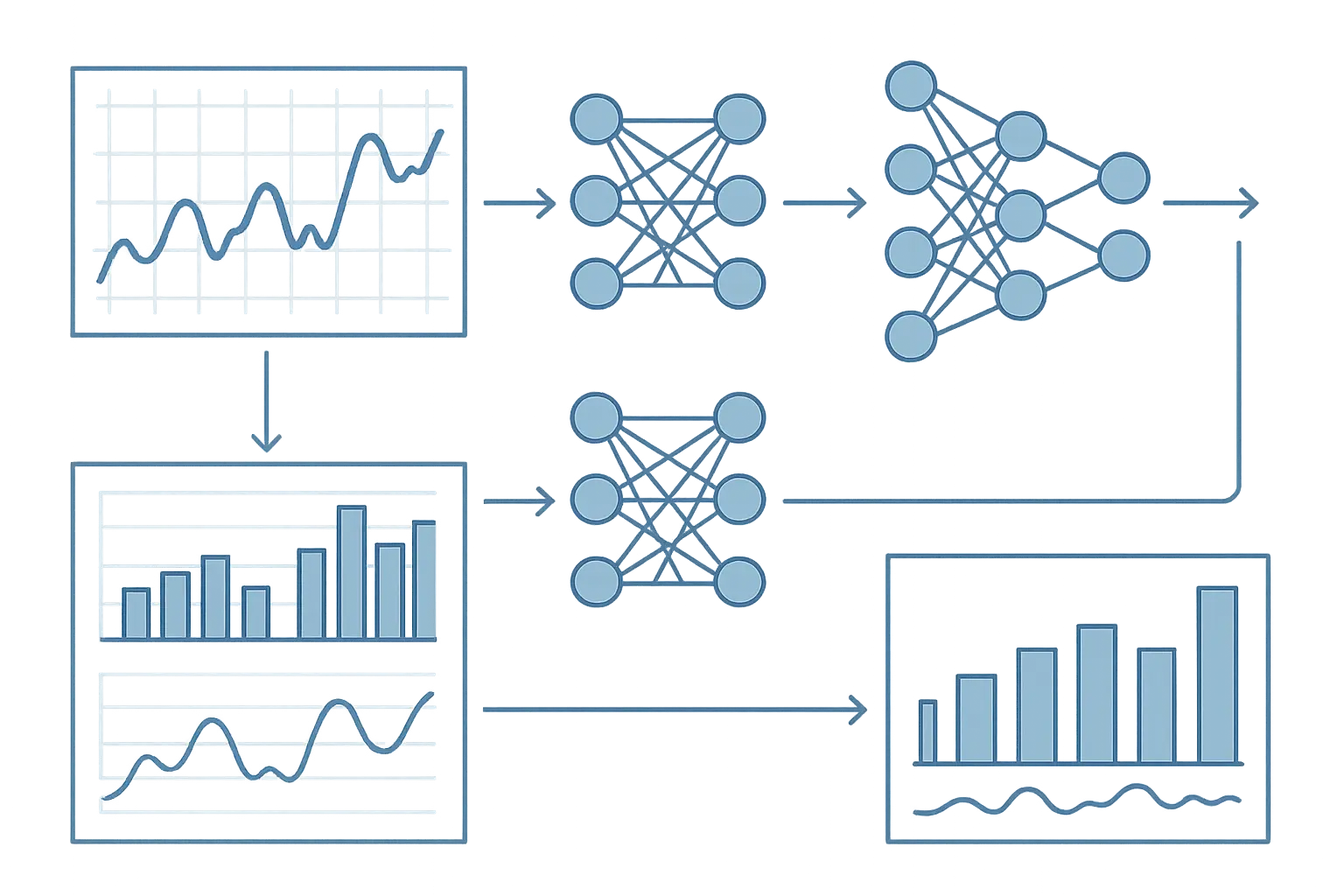

This is where elasticity analysis stops being just about pricing and becomes about strategic advantage. The businesses that are really winning aren’t just calculating current elasticity – they’re predicting how it will change and positioning themselves accordingly.

I’ve worked with companies that can predict seasonal elasticity changes six months in advance, identify emerging market trends before competitors notice them, and optimize pricing strategies across hundreds of products simultaneously. It’s not magic – it’s advanced analytics applied strategically.

Just as businesses leverage best AI search engine optimization tools to stay ahead of search algorithm changes, advanced elasticity analytics help companies anticipate and adapt to changing market demand patterns before competitors recognize the shifts.

Machine Learning Applications That Reveal Hidden Patterns

Machine learning in elasticity analysis is like having a really smart analyst who never sleeps and can process way more data than any human. These systems find patterns you’d never spot manually.

I remember working with an online retailer who discovered that their product elasticity changed based on the weather in major metropolitan areas. Rainy days made certain products more elastic, sunny days made others less elastic. No human would have thought to look for that connection, but the machine learning algorithm spotted it immediately.

Traditional elasticity analysis assumes linear relationships and constant conditions. Machine learning models adapt to non-linear patterns and changing market dynamics. They learn from new data and adjust predictions accordingly. This adaptive capability provides significant advantages in volatile markets.

The cool thing about these systems is they get smarter over time. Your first predictions might be rough, but as they process more data from your actual pricing changes, they become incredibly accurate. It’s like having a pricing consultant who learns your business better every day.

Scenario planning and simulation capabilities let you test different pricing strategies virtually before implementation. You can model various market conditions, competitive responses, and customer behavior changes to understand potential outcomes. This testing reduces risk and improves decision quality.

Seasonal and cyclical adjustments are where machine learning really shines. Traditional elasticity calculations assume conditions stay constant, but machine learning models adapt to changing patterns throughout the year. According to Omni Calculator, if elasticity is high, a price decrease will cause an overly proportional increase in demand, making it profitable to decrease the price, with luxury products like electronics or cars typically displaying this behavior, while essential products such as car fuel or medicines show low elasticity behavior.

Your Christmas pricing strategy can be completely different from your summer strategy, and the system accounts for that automatically.

Similar to how creating continuously learning systems AI enables businesses to adapt and improve over time, machine learning-powered elasticity models continuously refine their predictions based on new market data and customer behavior patterns.

Predictive Modeling for Strategic Advantage

This is the holy grail – knowing how your customers will respond to price changes before you make them. Predictive modeling takes your elasticity analysis from reactive to proactive.

The businesses using predictive modeling effectively aren’t just responding to market changes – they’re anticipating them. They can spot trends before competitors, adjust pricing strategies ahead of seasonal shifts, and position themselves for maximum advantage.

I worked with a company that could predict with 85% accuracy how their customers would respond to price changes three months in advance. They used this to optimize inventory, plan marketing campaigns, and stay ahead of competitors who were still using historical data.

These models incorporate external factors that affect elasticity – economic indicators, seasonal patterns, competitive landscape changes, and market trends. The result is more accurate predictions about how customers will respond to future price changes. Your elasticity calculator becomes part of a comprehensive forecasting system.

The key is integration – your predictive models need to incorporate economic forecasts, industry trends, competitive intelligence, and customer behavior data. It’s complex, but the strategic advantage is enormous.

Regular model updates ensure predictions remain accurate as market conditions evolve. What worked last year might not work next year, so continuous refinement keeps your strategic advantage sharp. Successful companies treat predictive modeling as an ongoing capability rather than a one-time project.

Look, all this advanced analytics stuff is exciting, but don’t get so caught up in the technology that you forget the fundamentals. The best elasticity analysis in the world won’t help if you don’t have quality data, clear strategy, and the discipline to implement consistently.

Running elasticity analysis manually or with basic tools limits your strategic options in today’s fast-moving markets. The Marketing Agency’s AI-driven analytics and automation systems can integrate elasticity principles into comprehensive marketing strategies that optimize both pricing and promotional spend across channels.

Our data-driven approach mirrors the analytical rigor required for effective elasticity analysis – we measure how marketing investments respond to budget changes, much like how elasticity measures demand response to price changes. This scientific approach ensures your marketing strategy development follows the same quantifiable principles that guide optimal pricing decisions.

Ready to transform your pricing and marketing strategies with advanced analytics? Contact The Marketing Agency to discover how our performance-based approach can optimize your revenue across all customer touchpoints.

Final Thoughts

Here’s the bottom line: price elasticity isn’t just academic theory – it’s a practical tool that can transform your business if you use it right. But like any powerful tool, it requires skill, practice, and respect for what it can and can’t do.

The businesses that succeed with elasticity analysis treat it as an ongoing process, not a one-time project. They invest in quality data, use appropriate tools, and most importantly, they’re prepared to act on what they learn.

Your pricing strategy is one of the most important decisions you make as a business owner. Elasticity analysis gives you the data to make those decisions confidently instead of guessing. But remember – the goal isn’t perfect calculations, it’s better business outcomes.

Start simple, focus on quality data, and gradually build more sophisticated analysis as you get comfortable with the concepts. Most importantly, don’t let perfect be the enemy of good. Even basic elasticity analysis is better than pricing by gut feel.

The market rewards businesses that understand their customers deeply. Price elasticity analysis is one of the most direct ways to gain that understanding. Use it wisely, and it’ll pay dividends for years to come.